Best DeFi variable staking? - Cub Finance Kingdoms

Direct from the desk of Dane Williams.

A guide to Cub Finance’s newest variable staking option inside Kingdoms, offering both flexible and fixed-term staking rewards for your CUB.

Variable staking on Cub Finance is the latest feature launched by the popular BSC-based DeFi platform.

By staking your CUB tokens into the new Kingdom, you are able to receive auto-compounding rewards either flexibly or over a fixed term.

Obviously the longer you stake and therefore lock your CUB away in this variable staking kingdom, the higher your yields will be.

The advantages of variable staking on Cub Finance are that unlike adding liquidity to farms, Kingdoms are single asset pools.

This means that you have no LP exposure to price swings and impermanent loss.

Just one click, simple staking of your CUB assets with the ability to earn yield.

For the technical mechanics of how Cub Kingdoms generate yield to not only pay those with stake, but also so the CUB DAO can continue to generate revenue to autonomously buy back and burn CUB, I’d encourage you to read the Docs.

How does variable staking on Cub Finance work?

When it comes to variable staking on Cub Finance, you’re presented with two options:

- Flexible staking

- Fixed-term staking

The basic premise being that flexible staking has lower yields, but you’re able to access your tokens at any time.

Fixed-temr staking on the other hand will offer higher yields, but your tokens are locked for your chosen term.

Meaning that you’re being paid more for taking your tokens out of circulation and not being able to dump them on the market if price rips higher.

