Bitcoin: Where Do We Go From Here? The Case for $17k vs. $50k

Bitcoin has been hovering between $30k and $40k for a while now and everyone is becoming antsy about where the price is going. In the short-term, it's anyone's guess. In the long-term, I think we all can agree that it's going higher.

There are a few different fundamental and technical analyses floating around which present a bear case: where we dip below $30k and continue to drop down to $17k or even lower.

There are also bull cases which cite fundamental reasons for BTC to rise well above $40k and beyond.

We discuss the various cases in this clip from the 33rd episode of the LEO Roundtable podcast and walk through different fundamental and technical models.

In my personal opinion, these types of models are fun to explore and discuss but at the end of the day, I am a long-term HODLer. We also discuss this idea of having a long-term mindset with one bucket of your HODLings while possibly having a small bucket to trade around your core position. With a burgeoning derivatives market in the crypto space, it's becoming easier and easier to leverage various products and margin opportunities to short or long around your core position. We may talk about some of these opportunities in a future episode.

For now, enjoy our analysis of Bitcoin and where we think the price is headed in the near term.

A number of people asked for clips of this episode. We'll roll out about 5-6 from the Roundtable #33 podcast since it was so long 🦁

Listen & Subscribe to the LeoFinance Podcast!

LeoFinance is a blockchain-based social media platform for Crypto & Finance content creators. Our tokenized app allows users and creators to engage and share content on the blockchain while earning cryptocurrency rewards.

| Track Hive Data | New Interface! | About Us |

|---|---|---|

| Hivestats | LeoFinance Beta | Learn More |

|  |  |

| Trade Hive Tokens | Wrapped LEO | Hive Witness |

|---|---|---|

| LeoDex | wLEO On Uniswap | Vote |

|  |  |

Posted Using LeoFinance Beta

Congratulations @khaleelkazi! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

I am a long-term Hodler as well. The one thing I have learned and continue to learn is that, unless you actively play the market, profit comes long haul.

Long-term hodling is my cup of tea. I like to stay active and take small positions to trade in the short-term but this is more so just to be engaged with the markets and have a little fun.

Posted Using LeoFinance Beta

... although I must admit, this recent rally of Bitcoin got me selling, hehehe. Ahhh.... life is good!

Posted Using LeoFinance Beta

While it would be cool to buy bitcoin on the cheap at $17.000, me and the boys have more important plans:

Posted Using LeoFinance Beta

Haha. That's the fun thing about "altcoins" and especially with a project like LeoFinance. It's something you can put your hands on each and every day and actively be a part of buidling it. With Bitcoin, we're all a part of the movement but it's so large and widespread that we have a smaller impact.

Each of us here on LeoFinance make Leo more successful. That's the most engaging aspect of the platform imo

Posted Using LeoFinance Beta

yup, we all want to have an impact in whatever we do. But I think in the long run Leo can impact me more than I can impact it :P

Posted Using LeoFinance Beta

Enjoyed this one, I don't know how to go short either, so I just tap the sell button like scardy said :)

Posted Using LeoFinance Beta

hahaha yeah I feel that perspective. I do occasionally short sell but typically as a hedge on my bigger long positions. i.e. I hold a lot of ETH but recently shorted it at $1700 (a very small short position in contrast to my long position).

This lets me cash in on some short term price movement. Either direction and I make a profit. If we go down, it's a win on my short. If we go up, I lose on the short but win in the long run on my main bag

Posted Using LeoFinance Beta

Yeah, I kinda always hope it drops after I take some profits so I could increase the bag by token volume, that is if I had 1 ETH then took profits at $1,700 I hope it drops lower to add 1 ETH plus+ depending on how low it went.

Posted Using LeoFinance Beta

I subscribe to @rollandthomas regarding that guy's prediction of BTC getting to $17,000. That's not going to happen. I'm less than four years in crypto, but if you look at BTC performing after the halving it replicates quite well its performance after the second halving.

$17,000?

Never again.

S2F model is one of the best metrics I follow to get the direction of BTC. I like simple things and can't think of anything simpler. Zoom out, get the yearly charts for BTC and have a look at the four years cycle and the situation is somehow clear.

For the moment though I belive BTC is a bit out of steam and alts will have their share of exponential growth as BTC had once it broke through its previous ATH. Some alts, including major ones such as LTC, haven't even got to their previous ATHs.

By the way @scaredycatguide you still have time to buy UNI.

Posted Using LeoFinance Beta

I agree on BTC. Definitely in the long camp. $17k seems unthinkable with the current cycle we're in.

totally possible, but not likely IMO.

I'm a big fan of S2F. A simple and foundational economic model to follow for BTC. I think many rational thinkers in the space hang their hats on this as well.

Alts have a lot of room to run here - as many of us are seeing with ETH (and WLEO 😎). BTC dominance is still quite high relative to last bull run!

Posted Using LeoFinance Beta

!WINE

Cheers, @cryptoaeneas You Successfully Shared 0.100 WINE With @khaleelkazi.

You Earned 0.100 WINE As Curation Reward.

You Utilized 11/3 Successful Calls.

WINE Current Market Price : 1.100 HIVE

Although anything is possible with crypto in terms of the process because its difficult to predict exactly how the market will perform but I don't expect the price to reach 17k$ again. Looking at the current market sentiments it seems like we will be able to see the price of 50k$ per BTC this year.

Posted Using LeoFinance Beta

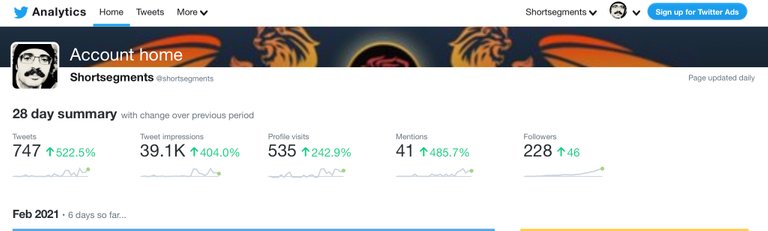

I am doing my part to get Leofinance noticed on Twitter, as my activity includes tweeting my posts and many of the posts marked as curators picks and trending.

I am trying to use Leofinance Media, so the quality is there and trying to promote solidarity between Leofinance and Hive, as well as recruit both Twitter and YouTube influencers to our community.

I greatly appreciate all the hard work your putting in, along with the hard work of your developers. So I am trying to tastefully and gently give people reasons to click on the links and learn about Leofinance.

The Twitter Storm Project has gotten off to a slow start, but I think it’s still worth a shot. The number of crypto people on Twitter is huge.

If you have any feedback let me know.

@shortsegments

Posted Using LeoFinance Beta

This is Just the beginning .. Bitcoin will touch minimum 100k usd

Posted Using LeoFinance Beta