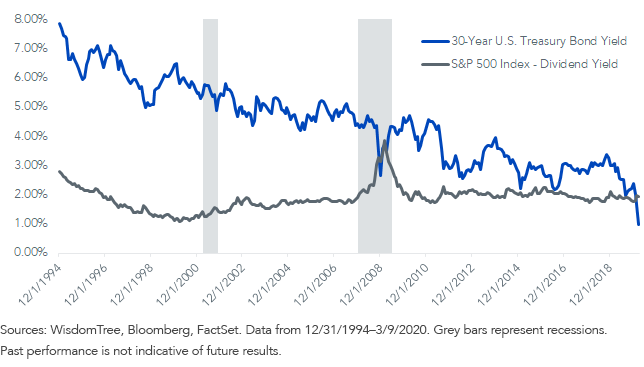

Stocks behave badly when the bonds pay more

This is a behavior I have seen in the Brazilian stock markets. The government, and private, bonds are increasing their yields, which puts selling pressure on stocks. The herd mentality is obvious:

"Why would I take risks when I can have a sure guaranteed profit?"

Recently the USA FED has been hinting about increasing the bond yields, which in turn pushed stocks down. Of course, this opens opportunities for small investors to get in. The behavior I saw this week was stocks going down, almost globally, on Monday, and today they recovered, probably because it was oversold due to the possibility of bonds increasing their yield, but people saw opportunities on cheaper stocks.

The problem for small investors is that bonds are also a good investment, there is a reason why bonds move markets and that is because they are, objectively, a good investment. Bonds may pay less in the long term, but they can also lose less, and losing less is key to making money.

I am diversifying and around half of my portfolio is on government and private bonds, but I am taking this opportunity to get some entries on some stocks that went down a lot, I plan to keep buying good bonds that pay high yields, but I want to increase the share of my portfolio allocated to stocks.

I only invest in brazilian stocks because I am brazilian and I think I prefer to invest in my own jurisdiction, but I have some investment funds that invest a small portion abroad, so the jurisdiction and bureaucracy issue is theirs to solve, so I can say I have got some nice entries in foreign markets through the funds I have (I have only 2 funds actually because over-diversifying is dumb).

When bond yields go up opportunities show up on various fronts, I have got some bonds that yield upwards of 10% a year (in BRL, Brazilian Real), some bonds pay the inflation plus an extra 4 to 5%, which means liquid profit adjusted after the inflation! And also some cheap stocks because I could not decide which to pick, bonds or stocks. I couldn't buy only stocks because stocks may go down, but I also could not go all-in on bonds because stocks may go up.

Overall, I am happy that I had fiat currency. It is not a matter of "bond yields are up so stocks are a good opportunity" because when bonds yields increase almost everything becomes a good opportunity, that is actually the reason why governments increase yields, to make people save and invest money (mainly to control inflation), and I don't know about you, but I can't outtrade governments, so I am taking those good deals.