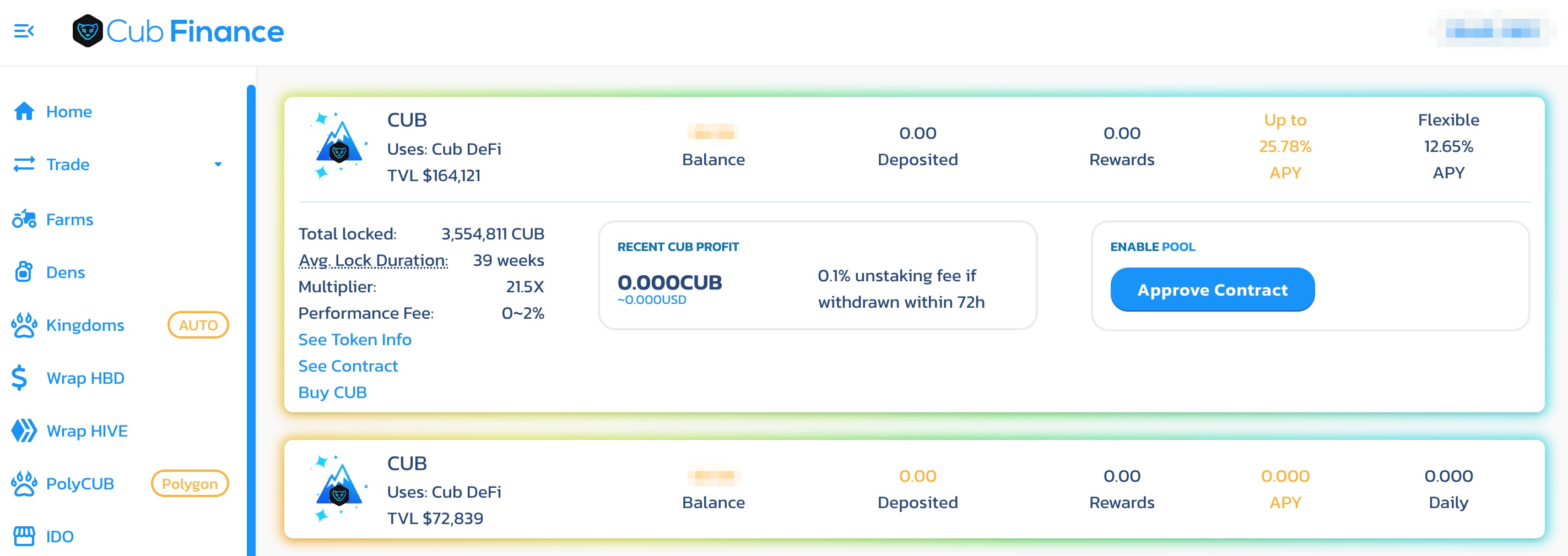

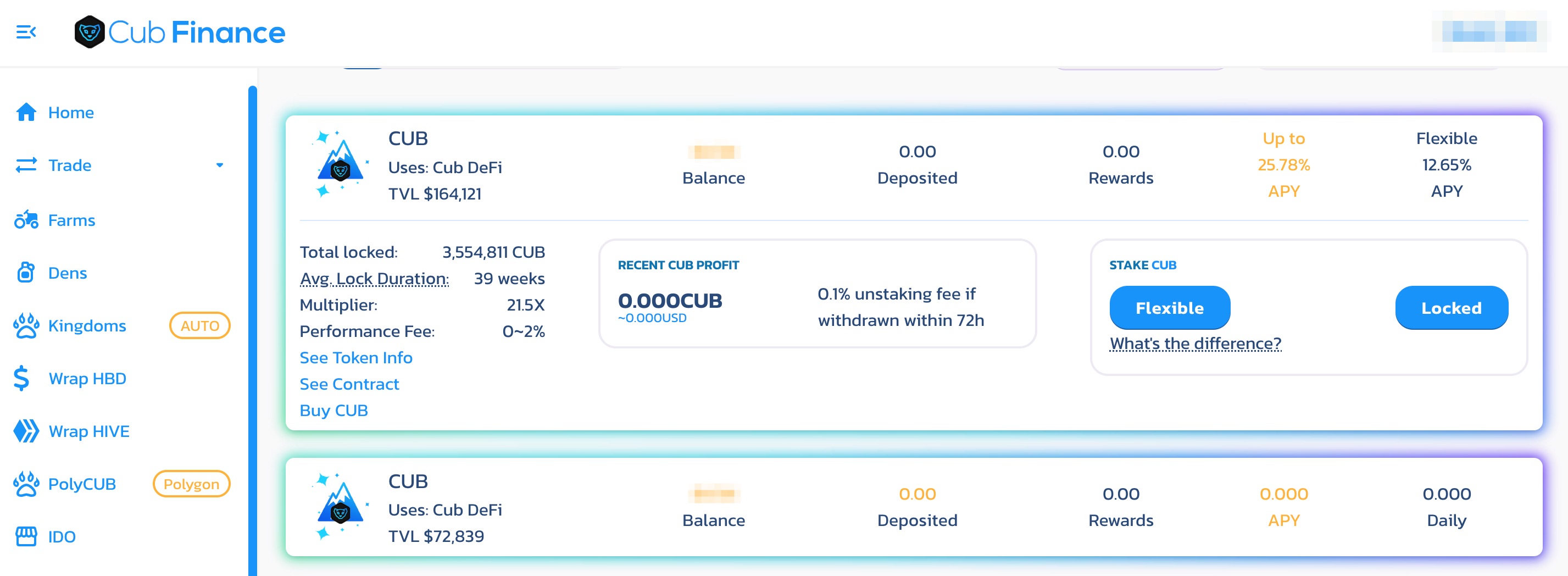

Step 1

Click Kingdoms in the left menu and select the top CUB Kingdom.

Step 2

After approving the contract, choose between flexible or locked (fixed-term) staking by clicking whichever button you want to go with.

