Bitcoin Collateralized Lending Vaults | How to Pay Your Bills Without Selling Your Crypto

Bitcoin collateralized lending has always been a fascinating part of DeFi to me. I think my first time using a BTC Lending Vault was about 4 years ago in the early stages of MakerDAO.

This was one of the first major DeFi breakthroughs that we were actually able to utilize. Most of DeFi in its infant stages was completely unusable.

In the beginning, there was really only one option - to collateralize WBTC at a fixed rate. Ethereum blockchain gas fees were extremely high so moving funds around in your vault could cost anywhere from $50 to $500 depending on when you did it.

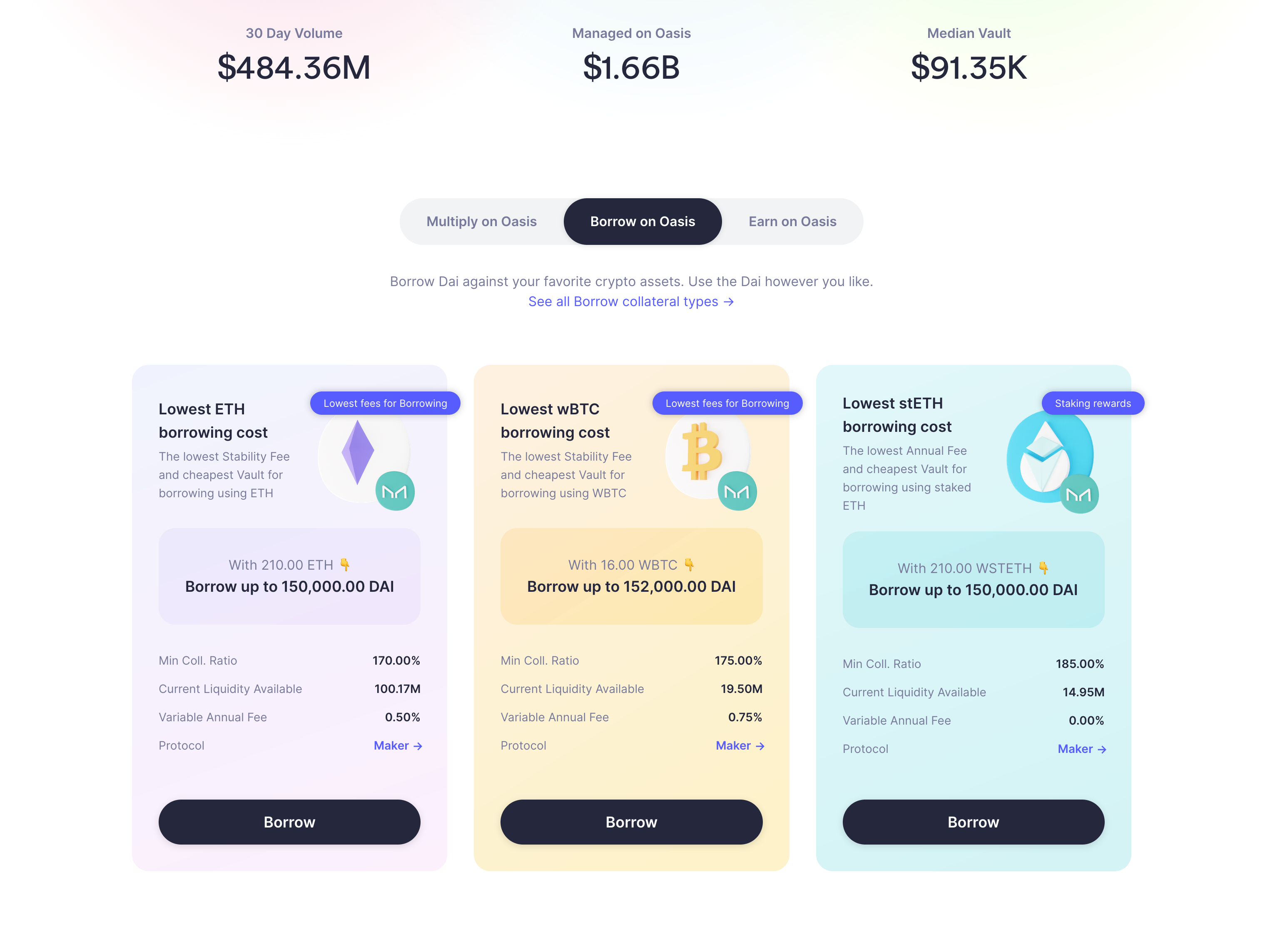

Today, there are 100+ options for collateralized lending. Ranging from centralized to decentralized. Ranging from WBTC to fringe alt coins. ETH gas fees are a lot lower now, so you can move funds around for as little as $10 or as much as $100 depending on when you do it.

