SEED Holdings Report #22 - Project owned HBD/SEED liquidity & more updates

GM everyone, finally it's time for an update!

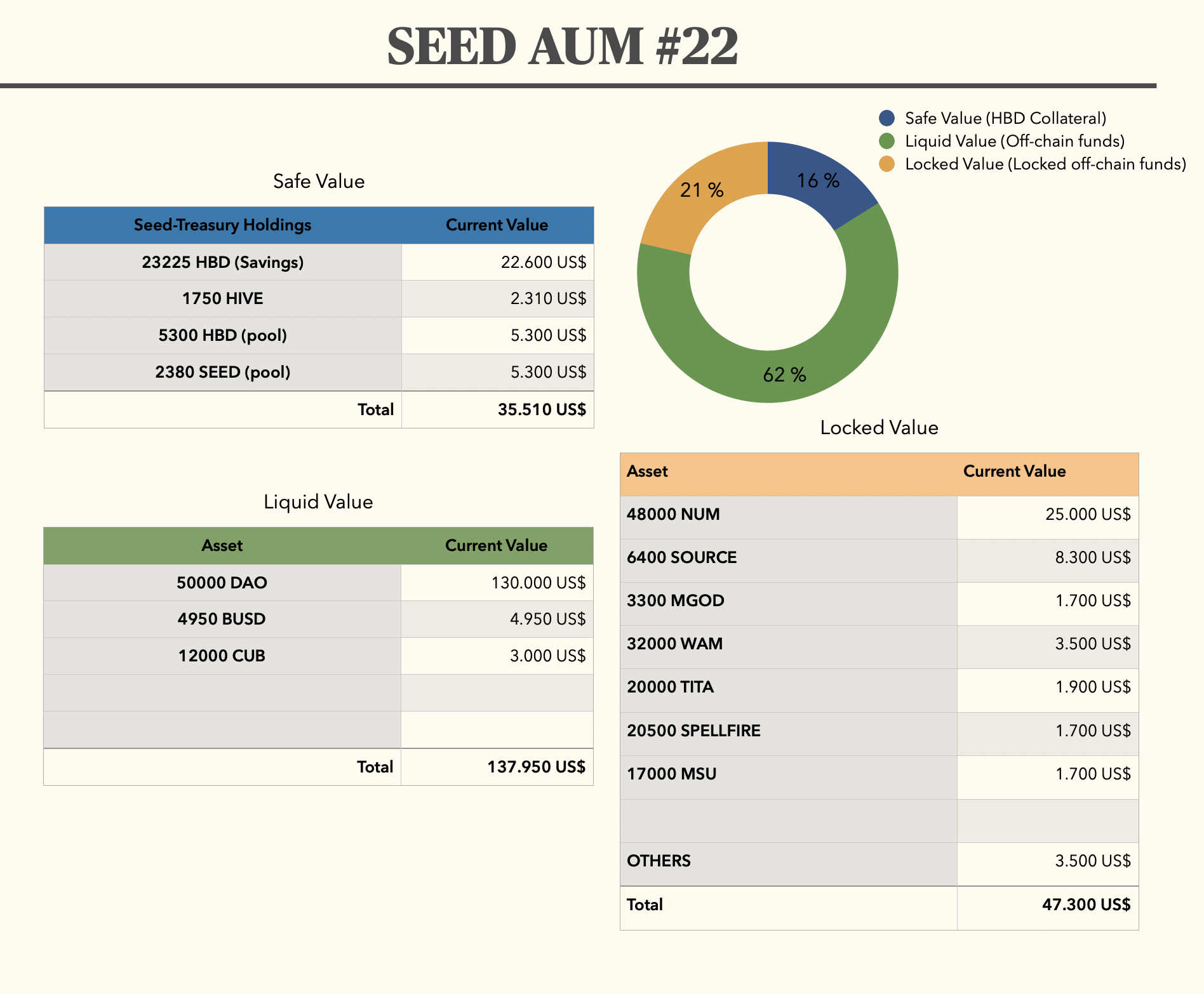

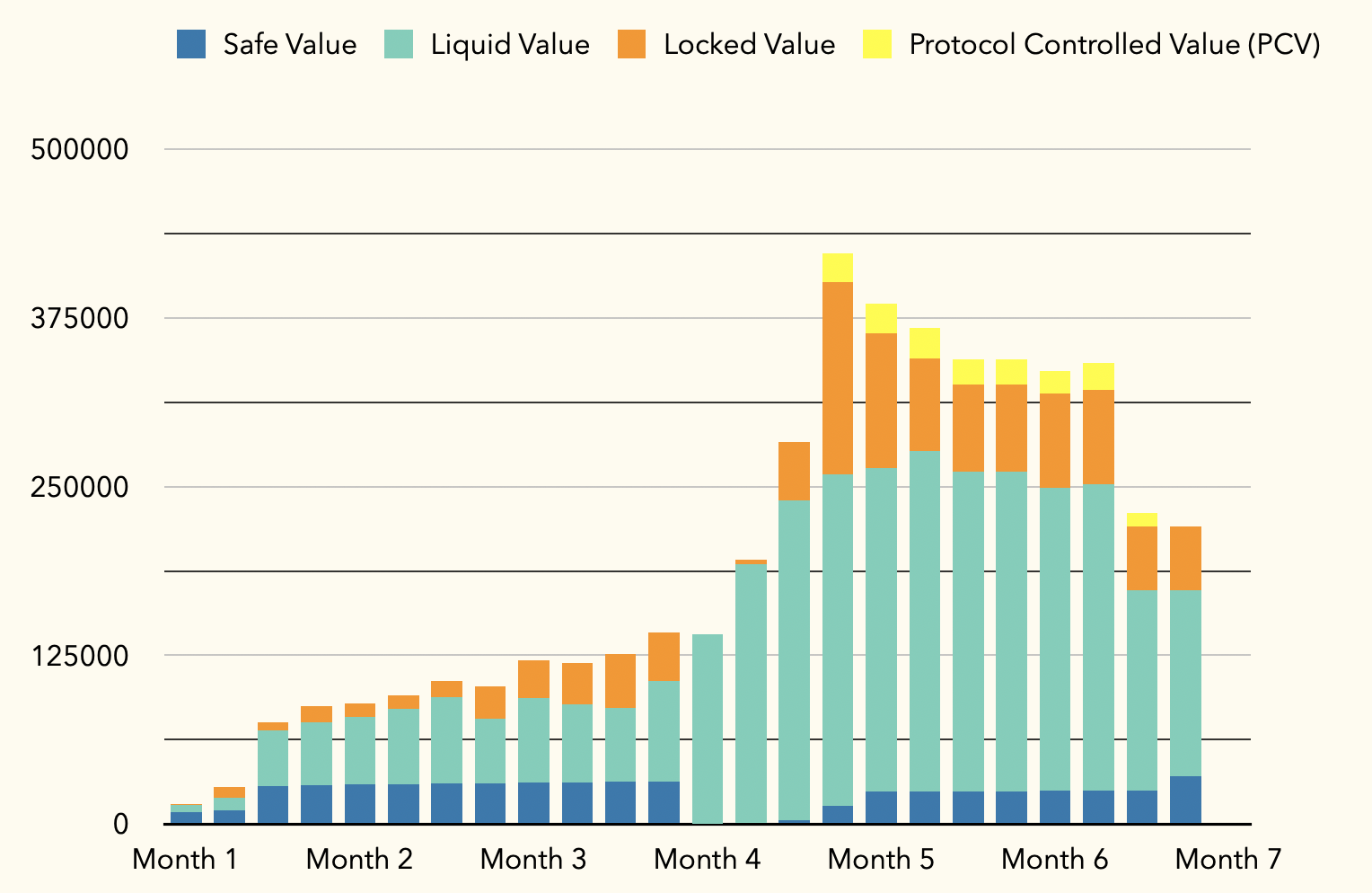

I've been thinking about a few core changes to our overall working structure (and still dubious about a few ones), but since it's time to make the holdings report, I'm disclosing them anyway. As you may notice, the portfolio has taken a hit, and even with my best efforts to hedge with stables we're several % down from the mid 300K$ value.

On the other hand, we would never have managed to reach these values without taking some risks before, and we're almost back to the point where decided to make the 'DAO bet'. Let's recap.

