What Does it Really Take for Bitcoin to Reach $1 Million?

We all want to see Bitcoin hit $1,000,000. I think that would solve quite a few problems for everyone in the industry. What does it actually take for BTC to reach this coveted $1M unit bias?

This is a question that I've seen repeated since my first day stepping into the world of crypto... Nearly 7 years ago.

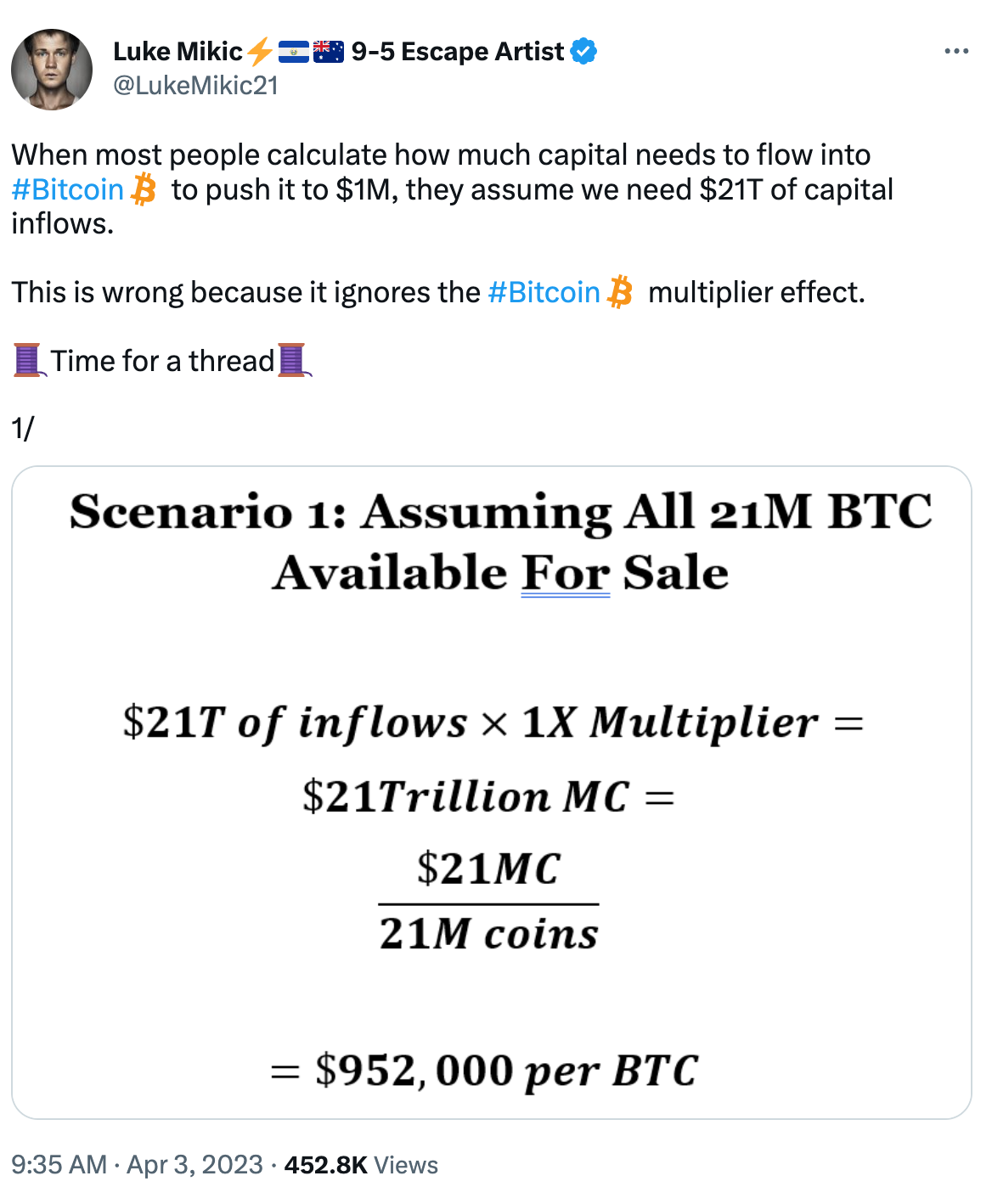

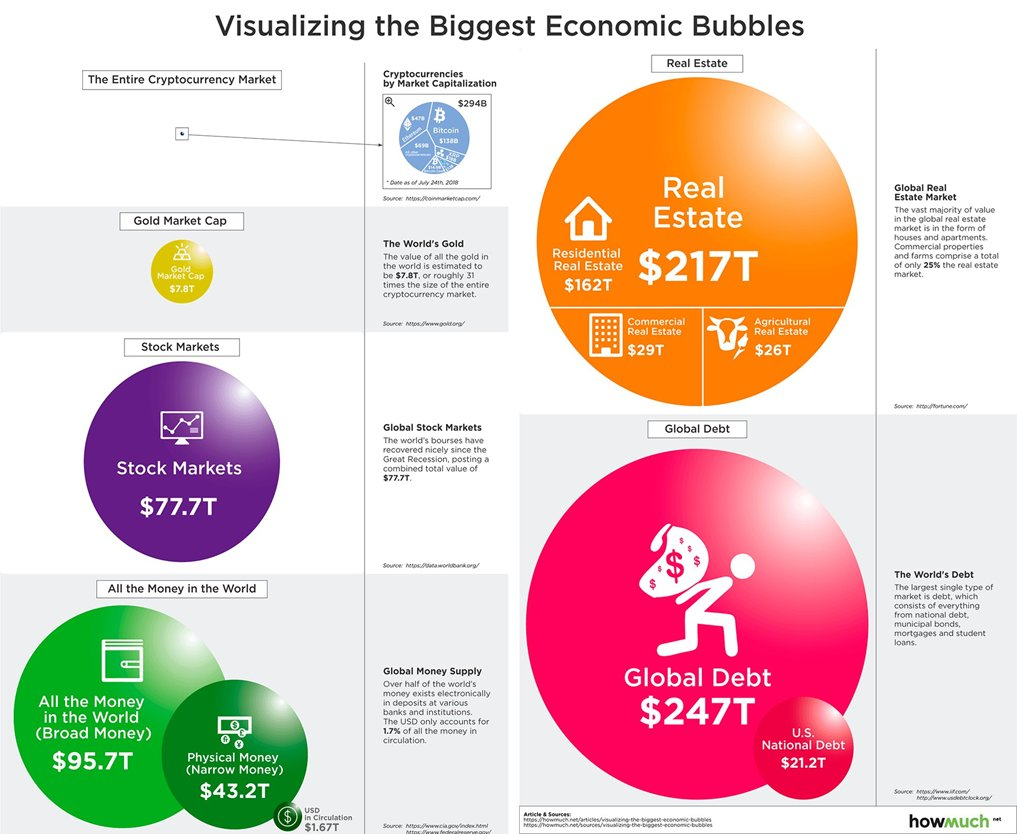

$21 Trillion might seem like a lot, but the global economy has quite a lot of money in it. This amount continues to grow, especially amidst high levels of inflation:

Although, many are saying that $21T isn't what is actually needed to push Bitcoin to $1M per coin. Let's unpack some math and consider if it's wishful thinking or perhaps a more realistic viewpoint.

What Does it Really Take for Bitcoin to Reach $1 Million?

