Best ways to build your HIVE stack faster

Direct from the desk of Dane Williams.

We take a look at some of the best ways to build your HIVE stack faster using LPs.

Are you trying to build your HIVE stack faster?

In today’s LeoThread, I took a look at some of the best places to put our HIVE to work.

I’ve repurposed the content into a post, so let’s jump right into the results.

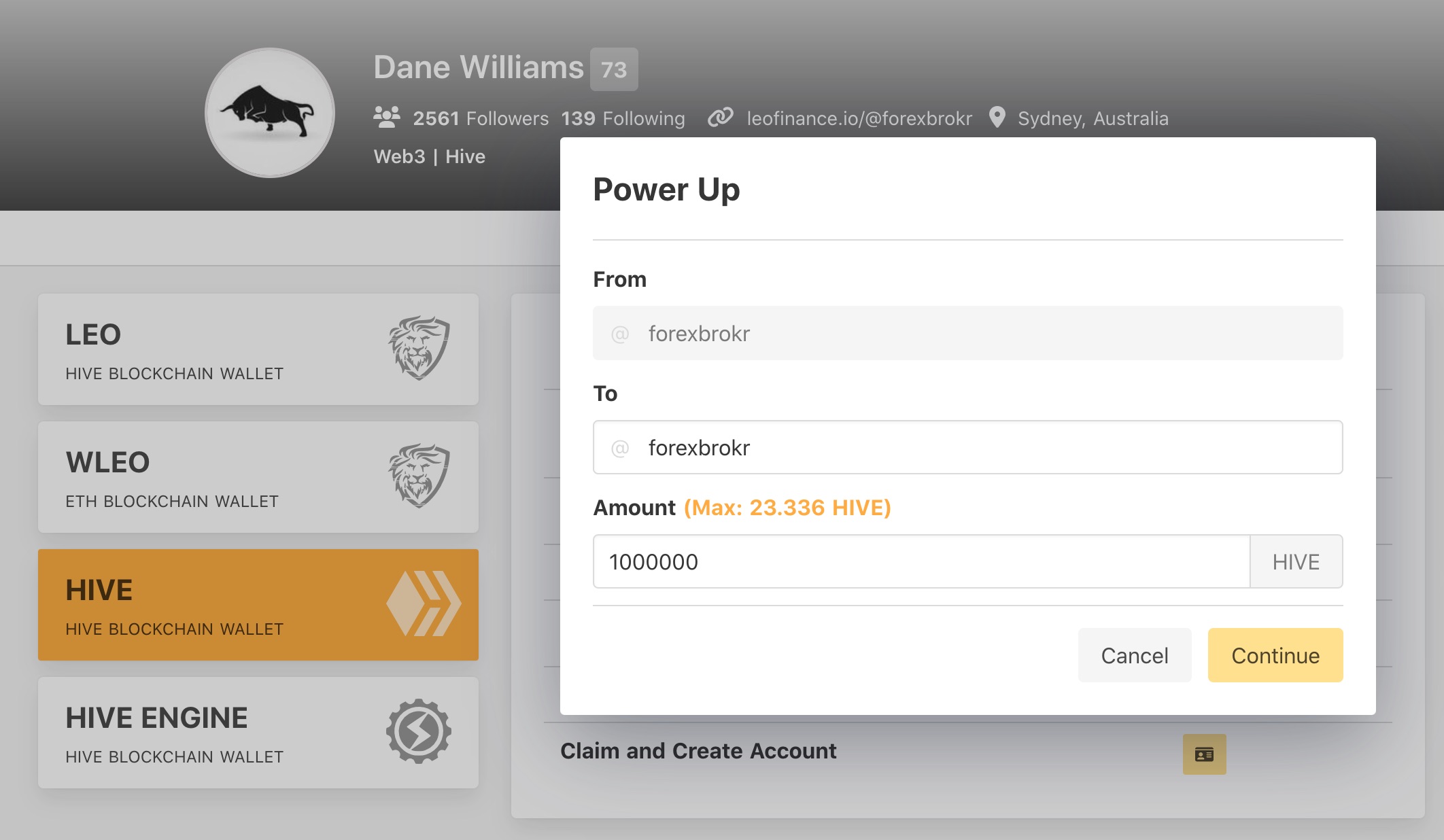

1. HIVE POWER on LeoFinance

Staked HIVE in your LeoFinance wallet, currently offering: 3% via inflation as well as another 10% via curation rewards.

For me, the ability to securely stake your tokens and earn rewards is the most underrated aspect of Hive.