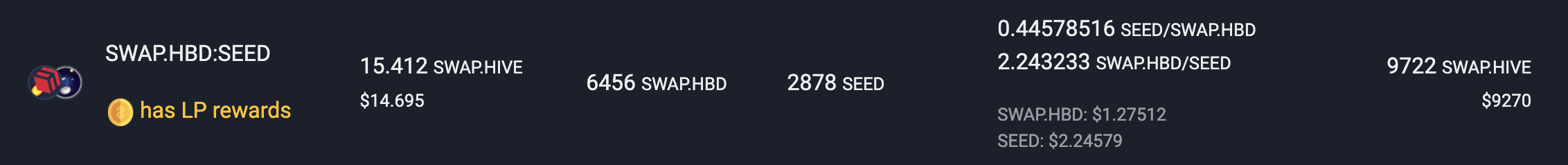

- Now @seed-treasury owns most (+80%) of the liquidity from the HBD/SEED pool. That equals +5000 HBD and +2350 SEED in hands of the treasury itself.

- Currently, the HBD/SEED pools is paying a 7,8% APR (paid in HBD!) to LPs. My reference is the 12% of savings but anyway I'm pooling the rewards slowly (basically when I have some spare liquidity).

- Since the portfolio is taking a very decent hit backward in terms of mcap, I've decided to get rid of the 'PCV' section of the portfolio (at least temporarily).

Apart from that we keep on our mission of solidifying the portfolio with stablecoins and other income assets. This is how we're standing at the moment.

Liquidity in hands of the treasury, what does it even mean?

Exactly that! Since you're all a pretty stubborn crowd and almost no one wanted to cash out his SEED earnings (something that I expected to happen and it didn't ''haha f*ck u empo''), I've 'almost' been forced to provide the liquidity myself (because let's assume, we'll need it sooner or later).

The top 20 SEED holders have +500 SEED each. NO ONE of them has sold! In practise it means that If I want to buy SEED from the open market (low amounts) I have to pay a +50-100% premium.

This is bad for multiple reasons, but the worst one is 1) it's very difficult for new people to step in and 2) also very difficult for current holders to get out.

Friendly reminder that 99,9% of Hive-Engine tokens face this problem, and another friendly reminder that you can always reach me and I'll buy back your SEED (not the most convenient way, since we have a lot of money locked, plus the friction of reaching to me, etc...)

The simplest solution has been to simply sell some SEED from me to the protocol, and the equivalent in HBD. I've been doing this in small amounts every single time, never forcing SEED to drop below its 'backed value' (which is the sum of all the values of the assets in hands of the project treasury).

Now, @seed-treasury owns around 2350 SEED, which basically means that 2,35% of the total supply is in the Pool and in hands of 'everyone'.

Some thoughts about HBD & SEED

My initial vision for SEED has always been to interact with HBD as a sink. Lately, I see HBD as the 'killer app' for HIVE and the feature which once polished will unleash the true potential of this platform.

With SEED, we're a little step closer. And this is my way to contribute here.

Currently, we own +23000 HBD in Savings and +5000 HBD in the diesel pool paired with its SEED counterpart. 1000 HBD have been pulled into the 'distribution contract' to pay for LP's. 80% of these rewards are slowly flowing back into the @seed-treasury acc (since it owns 80% of the pool liquidity).

We're very close to the HBD position which we had when we decided to make that YOLO bet and go all in into DAO. Do you remember, anon? check this post. We own 28000 HBD at the time of writing, back into that day we owned 31K HBD. Incredible how time flies and circumstances change.

Regarding the PCV.

As I said before, I didn't want to sacrifice the growth of the portfolio and for now, I'm putting the PCV model in the box temporarily. (I don't need a salary of a few hundred dollars, and as I told in this same post and the project itself 'bought its initial liquidity'). If I need some liquidity for my own personal reasons I'll sell whatever I need to sell.

Current SEED Stats:

Circulating Supply: 100.000 tokens (full released)

@seed-treasury owned: 2380 (2,38%).

