SEED Holdings Report #8 - [Call to action for all token holders]

What a busy week!

- Yield farming rewards announced & activated (+35% APR) on BeeSwap.

- NFTrade Presale (I ran a little contest yesterday).

- Starpunk Presale (waiting for listing).

We also had an ugly week in terms of price performance (Evergrande + China FUD combo), but we are at our strongest point ever. GAME had a magnificent run and I also have a few Dao Maker updates to share.

Please read until the end because I (we) need SEED holders to voice their opinion regarding a matter.

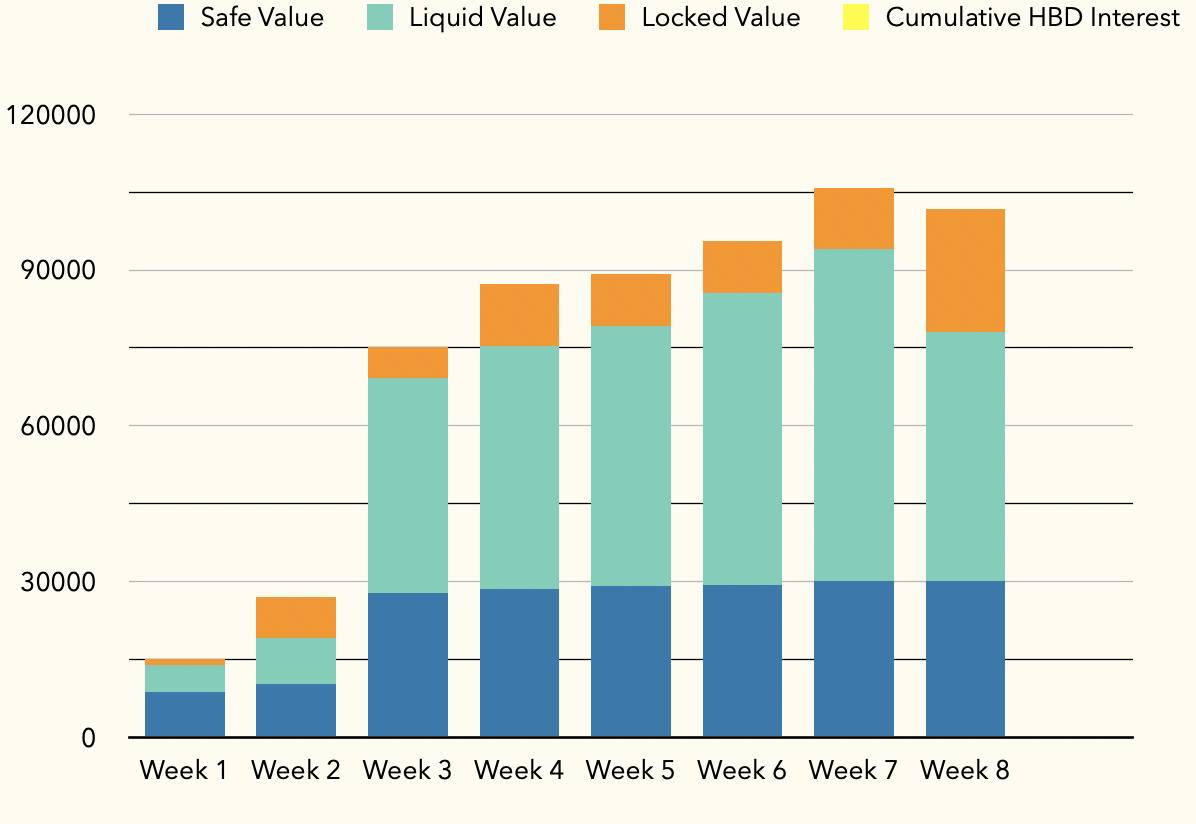

Let's run our colored weekly stats in the meanwhile.

(Today I'm skipping the first chart, too much redundant info I guess).

The most noticeable loss for this week is the one with our major holding, $ORN. The breakout to the upside has ended being what we call a 'fakeout' and the price returned to their old range between 7,7 - 10,5 dollars.

All the market has plummeted with it, so nothing bad, just 'another day at the office'. We'll need a bit more patience while momentum keeps building up.

It's incredible all the similarities we have Vs. 2017. Are we into the matrix? If everything goes as expected, we're primed for a massive run around the end of the year.

The other day (1 month ago) was 'drawing' around and today stumbled again with the long-term ORN/BTC chart. So far it has been playing out nicely. The price respected my magic line!