Step 1 - Get Collateral

This step is probably already done if you're reading this article. If you're reading this, you probably already own Bitcoin or some form of collateral that you're looking to collateralize.

If you don't, then find a collateral type that you're comfortable with. IMO Bitcoin has always been a pristine collateral. It's the gold standard in Crypto and has the least volatility amongst anything that has crypto exposure.

Step 2 - Find a Platform

Like I said, nowadays there are over 100 options for collateralized lending. Some centralized, some decentralized.

I've used at least 6 different platforms in both arenas. Through my trials with all of them, I still believe that MakerDAO - the OG platform I started with - offers the best vaults with flexibility, trust and ease of use.

Step 3 - Deposit Collateral, Take a Loan

This part is where you need to make some decisions. I have a few different vaults that I use in various ways. Some vaults are to pay personal expenses, some vaults are to simply use collateral as margin to get more collateral (i.e. deposit 2 bitcoin, use a loan to buy 1 bitcoin and then deposit it for a leveraged position of 3 total bitcoin).

There are countless ways to use these vaults. What you're doing is locking up collateral to get access to liquidity. What you choose to do with that liquidity is completely up to you.

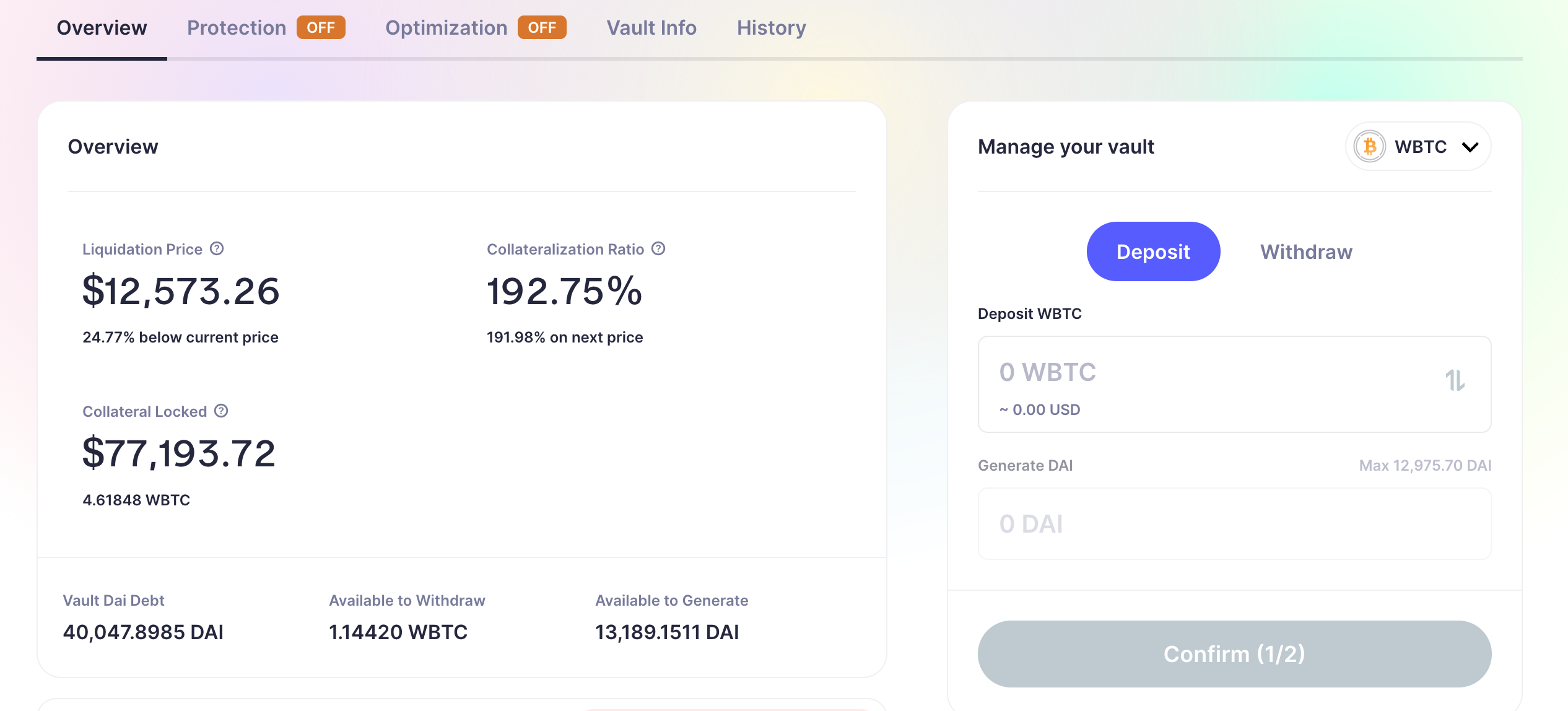

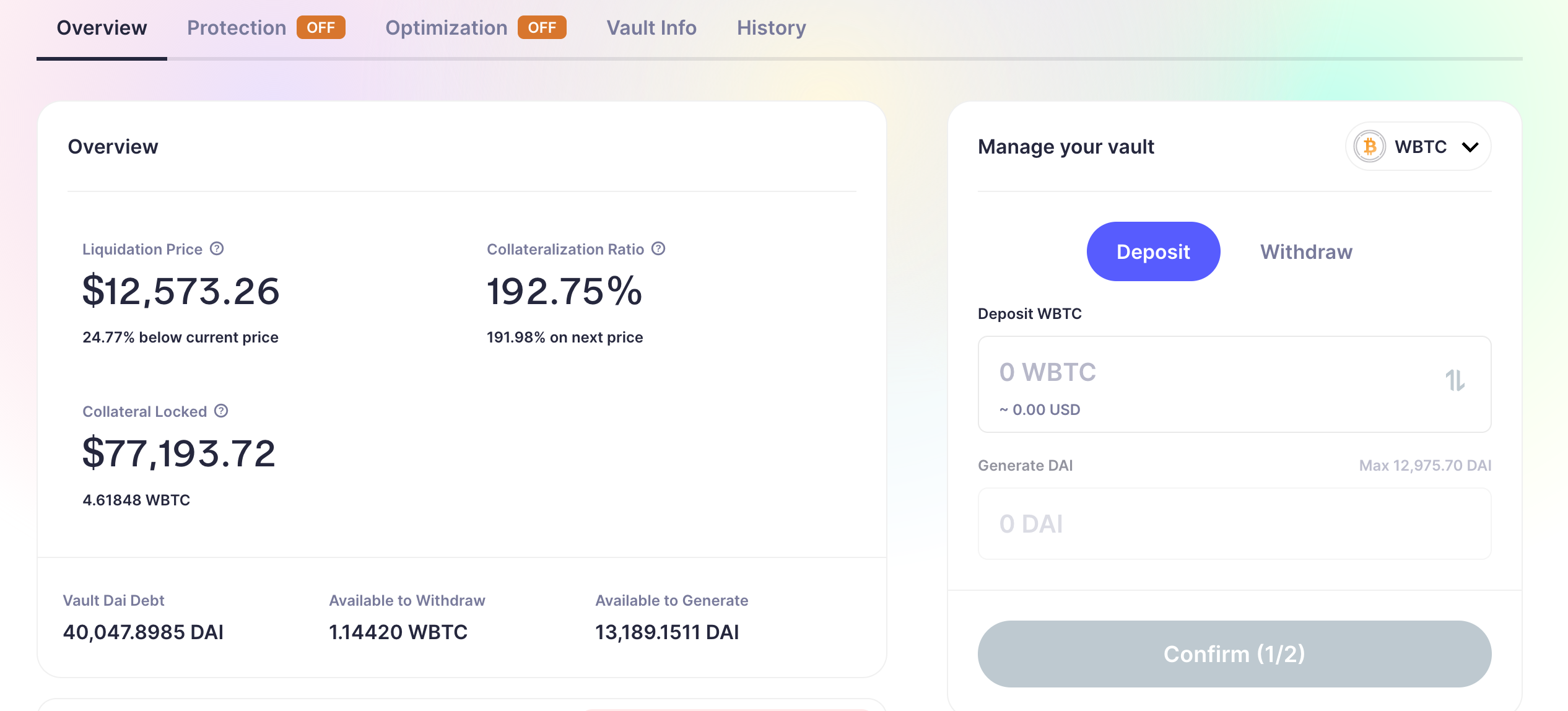

The above image is one of my actual vaults. It's slightly more "risk-on" than most vaults I have. Most of them have a liquidation price well under $8-9k but relative to those, this vault is small and highly active so I'm always moving capital in and out for various things.