AUM Value (All assets): 220.000$

SEED TOTAL Value: 220000/100000 = 2,2$ /SEED

229/7 = 32,7% MoM profit

And here we go with our seventh month! Have a great weekend :)

100% of blogging rewards paid to @seed-treasury.

Remember you can follow the portfolio in real-time here:

https://cointracking.info/portfolio/seedtreasury

You can join us on Telegram and follow me on Twitter.

Posted Using LeoFinance Beta

Hey Empo, hope you do good.

The liquidity problem was something I mention in some posts in the past.

Issue more tokens all 6 months to hammer the price down to 1$ again would make it easier to add liquidity.

Like a seed is worth for example 4$ and every holder gets 3 extra tokens.

So you don't have to do the math :) Like 1 Seed is on issue date 1$.

Stocks work with splitting the same. In theory, it would be the same 0,25 Seed = 1$ or 1 Seed 1$. But it would be in some way like a diffident payment.

My 2 cents on that :)

GM! :)

Edit: What I forget to say, with more tokens released, it's also a way to add additional some more to new people that want to invest. So fresh funds come into the seed treasury :)

Posted Using LeoFinance Beta

It wont change things if people are not willing to sell. You are just playing a numerical game.

If someone has 1000 SEED and isnt willing to selling, making it 3000 SEED at 1/3 the price is still not going to get the person to sell.

Liquidity issues can stem from too small a float. However, with 100K, there is enough there. The challenge is that nobody is selling. If holders of 25% of the stake (25K) were selling, it would not be an issue.

Posted Using LeoFinance Beta

I agree, but it is a psychosocial thing + it allows issuing new tokens for 1$ to new investors. It's the typical " its expensive thinking" and not thinking in shares.

Look shiba or doge. I think nobody of those investors thinks about i own x% of the token supply.

They like to see "I hold 1 000 000 Shiba".

But back to the point. If nobody sells it changes nothing but it would allow issuing some more tokens and get the fund bigger.

The thing about seed is 5$. Supply would go to 500k. Now, empo issue another 500k token to double the investment power.

Its also another thing, if you want to buy more, it's currently impossible :)

If empo issue now tokens, it involves to much math :P.

Expanding the fund is IMO the best thing that can happen, profit hive also because of the HBD part :)

Issuing new tokens could be a possibility, but not for 1$. Those tokens need to hold the real value, which is almost at 2,5$ as per the chart above. You talk about 'share', well early investors took a risk which is higher when investing in the fund today. Maybe that deserves a premium on new token value, like 3$. That said, I don't see any reason for SEED to issue new tokens. When SEED needs more liquidity, then the fund could go to the market and get some crypt loans. This morning someone in a YT vid told me these loans are dirt cheap at the moment. The cost of the loan is a cost to the fund which decreases profits, but the fund will have the liquidity needed to invest in new token launches. At some point, peeps will like to trade their SEED, but this is not the time.

read and try again.

If token is 5$ everyone gets 4 tokens more. Then the price is 1$. That allows issue more for 1$.

Sure, I understand what you say. There is no difference to your example of 5$ versus issuing new tokens right now for the price of SEED based on current fund value. Which is kinda like 2,5$ right now (a little less maybe).

I still don't see why more tokens need to enter the market. As I don't see why it is a problem that it's not easy to trade the token. At some point, more SEED holders will want to sell. But that is not the case now. Fine with me, and should be fine for SEED as well.

Think about it this way.

You hold seed and all 3 months for example you receive more seed tokens to bring it back to 1$.

In terms you don't want to sell, nothing changes.

But in terms to issue more tokens, it's a really good sales pitch.

More funds allow empo to invest in more things.

With a "presale" empo doesn't need to face the changing price issue.

If new tokens are released for example "3$", price can go up to 4$ and it sucks for empo.

If there is a date in the future for token issuing, it would allow exactly defining the worth on date x.

Everything else is really complex in terms of expansion.

Sure that would be some work too but would allow expansion more easily.

Another thing is, maybe some people want to sell the new tokens.

At the end of the day, it could be a way to generate more value.

the point was more to show empo some ideas.

When you believe it's the number of tokens that is a thing, then you are right. Then I think, why not 10ct tokens instead of 1$. But yea, can be any figure, also 1$.