Simply power up your HIVE, upvote on the content that you like and you will earn 13%.

Pro tip:

If you don't have time to curate but still want a safe, simple 10% return on your HIVE POWER, then follow someone else's curation trail via hive.vote

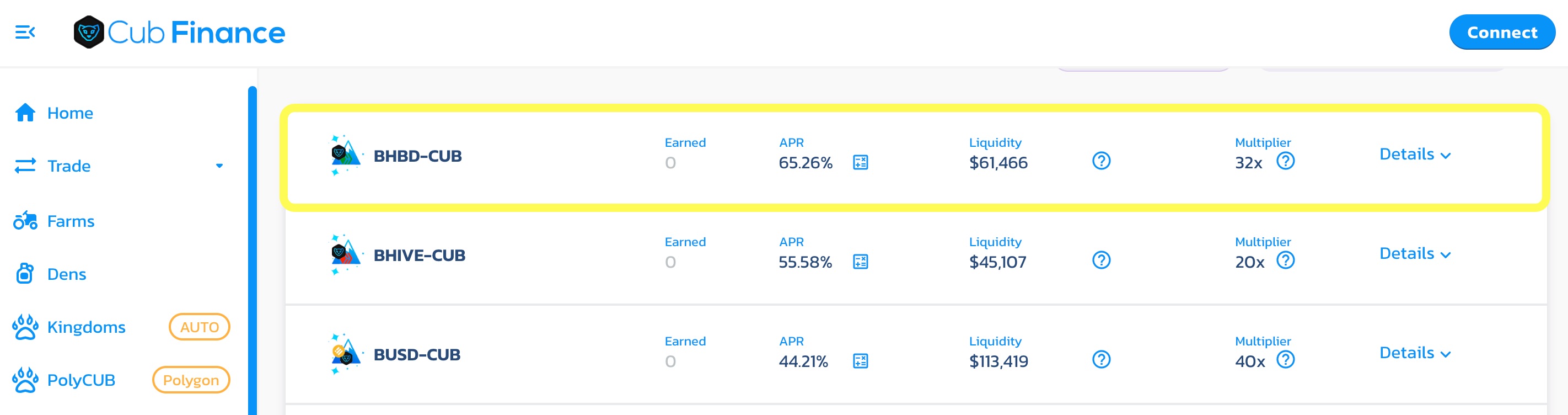

2. bHIVE:CUB LP on Cub Finance

The bHIVE:CUB LP on Cub Finance, currently offering: 55% APR.

The original BSC based DeFi platform from the LeoFinance team now offers LPs featuring HIVE.

Wrap native HIVE into BSC compatible bHIVE and then pool with CUB for a 55% APR. https://wleo.io/hive-bsc/

Pro tip:

If your end goal is to stack HIVE, then track your impermanent loss and keep selling your rewards into bHIVE.

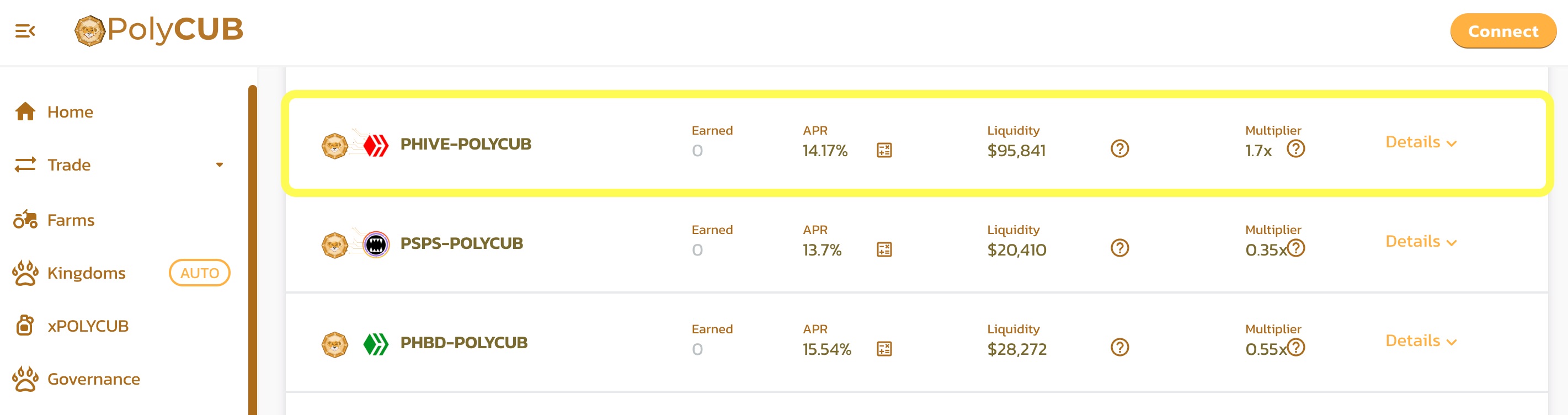

3. pHIVE:POLYCUB LP on PolyCub

The pHIVE:POLYCUB LP on PolyCub, currently offering: 30% APR.