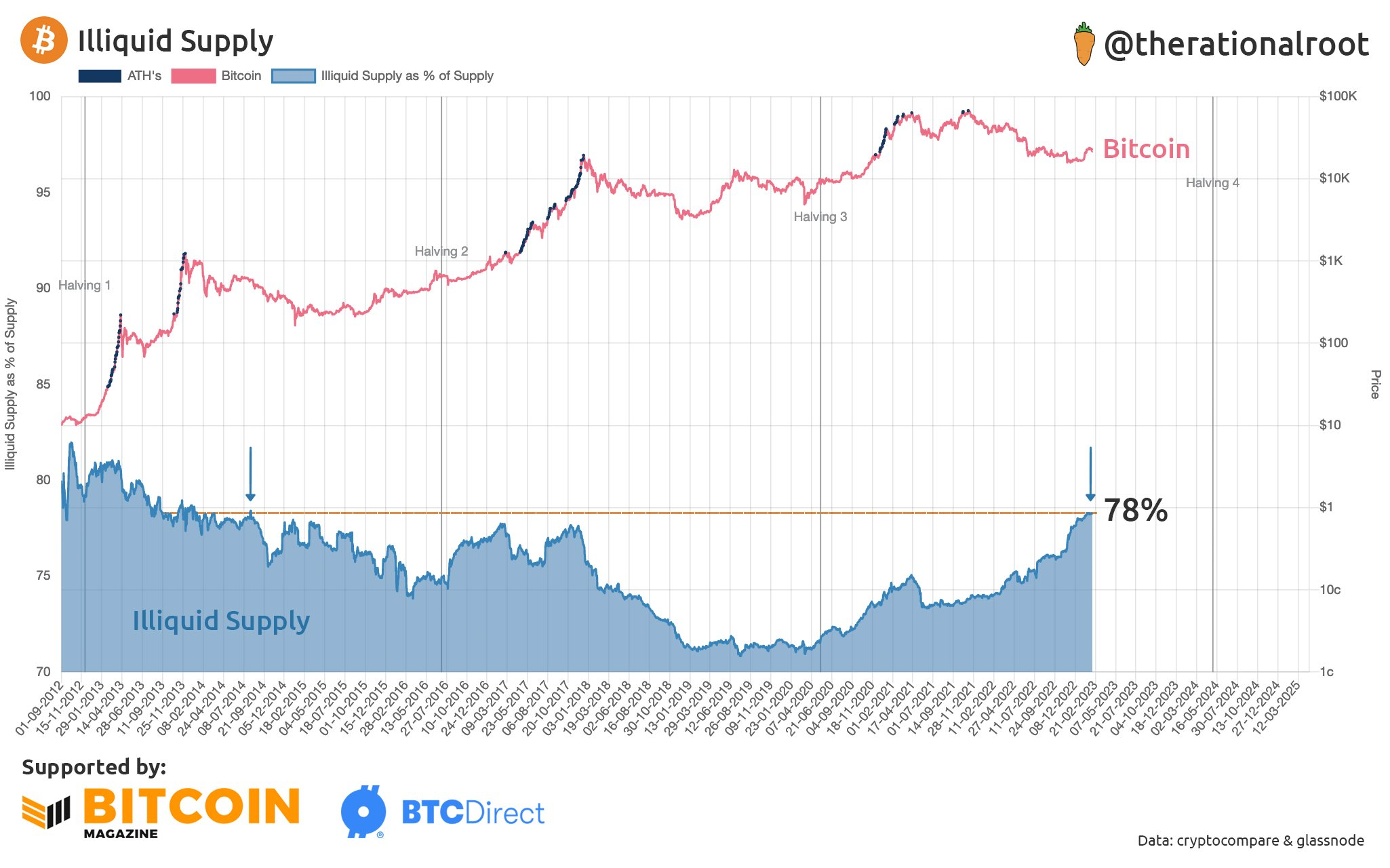

As it stands, only 22% of the circulating BTC supply is actually liquid and moving. This chart shows the supply of Bitcoin that hasn't moved in the past year.

It's been growing steadily since 2020, which is quite surprising since BTC has actually been skyrocketing. You'd think that illiquid coins would suddenly turn liquid in the face of massive price appreciation.

That definitely happens and you can see some wallets "awaken" when the BTC price goes up. On a macro trendline though, you can see that the illiquid supply continues to increase.

This tells us that BTC is consistently being moved to wallets and then HODL'd in those wallets for 1 year+.

Some other data I've read shows a lot of Bitcoin moving to smaller hands. The # of wallets holding a low, but non-zero BTC balance continues to increase. The network is growing and more and more people hodl BTC in their own wallets with each passing year.

This illiquid supply is relevant to our discussion here. To increase to a marketcap of $21T, we don't need to see every single Bitcoin catch a bid. Only the liquid coins need to be bought. If those coins are moved to wallets, then the liquid supply will dwindle.

Supply and demand continues to drive every market force.

Multiplier Effect

An interesting theory, seen in practice: for every $1 that bought BTC, the net market cap increase was an average of $2.6.