However, I don't think the new tokens issued in your scenario will drive peeps to sell them. I think for the top holders, holding the majority of the tokens, the investment into SEED is a small part of their total crypto/investment, hence they hodl, as everyone would do when believing the project is good. Other factors for hodl-ing may play a role as well, like the top-level subscription to makerDAO. But you may be right when many more tokens in the market, with new investors, a bit more trading may be the result, though I really doubt it. I have the 'feeling' some of the existing investors will buy more SEED rendering the effort to no real net result 😂

Here is an idea: When Empo offers like 2 to 3x current value for SEED, I can imagine that will drive some peeps to sell 😜

More seriously: Giving more incentives for peeps to enter the liquidity pool may help as well.

Working on that ;)

It's perfectly fine! It was a 'positive ranting' in the sense of how difficult getting that initial liquidity has been.

The SEED holders simply believe in the fund manager, hence no one wants to sell :)

What I think is new to crypto compared to the fiat world, is investment funds becoming tradable on the free market. I still wonder about that. What is the benefit of a tradable investment fund? The value of the investment fund is the value of all investments. I suppose, by making an investment fund publicly tradable, the only positive effect of that is the value of the investment fund manager is included in the price. All the other elements such as market sentiment, I see as a negative effect. What is your take on this?

I agree completely but... how do we value the fund manager? (rather than with our trust)

Did you just agree and give the reason why an investment should not be publicly tradeable? 😂

Maybe I just misundertood. I agree in the following:

A 'tradable' crypto fund isn't different (at least in the core) than investing in a basket of assets ( same as a investment fund which most banks offer).

HOWEVER! (and it's a big one), crypto fund can offer a flexibility which banks can only dream for. Main thing is that these type of funds doesn't have interests aligned with the customer since the bank basically relies on fees on the customer itself, and no 'real profits'.

It's also remarkable all the hidden fees, since the fund manager from the bank usually will pick the assets which HE/SHE is allowed to (and not necessarily the optimal ones). P.e products from the same branch

TL;DR banks incentives aren't necessarily the same with the customer. A problem which doesn't happen in crypto (if rules are clear from the beginning, of course).

Dunno if I'm missing something... I'm answering your question or raving to much? :/

I do agree with crypto being more transparent, maybe less fees and less politics, though the later may still happen when a fund is run by a team.

I try to make a different point, the investment fund and the open market tradebility thereof.

Bank or other institutional investment funds are not tradeable on the open market. Peeps trade with the fund itself and pays/receives the intrinsic value of the fund, whilst the value of such fund is not full of sentiment and whatnot. My take is this is wanted, in a centralised setup but also in a decentralised setup. I mean, it is wanted that the valuation is done purely on assets it holds and knows the market value of these assets.

Well, not all investment funds are like that, for instance, a fund investing in paintings or other art will have difficulties establishing a price point for each such asset. But that aside, SEED doesnt own such type of assets.

For SEED you like to see more liquidity in the market so peeps can buy and sell like stock or general crypto on the open market. I wonder why you want this? And/Or this 'degrades' the investment fund value from pure valuation based on known assets with known prices, to an investment fund valued not only on the previous but also on a range of other non-financial factors, such as sentiment, emotions. Any open market trading system has this effect. Maybe ok for shares in businesses. But is this, in your opinion, wanted for investment funds?

As I see things, 'backed' value doesn't matter if there's no liquidity ON A REAL MARKET to sustain that value (what I can buy now at the marked price without moving the market by orders of magnitude).

Lack of liquidity creates a 'mirage' of value, or an illusion (as you like to call it). And there's not a better recipe than that to get 'dissapointed investors' later.

Most projects use 'ICO' funds and allocate 1-3% of the supply to a liquidity pool or to get CEX listings ('liquidity incentives'). Since we had a 'fair launch' and everybody payed for their own tokens, such a thing wasn't available since day one (Since we raised funds at 1$ and denominated a 'fair base value'), hence we were going to need this later.

Having said that...

Maybe this is not needed for traditional investment funds since the value of the basket of all the assets defines the value now (and hence enabling liquidity impacts the token price in new ways).

