EQUILIBRIUM; ALL DEFI UNITED IN ONE PLACE

Before the coming of Cryptocurrency and Decentralized Finance (DEFI) in particular, there have been difficulties in securing loans, lending out funds, and performing other financial transactions. Decentralized Finance leveraged on Blockchain technologies to build financial applications that focus mainly on Lending, Borrowing, staking ( POS and DPOS), and Trading. Using Smart Contracts, DEFI gave people direct access to borrowing, lending, staking, and trading. The stress of standing in queues or signing tons of papers to get any of the above services was thus removed.

Projects started springing up to offer some of these services to investors. Some came to specialize in lending and borrowing, some also went for staking. Equilibrium the first decentralized interoperable money market came into the crypto sphere to offer all the services that defined DEFI.

WHAT IS EQUILIBRIUM ABOUT?

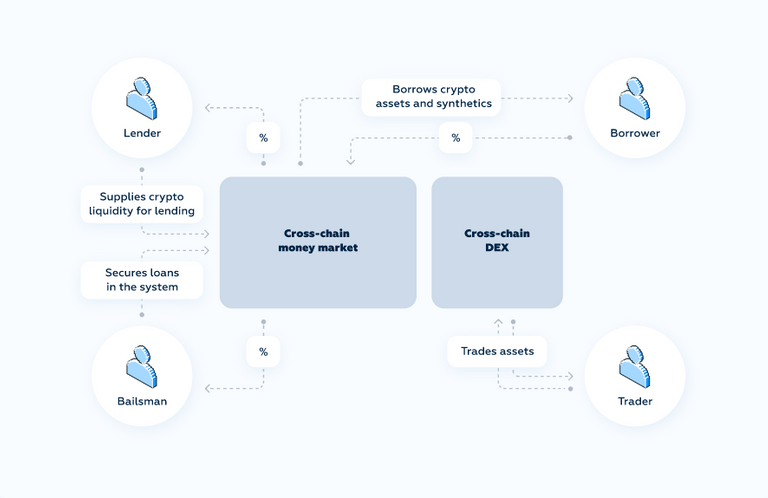

Equilibrium is a decentralized money market that combines pooled lending with synthetic assets generation and trading to give users the best platform for their financial needs. Users are opportune to lend, borrow, stake, and trade(the four main focuses of DEFI) both cryptocurrency and synthetic assets. The beauty of this is that the cross-chain feature is powered by the Polkadot bridge.

THE EQ TOKEN OF EQUILIBRIUM

EQ is the utility token of equilibrium that powers most of the transactions carried out on the platform. Some of its features include;

Governance Right: EQ gives hodlers the right to contribute to the project. Hodlers can select substrate validators and participate in voting during proposals.

EQ is the native currency of the platform is used to pay transaction fees on every transaction carried out on the platform.

Passive Reward through Staking: EQ can be staked for passive reward. Staked EQ can serve as Bailout Liquidity to hodlers who secured loans on the platform.

WHAT OTHER FEATURES MAKE EQUILIBRIUM STAND OUT AMONG OTHER DEFI PROJECTS.

1.Equilibrium has three layers of proactive system solvency protection. They include;

Over Collateralization.

Presence of bailsmen who take over debts when there is a threatening margin call.

Covered by Insurance Policy: As a way of showing transparency and in making plans for unforeseen circumstances in the crypto market. The first $13M raised by the project is kept for liquidity and system stability.

2.There are no set liquidation penalties, and no hidden fees when borrowers default on their loan. This is something not common in most similar Defi projects.

3.A balanced two side system where borrowers are on one side paying fees to lenders and Bailsman while the lenders and bailsman are on the other side ensuring that liquidity is not wanting.

4.There is no fixed governance interest rate. Interest rate is given based on the following factors; borrowers portfolio,

borrower debt, overall system liquidity, and the market's risks and dynamics. There are many more features that I will reveal in my next post.

So basically, Equilibrium has all the defi features you can ever desire and the Polkadot underlying technology makes Equilibrium the first interoperable decentralized money market. If you you are conversant with what Polkadot bridge can offer, you will surely agree with me that Equilibrium is a project to consider.

USEFUL RESOURCES.

WEBSITE

[Telegram](The first cross-chain money market that combines pooled lending with synthetic asset generation and trading.

Official Announcement Channel: https://t.me/equilibrium_news_feed

Website: https://equilibrium.io/)

All images were taken from the website.

Posted Using LeoFinance Beta

Posted Using LeoFinance Beta

https://twitter.com/Josemendez_1010/status/1452798526266675202

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.