Z1 Money Supply

Alright so I was listening to @taskmaster4450's assessment of Nayib Bukele, El Salvador, and their adoption of Bitcoin as a "hedge against inflation".

https://peakd.com/hive-167922/@taskmaster4450/kfafgrmi

I don't believe it is a super fair assessment of the situation to say that this experiment was a failure. I'll consider it a failure when they sell all their BTC at a loss and ragequit the crypto game. Until then the jury is still out.

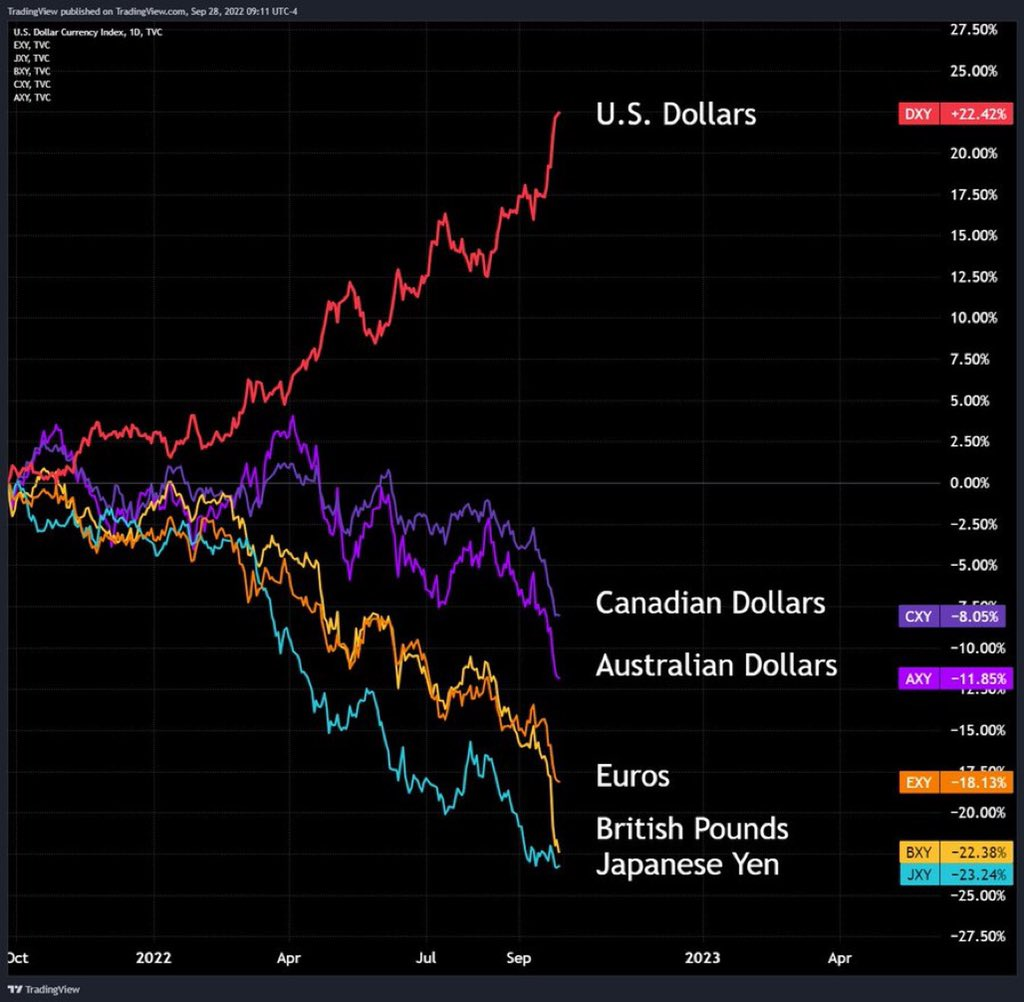

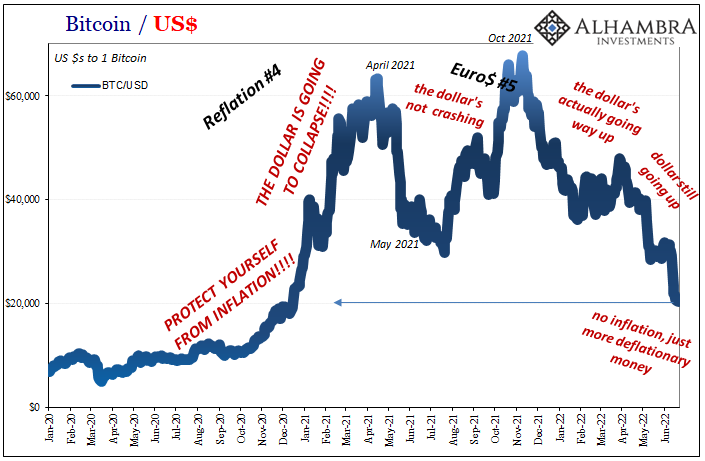

I also don't believe it is fair to say that Bitcoin isn't a hedge against inflation, especially when it's already been explicitly expressed that what is happening right now is actually deflation and a dollar shortage. Bitcoin reached all time highs during QE and 0% rates, which is exactly what we would expect a hedge against inflation to do. Bitcoin crashed when the FED dialed it all back with deflationary measures, which is exactly what we'd expect a hedge against inflation to do.