But I'm slowly changing the way I see seed from a 'typical investmend fund working in the crypto environment with HIVE & HE resources as the infrastructural backend' to 'a profit based DAO based on HIVE which compiles a group of power users which invests in abc to xyz...''

What I mean with this is that SEED started as my little kid and the initial idea was to share my profits thorugh the token (something which has worked tremedously well so far).

But what If I wanted (we want to) be something more in the future? I still don't know... but just in case... I wanted to be ready for that and start preparing the required infrastructures for that.

Expansion cannot happen with liquidity... because those liquidity will always help us to discover our 'real value' (even if we're still pegged on the downside).

Again I'm raving a bit too much... or not, dunno. Thx for the conversation @edje. Since these kind of deep questions allows me to realise in what stage we are and where I want to conduct this business/idea

Your welcome 🙇

Now I think I already mentioned this to you over at TG some time ago. Qredo (https://www.qredo.com/) is building a service to be used by fund managers. They build workflows around DeFi in which multiple peeps need to sign for a transaction before the transaction actually happens. This goes way beyond what you mentioned above, but since you look into the future, a service like Qredo may help to decentralise fund management. Not sure, but this service may also be interesting (though I don't believe in the MC valuation of 1B$, way too big imho): https://www.sandclock.org/ (you need to watch the not so good YT or read through the preso link, I didnt discover any real doc-section). Lithium Finance is coming out with interesting services (https://lith.finance/#Usage)... Essentially a service that allows for difficult to value assets to get a valuation. Can you imagine at some point in time SEED fund offering the market the ability to get SEED taking a stake in a rare asset that is prices through Lithium?

Liquidity is covered for new token launches. No problem. It's just that I try to accumulate HBD in savings and don't touch it later.

Not thinking about loans atm but could be something that I explore soon in polygon with Aave.

Tbh, I don't want the mentality of shiba holders there. They destroy the price in both directions. They're the first to complain when things go bad and the first to congratulate themselves when things go fine.

Issuing new tokens (amplifying the supply ratio) will come at a high premium for new investors (if that ever happens).

I prefer to keep things relatively easy. The fund will grow naturally when it's underlying assets held also grow in value.

One thing is for sure. If new tokens ever get minted (I would have to create a new token and all that stuff), % of existing holders won't be diluted. That's for sure.

It doesn't seem like a bad return to me since you have exposure to the growth of Seed.

Best of both worlds :)

SEED is strong, amazing project and the pool enables this token to show its strenght.

@tipu curate

Upvoted 👌 (Mana: 28/68) Liquid rewards.

You can have my seed in exchange of 100k hive.

Posted Using LeoFinance Beta

ewwww

nasty

Gay

The drops are normal but if the project is strong we will see maximums again and that is what I think will happen with Seed.

It is true that there is a liquidity problem but I would differentiate. It is not the same that people do not want to sell that there is a problem of buyers.

I would equate it to those real estate funds that open and close at a certain time. If there is more demand because the manager's skills are trusted, then Seed2 will open and that's it.

That's it ;) Not a real problem. I'm myself a buyer at the floor price.

I've noticed this with POSH as well, people barely bother placing buy or sell orders, always just instant sell or buy. That's one of the reasons we allowed people to earn part of the daily issuance through delegations.

Sorry acid, could you direct me to the POSH whitepaper (if any). I would like to read about those delegations,

ty and hope you're doing great.

Hey! No whitepaper (yet) but here are some posts explaining it:

https://peakd.com/hive-174578/@acidyo/dollarposh

https://peakd.com/hive-174578/@acidyo/dollarposh-updates-delegations-to-poshtoken-in-exchange-for-daily-posh-rewards-and-other-things

https://peakd.com/hive-174578/@acidyo/poshtoken-autovotes-based-on-posh-earned-poshtoken-buyback-starts-and-some-other-news-and-info

Thx I'll check it out

I'm a simple clown, I see a meme in empo's post I tell him good job. Also it's a bad sign when you can't pull out easily, that can get very expensive very quickly :P

lol

golden

Posted Using LeoFinance Beta

To pull out is always a risk, better to enjoy with memes sir

agree sir, have a great day sir

To get SEED holders to sell, you have to do some shit with the fund first so we lose total trust.