This can be seen in BTC and it can definitely be seen in smaller market cap coins. For example, if you put in a bid to buy $10,000 USD worth of LEO, you'll see the market cap of LEO increase by a helluva lot more than $10,000 USD. This has to do with the liquidity available and what price you'll get filled at.

BTC is no different. It's just a larger scale of the same phenomenon. When $1,000,000 goes out to buy BTC, it doesn't just add $1M proportionally to the market cap. The supply is simply not liquid enough to allow such a straightforward calculation.

With 78% of the BTC supply illiquid, exchanges will receive those bids and market makers start moving. Next thing you know, BTC's market cap might increase $2.6M from that $1M. At least, that's what this data tells us.

Luke used a 3x multiplier to give us a rough estimation that if $8T flowed into BTC, then we'd see BTC hit $1M per coin.

The market cap of gold is currently $13.193T. Might not seem as far fetched in that context.

Conclusion

I am obviously a huge BTC bull. I've been a net buyer for the past 7 years - each and every year, I end up with more BTC than the year prior.

Yes, I may sell some here and there but I always end up with more Bitcoin. I take advantage of DCA'ing in and DCA'ng out. My end goal is always more SATs.

While I love to buy into some of the wishful thinking out there, it's also easy to refute a lot of the explanations like this Twitter thread that I've shared from in this post.

I am an optimist but I am also a realist. I have often put my prediction in that Bitcoin will flip the Gold market cap.

Like I said, Gold is worth $13T right now. It's doing quite well amidst the current banking crisis.

To me, Bitcoin is superior gold. It's digital Gold for a digital era in humanity. Bitcoin offers us "easy" storage and the ability to transact globally, permissionlessly and without the need of Banking intermediaries. You can buy something from someone across the world using Bitcoin with no banks in between if you want. Obviously, there is also a need for TradFi in terms of cashing out BTC, but that's a whole other story.

The Bitcoin market is still a tiny little baby. The current market cap of BTC is $546B. For Bitcoin to flippen Gold, we would need a 26x in the current price. That would put BTC at $728k per coin.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Alpha

I think the points you raised here for BTC to reach $1M are attainable. The whole asset group could be demolished ( just kidding) but until and unless there is demand, the supply market will be there. I am buying BTC. I am not sure if my investment is big enough that i will benefit in the future. having said that, i am buying. 😎

I think demand has only increased these past several years but is still nothing compared to tradfi

Things will get really crazy in the next 5 years

Posted Using LeoFinance Beta

You have raised some valid points, and I agree that this could be possible, but what about the effect on environment. Mining through Pow protocol is not cheap, granted that it fulfils the measure of scarcity. But on a second note, we have a whole new class of protocols that could possibly do the same thing, without biting the dust. It's something to think of, and also this is an emerging industry, we need to think of the mistakes that the traditional industries especially the banking industry has been making, so as not to repeat those mistakes again, otherwise this experiment with new class of assets will be failure.

When tradfi demand comes in, things are gonna get really wild

Posted Using LeoFinance Beta

Yep, I agree

Makes me wonder how much BTC is actually locked in wallets of which the keys are simply gone or forgotten. In the early days 1000 BTC was worth nothing. I'm sure quite some hard drives with forgotten BTC have been sent on a oneway trip to the dumpster over the years.

Yeah there is definitely that too… tons of BTC lost forever

Posted Using LeoFinance Beta

Damn it! You made me buy some more Bitcoin now! 🤑

Haha I’m buying more too

Posted Using LeoFinance Beta

Actually, to this date, there are so many coins other than Bitcoin to make remittances. But Bitcoin is still the Bitcoin and the king because of its security and degree of geographic decentralization.

In the early days when the concept of satoshi was contemplated, it was argued and deliberated that it has been designed in a way that each satoshi will be worth 1 USD one day. I am not going to make the claim that Bitcoin will hit 1 Million USD in 3 months or that early. But I personally anticipate that by 2030, BTC will reach 1 million USD.

Regardless of the sophisticated app and 2nd layer economy we have in crypto, BTC will be seen as a different commodity in the crypto domain.

