Zero To Hero Challenge Ep 20: Bearish Exhaustion

Once the last seller has sold there is nowhere to go but up! Consolidation and accumulation periods dont last forever even though it may feel like it has been dragging on for eternity. Each day in crypto feels like 3 in the normal world and time seems to be standing still.

The signs of a bearish exhaustion are all around us with local price floors being established across most markets. Altcoins are rallying here, positive mainstream news is causing tiny rallies in coins like MATIC for example. Stocks are generally the only thing that keeps edging down since individual conpanies are just burning through cash in this economy.

Mass layoffs are still around the corner and a major housing crash but the equities markets may have bottomed for now. Traders in crypto have been waiting a whole year for things to stop selling off. Bitcoin wants to stage a recovery rally but the volumes have been muted.

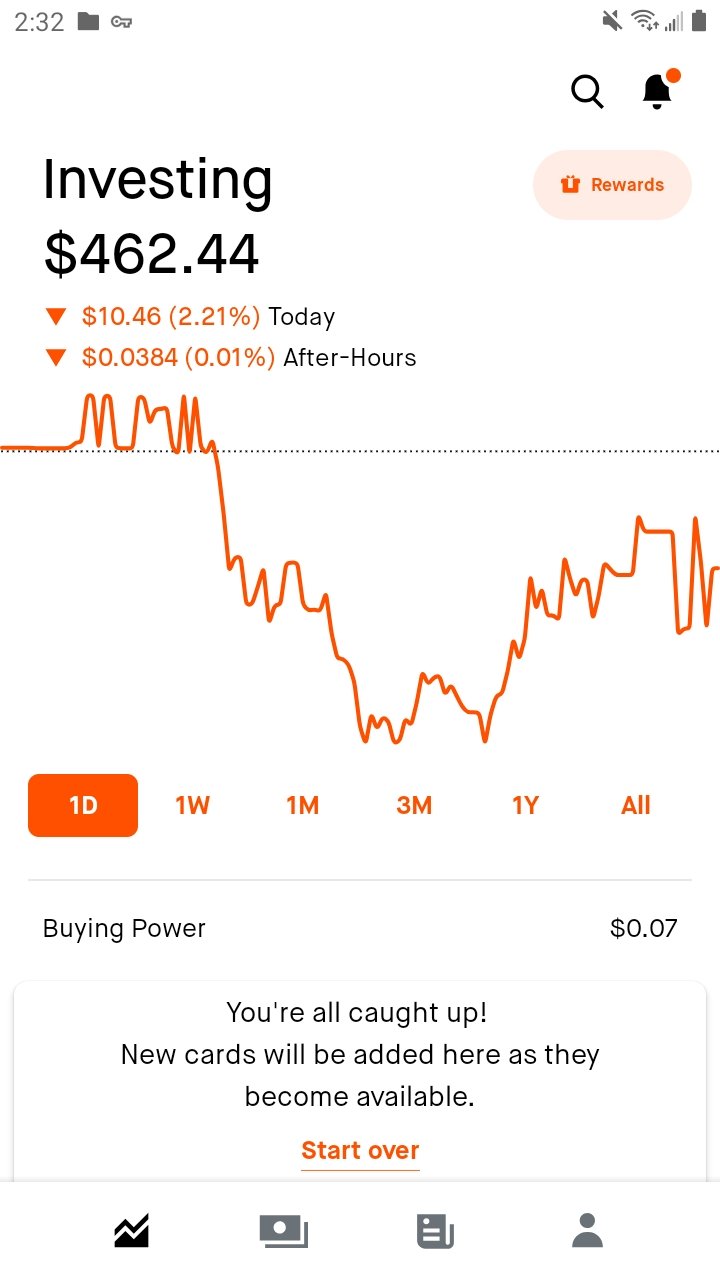

As far as my stock portfolio its really just churning in circles as I backpeddle from losses and general trading mistakes over the last 3 months. The bottom may in fact be near for us so buckle in and enjoy the ride. Just waiting for those in between days where I can ride the green candles.

