The State Of The Markets 2022

Things are not good- let's just be honest here. The market has been in a consistent downtrend lately and there is blood everywhere with no end in sight. What is causing this all and when will it stop? That is what we are about to discuss here today, highlighting both crypto and the greater macroeconomic trends that have occurred that last two years.

In case you haven't noticed

The stock markets and cryptocurrencies have been selling off pretty badly, in the last two months especially. Since November 10th, 2021 when Bitcoin hit its all-time high of $69,000 we have been losing steam on a weekly basis as the morale and sentiment slowly begins to shift towards bearishness. The pain is beginning to set in since crypto is one of the riskier and more fringe investment spaces it tends to see more dramatic movements in response to the economy. Small gains or losses in Bitcoin can be immensely magnified in altcoins which makes things even crazier for traders and investors.

Let's first take a look at some of the charts and technical reasons before we get into more fundamental background reasons for the market volatility and uncertainty.

Here is the daily chart for Bitcoin and as you can see it has dropping steadily along this trend line until the most recent market capitulation this last week. This price range is coinciding with the cost of production at these network hashrates, which is about $34,000 USD per BTC. The price can certainly drop below this level because Bitcoin has a variable mining difficulty which can adjust as needed depending on the target block speeds. If hashrates fall, due to mining profitability dropping too low and miners turning off, then the network will make necessary changes to approach the 10 minute block times. This would result in an even lower "price floor" for Bitcoin as the cost of production would drop in tandem with hashrate.

On this chart I overlaid Fibonacci retracement to highlight the support and resistance levels that may be posed. We are currently hanging around the golden retracement at $32,500 and this could present a major buyer zone if we dip into that area again. Should the market face an even more harsh capitulation and economic duress in 2022 we could see Bitcoin fall between $22.5K-$32.5K levels before really finding a floor this year. There is very little support between the breakout at $20K price and where are are right now because Bitcoin has virtually no historical trading in this area. Again, cost of production will come into play as major institutions, corporations and governments will begin to accumulate BTC and delve into mining.

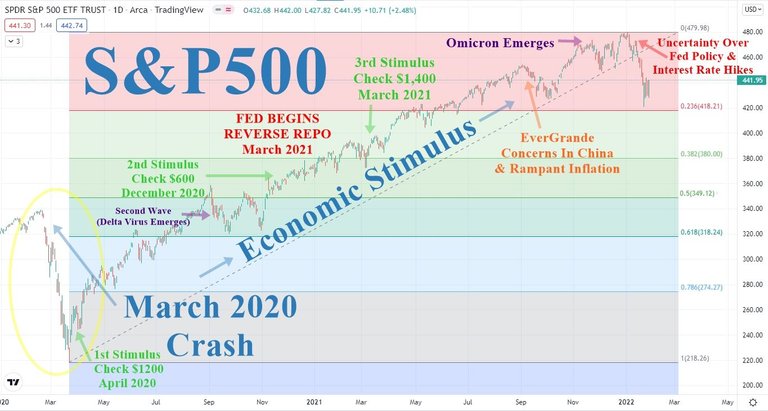

The S&P500 is my go to reference to see how the stock market is really doing since it is comprised the largest and most profitable companies in one index. On the chart you will see I indicated different events and key points to pay attention to. Starting on the left in March 2020 we had the very first massive crash due to the pandemic outbreak across the US and economy effectively shutting down. Americans got their first stimulus check in April and the recovery had already started to begin somewhat as the Federal Reserve began to fire up their purchasing of assets. Late 2020 the Delta variant emerged and caused a second wave of infections which threatened to lock down more countries and bring the economy to it's knees yet again.

December 2020 there was a second stimulus check for only $600 and the market continued to rally on positive stimulus from the Federal Reserve. March 2021 things begin to shift slightly without much notice, as Americans got their third stimulus- this time it was the largest at $1,400. The Federal Reserve quietly started up their reverse repo facilities to slowly tiptoe into tapering their fiscal policies as the economy began to return to normal function.

Everything seemed fine until the fall 2021 when inflation numbers began to rise incredibly high, fueled by ongoing supply chain constraints and obvious loose monetary policy from the Federal Reserve. Low interest, increased liquidity in the market and several trillions in direct economic stimulus had finally begun to take its toll on the artificially bloated economy. Only a month or so after the EverGrande China news broke we get the outbreak of Omicron variant, which again threatened to destabilize the recovery efforts.

Fast forward to January 2022- the Federal Reserve is now looking at the whole situation and trying to navigate the best course of action to take. They have continually "kicked the can down the road" on inflation by not raising interest rates at all during this entire recovery, assuming it would counteract their progress thus far. Eventually we have to face the music and get the inflation numbers under control as the Federal Reserve is losing their grip through current fiscal measures. In order to compensate they are going for a slightly aggressive yet gradual approach to raising rates in 2022 with the first of such estimated to be in March.

More importantly the Federal Reserve is aiming for a triple attack strategy going forward in 2022:

- raise rates gradually, but several times

- reduce the balance sheet

- reduce or completely stop asset purchases

Personally I think the Feds are doing too little too late in response to a greater problem which is rampant inflation. The situation is much more dire than they make it out to be and you can see this in TRUE asset inflation like housing, food costs, and fuel. This was reflected in the highest year-over-year inflation in 40 years according to last month's Consumer Price Index report. The cost of labor is up since the minimum wage increases, therefore many of these price hikes are also here to stay. You cant take back the toothpaste once its been squeezed out of the tube but you can certainly scoop it back up again and use it later- which is what the Feds are doing now.

By expanding the Federal balance sheets they have pumped billions in liquidity into the market on a daily basis. Now by reversing that strategy they are going to choke out the market even more so than they already have. Prices are high, but wages are not keeping up so with an incoming slow down of economic growth in 2022 we will be facing some severe constraints on the global economy. Once the interest rate hikes actually go into effect it could cause a cascade of effects starting with the real estate markets.

How this will all affect Bitcoin and the crypto markets has yet to be determined but so far it seems that we have been tied at the hip the the stock markets. All liquidity is linked across capital markets and it is very obvious when you compare the SPY (S&P500) and BTC charts side by side during trading hours. Wall Street now has their fingers in all of the pies so be careful moving forward, as we are in uncharted waters and they are tumultuous. Our greatest hope is that crypto grows as a true hedge to inflation and there is a mass accumulation by nation states, corporations and billionaires worldwide during mass adoption.

I expect cryptocurrency markets to continue to feel the pain of the stock markets through 2022 as there is still much uncertainty. Regulations and restrictions are popping up across the world in just about every crypto sector now which has caused even more jitters. Ultimately we are not out of the woods yet and things could get a lot worse before they get any better.

I am not a financial advisor and this is not financial advice. This information is for entertain and educational purposes only.

This post is brought to you by IceBreak-R.com - Breaking The Ice On DeFi. To get our new upcoming Hive-engine token (BRK) CLICK HERE

Posted Using LeoFinance Beta

Crypto mass adoption is inevitable

Posted using LeoFinance Mobile

It's just taking too damn long haha!

https://twitter.com/CannaCollectiv2/status/1487291634588938242

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.