The LeoFinance team's second foray into DeFi on Polygon also offers LPs featuring HIVE.

Wrap natve HIVE into Polygon compatible pHIVE then then pool with POLYCUB for a 30% APR. https://wleo.io/hive-polygon/

Pro tip:

Just like CUB, the POLYCUB token is extremely risky to hold, so track your impermanent loss and keep selling your rewards into pHIVE.

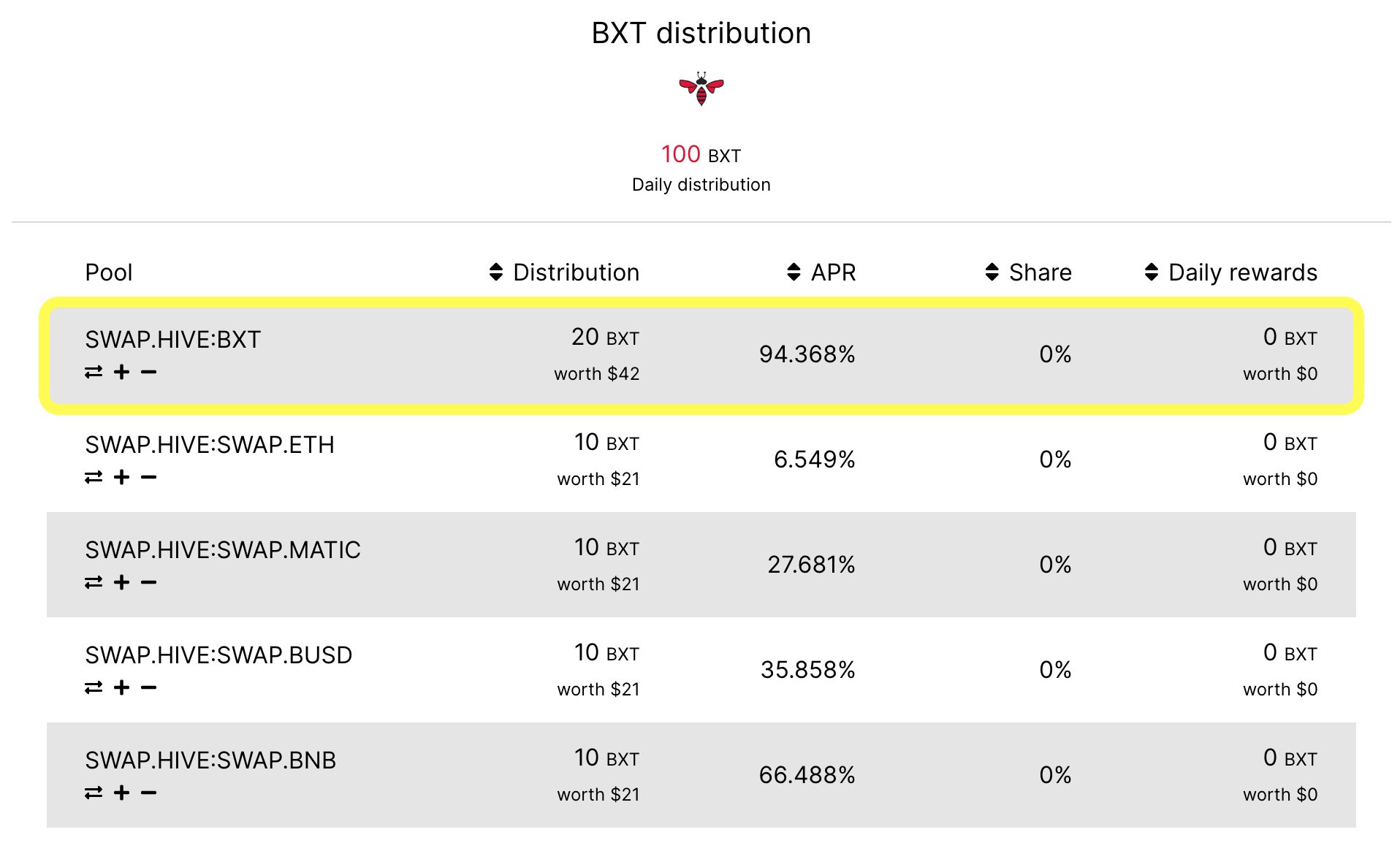

4. SWAP.HIVE:BXT LP on BeeSwap

The SWAP.HIVE:BXT LP on BeeSwap, currently offering: 95% APR.

