Confirming USA Stocks Are In a Bear Market!!!

Chart at front of this post is the exchange trade fund TLT weekly plotted by Stock Charts. TLT decline in the past year from a high of 165 to lows of under 110 has confirmed that US bonds are in a bear market. Such an event has only happened three times in US history.

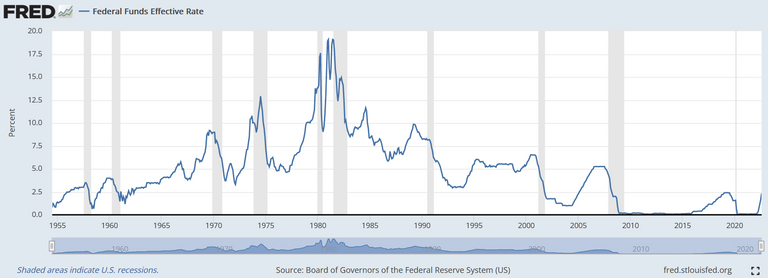

1970s Feds Funds Rates

(Courtesy of St. Louis Fed's Data)

Fed's funds rate which has recently rose in the past six months was relatively in a down trend for the past 40 years. Since the peak in rates during the 80's the interest rate has been falling with small rises in between only to have it end lower down the road.

The lower interest rates is inversely correlated with the asset prices when it comes to bonds. So with government paying less and less interest the bonds increase in value. The rolls have reverse in the past six months where interest rates are rising which is lowering the prices of bonds. For long term holders of bonds this is not a good outcome.

Similarly in the 1970s bond prices failing as interest rates rose. Back then the inflation was out of control so then Fed chairman Paul Volcker rose the interest rates to as high as 16%. This of course created a recession in the US economy.

(Courtesy of NPR.org)

Volcker essentially ushered in a difficult time for Americans during the early 1980s as high interest rates reduce demand for money supply. The bottom line here is that when interest rates rose and made bond prices turn bearish it was also a sign the US economy would soon struggle.

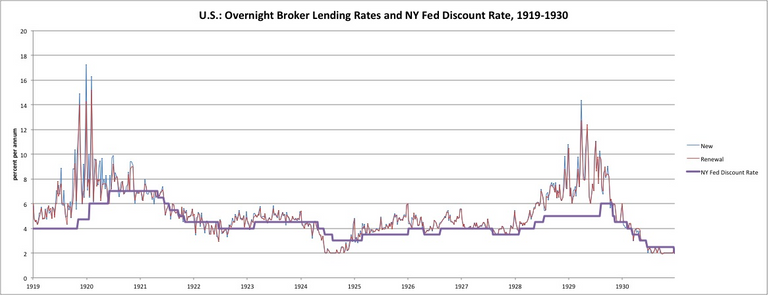

1920s and the Great Depression

(Courtesy of New World Economics)

Similarly to today and in the 1970s there was another occurrence where interest rates were on an uptrend while bond prices were falling. This happen in the late 1910s where it was during World War 1. The economic boom of the 1920s was partly due to the end of the war but it would end up being a costly boom as FED rose interest rates to curb demand. Little did the FED know that the rise in interest rates would go on to create the worse time in America's history, the Great Depression.

Rates in the 1910s rose to a staggering 18% at peak which surpassed even the 1970s hikes. With those kinds of rate hikes it would eventually trickle into the economy making it suffer. By the time the FED took action to lower interest rates it was already too late as the US was spiraling into a depression.

Conclusions

Whether it was 1910s, 1970s, or present time one major similarity that has happen in all three time periods is that the bonds interest rates rose. In all three occurrence it had lead to stock market losing +20% from peak values.

The harder question now is to know when the markets will pivot and rise again? Since not all bear markets are permanent and that most of the time markets are bullish.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

!PGM Reblogged

Reblogged for being awesome !PGM

Reblogged for being awesome !PGM

!PGM Reblogged cause you are awesome, has anyone told you that today?

I am very motivated with your writing this, thanks for share your experience..

Glad it motivated you !LOL !PIZZA

This is amazing write up. Thanks for sharing this great post with me

Thanks !LOL

A few days ago, my friend updated me that Bonds were experiencing a bear market. I was shocked.

And the reason is that I had learned about personal finance for a while now, and we have this advice that we can invest in bonds as they are low risk investments

It turns out I hadn't been paying much attention to the part that explains bonds are liable to fall in price once the interest rate rises

When I saw that update, I had to read about bonds again and that's how I found the link I had been missing for so long.

Posted Using LeoFinance Beta

I think majority of investors are not looking or not realizing the bond crash. It may take until year end when people actually review their portfolio and realize 2022 was a painful draw down across all assets while inflation soar.

Glad you are noticing and hope you can react to it.

Yes, I agree. They will receive the shock of their lives at the end of the year.

I am already reacting right now by leaving a thoughtful comment on your post.. hehehehe 🤓

PIZZA Holders sent $PIZZA tips in this post's comments:

@mawit07(1/5) tipped @rikoy (x1)

Learn more at https://hive.pizza.