Can pHBD be a means to avert impermanent loss when investing in liquidity Pools?

Providing liquidity in crypto is very essential because it makes it easier for people to invest or exit without causing harm or slippage in the market.

Liquidity pools are created so that certain tokens or coins will be available no matter what which makes them easily acquired, and some ways of providing liquidity in hive is by staking hive, second layer tokens, or even making use of the HBD savings which can make these tokens and coins accessible to others who want to buy in.

There are so many advantages of investing in liquidity pools, and while there are advantages, there are also disadvantages which can come in form of impermanent losses.

What is impermanent loss?

Impermanent loss is the temporary loss of value when two tokens you invest in change in value, this loss can happen based on different reasons and occurrences, so it is important to know why and when you can experience these losses.

When do you experience impermanent loss?

- When two tokens you invest in change in value

- When one token goes up in value and the other one stays the same.

- When one token goes down and the other stays the same.

How to avoid impermanent loss?

By choosing stable coin pairs: you can avoid impermanent loss by finding coins that are stable and immune to the rise and fall; by doing this, you can avoid loss and also gain small rewards over time.

Avoid risky or volatile coins: since impermanent loss is maximized when coins are volatile, the best thing to do is to avoid these coins unless you are feeling adventurous and willing to risk it. Even though most coins that are volatile are usually high reward coins, it is important to know that they could also be high risk coins.

Provide liquidity when prices of coins are low: by doing this, you will most likely get an advantage when these coins gain value as opposed to when it loses.

Provide to places that offer extra incentives: You can simply do this by providing your coins to places that offer extra rewards; this can simply be done by staking your second layer tokens and even delegating out for curation rewards.

Using pHBD as a means to avert impermanent loss

With all the talk of impermanent loss, it is important to realize the advantage that comes with providing liquidity of HBD through polygon network.

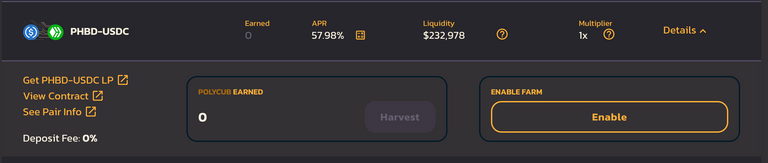

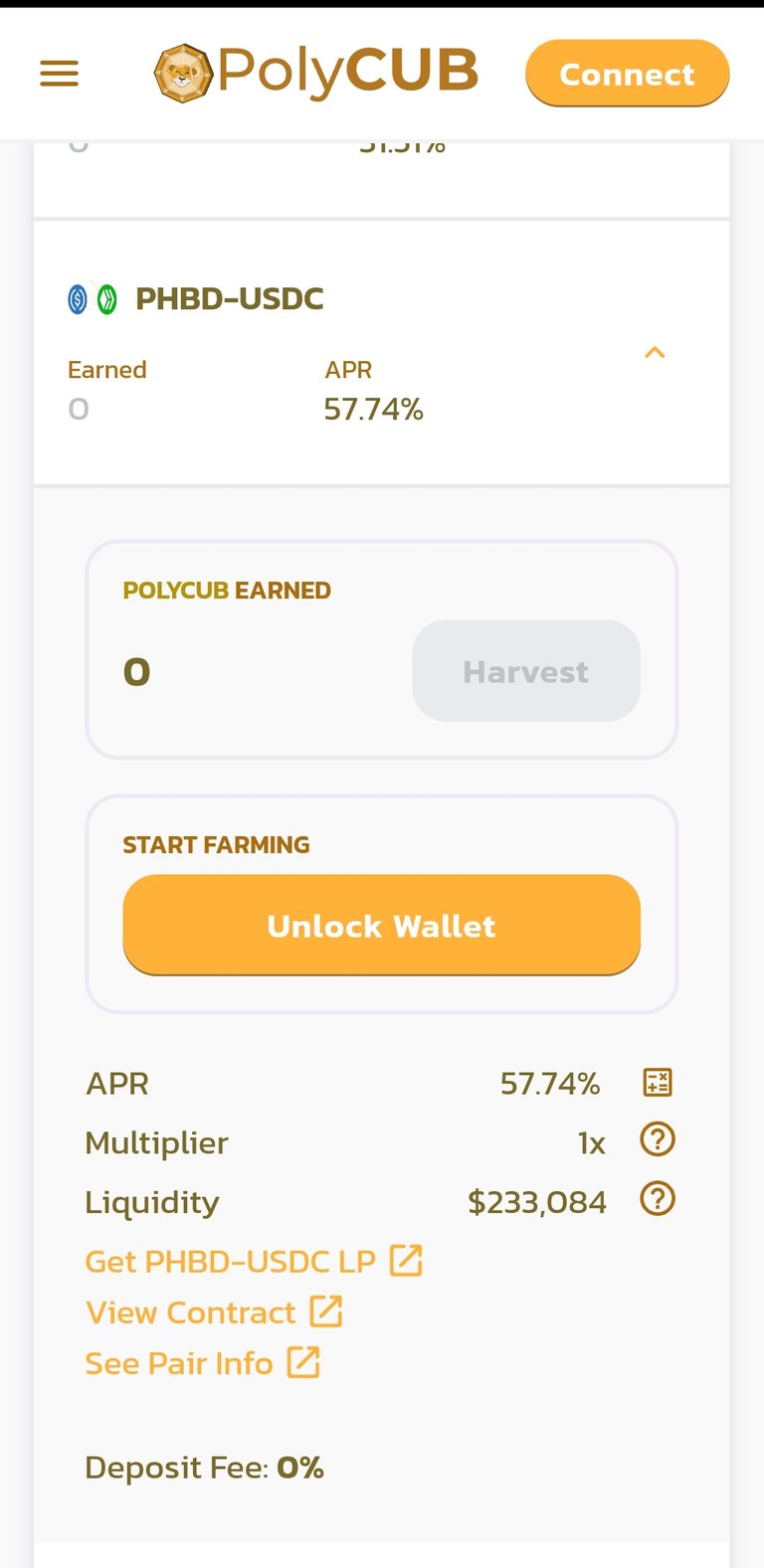

HBD on it’s own is a stable coin and with pHBD-USDC farm currently providing a 57.98% APR or 78.49% compounded APY, providing liquidity through pHBD has a benefit that banks and so many other means can’t even proffer and since hive has made it easy to earn HBD, it is a win-win situation no matter how you look at it.

At this point, we have an advantage through pHBD, and I personally plan on utilizing this opportunity as much as I can.

The liquidity pool is currently at $232k and since leofinance has a goal to increase this pool to $5M which will provide flexibility for defi whales to buy in or out, it is essential for us as hivers to take this opportunity to invest because ultimately, it will help the growth of hive.

Finally,

For more information on the pHBD you can read this article by leofinance or check out the polycub website.

Posted Using LeoFinance Beta

https://twitter.com/opheliajacksons/status/1515564484596846596

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.