The backing behind the BTC since its inception is by elites, you must be wondering who are those people who from 2012-13 to this date never sold BTC. The 5 yr HODL curve is ever-increasing in BTC. Put simply, in the context of scarcity, BTC is truly a scarce coin.

Yes exactly. It’s kinda funny when people compare other cryptos to BTC. You simply can’t. Network effect is what keeps companies like Facebook, google, apple in businesses. It’s the same thing that keeps and will remain to keep BTC the top dog in crypto

Posted Using LeoFinance Beta

Bitcoin reaching a value of $1 million is a theoretical possibility, but it is important to remember that it is just that – a theory. Bitcoin's market price is determined by supply and demand dynamics, and its value can be influenced by a range of factors, both internal and external.

That being said, there are a few key factors that could contribute to Bitcoin reaching $1 million in value:

Increased adoption and demand: As more people use and invest in Bitcoin, its demand and value could rise. This may happen as Bitcoin adoption spreads in countries where financial systems are unstable, or as more people become disillusioned with traditional financial institutions.

Limited supply: Bitcoin's supply is limited to 21 million coins, which means that over time, as more coins are mined, the available supply will decrease. This scarcity could drive up the value of Bitcoin.

Institutional investment: Large financial institutions, such as banks and hedge funds, have started to invest in Bitcoin. If more institutional investors enter the market, it could drive up demand and increase the value of Bitcoin.

Bitcoin as a store of value: Some investors see Bitcoin as a potential alternative to traditional assets like gold. If Bitcoin becomes widely accepted as a store of value, its demand could increase and drive up its value.

Global economic instability: If there is economic instability or uncertainty on a global scale, investors may turn to Bitcoin as a safe haven asset, which could further increase its value.

It is important...

I agreed we need to see those things and more play out in BTC to see mass adoption needed to drive us toward $1M

Posted Using LeoFinance Beta

Es común que los entusiastas de Bitcoin consideren la adopción masiva como un factor clave para el aumento del precio de Bitcoin. Sin embargo, es importante tener en cuenta que el precio de Bitcoin es determinado por una variedad de factores, incluyendo la oferta y la demanda, la actividad de los inversores, la percepción de los medios de comunicación y las regulaciones gubernamentales como por ejemplo los EEUU que ello le tiene una guerra al mundo de la cripto.

En cuanto a la posibilidad de que Bitcoin alcance los $1 millón, es difícil de predecir. Algunos expertos creen que es posible, mientras que otros son más escépticos. En última instancia, el precio de Bitcoin dependerá de muchos factores, algunos de los cuales pueden ser impredecibles.

This reads like ChatGPT output 😂

good afternoon friend greetings first of all

I am not using the program because I am from Venezuela and I don't have money for it, I don't have money or card.

ChatGPT can be used for free. I use it often, it structures the texts very well (but in an easily recognizable pattern). Here's an example

My prompt:

ChatGPT answering:

Increased adoption and acceptance: As more individuals, merchants, and institutions begin to adopt and accept Bitcoin as a form of payment, the demand for the cryptocurrency could increase significantly, driving up its price.

Limited supply: Bitcoin has a finite supply, with a maximum of 21 million bitcoins that can ever be mined. As the supply approaches its cap, scarcity could drive up the price.

Institutional investment: The entry of large institutions, such as hedge funds and pension funds, into the Bitcoin market could boost its value as these entities can invest large amounts of capital.

Geopolitical instability: Economic uncertainty, political turmoil, and currency devaluation in some countries could push investors to seek safe-haven assets like Bitcoin, driving up its demand and price.

Development of the ecosystem: The continued development of the Bitcoin ecosystem, such as the introduction of new applications and use cases, improved infrastructure, and enhanced security, could attract more users and investors, contributing to a potential increase in Bitcoin's value.

can be used on computer or only mobile friend as what program are they and sorry for the abuse

$728k ain’t that far from $1m so in actual fact, $1m BTC is actually more possible than I thought. Interesting.

Super achievable long term

Posted Using LeoFinance Beta

https://twitter.com/1626899177044324353/status/1643567889914679296

The rewards earned on this comment will go directly to the people( @rashid5 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.