BeeSwap is technically just a Hive-Engine front-end that displays their native Diesel Pools.

But on top of the rewards offered for providing liquidity to Diesel Pools, BeeSwap also pays BXT rewards for 10 LPs.

Pro tip:

I have featured the SWAP.HIVE:BXT LP because it has a HIVE side and offers the highest APR.

But I encourage you to look at the other LPs featuring BXT rewards to find the best fit for you.

5. SWAP.HIVE:SPS LP on Splinterlands

The SWAP.HIVE:SPS LP on Splinterlands, currently offering: 140% APR.

While this is just a regular Diesel Pool, Splinterlands are offering much higher APRs than you see on the other front-ends.

Access them via the Splinterlands site > SPS > Pools.

Pro Tip:

These APRs are insanely high and certainly won't last forever, so grab them while they're hot.

Final thoughts on the best ways to build your HIVE stack faster

Any of these LPs can be used to stack HIVE faster than simply holding.

Just make sure you weigh up the risk:reward on offer for each before going all in on an LP.

Impermanent loss can certainly fuck you.

Best of probabilities to you.

Posted Using LeoFinance Beta

Hmm... They all look risky.

But I have a few cubs and hive but I won't be using any of my liquid capital from outside to find this venture.

SPS and hive is something I am looking at

Then cub and hive.

Great post but full of risks but isn't life full of risks?

The level of risk you want to take in order to build your HIVE stack is completely up to you.

If you want low risk, then simply take the 13% for staking and curating.

If you want to try and stack faster by risking a portion of your portfolio in LPs that offer higher APRs, then there are options.

Just gotta find your own balance that you're comfortable with.

Posted Using LeoFinance Beta

I believe this are nice ways to earn and grow hive gradual but staking hive for 13% will always makes sense

Posted Using LeoFinance Beta

Yep, I totally agree.

No risk of impermanent loss and compared to bank interest it's a HUGE return haha.

Posted Using LeoFinance Beta

Just bookmarked this so I will remember to read whenever I get home from vacation next week. I know you will have some great recommendations as always.

It's just all about weighing up the risk:reward between:

Posted Using LeoFinance Beta

Great Post!

!1UP

Click the banner to join "The Cartel" Discord server to know more!

Thanks for stopping by mate.

What is your opinion on using these LPs to stack HIVE faster?

Posted Using LeoFinance Beta

To be really honest, I was really excited about LP in the past (even wrote some posts about them and all that jazz), but I'm becoming more and more reticent about them.

My main problem with them is that those high APR usually run out faster than expected as everyone flocks to the few pools with high APR; and then you usually end up receiving lots of shitcoins as rewards that you can't even liquidate.

I personally put lots of money on LPs, and ended up losing money in the majority of the cases due impermanent loss + rewards being paid in not-so-good tokens...

!PGM

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Yep, this has pretty much mirrored my experience with DeFi.

I'm now extremely picky with the LPs that I go into, dump all rewards into HIVE as I earn them and use DeBank (or BeeSwap if they're Diesel Pools) to monitor my impermanent loss like a hawk.

Cheers for sharing :)

Posted Using LeoFinance Beta

You have received a 1UP from @luizeba!

@monster-curator, @leo-curator, @ctp-curator, @bee-curator, @neoxag-curator, @pal-curator, @cent-curator

And they will bring !PIZZA 🍕.

Learn more about our delegation service to earn daily rewards. Join the Cartel on Discord.

These are not technically LPs but buying some EDS Miners (EDSM & EDSMM) get you EDS tokens which then pay out weekly in HIVE. APRs are over 20%. It's a long-term play but I've been doing it for over a year now and it just keeps building slowly but surely.

Also, holding SIM Power in the dCity game can give you some passive HIVE as well as holding packs or CROP in the dCROPs game. I'm picking up 2-3 liquid HIVE every day from those games.

Just thought I'd add that on to your list.

