ZENTEREST, AN OVER COLLATERALIZED LENDING PROTOCOL OF THE MANTRADAO ECOSYSTEM

Among several innovations brought by decentralized finance ( Defi) to the cryptocurrency world is the ability to lend and borrow cryptocurrency assets without having to pass through KYC verification. This made it possible for both lenders and borrowers to achieve their goals with their assets.

Zenterest, an over collateralized, money market, and lending protocol of the Mantradao Ecosystem offers investors an opportunity to supply, borrow, and also use their crypto assets as collateral to acquire loans from the platform. It is a fork of both Compound Finance & Cream. finance but with a unique feature and lists of assets available for lending and borrowing. Zenterest is only available on the ethereum network, the Binance smart chain is in development.

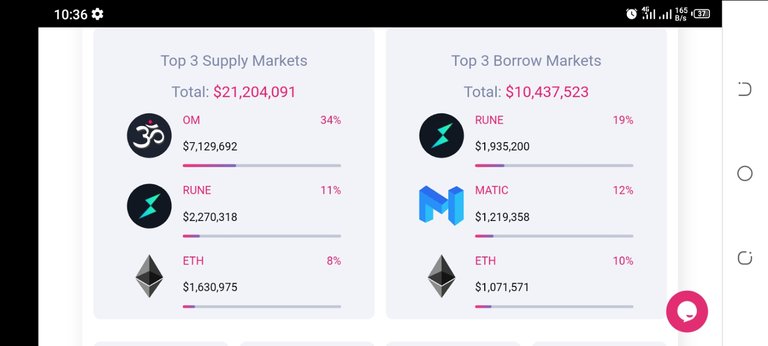

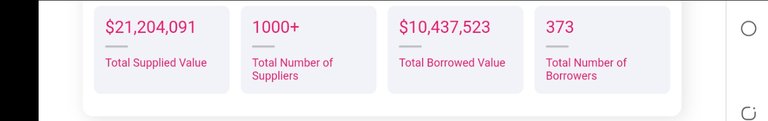

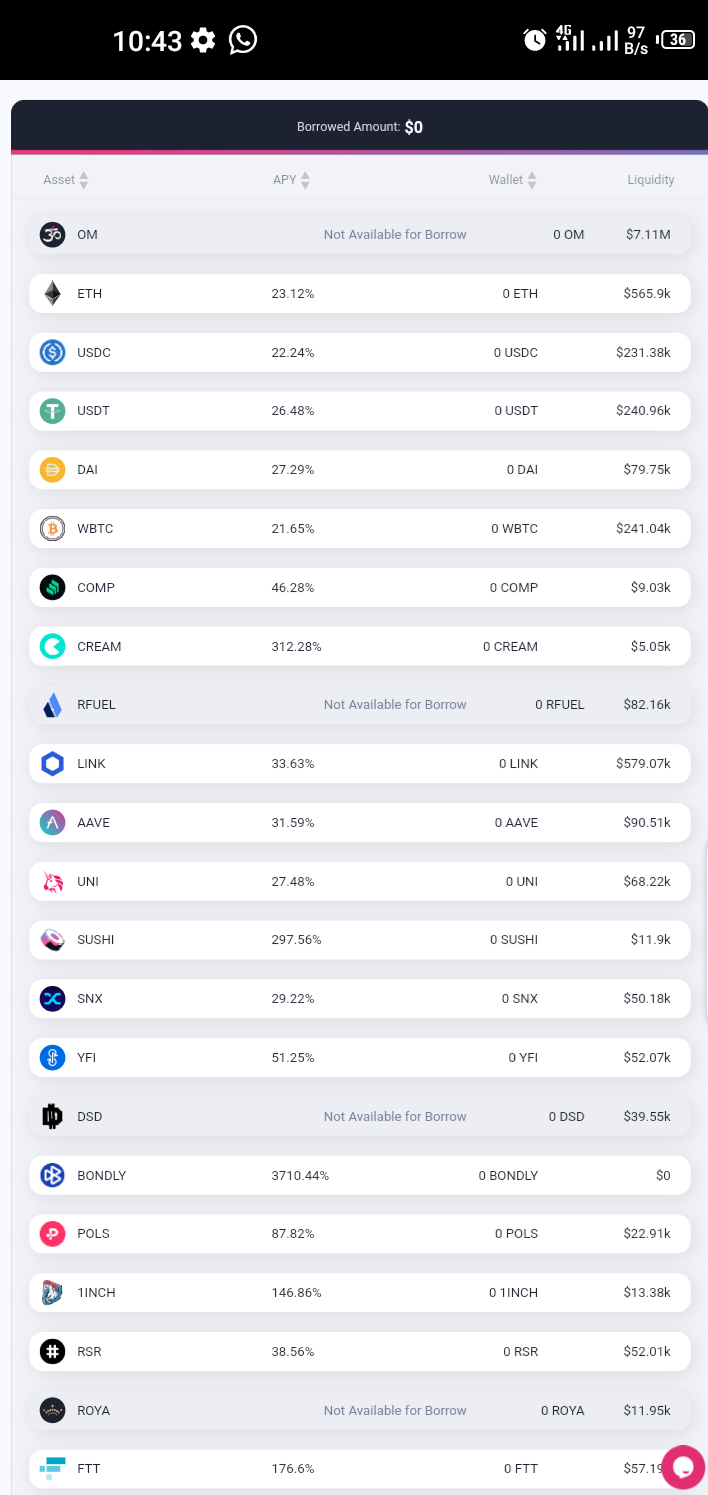

**Below are details of the Supply and Borrow Market

**

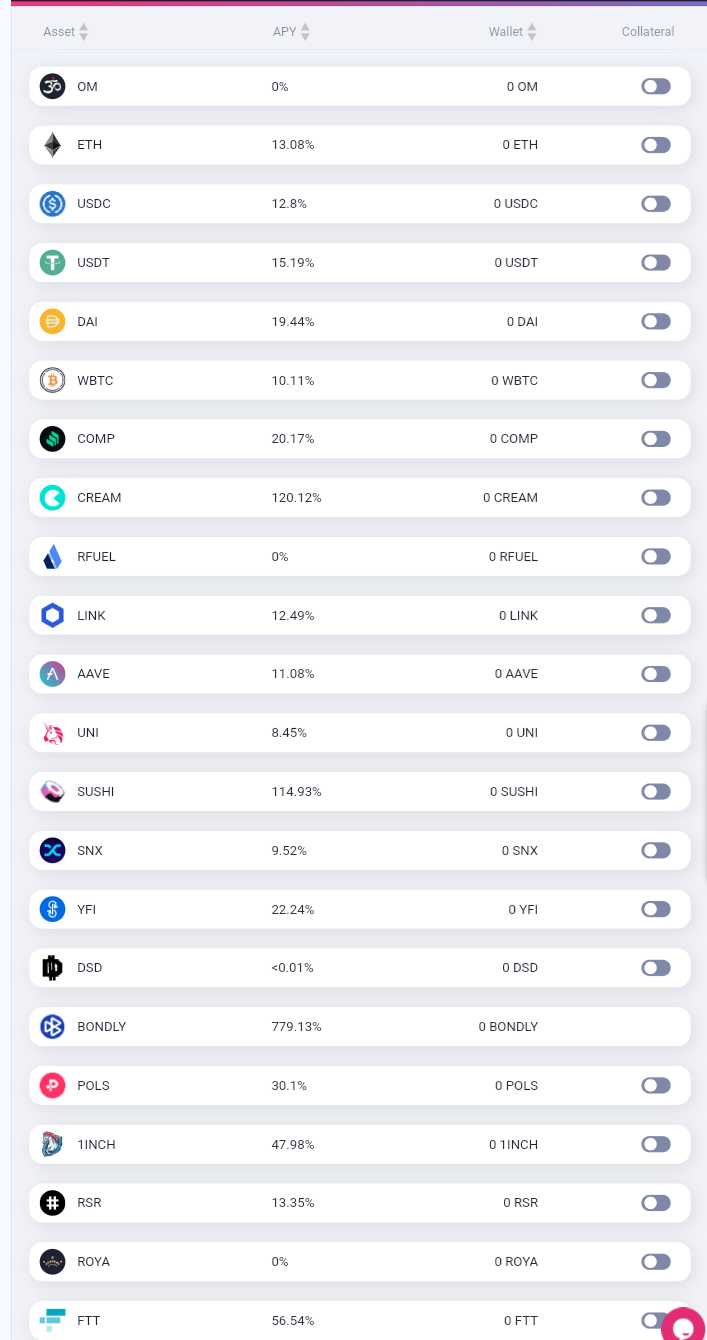

To access this amazing over collateralized lending protocol, you need to connect your metamask wallet to the Mantradao app using this URL . Ensure you are on the Ethereum network. Click on the sidebar to access a list of features available on the app such as Staking, Zenterest, Zendit, etc. Upon clicking the Zenterest option you will first see the Supply market and list of assets available for supply with their APR. If you have any of the assets listed, it will be reflecting on the app and you only need to push the button at the end of the asset. This enables you to supply your token after confirming the transaction. You can scroll down to the borrow section and choose the asset you want to borrow.

To lend, you just need to supply the token and you will be earning from the APR allocated to it.

ABOUT MANTRADAO

