Learning to Budget Your Money - What You Need to Know

Budgeting your money is a strategic plan to determine how to best allocate your monthly income to meet all your necessary expenses. This spending plan is also known as a budget. By making a budget, you are able to ensure that you are financially on track and are able to properly spend on items you like without getting into debt or running out of cash. Once you have created a budget that suits your lifestyle, you are then able to use it in all areas of your life and start saving money to fund your future.

To set aside an emergency fund, you need to first set aside a fixed amount each month to use as an emergency fund. Then, if an emergency comes up, you can use the money to pay for it. This can help you to avoid borrowing from credit cards or other sources which can lead to serious financial troubles in the future.

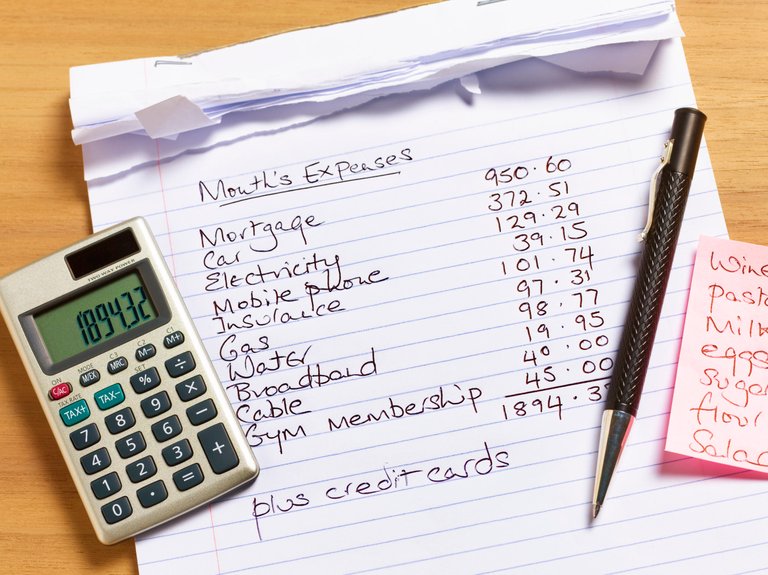

A budget helps you to understand where your spending is going and helps you to make smarter buying decisions. For instance, if you only save a certain percentage of your income towards your debts, you know exactly how much to set aside each month to cover living expenses and debt payments. If you were to save money for a long-term investment, you would want to ensure that the investment returns are enough to pay back your creditors. With a budget, you know what portion of your income is going towards expenses and what part is earmarked for investments or savings.

Budgeting helps you to learn how to live within a budget and helps you to cut unnecessary spending, which can be very beneficial in the long-run. It teaches you how to save money for major expenses like home and car maintenance, college education and other miscellaneous expenses. The most important part of a budget is setting specific amounts for expenses and determining an accurate spendthrift to estimate future income. Without these budgeting skills, the task of living within a budget becomes impossible.

Learning how to budget your money is not difficult, especially with the availability of online budgeting tools. The main tools are Microsoft Money, Quicken by Intuit, and budgeting worksheets available on the internet. These tools help you to plan and organize your finances. The Microsoft Money excel spreadsheet is the easiest of budgeting tool and allows you to create a monthly budget using the standard budgeting categories and expenditures.

Other budgeting tools available online are budgeting worksheets for small and large families. These provide a simple way of planning finances for a household and track family income and expenses. The goal of budgeting is to have enough money to meet long-term goals such as buying a home or saving for retirement. Each family has its own personal and unique expenses so budgeting needs to be done differently for each household. For example, families who have children, working mothers, retired people, and those with disabilities will have different requirements when creating a budget.

With the help of budgeting helps, all household members are more conscious about their spending. They learn how much they can afford to spend every month on different categories such as food, transportation, entertainment, and other basic necessities. This is important because it helps them to save money. One effective way of saving money is through controlling credit card debt because it has a high interest rate. Credit card debt usually grows significantly in a relatively short period of time which makes it hard for individuals to control their spending.

If you are interested in learning how to budget your money, then you should start with a personal budget for a few months. It will help you to understand your spending habits and where you are wasting money. You can take this information and use it to create a more effective spending plan. Remember, creating a budget is the first step to financial freedom. With a spending plan and a budget you will be able to control your money so that it will be available for important things like housing, food, and entertainment.

Posted Using LeoFinance Beta