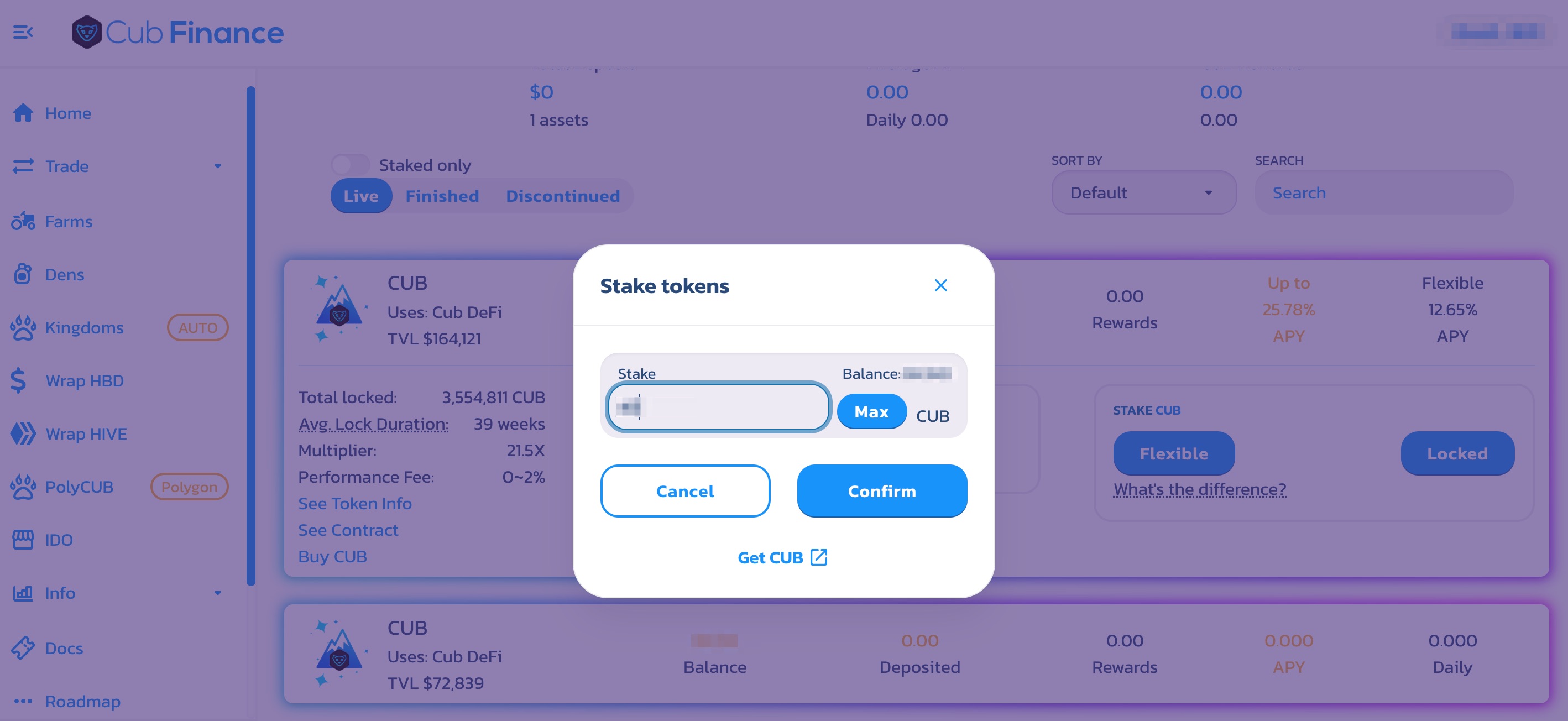

Step 3

For flexible staking, choose your stake and confirm the transaction.

For fixed-term staking, choose your stake, term and confirm the transaction.

Depending on your choice, your yield will finally be displayed in the top right hand corner of the Kingdom box.

Should I move my CUB to the new variable staking Kingdom?

If you’re currency in the old Kingdom, then yes, you should move your CUB into the new.

By moving your CUB into the new variable staking Kingdom, you will receive a higher APR.

Especially if your CUB is just sitting in the Kingdom for a long term hold and you have no plans on selling it.

As for what is the best staking term to lock your CUB away for, well that’s entirely up to you.

There is no correct answer to this one and it all ultimately comes down to how you feel you’ll hit your personal investment goals.

Pro tip: As both flexible and fixed-term staked CUB are held within the same pool, you’re able to convert between the 2 at the click of a button.

So if you’re not sure, start with flex and up your staking term once you’re more comfortable making the call.

Final thoughts on Cub Finance’s variable staking Kingdoms

I want to wrap up by briefly mentioning the LeoFinance team’s shift to DeFi 2.0 and their renewed focus on generating sustainable, reliable and growing yields in DeFi.

We all get sucked into looking for price moonshots on DeFi tokens like CUB and POLYCUB, when we should be worrying about sustainability instead.

