CUB Monthly Report | November 2022 - 50% of CUB Inflation Bought & Burned, TVL Continues to Grow & Arb Bot 2.0

CUB has continued to grow throughout this downtrend in the broader Crypto Market. While many asset prices over the last month have fallen ~30%, CUB has managed to still grow the bHIVE & bHBD liquidity in its pools.

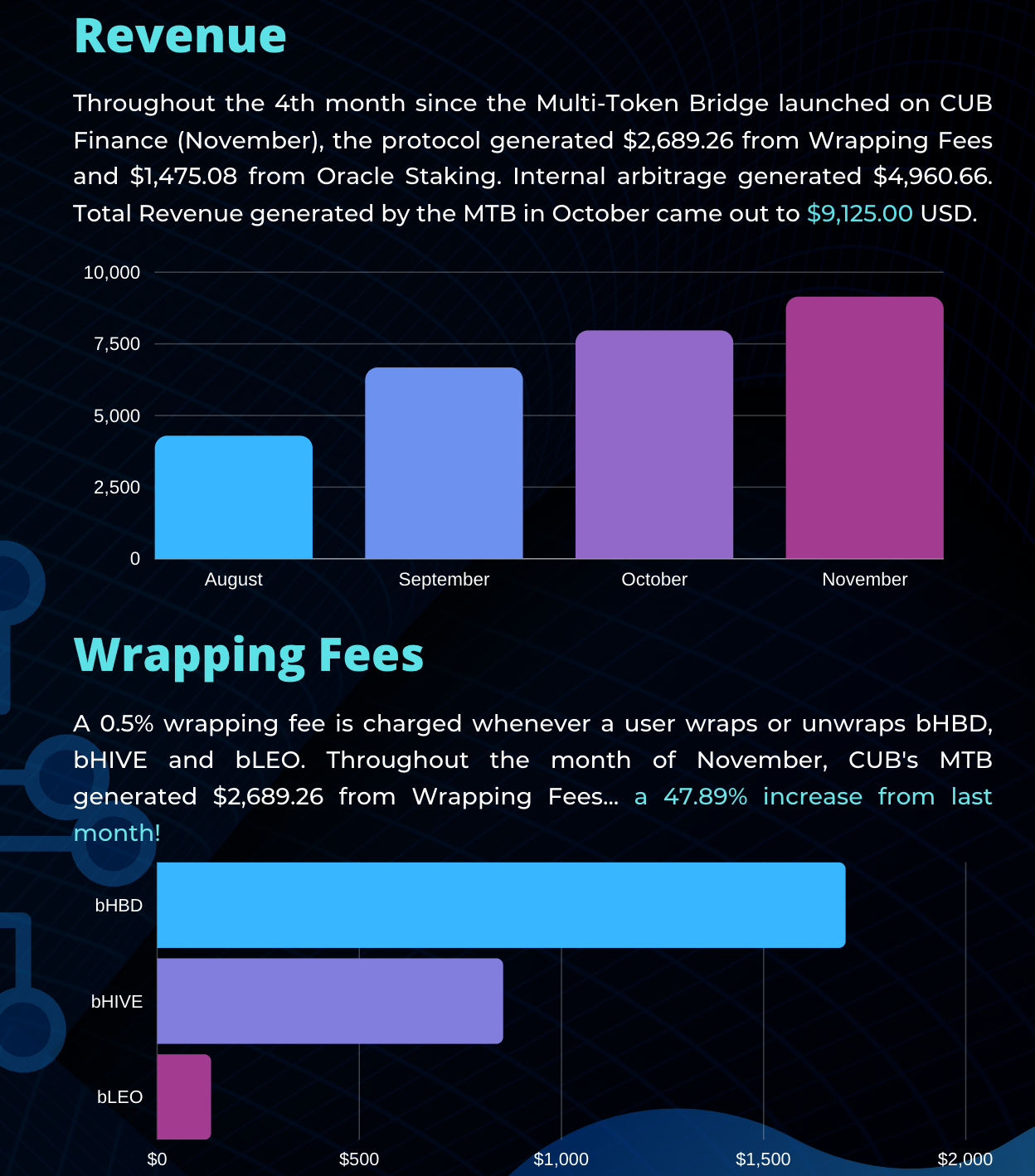

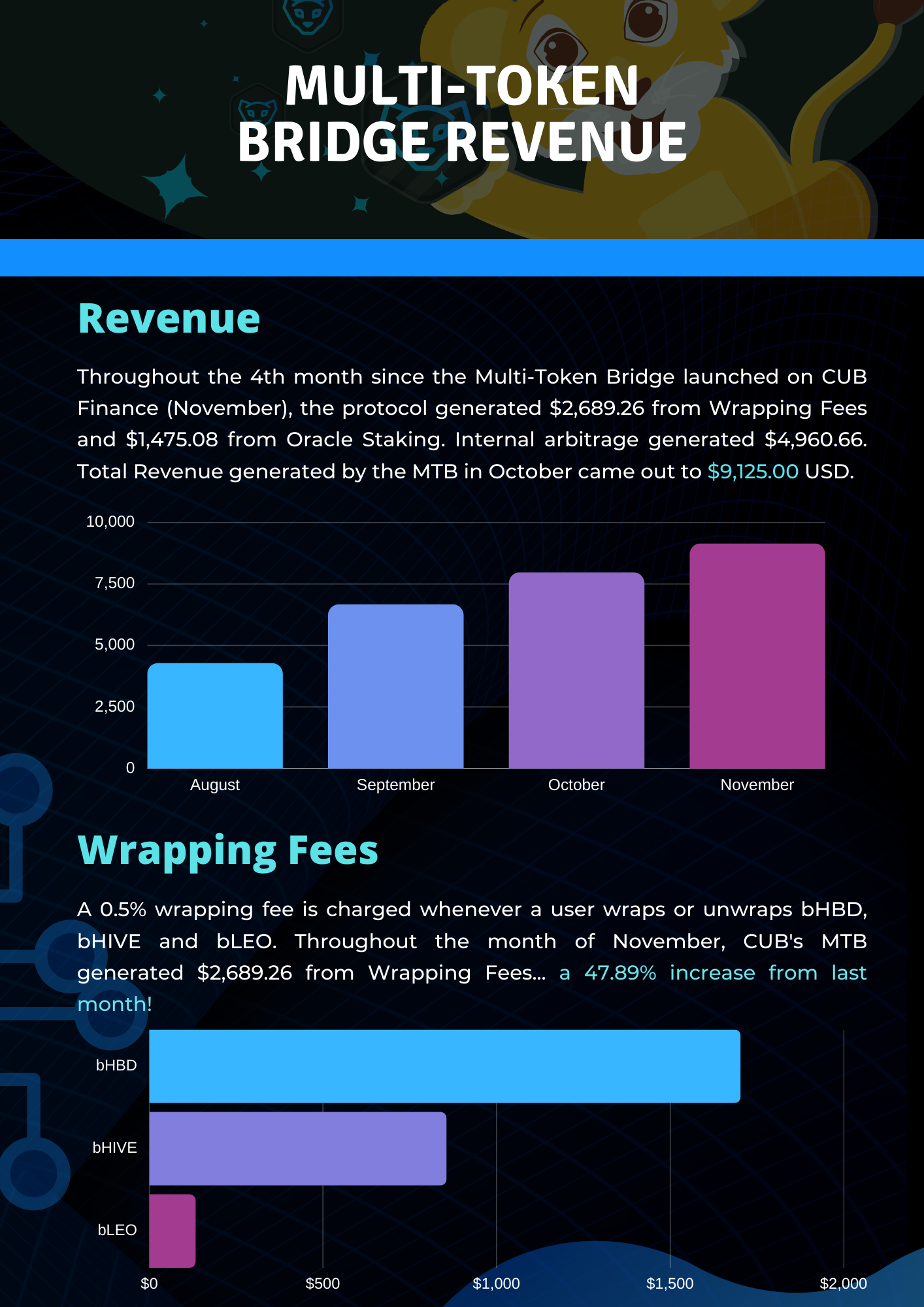

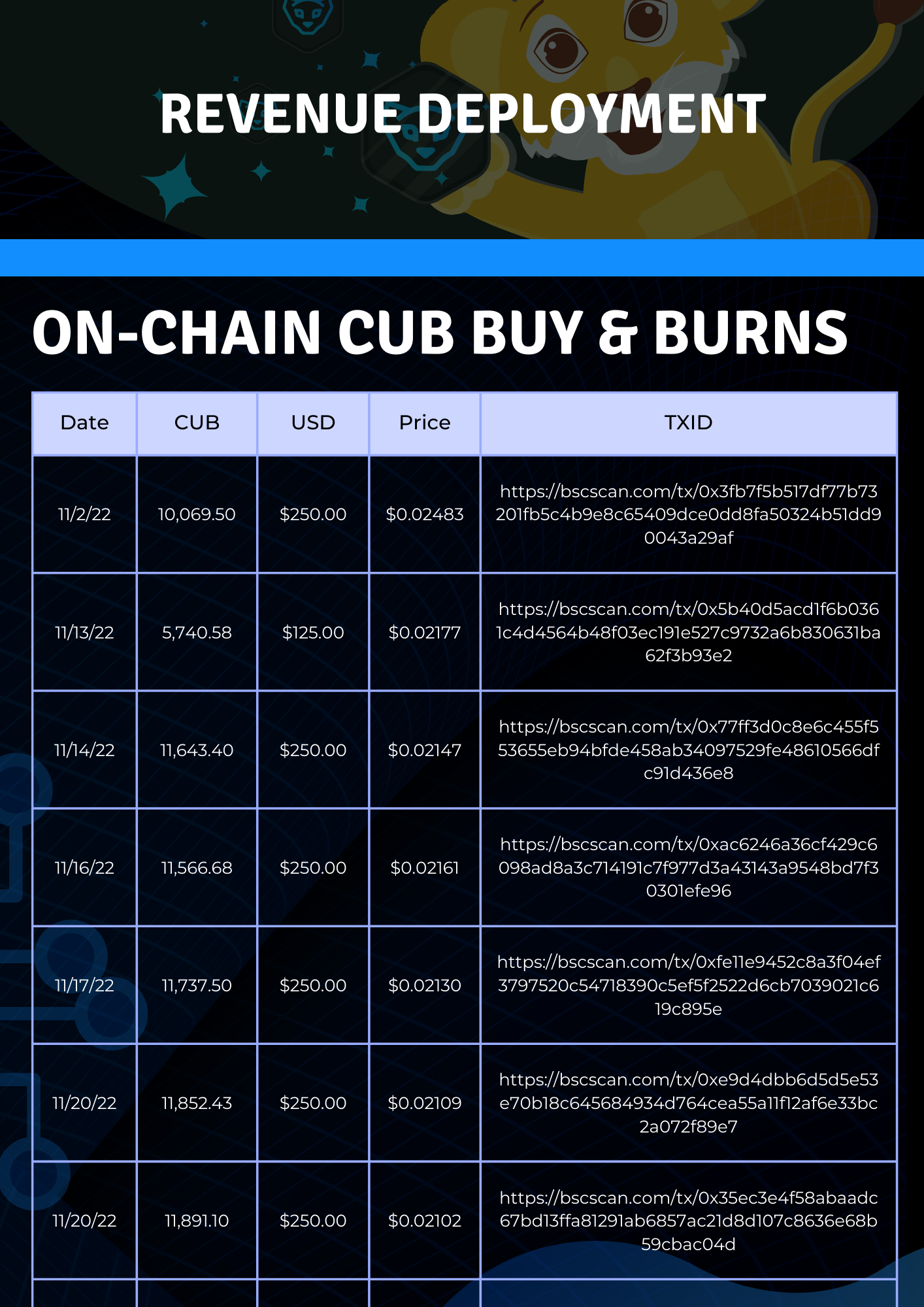