Update on DAO Maker

Dao Maker restructured their lottery system (and they keep doing it) and this week we had great results after +1 month of drought. We won 2 presales in a single row.

Presale 1: Nftrade ($NFTD)

We had a 1200$ allocation which ended up receiving 9600 tokens at 0,1$ each (20% unlocked, 80% gradually).

- I sold our unlocked 20% allocation for 1150$, so, almost 100% ROI.

- We keep the remaining 7680, which they're worth around 0,56$ each now, so 4300$ of pure profit sitting in our 'Locked value'.

Presale 2: Starpunk ($SRP)

We have a 450$ allocation, token metrics are as follows:

Total supply: 680M

Initial Supply: 30,4M

Initial Mcap: 700K$

Price: 0,023 $

Lockup: 33% unlocked at TGE, 3 months cliff, and then vesting linearly for 2 months.

Nothing more to comment on while I wait for the official listing. Let's pray for another x5-x10.

As you can see it's very (very easy!) to get a sweet multiplier at the beginning, where you simply retire your initial investment (to keep rotating). After that, it's a comfy hold. If the project delivers, great, if not; no biggie.

Presales in High Demand, DAO Maker increasing their tiers [Input needed]

After the recent update, we had 4 tiers which ranged from 0 up to 10K DAO (25.000$ at current prices) all of them were already very crowded given the massive benefit presales give to their participants.

From now on, DAO Maker introduced 2 new tiers:

- 25K DAO ( 62.500$ at current prices) with a x2,6 increase in winning chance Vs 10K tier)

- 50K DAO ( 125.000$ at current prices) with a x5,2 increase in winning chance vs 10K tier)

I already secured a 25K DAO spot from my own holdings.

What I am asking you is:

As a SEED holder, how would you feel about moving a big chunk of our liquid funds available to try to grab that 50K spot? (we would need 62.500$, where I would be putting even more of my own funds).

Think about a 60/40 or so. As always nothing is set up in stone.

In practical terms would mean getting rid of almost (if not all) of our ORN position for the equivalent in DAO.

Pros

- Even bigger allocation on presales (5-10K$ profit every time we win based on past results).

- If we give it enough time to escalate (as it's already happening) we'll get an absurd exposure to GameFi in no time.

- We give SEED a more defined value proposition as it would act as a VIP ticket for 'whale opportunities' as a community which are unavailable for 99,9% of people out there.

(How many regular people have 50-100K$ spare cash to invest in Venture capital?)

Cons

Getting rid of a gem ($ORN). If it shoots up in the short term it would be a pity. However, it's not really a 'con', since everyone can keep buying ORN outside of SEED (I'm not required for that). Orn in that context is only a winning horse IMHO. Everyone can hold some ORN but not everyone can opt to participate in high level allocation presales.

More value locked into the 'Locked value' category (in the short term at least).

Note also that however, ORN has much more 'mooning potential', DAO itself isn't a bad hold and If it recovers his old ATH we're talking about an x3-4 anyway.

**Please take 5 min to think about it and drop a meaningful response in the comments. I want to hear you, SEED holder. **