It is however quite fair to say that Bitcoin is not a hedge against what most people think is inflation. Bitcoin is absolutely not a hedge against an increase of the CPI and global supply shock. It is not a hedge against stock market collapse (yet). It is not a hedge against overleverage and greed, in fact Bitcoin leans into overleverage and greed more than any other asset on the planet.

It is also quite fair to say that Nayib Bukele, like most others, doesn't understand the banking sector, instead opting to stand with all the "printer go brrr" fanatics; A gross oversimplification to be sure. How can we expect people who run entire countries to fix the economy if they don't even understand the economy?

But then @taskmaster4450 made his most absurd claim yet!

He said that the supply of USD in circulation has only increased about 1% per year since 2008. That can't be right... can it? No... I was going to ask him where he came up with that 'absurd' statistic, but then I rewatched the video and noted this number can be found within the "Z1 money supply".

WTF is the Z1 money supply?

I've never heard of such a thing. All the "printer go brrr" fanatics are looking at the M2 money supply... This is how people come to the conclusion that 25% of the entire money supply was printed in 2021 and whatnot. Clearly that doesn't jive with the concept that actual money printed has only increased 1% a year on average.

Basic Google Search: Found this article on Z1.

The Everything Data’s (Z1) Verdict: Not Inflation, Only More Of The Same

Now I don't know if "Alhambra Investments" is a trustworthy entity, but this article reads like it was written by @taskmaster4450 himself, which is crazy because we rarely see economic analysis come to these conclusions.

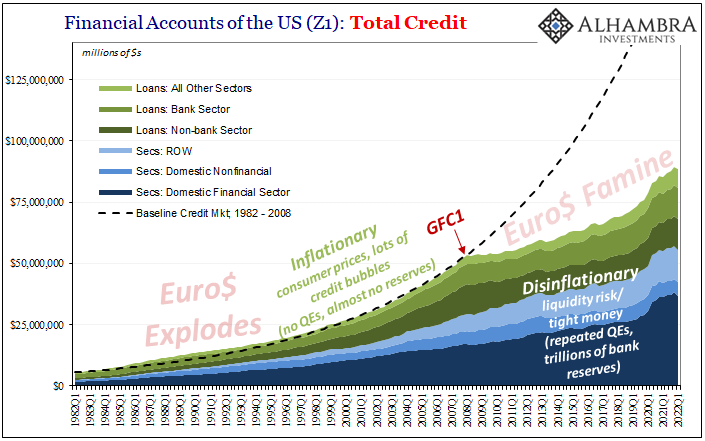

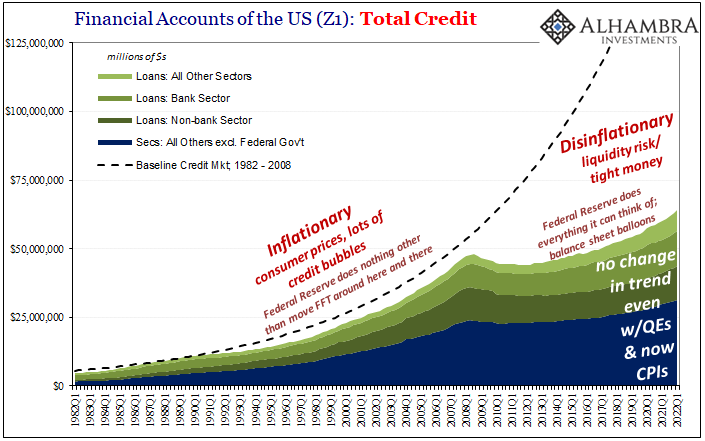

The only thing that changed was the CPI. What distinguishes 2021-22 from the prior post-crisis period 2007-20 is merely the performance of whatever consumer price index. This latter has been called inflation, yet the data conclusively support the market verdict pricing how it never was.

What data? The “everything” data, the most comprehensive financial and monetary compendium yet available: The Financial Accounts of the United States, or Z1. While this doesn’t quite cover the entirety of shadow money out there, it’s as close as we might currently hope to get.

Fascinating...

People forget that George W. Bush’s administration was first into the helicopter business because the results were just that forgettable. Didn’t work. No inflation. Massive deflationary money, in fact, followed by that walloping deflationary economy (to this day).

Are we sure @taskmaster4450 didn't write this?

Asking for a friend.

The government at all levels has been intervening near constantly (all over the world) because of the one other regular feature of the post-crisis era: Euro$ Famine.

Euro Dollar Famine?!?

Def written by Task.

Confirmed.

The Federal Reserve’s comprehensive Z1 statistics were released a few weeks ago, and what they show is the same thing they always show. QE, “helicopters”, whatever, none of it makes a dent.

Bank reserves are not money, and the market prefers only safe and liquid, so that only leaves sentiment which, as you can plainly see, fairy tales about money printing don’t help, either. They are, in the end, actually harmful (see: Crytpo Winter).