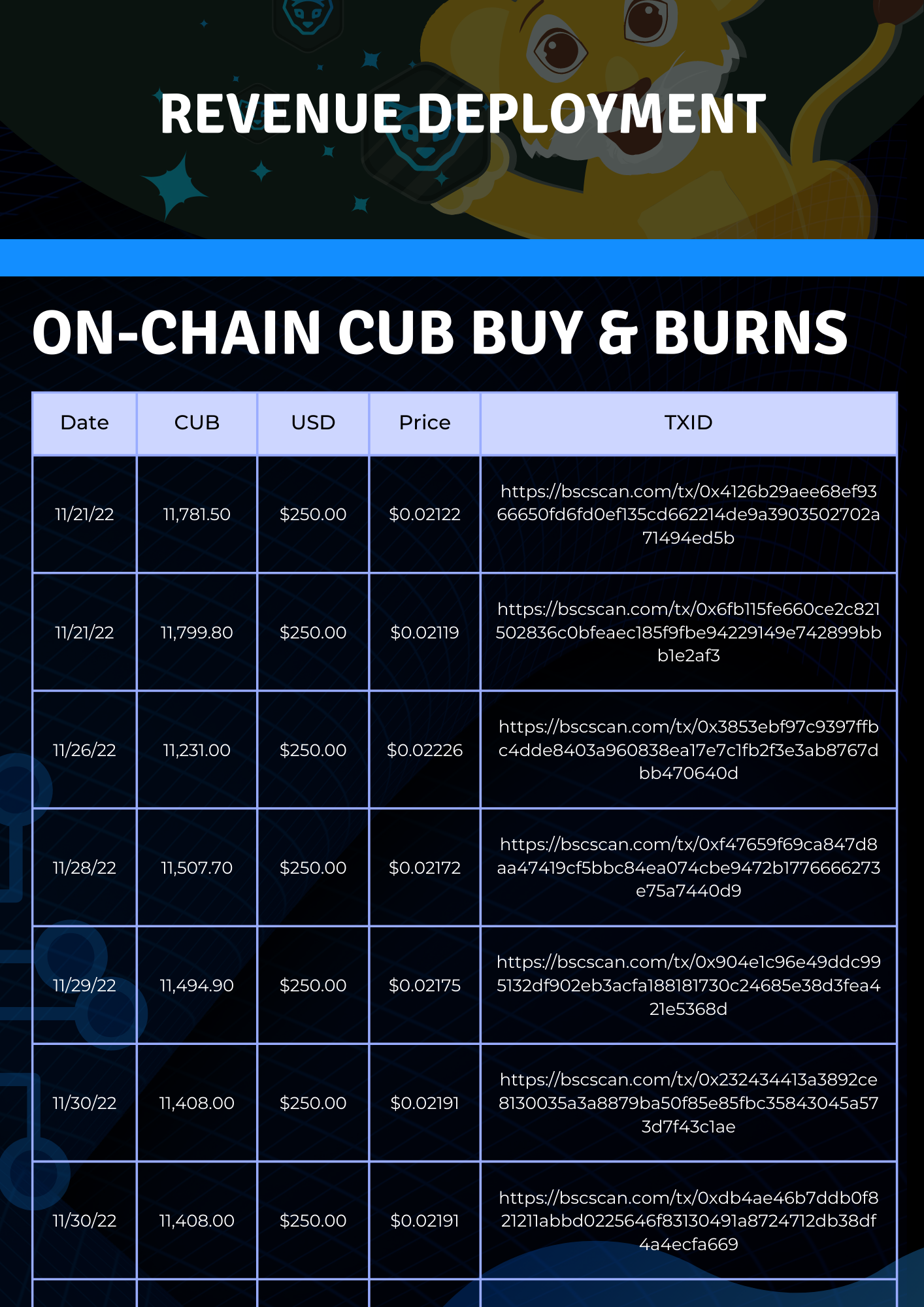

We're only in month 4 of the Multi-Token Bridge being live on CUB and revenue is currently at $9,125 for the month of November.