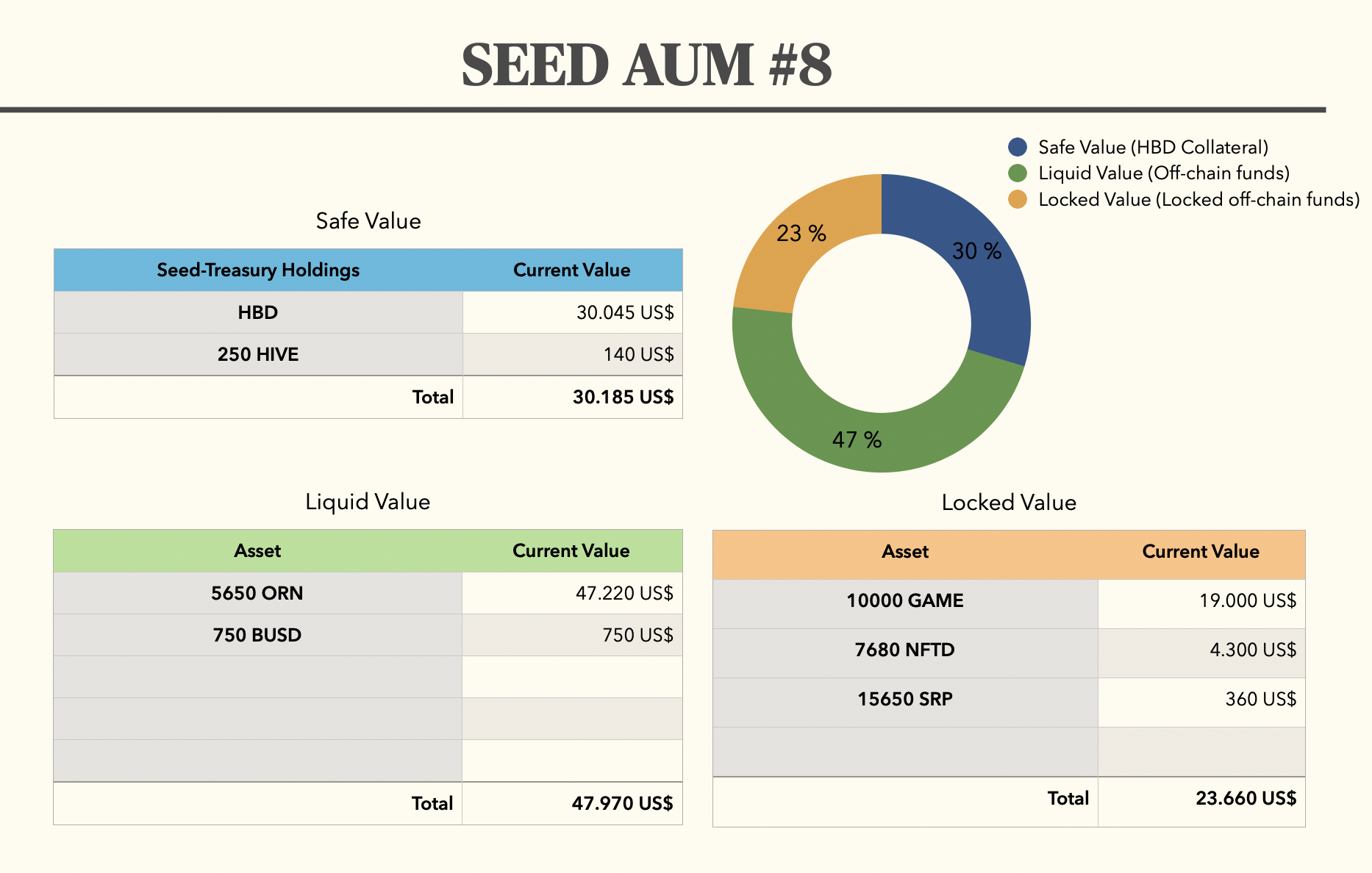

Current SEED Stats:

Circulating Supply: 75,000 tokens.

Total Supply; 100.000 tokens (25K unissued).

AUM Value (All assets): 101.815$

SEED TOTAL Value: 101815/75000 = 1,357$ /SEED (+35% since the beginning).

SEED Liquid Value (Only liquid assets): (101815-23660)/75000 = 1,04$/SEED

Holding strong there on the 100K$!

Enjoy your weekend and please, take your time to drop a comment. I would like to make a decision soon based on your general sentiment.

100% of blogging rewards paid to @seed-treasury. Remember you can follow the portfolio in real-time here:

https://cointracking.info/portfolio/seedtreasury

You can join us on Telegram and follow me on Twitter.

Posted Using LeoFinance Beta

I'm for bigger allocation.

Maybe to keep some ORN too, though?

Anyway, 'liquid' part simply sits still waiting for a pump. 47% is a bit too much for idle funds imo.

Posted Using LeoFinance Beta

noted.

However, note that it isn't just sitting 'idle' in a wallet/exchange, all our orn is staked yielding a +10% APR (which I'm not including directly in the reports as it's a negligible amount on a week after week basis), but they're counted as a 'decrease' in average cost. Hope you get what I mean.

Thanks for the input

Go big or go home. I say we move to the bigger play.

Posted Using LeoFinance Beta

:)

I would move the funds I think it is a better opportunity, but it is just my opinion I still do not have Seed.

In case you missed the title :)

Posted Using LeoFinance Beta

Thanks for the input, doesn't matter that you don't own seed, hearing opinions from others ara always valuable.

I'm for a bigger stake on DAO.