How I Use Them

I know a lot of people that use these vaults in a very similar way that I do:

- We're constantly stacking BTC, which means that we are constantly gaining more collateral to push into vaults

- We have life and business expenses, which means we'd have to sacrifice stacking some of that BTC each month in order to pay for things

... unless!

Unless you stack the BTC in step 1 and then stake the BTC in step 2, then take a loan out against it to pay the bills.

Why?

Why would you do this? It sounds like taking on a lot of debt!

Well, yes - you are taking on debt. This is not free money. Any $ that you take out against your collateral must be paid back at some point in the future.

I've been doing this for years which means that I setup some BTC Vaults during the last bear market and held them into the subsequent bull market - when BTC rose by a factor of 20x from the bottom of $3k.

What happened to my vaults? My loan-to-value ratio kept dropping which means that the amount of loan vs. the amount of collateral I held was getting healthier and healthier.

Eventually, the loans were such a minuscule dollar figure compared to the BTC Collateral in the vaults. What did I do? Sell a tiny % of the collateral to pay the loans.

You see, at the time I took those loans, they were nearly 40% of the value of the Bitcoin.

So for example, I had $100k worth of Bitcoin and took a $40k loan against it when Bitcoin was trading at $5k.

Then Bitcoin was $50k. The vault was worth $1M and the loan was still $40k. I sold 4% of the Bitcoin in that vault to pay what was once 40% of the vault's value.

Hindsight is always 20/20 but today's market is feeling a lot like the last bear cycle.

Instead of stacking less Bitcoin and paying bills, I am stacking more bitcoin and still paying my bills through collateralized loans.

The Risks

Everything in life has risks. You need to be vigilant when it comes to collateralized lending.

Never forget that you are your own bank when you do stuff like this. That means you assume all of the risk. Nobody is coming to bail you out when you're in trouble.

No matter how much I collateralize and how much DAI debt I accumulate, I still have loads of BTC that is not used as collateral.

This means that if BTC's price suddenly drops, I can quickly deposit more collateral before I get liquidated.

I've been liquidated in the past on 1 vault and let me tell you: it sucks.

You never want to be in a position where that happens. You lose thousands of dollars and you feel like an idiot for not being on top of it.

A mistake I made once, never to make it again.

Another risk is what asset you're using as collateral. There aren't any decentralized native BTC lending vaults yet (Thorchain is working on one and hopefully will have it by the end of 2023), so until then: we're stuck using WBTC.

WBTC has counter-party risk. I'm comfortable with it but you should definitely DYOR and be comfortable with a wrapped token before pushing a bunch of collateral through it.

This is starting to get long, I'll probably do a part 2!

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

Cub loans coming?

Soon

Posted Using LeoFinance Beta

Ah, the famous Soon™ :P

What I was about to ask! You beat me to it :)

!PIZZA

Posted Using LeoFinance Beta

I wrote this post in conjunction with testing an idea on #threads:

A new way to engage with and build your audience on Hive - ask them what kind of content they want to see. Get your audience more involved in the long-form part of your Hive profile.

Threads is evolving and growing each day. More and more users. Love to see it!

Posted Using LeoFinance Beta

Awesome. But how can tribes integrate into Threads?

Posted Using LeoFinance Beta

Didn't CTP do that with Veews? Didn't CTP find a way to integrate sharing via LeoThreads with Veews?

Posted Using LeoFinance Beta

Yes. It's up to communities to find ways to leverage Threads

We've put the tools out there, it's up to them to find out how to best utilize it

For example, creating a #hashtag for their community and making it trend. Look at how successful #gmfrens has become. #1 trending tag all the time. First thing anyone using Threads sees is GMFRENS

Imagine if #ctp, #stem, #splinterlands and other projects followed that lead

Posted Using LeoFinance Beta

Creating a community hashtag at LeoThreads is the least a community can do to get more exposure while at the same time LeoThreads gets a boost in activity. It's WIN-WIN on both sides.

I'll put up a PSA Index Card at LikeTu piggybacking on your suggestion. As with all dApps here, only so many tags can be included in this post, so I will be rotating the PSA Index Card a few communities at a time. For anyone who thinks I'm abusing token tags: It's a PSA, so I'll decline payout on upvotes (although wallet-to-wallet contributions are welcome).

Posted Using LeoFinance Beta

Interesting idea. I will try it out. I wish there was a way to use an email like notification on the blockchain to reach all your followers with an idea like this.

Posted Using LeoFinance Beta

Congratulations @khaleelkazi! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 20500 replies.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Support the HiveBuzz project. Vote for our proposal!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

a lot to think about.

