Why You Should Trade Synthetic Indices

So it has become almost a ritual that each time I leave Hive for a long time, it's because I'm learning something new. Well, this time is no different. I've been away for some months now, primarily because I've been busy with my internship after medical school. But, I've also been learning to trade as well with every little free time I've managed to squeeze out-the forex market, technical and fundamental analysis, and the whole works.

I've gotten to explore different kinds of markets and different forms of trading — options, binary, spot, leverage, etc. — but I've been most interested in derivative trading (widely known as deriv). So basically, in finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying".

Since derivatives are contracts that imitate the movement of a particular trading pair, you need only pure technical analysis to trade. Fundamentals do not affect the market movement of derivatives. I know what you're thinking. You can see an implementation of blockhain technology here, and so can I. If derivatives trading is to become widely adopted, immutable data storage, which blockchain technology provides, may be a key element.

Currently, there is only one broker which allows trading derivatives on a real account - DERIV.

About Deriv

Deriv Group has several subsidiary companies that are licensed to operate Deriv in their registered jurisdictions. Since 1999, the group has served traders around the world with integrity and reliability.

Deriv Investments (Europe) Limited – W Business Centre, Level 3, Triq Dun Karm, Birkirkara BKR 9033, Malta – is licensed in Malta (license no. IS/70156) and regulated by the Malta Financial Services Authority under the Investments Services Act to provide investment services in the European Union.

Clients in the European Union who wish to trade financial instruments can have accounts under Deriv Investments (Europe) Limited.

Deriv is Simple, Flexible and Reliable.

Markets to Trade on Deriv

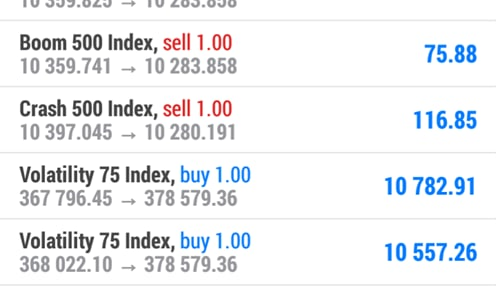

The markets that you can trade online with Deriv include FOREX, SYNTHETIC INDICES, STOCKS & INDICES, CRYPTOCURRENCIES, AND COMMODITIES.

Synthetic Indices and VIX are gaining popularity quite rapidly around the world.

Synthetic indices like Crash and Boom and VIX are now attracting investors all over the planet, but there is a lack of a reliable and complete trading strategy to trade synthetic indices and VIX.

So, if you are trying to trade VIX and other synthetic indices like Crash and Boom, I'll be talking about that in this new series. I promise to break down the synthetic indices and VIX.

So, What are these Synthetic Indices?

Synthetic indices are generally simulated trading instruments which move on the basis of an underlying asset, usually based on the stock market and other financial markets.

A synthetic index generally depends on randomly generated numbers and sometimes stock market volatility.

One of the best things about synthetic indices is that brokers can not manipulate the market as the random numbers generated in this market are programmed by a cryptographically secure computer program for transparency issues.

It is quite similar to any other financial market, but in this case, the broker can not have a single influence on the market movement.

Moreover, the volatility index charts are audited by a third party to ensure fairness of NO MANIPULATION based trading environment.

Why Should You Trade Synthetic Indices over Forex?

A most asked question is, why should a trader trade Synthetic Indices over Forex and Crypto? Let’s find out from the points below

- UNDERLYING ASSET/CAUSE OF MOVEMENT

Forex is based on the movement and relative strength of the real currencies of the countries, but synthetic indices are random computer-generated numbers which cannot be manipulated with any fundamentals or political decisions.

- VOLATILITY

Volatility in Forex trading is quite variable and sometimes you might get stuck due to global recession or global issues like the COVID-19 or political unrest in the countries. On the other hand, synthetic indices have constant volatility throughout the year. There is no best time to trade synthetic indices as their rate of movement is the same 24/7/365.

- AVAILABILITY

The Forex market is open 24/5, whereas the synthetic index market is open 24/7. As we mentioned above, it contributes well to the volatility and does not constrain you to trading in a specific or segmented manner.

- MARKET MOVEMENT DOES NOT DEPEND ON FUNDAMENTALS

The forex market’s main drivers are fundamentals, which pushed the market to hit a definite trend, but as synthetic indices are not impacted by fundamentals, there is no sudden risk of news rollout or fundamental issue-based volatility.

Many traders understand that to have an edge in the forex market, you need to have a good knowledge of technical analysis, but you also have to pay much more attention to fundamentals, which is the primary market driver. Trading derivatives and synthetic indices eliminates the need to worry about fundamentals.

In my next post, I will be talking about the different types of indices and how to get started trading them. Make sure to drop a comment and a follow so you don't miss out.

Dear @gamsam, we need your help!

The Hivebuzz proposal already got important support from the community. However, it lost its funding a few days ago and only needs a bit more support to get funded again.

May we ask you to support it so our team can continue its work?

You can do it on Peakd, ecency, Hive.blog or using HiveSigner.

https://peakd.com/me/proposals/199

Your support will be really appreciated.

Thank you!