As someone previously stated, the "interest" you get for powering up your HIVE combined with the curation returns are really a great way to keep building. It doesn't look like much, but when you do it for a few months and look back it's pretty amazing how much it's actually building.

Nice list!

Posted Using LeoFinance Beta

I'm personally balls deep in the SWAP.HIVE:SIM LP haha.

I love it because if SIM goes down and you lose SWAP.HIVE to impermanent loss, you end up gaining more SIM Power.

SIM Power that means you earn higher HIVE rewards.

Cheers for adding to the list :)

Posted Using LeoFinance Beta

Super post!

Posted Using LeoFinance Beta

Super duper!

Are you in any pools?

What's your opinion on using them to stack HIVE faster?

Does the reward outweigh the risk?

Posted Using LeoFinance Beta

I have been doing some pools to get more of the BXT token over the past couple of months. It has been a really good one to hold since it pays you dividends in Hive.

Posted Using LeoFinance Beta

Yep, great point.

While I featured the SWAP.HIVE:BXT LP in the post, you can simply stake your BXT and earn HIVE rewards for doing so.

IF you are happy with the risk of 100% of your position being in BXT.

The current 33% APR paid out in HIVE is certainly nothing to scoff at.

Posted Using LeoFinance Beta

Staking BXT is enough to allow one to earn daily drips of HIVE. BXT isn't cheap, but the reward in HIVE makes it worth buying to stake and HODL.

Posted Using LeoFinance Beta

How is the percentage of Hive returns calculated?

Also, is there a special treatment for either staking and just holdling?

The daily drips of HIVE result from BXT which is staked. Liquid BXT won't be enough.

As for calculating the percentage of HIVE returns, I don't know how the calculations are done. If anything, I was going to convert all prices to HIVE first before calculating returns.

Posted Using LeoFinance Beta

From the BXT whitepaper:

BeeSwap being their deposit/withdrawal bridge between HIVE and SWAP.HIVE.

So as magna said, you need to stake your BXT in order to receive HIVE rewards which are currently paying out at 33% APR.

Posted Using LeoFinance Beta

Thank you so much for doing this Dane. Juicy APRs xD

I am going to try some of them for sure and I am already in some of them. 🙈

Posted Using LeoFinance Beta

Juicy APRs...

But I just have to stress that if you're trying to build a HIVE stack, putting HIVE into an LP puts you at risk of impermanent loss.

Just gotta monitor your positions like a hawk and dump rewards back into HIVE as they come in.

Posted Using LeoFinance Beta

I think staking and curation on top of author rewards are the best way to go. The rest all require some pairing to other tokens so it depends on how well the other tokens move.

Posted Using LeoFinance Beta

It all depends on how quickly you're trying to stack.

The quicker you try to build, the more risk (in terms of impermanent loss) you have to take.

Posted Using LeoFinance Beta

I would just add BXT staking but it does require you to swap Hive for BXT.

Great list. I had no idea you can find pools on Splinterlands now.

Posted Using LeoFinance Beta

Yep, I'm a huge fan of BXT staking because it pays out daily in liquid HIVE.

But like you said, it's taking a bigger risk because you have to hold only BXT.

As for the Splinterlands pools, they're exactly the same ones you find on Hive-Engine.

They just show that higher APR paid out in SPS rewards - Something you don't see via the other front-ends.

Posted Using LeoFinance Beta

A single staking vault would be great. Impermanent loss is always a concern with LPS. A few good opportunities though... if you meet the risk profile.

Posted Using LeoFinance Beta

HIVE's single staking vault is pretty much powering up and then using hive.vote to automatically curate.

We were DeFi before DeFi was cool ;)

Posted Using LeoFinance Beta

My plan was just stake my Hive and Leo to my wallet (originally) as I am not that well versed in Liquidity Pools etc. Probably I am late in the party but I will bookmark this for now and see what I can digest and try with a little amount that I have in store.

It will be risky for sure but might as well try it to experience and learn!

Thanks Dane for this post!

Posted Using LeoFinance Beta

Maybe stake 80% of your HIVE?

I mean earning the 13% just for being powered up and voting on posts is nothing to scoff at.

Then you can use the final 20% of your tokens in more risky LPs (because you're risking the possibility of losing your HIVE to impermanent loss) to try and earn a higher return.

Posted Using LeoFinance Beta

Agree - this will be a numbers game again haha I hate it.

Need to study this seriously - 20% isn't that much right now since I am just accumulating tokens so it is feasible.

Thanks Dane for the insights! Appreciate it.