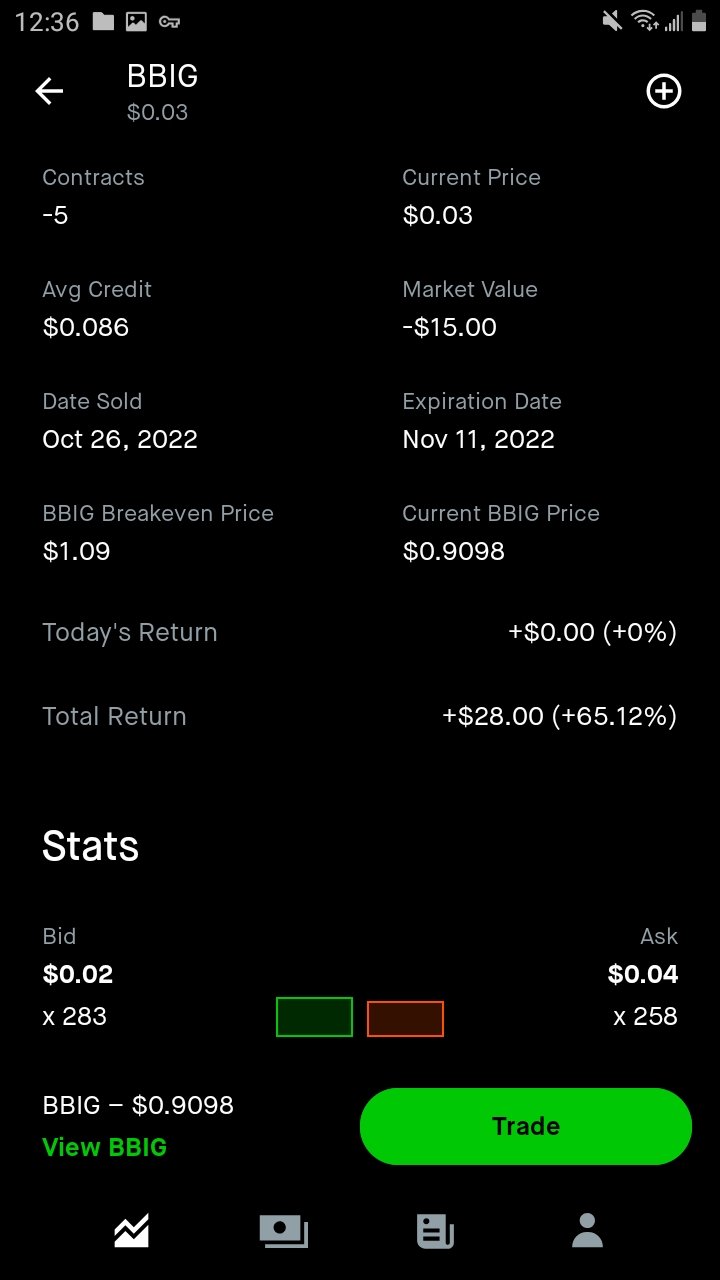

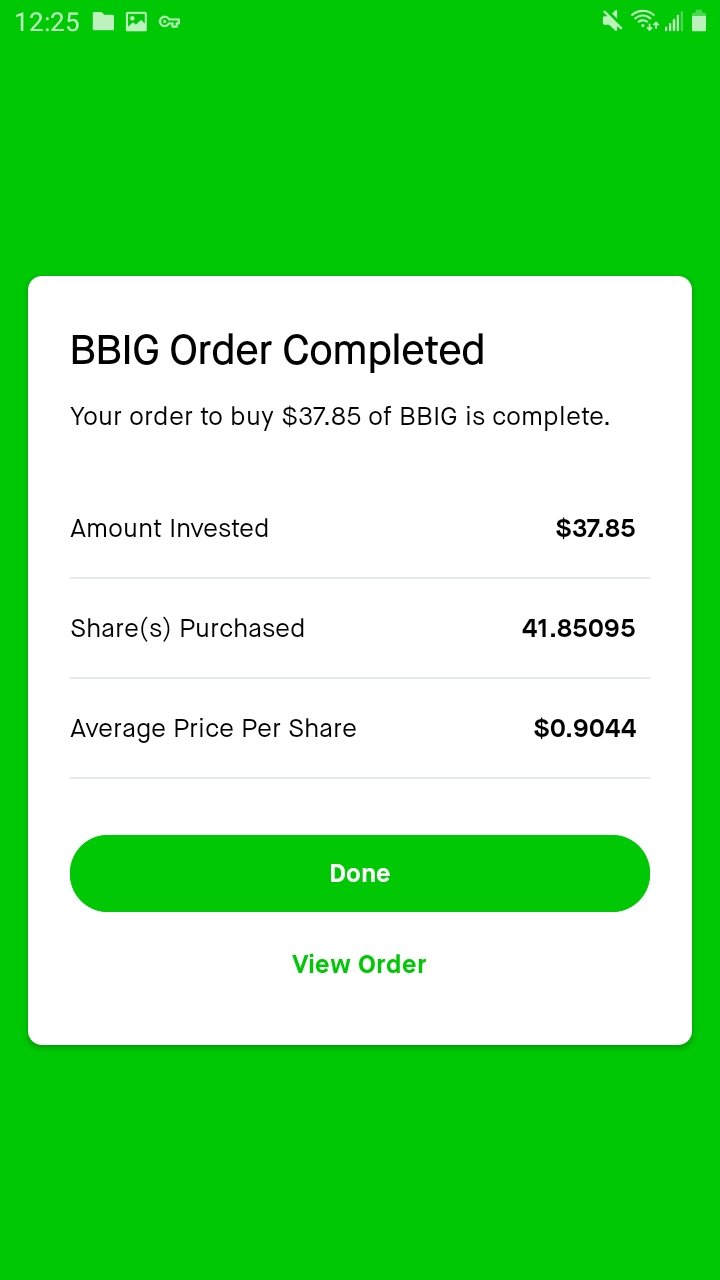

$BBIG has been slowly trending down and dropped to 87c today. I decided to buy shares yesterday using my cash buying power but should have waited til today. I have now averaged down my cost basis per share and intend to gather 100 shares to be able to write one more contract. The covered calls I wrote last week are still decaying but slowly as there isn't much value left ($3 each). This will go to zero by next Friday as BBIG stays below $1 per share, giving me max value on them. Hoping to get my collateral unlocked by the following Monday to rinse and repeat the strategy.

Overall my portfolio stands to gain the remaining $15 value from those contracts to put me somewhere near $475-480 in total equity at the current price.

Over the weekend Im going to have my eyes closely tied to Fantom (FTM) and Avalanche (AVAX) charts as those are my biggest holdings overall and Andre Cronje just announced he is back. Things could get interesting over the next few weeks or months as new developments arise fron Fantom Foundation, especially in regards to their Fantom Virtual Machine middleware upgrades.

@ecosaint Please bless this post for more $BEE so we can speed up this ICEBRK upgrade