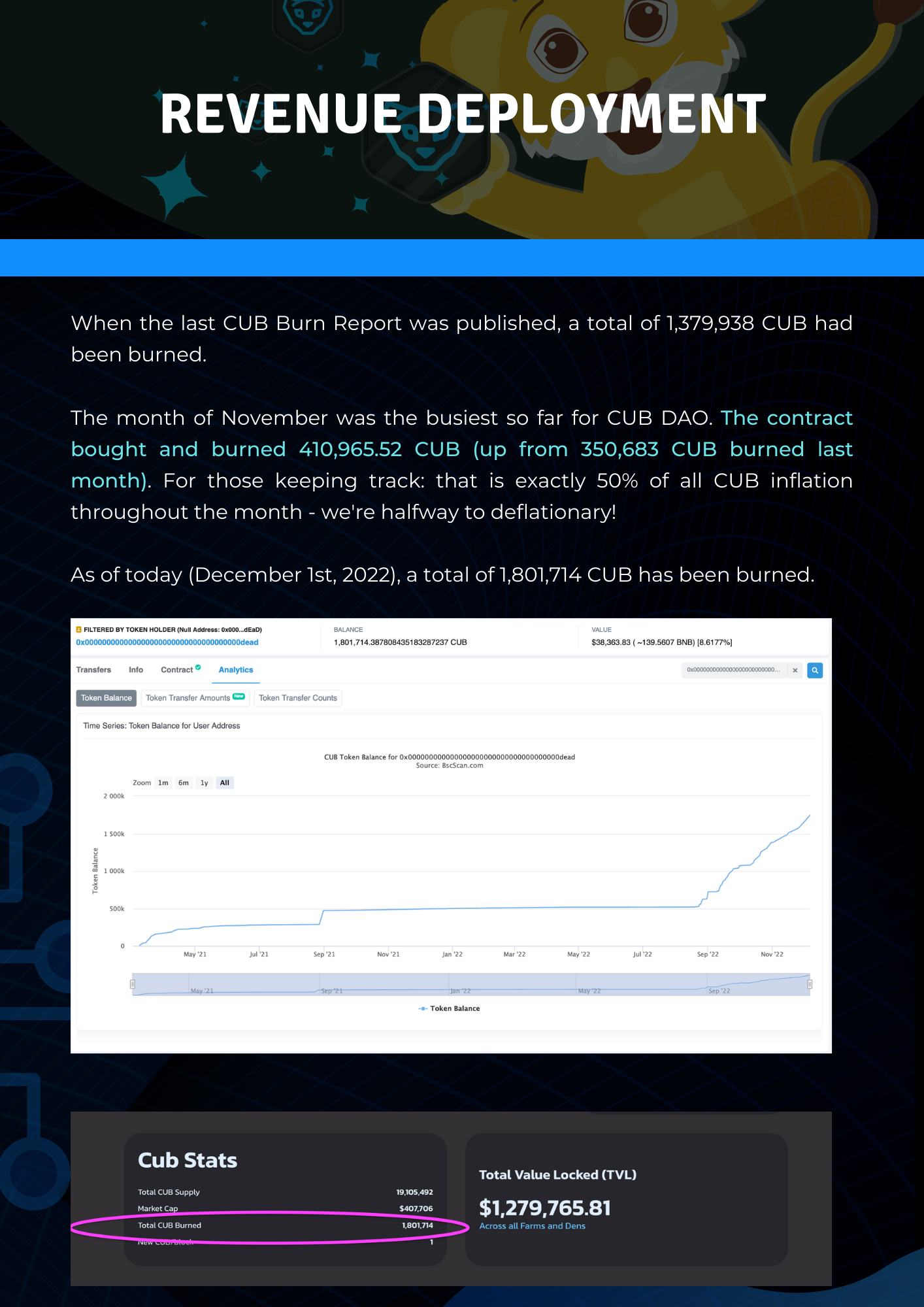

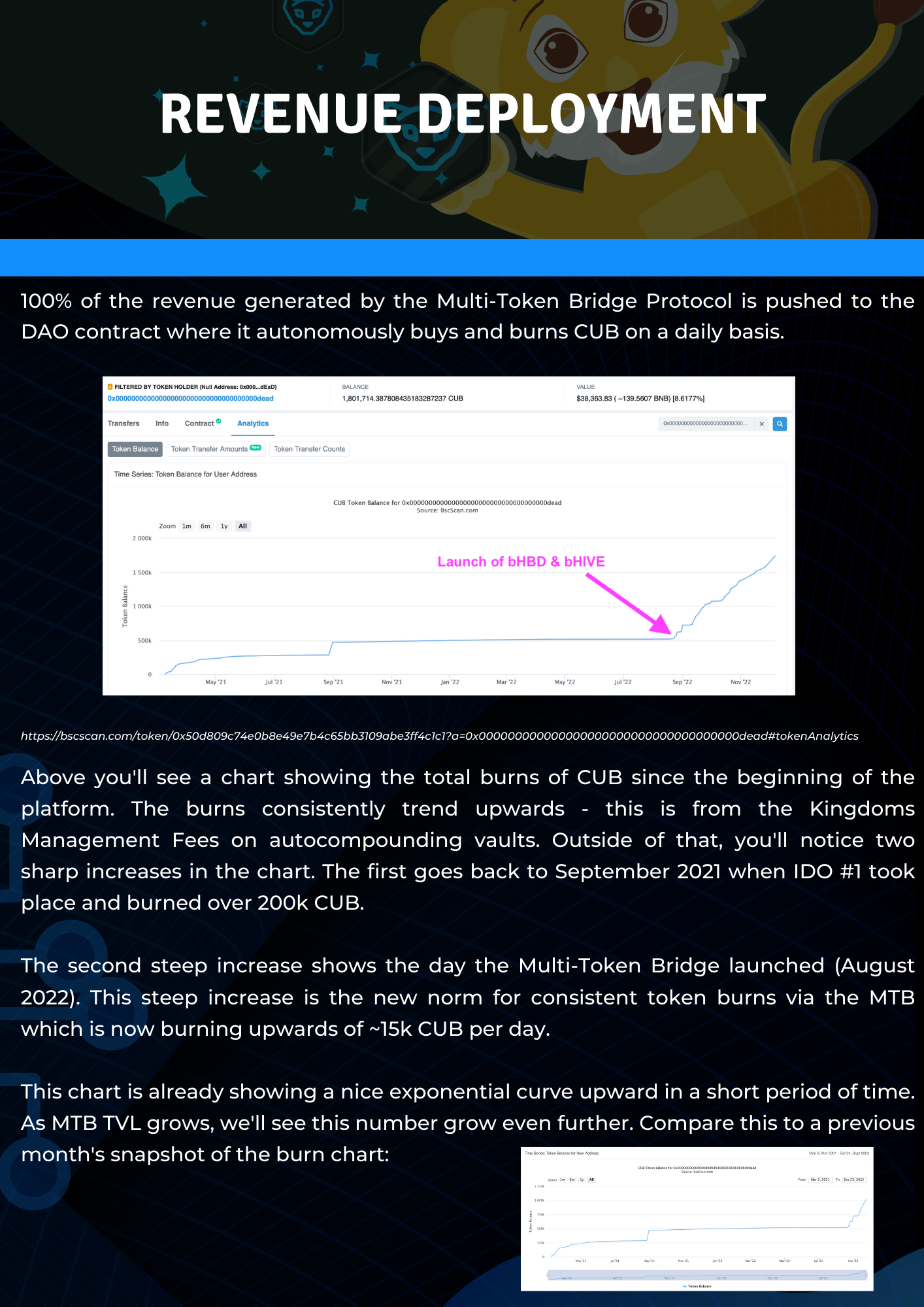

This is an amazing figure. It is exactly 50% of the amount of CUB inflation that is minted to pay LP Incentives each month.

apologies for the late report. We were adding a number of charts / sections about the Arb Bot 2.0. We ended up including a wide range of new charts in this report but have a lot more in store for January when 2.0 goes live and starts skyrocketing Trading Volume. Stay tuned 🦁

We are halfway to our goal of flipping CUB deflationary. If the price of CUB can stay at the low levels that it is currently at, we believe it can have a very beneficial impact on the CUB economy.

$17,640 per month. That is the amount of $$ that CUB is paying in LP Incentives for users to pool assets on the platform.

$9,125 per month. That is the November figure for revenue generated by the CUB DAO. That's 51.7% of monthly inflation.

Closing the gap on these two numbers would mean that CUB has officially flipped deflationary.

Arb Bot 2.0 is one of our newest developments. We're hoping to have it done sometime around the end of December.

The current Arb Bot generates ~$4-$5k per month with current liquidity depth on bHIVE & bHBD.

As you can see in the monthly reports, this number has been growing ($4k in October, $4,960 in November). This is growing thanks to liquidity deepening in the pools. As liquidity continues to deepen, total revenue will grow on all sides: arbitrage, staking and wrapping fees.