Posted Using LeoFinance Beta

Well, rough times. But I think SEED has a strong foundation and it will be fine long term

Posted Using LeoFinance Beta

Looks like SEED is an exclusive club now, most if us HODLing strong.

I can't believe it's been 7 months already. Time flies.

Again, thanks for making us rich :)

Posted Using LeoFinance Beta

I was thinking the same thing when I read that.

Posted Using LeoFinance Beta

It is true though, look at how strong people are holding. I suppose weak hands or those who had short time plans for a quick profit are out now.

Posted Using LeoFinance Beta

And you don't know how much I value that fact.

bah, it's no big deal, Give me more time to build and we'll be ina much better postion. Currently handling a lot of growing pains (since it would be a bit difficult to manage a liquidity run since a lot of the funds are locked in DAO).

You have all the time you need. This is not a one-night stand. This is a long term marriage darling 😂

Posted Using LeoFinance Beta

Only regret I have is I didn't buy enough when cheap. Seriously have no intention of selling anytime soon. I guess you're planning on selling out most of your stablecoins when markets reverse?

!PIZZA

That is always the regret with strong projects.

Posted Using LeoFinance Beta

Initial idea for SEED has always been to build a strong foundation of HBD and build from there. In my humble opinion we'll have to deal with a bear market sooner or later and I want to be prepared for the chance.

I'll probably buying some, but I want to keep a big stack of HBD as I said.

Not only for 'us' as a project, also for HIVE.

Thank you for the response. The strategy makes sense. I'm among those who beleive Hive can become a $100 crypto.

!PIZZA

PIZZA Holders sent $PIZZA tips in this post's comments:

@d-zero(2/5) tipped @empoderat (x2)

Learn more at https://hive.pizza.

Is it really important to get in and out quickly?

I mean it's good to have it, but should it be a somehow primary goal?

Posted Using LeoFinance Beta

It is very important. Since people should be completely free to sell/buy without a big hassle.

Liquidity allows new investors and a recycling process for the old ones (who doesn't want anymore to own the underlying token).

Personally, I avoid at all cost iliquid tokens (because If I get in I'm fucked for the slippage), but I'll be eve more fucked when I'll try to get out.

I want to minimize at the minimum the impact of that. And that's why I want (I'm already doing btw) to build a solid foundation in HBD.

I agree completely. This is something that most are overlooking, the value that is available to Hive with HBD. It is something that is going to stand out if we take the proper steps.

As for selling SEED, sorry but this is a 5 year horizon for me. I love the lottery tickets that can pay off in a big way. The market pullback hit the total value held that that happens. Only temporary. We are on the right track.

When being money is available, no need to sell for small money.

The burden of success it seems.

Posted Using LeoFinance Beta

The liquidity issue is better overall in SEED but I like that you are making it easier for people to get out. I guess I might be one of the HODLers that are a problem because I just plan on holding onto it in my HE wallet.

Posted Using LeoFinance Beta

Don't get me wrong, I value a lot this problem. But I always want to give people options.

very interesting stuff. I enjoyed all the #'s and graphs.. trying to figure out just what is it saying. So this is a hedge fund? or that is just one of the strategies u use sometimes?

Hey (hola, hablamos el mismo idioma?)

SEED is my own project and also a token listed on HE. however I recommend you to use the pool available on beeswap:

https://beeswap.dcity.io/swap?input=SWAP.HBD&output=SEED

The token is backed by assets, which you can follow there:

https://cointracking.info/portfolio/seedtreasury

When the value of these underlying assets grow, also does SEED. We started at 1$/token and were at 2,2$ after reaching a ATH of 4,5$ back a few months ago.

We had a fair launch (no allocation to me since I bought myself y own tokens like everyone else) and we've been running since late July 2021.

regards!

thanks for that info. I will check it out..

I don't feel sorry for new investors trying to get in and can't. This is how things work when a project is successful and all of us would buy more if they were available. We invested in you and not some arbitrary token.

Posted Using LeoFinance Beta

Me neither. Thank you for your encouragement words mr coffee :)

People getting in will be hard, and now, would probably make less sense for them, as the project is funded.

If they want to get out, it is a different story, but I think with the options available, there shall be no issue.

Posted Using LeoFinance Beta