MANTRADAO is a community governed Decentralized platform that leverages the wisdom of the community to offer staking, lending, and Cross-Chain Multi-Asset service transparently thereby giving financial control back to the community. They have a Bi-weekly buyback strategy where they buy OM from the Market. This will make OM scarce in months to come and thus increase the price of OM. A total of 4,139,186.80 OM had been bought back.

Some of the features of the mantradao App includes;

STAKING PLATFORM:

Here Sherpas and community members can put their assets to work and generate passive income for themselves. The staking feature is available in three networks; Ethereum network, Binance smart Chain, and Polygon network. The staking can be naked staking or LP Staking.

ZENDIT:

This is their launchpad where new projects are launched. Sherpas are opportune to be part of the launch, and this is made possible through tier classification. This is based on the number of OM held by the Sherpa.

KARMA:

This is a crediting system whereby Sherpas are given a Karma point for each transaction they make on the app. Although it is still in development, Sherpas who have used the app for several purposes can receive their Karma point once the protocol is live. The Karma point can be beneficial during lending and borrowing. Sherpas with Karma point will be able to borrow at a lower rate, higher APR for lenders, and many other benefits.

MANTRA POOL:

This is the lottery aspect of the Mantradao. This is a weekly event and is available both in the Binance smart Chain and Ethereum network.

SWAP:

You can be able to swap some specified assets for another using the app. However not every country is eligible to use the swap feature.

All images were taken from the website as screenshots.

Useful links

WEBSITE

Posted Using LeoFinance Beta

As it is built on eth, it seems pointless, to me.

Who pays those fees?

Zenterest is on ether for now but you can leverage on other features of mantradao