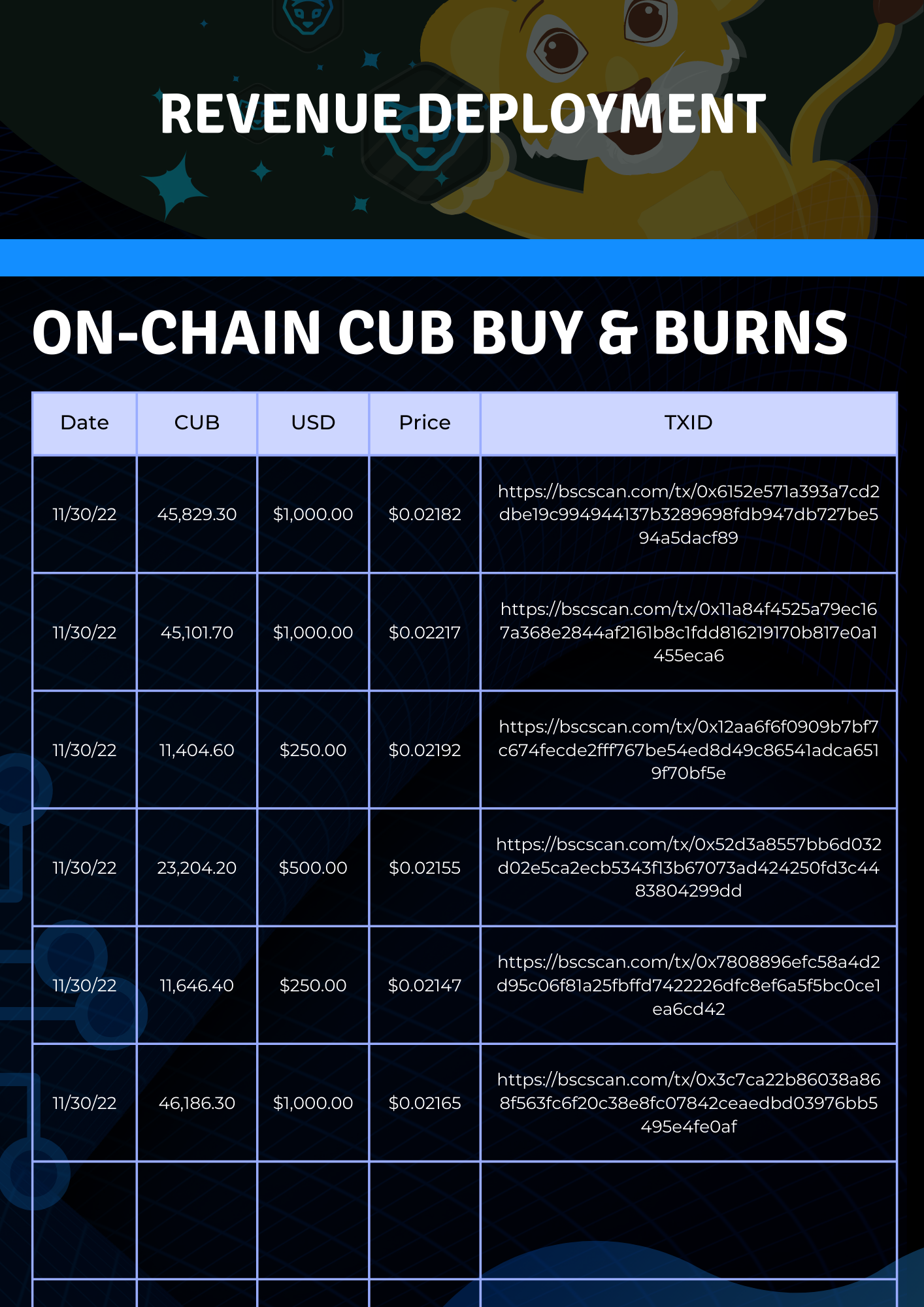

Arb bot 2.0 introduces new routs for arbitrage as well as an internal market maker directly on the Hive blockchain for HIVE->HBD trading. This combined with greater speed and overall efficiency puts our estimates at 2-3x+ in terms of revenue generated per month.

That alone - even if there is no growth on bHIVE & bHBD - should flip CUB deflationary (more than $18k per month generated by CUB DAO to buyback and burn CUB).

As liquidity deepens, growth continues. We're excited to see CUB become one of the first truly sustainable, reliable and growing DeFi platforms... and the first HIVE & HBD derivatives platform to successfully launch on another blockchain.

Our mission is to grow Hive. We believe HIVE & HBD trading needs to be decentralized and CUB is at the core of creating just one notch in the broader solution to take HIVE & HBD trading off centralized exchanges and move it onto Decentralized Exchanges. Derivatives like bHIVE & bHBD make this a reality.

View The Full November CUB Report in PDF Format for Best Experience

View the Full PDF

Sometimes images get cut off on Hive. View the PDF to see the full report in all its glory ;)

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

https://twitter.com/1149806884335050752/status/1602703699687755780

https://twitter.com/1415155663131402240/status/1602889826692259840

https://twitter.com/1021896104118341632/status/1603897111048642560

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg, @shortsegments ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Great to see the revenue growing which will benefit CUB in the long term. And this is why we are all here...

Posted Using LeoFinance Beta

CUB DAO revenue has consistently grown 15-20% each month since the inception of bHIVE & bHBD

This, combined with the release of Arb Bot 2.0 will likely lead to CUB being deflationary sometime around February IMO!

Posted Using LeoFinance Beta

Awesome numbers! With the CUB DAO buying and burning $CUB month after month (and the revenues growing), it is quite exciting to imagine what happens in the next few months or so.

It's great to see that the MTB's revenues are growing despite the market conditions. Goes to show that people are moving their assets in and out of the chain.

Posted Using LeoFinance Beta

This market is EXTREMELY tough to raise capital in. Look at any crypto project and you'll see them desparate for oxygen (capital).

That being said, CUB continues to grow in number of assets pooled on the platform (HIVE & HBD).

That's super hard to do but we are doing it... Slow and steady.

I hope to see the growth continue on throughout this bear because come bull market, things are going to radically take off (in terms of TVL and HIVE & HBD being LP'd on CUB).

Posted Using LeoFinance Beta

It is indeed and it's understandable given the market situations. But the good thing is that the community is still very supportive and are pooling in their assets to the LPs and hopefully, the volume will keep growing.

Posted Using LeoFinance Beta

Truly amazing stats.