Also because I still didn't get in personally yet :D

Posted Using LeoFinance Beta

Perfect :)

I'm for the 50k spot, if we win there we can always reinvest the winnings back into ORN ^^

Nice to know.

You've been doing great and it looks like you believe in the 50k play so I say let's go for it!

Posted Using LeoFinance Beta

:)

I'm also voting in favor of the 50K spot and maybe leave some ORN for wen moon :)

Posted Using LeoFinance Beta

Thanks for the input.

I love $ORN as a project and I'm certain that this prices are a bargain and will go up significantly.

However moving into the big tier of DAO Maker can bring a lot of value for the SEED community and I'm 100% on this.

I also hodl my own $ORN bag and everybody can do it too. If there is any spare change I would keep some ORN by the way.

We won't have much spare change, for that reason I'll be putting more money from my own holdings, +10-15K$ or so

Cool!

A bigger stake on DAO seems fine to me. As some pointed out we can invest our profits back into $ORN, if its price stays in a good spot.

Posted Using LeoFinance Beta

That's a very good question and I would think also not easy to make a decision for. I do like the idea of having more potential on launchpad tokens on DAI. They seem to do well. Question is, how well are these tokens doing when some form of crypto winter will start coming months. Though I understand most of the investments in these launch tokens are recouped by selling the first batch just after launch. Worst case scenario, not much gains overall, but also not much (or no) losses... obviously, this 'conclusion' is based on past experience with SEED fund launches.

Hear from my circles a true belief BTC will be pushed down to 30k and may not even hold that level and be pushed further down to 22/24k very very soon. After that, these same peeps think BTC will go to 100k/150k. At least one person having such belief, shorter BTC with millions of $. I have no clue on this matter to be honest. However, when BTC is indeed pushed down to hard, it'll harm ORN as well, likely much more than BTC itself. Therefore, it may not be unwise to lower ORN exposure for the short term.

Question is, when getting out of ORN: To put this into a longer-term play with the launchpad? Or something else?

Now I give you an idea:

Now, I can imagine the 2nd Fund may cost too much time at the moment, while you still figuring out SEED and the next steps. But you could consider this.

Keep in mind, I make the above suggestions based on your statement in SEED TG chat channel you plan to have SEED running for a long time to come. Well, maybe not a real plan, but you seem to have the idea to keep going with the SEED fund, even if we would enter yet another crypto winter. I like that. And because you think longer term, you may consider making various investment funds with each focussing on some specific market segments.

Posted Using LeoFinance Beta

this was way too serious of a post, wen funny empo ?

sunny wen funny, serious wen serious ma fren

I mean, funny wen funny, suny is justy

being gangsta is hard yo :))))

It is a difficult choice, they are two good projects. I would opt for the DAO Maker mainly even so I would keep a small amount of ORN in case it has a very strong rise.

I read the secons post first but I agree with "go big or go home". I got into this project because while there are some safe guards it seems to tend toward a little more risky approach to investing. Something I'm hesitant to do on my own. :)

Posted Using LeoFinance Beta

That's the whole idea of SEED after all, allow 'regular' holders access better opportunities, even If that implies to don't know sh!t about what's happening behind the scenes.

Let's see how everything unfolds :)

Maybe unfortunately for me, I'm not familiar with DAO Maker.

I'm also tempted to say go for the top tier as well, but there are a few things I'd like to know first:

No lock. The tokens are held in an ETH wallet so 0 risks from a smart contract standpoint.

Bear market is still a few months away. Let's see where we stand then.

Logically, a big chunk of our portfolio will rush into HBD or other stablecoins when the bear comes :)

That makes sense. And it's awesome there's no lock. That's what I was a bit worried about.

I am fine with going a bigger on the DAO funds.

Posted Using LeoFinance Beta

Very happy you made the call as I would back that decision as profit wise it makes more sense. We are all invested to make returns and you know what to do.

Posted Using LeoFinance Beta

I'm the manager and all SEED holders agreed with 'me moving the funds around', that though, doesn't mean that I'm not allowed to ask and see how overall people feel regarding the decision.

It's not a democracy, SEED is more of a dictatorship at this stage.

However, this isn't bad by itself, as we can make moves at a very fast pace and remain flexible with market conditions.

This will change over time..

GO moon

I arrive late to this as Ive been swamped this week but Im quite aligned with your overall way of thinking and you guys have made the correct decision imho. Also is fair to share with you half of the proceeds as you are basically risking 50% of the money from your wallet.

You are managing this small "centralized/DAO" well :-)