Ha ha. Nice

Posted Using LeoFinance Beta

Cub loan will be amazing

Posted Using LeoFinance Beta

good strategy!

I will do that once I am confident that we have bottomed.

I need MOAR. Give us part #2. SOON !

Posted Using LeoFinance Beta

Soon!

Posted Using LeoFinance Beta

More info why you see this.

Posted Using LeoFinance Beta

This is good move,I hope it brings out good results soon

I haven't had a real time experience with collateralization of MakerDAO but I took the time to read and understand how it works. The steps you provided has opened up the eyes of my understanding to what I read in a blog post sometime ago. Thank you for sharing this timely guide, I anticipate part 2 of it.

Posted Using LeoFinance Beta

insanely valuable information here guys.

Posted Using LeoFinance Beta

🦁

Posted Using LeoFinance Beta

Nice strategy. But you definitely have to have knowledge and experience with defis before doing that otherwise it’s a recipe for liquidation!

Is there any reason NOT to just put some BTC there without taking a loan against it? Just so it's there and ready if you ever do? Are you paying any fees for the account if you don't use it? Is the BTC "safe" while it's there? I realize there are no guarantees, but I would like to hear your opinions. You obviously have a strong working knowledge of the platform...

Posted Using LeoFinance Beta

If I wasn’t taking a loan against the bitcoin, then it’d be better to hold native BTC in a cold wallet

Remember that this is WBTC. So some risk there. I’m willing to take that risk in exchange for access to DAI loans

Posted Using LeoFinance Beta

https://twitter.com/494429019/status/1610395880305168384

The rewards earned on this comment will go directly to the people( @successforall ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I gifted $PIZZA slices here:

@d-zero(1/5) tipped @cwow2 (x1)

Join us in Discord!

Had to read this twice, and its quite a revelation! Really going to put my BTC together and see how to take advantage of this bear market, now that prices are very low. Thanks so much for sharing this. Super valuable

Posted Using LeoFinance Beta

If you are careful and cautious, this is one of the best bear market strategies out there

Posted Using LeoFinance Beta

Thank you for sharing this where we can get a view of how things are done in collateralized lending.

Posted Using LeoFinance Beta

Thanks for this breakdown

I always wanted to try something like that, but I admit it feels a bit intimidating. Maybe I will start with small amounts just to see how it feels

Posted Using LeoFinance Beta

Wen do we have collateralized loans on PolyCUB and CubFinance?

Posted Using LeoFinance Beta

Possibly soon,

But also: soon

Posted Using LeoFinance Beta

Thanks for the tips. I think Collateralized loans are like the Holy Grail for people who don’t have the ability to do this with stock or real estate. This aspect of cryptocurrency is one of the most important democratization of finance ideas out there. Thank you for shining some attention on it.

Posted Using LeoFinance Beta

I really like the option of staking the BTC to get a loan, it must be a very difficult decision to make but I admired that one.

As far as the loan is used for a good purpose. Thank you for saying this @khaleelkazi

Posted Using LeoFinance Beta

, I still believe that MakerDAO - the OG platform I started with - offers the best vaults with flexibility, trust and ease of use. - You can always say this times without number because you’ve tested it and you’ve seen it is way too trusted .As a decentralized autonomous organization (DAO) that operates on the Ethereum blockchain, it is clearly focused on providing stablecoin financial products that are collateral-backed and algorithmic-based.

Posted Using LeoFinance Beta

From your income, do you stack first, then borrow to pay bills? Or, do you use income to pay bills and stack with what's left over, only borrowing for big expenses?

Posted Using LeoFinance Beta

I stack first, take a loan and then pay bills

If you can get your income to be 2x your expenses, then you can stack 100% of the income and borrow 40-50% DAI against it to pay bills

For some, this might be hard. If you can get expenses under control though, it’s a game changer. It essentially is like staving off your bills for a future year when crypto is high and you sell collateral to pay debt back

Posted Using LeoFinance Beta

THORChain lending is supposed to be out Q1 2023 and will have zero liquidation risk. It should be a game changer.

Wen collateralized loans for Leo power sir?

Posted Using LeoFinance Beta

Possibly soon

Posted Using LeoFinance Beta

Now to get that time machine to go back and use this technique before spending everything to live :)

Posted Using LeoFinance Beta

Lol

The best time to start was yesterday, the second best is NOW.

Posted Using LeoFinance Beta

as long as you have the dough for it

Posted Using LeoFinance Beta

thanks for sharing!

I'm still new to the DeFi platforms and https://rocko.co/ looked like a solid start.