I thought I was the only one hoping that prices stay low for a while longer. Sometimes low prices ain’t always a bad thing lol. Nice one Cub fam.

Posted Using LeoFinance Beta

haha nope! You're not alone

I want to see CUB's price stay low as long as possible. The MTB is catching up to the LP Incentives being issued each month.

I hope the CUB price stays at these levels until the MTB flippens the CUB Inflation rate..

Then we could see slow and steady growth as opposed to a quick pump and dump back down to equalize with revenue.

My idea vision is that CUB stays at $0.021 or lower which = $17,640 in monthly CUB incentives paid to LPs. Then MTB revenue catches up and surpasses $17,640... Then CUB price slowly rises alongside the revenue of the MTB increasing and we stay deflationary for the forseeable future.

Posted Using LeoFinance Beta

Impressive figures here. I had to go through this document twice because stats give us little investors the assurance that we are doing the right things. For example

This shows that growing more state in the CUB ecosystem and other aspects of the entire LEO project is certainly a well-informed decision.

I have plans to do more!!! Thanks for this report

Posted Using LeoFinance Beta

Glad you read through it! The Monthly CUB reports are showing a clear trend: we're finally seeing the revenue needed to overtake inflation.

Each month, we grow by about ~15-20%... In a few months, I'm confident we'll see CUB flip deflationary and buyback and burn more CUB than is being issued as LP Incentives

Posted Using LeoFinance Beta

That is right. All this growth points to the fact that stacking up more leo is a smart crypto investment decision. Lets do more!!!

Posted Using LeoFinance Beta

Arb Bot 2.0 is coming to POLYCUB, right? It will be lot more work than a simple copy and paste. But the revenue generated will be definitely worth the effort.

I'm also looking forward to see more CUB Outposts with all these features get launched on few more chains when the next bull market arrive.

!PIZZA

!LUV

!CTP

Posted Using LeoFinance Beta

@leofinance, @vimukthi(1/1) sent you LUV. market | tools | discord | community | HiveWiki | <>< daily

market | tools | discord | community | HiveWiki | <>< daily

HiveBuzz.me NFT for Peace

Yes, it will be. We have a lot of changes in store for PolyCUB but we first need a PIP approved by the holders. The last one was not approved and we're organizing the next proposal to bring POLYCUB to a static inflationary rate (like CUB).

The model is working VERY WELL on CUB. As can be seen in this report.

We want to take that model to POLYCUB but it needs to be passed by PIP.

Arb Bot 2.0 would increase revenue on POLYCUB dramatically. But Polycub currently has super low liquidity because of the halvening inflation rate.

As for outposts: our ideas has shifted and we will no longer be launching separate outposts. That being said, we are considering the Outpost idea with a twist: no new tokens. Instead, we use the CUB token and create wrapped versions on other chains and then divert a very tiny % (say, 5%) of BSC CUB inflation to each chain. This way, there is no increase in CUB inflation. Instead, a small % of the existing (1 CUB per block) inflation would simply be used to drive liquidity on say, ethCUB or avaxCUB.

Posted Using LeoFinance Beta

The idea of diverting part of CUB inflation to other chains is effectively like introducing a softer version of a CUB Halving effect. I'm definitely excited for this idea!

Do you have plans for a unified interface for all of these outposts or do you plan to keep them separate and introduce their own quirks. I think our community could come up with some very creative ideas with Evmos.

Best of Luck!

Posted Using LeoFinance Beta

... adding to my above comment since people have asked: it would also mean that all revenue generated by ethHBD or ethHIVE or avaxHIVE or avaxHBD (for example) would go back to buying and burning BSC CUB.

Posted Using LeoFinance Beta

Wouldn't it be easier to buy and burn ethCUB, avaxCUB etc. with a potential of creating more opportunities for arbitrage between blockchains? Am I asking for more chaos here? Don't overthink the idea. I'm only thinking out loud.

Posted Using LeoFinance Beta

I gifted $PIZZA slices here:

@vimukthi(2/5) tipped @leofinance (x1)

Join us in Discord!

these reports give people hope in the bear market. solid numbers. keep it up team!

Posted Using LeoFinance Beta

DeFi Paradox.

Bear market DeFi yields are down & defi tokens are cheap. But in a Bull Market both will rise. Yields of 4 USD a day for 2 cent tokens, are 40 USD at 20 cent, or 100 USD at 50 cents or 25x. Consider DeFi did 1000x in 1 year. #Financeleo #Cubfinance www.cubdefi

Posted Using LeoFinance Beta