What returns do you get in a 1 off pump and dump?

A 100% return would be considered a great result, right?

You dump your tokens, double your money and never think about that particular investment or coin again.

But as I mentioned above, we should instead be looking for price stability in DeFi tokens like CUB.

If price stays stable and you are earning 50% yields on your investment, sure it will take you twice as long.

But with sustainability comes the ability for you to keep earning.

Day after day, year after year.

Just grinding out a passive income from your DeFi investment.

So if you’re looking for the best DeFi option, focus on whether the platform facilitates sustainability in its native token.

Thanks to the Multi-Token Bridge revenue model, Cub Finance becomes not only a viable choice, but one of the best in the industry.

Cub’s variable staking options just add to the platform’s appeal.

Best of probabilities to you.

PS. If you’re a LEO investor who is unsure about the value of Cub, click here to learn how CUB Finance adds value to LEO.

Posted Using LeoFinance Beta

Thanks for this. It reminds me of the CUB I bought 9 months ago.

Posted Using LeoFinance Beta

If you believe in the sustainability of CUB's new model, it might be worth doubling down on your investment from 9 months ago.

Posted Using LeoFinance Beta

That's what I am thinking. What I did 9 months ago was just a test buy.

I just decided to move my CUB from my old kingdom to the new kingdom. It's not like I am planning to let that go anytime soon but I might take some profit off the farm rewards though.

Posted Using LeoFinance Beta

Definitely take profits.

Remember with DeFi, we should be more focused on price stability and the yields that can come from this stability.

My personal strategy involves using CUB to stack HIVE faster.

Posted Using LeoFinance Beta

As much as I want (read "need," because I have quite a bit) CUB to succeed, I am too frustrated with cubfinance to even be bothered to waste a few bucks in unstaking from the current kingdom and migrate to the new one. Somehow, regardless of all the "big" plans and roadmaps from the leofinance team, I just don't see CUB drwaing any significant value or interest from outside of HIVE, not even outside of the LEO stans to be absolutely honest.

Yeah, that's fair.

If you loaded up early and held through, watching the slow price decline has certainly been painful.

Trust me, I feel you (😢)...

But ultimately DeFi is about finding a sustainable balance for the token.

Purely using inflation to pay yields early just wasn't sustainable...

But after becoming the only way to bridge HIVE into the BSC ecosystem and generating fees from those transactions, Cub Finance has found stability.

Using the MTB revenue to buy back and burn tokens is keeping inflation in check and price is remaining steady as a result.

Even during the FTX shitstorm, the 0.021 price floor was never breached.

We finally do have sustainability!

As Cub Finance is now running a sustainable model, it literally doesn't matter.

It's free money that even if the LEO/Hive stans continue to stack and take advantage of, the platform will eventually grow.

I keep saying it, but all that matters is sustainability and the MTB has allowed CUB to find it.

Take advantage of it!

Posted Using LeoFinance Beta

Still trying to understand the benefits of this new kingdom.

Locking tokens moves them off the market but new tokens are still coming in from emissions and the locked tokens aren't used in any shape or form by the platform itself.

What am I missing here?

Posted Using LeoFinance Beta

All that really matters for the price of CUB right now is that the MTB continues to generate revenue.

People bridge/wrap/arb the HIVE BSC derivatives, generating Cub Finance revenue and it is finally used to buy/burn CUB.

Enough is being bought to offset inflation and you have a sustainable reward structure that encourages more money to be locked away to chase yields.

Sustainable yields!

These new variable staking kingdoms are just another option for that new money to be put to work.

Posted Using LeoFinance Beta

Reaching an equilibrium is fantastic but I still see an issue here, not just with CUB but with boosted rewards for locked tokens in general.

Boosted rewards put even more tokens into circulation which equals to more sell pressure. While the price is stable everything is fine but as soon as it tries to go up it is suppressed by those that have an excess of farmed tokens.

Without a realistic approach to the problem you end up in a situation where Curve and Velodrome are now - their token price is in limbo and mostly trending downward for the reasons mentioned above.

Posted Using LeoFinance Beta