Seriously though, Task, admit that you wrote this. lol

The distinct lack of positive effect is even more dramatic and widespread than it may already appear. Since the eurodollar system is the real global reserve money, its breakdown affects more than available US credit. In other words, as offshore banks fail to create money and credit for use inside the US, they also fail to do the same on the outside for the rest of the world (which isn’t measured).

This fact didn’t change with QE6, Uncle Sam nor any of the additional “tools” the Fed claims it thought up in the wake of March 2020 (FIMA, improved overseas dollar swaps, etc). Not even a single positive blip on the chart above, totally consistent from 2007 to today and that’s the whole problem.

QE doesn't work... never did.

The magic money that everyone thinks is being printed?

Well, it's not being printed.

Had accelerating CPIs represented genuine inflation, we’d have seen it as clearly (somewhere, anywhere) in this global eurodollar credit/money data.

We’re left unsurprisingly with only a supply shock. The Z1 figures conclusively eliminate “too much money” that so many people claimed and came to believe, including all those poor souls who poured their savings into “stores of value” digitals which weren’t needed to be stores since the system was never in danger of dollar crashing.

UNCANNY I TELL YOU

It all ties together, from market prices and what we’ve known and suspected all along in real-time, corroborated decisively by the most comprehensive (therefore useful) data source available to anyone.

What this ultimately means is, of course, Euro$ #5 because that’s not any different, either. This Euro$ Famine world is a global economy susceptible to these kinds of repeated setbacks, the unbroken vicious cycle lack of liquidity which keeps a lid on more than just money and credit, restrained growth and potential therefore no chance at real recovery.

All of it ensures any non-money, non-economic supply shock effects will be, dare I write, transitory.

What a bombshell.

But are we really allowed to be shocked that the most comprehensive dataset definitively shows us what @taskmaster4450 has been trying to tell us all along? No money is being printed. The CPI is not 'inflation'. The Eurodollar famine is a huge deflationary threat to the economy. Supply-shock is the root cause of CPI 'inflation'. 'Inflation' actually is transitory, just like the FED told us in the beginning.

Look at what they do, not what they say.

Board members of the FED have already come forward and said they dumped a ton of assets at the top because a "conflict of interest". That "conflict of interest" is just more insider trading. They have access to all of this data and more, and yet they continue to use broken metrics and trailing indicators to dictate economic policy. I've been saying it for months now and it's even more relevant now: we have to assume they are doing this shit on purpose. They are still clearly insider trading. The "conflict of interest" statement is a smokescreen for more insider trading.

And to be fair the FED has very little power over these things and they are legitimately trapped in terms of economic policy. Nothing they do can really fix this situation. Just like everyone was figuring out what what a "credit default swap" was and "mortgage backed securities" when everything went belly-up in 2008, so to will people be asking questions about the Eurodollar system if and when it collapses the entire world economy.

Conclusion

@taskmaster4450 was right all along (go figure). Nobody understands the banking sector. "Printer go brrr" is a childish know-nothing opinion spewed by the masses. The economy is trapped between a rock and a hard place, with no escape in sight. To be fair this has been the case for a decades, so who knows how much longer we can keep the music playing until it inevitably stops and we witness the systemic failure of the banking sector.

I've been talking about Bail-Ins and haircuts for years. Now more than ever, it is a real threat that citizens with money in the bank may just have their money stolen from them to prop up this ridiculous zombie economy. Yeah, it's not fun to ride crypto down to the bottom, but we live within a time period where every paper asset on the planet is risk-on. Might as well pick the asset that we provably own via cryptographic proof that can't so easily be stolen from us.

Eventually the FED will have to admit just how badly they handled this situation. Raising the fund rate into a dollar shortage because the CPI is high... that's not a valid strategy. The blunt tools at their disposal are simply too archaic to actually have any positive long-term affect on the economy. Get ready for them to continue kicking the can down the road for as long as they can before the music stops playing.

Something the article never mentions what @taskmaster4450 spells out all the time: we need pristine forms of collateral. This is why there is a dollar shortage. This is why banks don't want to give out loans. The collateral is lacking.

Within a fractional reserve system of KYC and credit scores: people are collateral. It's not hard to see why conspiracy theorists would shill a worldwide depopulation agenda when it is very obvious that the value of people themselves-as-collateral is going down. In an environment of automation, AI, computing, and other forms of tech/abundance, what good is feeding, clothing, and housing 8 billion humans who all carry with them a carbon footprint? Something has to give.

On the flipside of this argument is the fact that all our economic systems 100% depend on constant growth, even if that growth is cancerous and unsustainable. This is the rock and the hard place we find ourselves in. There are too many people on Earth, and there also aren't enough to sustain the pyramid scheme we have going. The Baby Boomers aren't getting any younger, friends.

For all these reasons and more it is imperative that crypto continues to enact the cliché pairing of "innovation" & "disruption". The system we are creating here is not one that is based on debt, but one that is based on collateral. It is no accident that we are building exactly what the legacy economy needs to say alive. Starting from ground zero is absolutely not the ideal option. The goal is to tame the economy, not destroy and replace it. Baby steps.

Posted Using LeoFinance Beta

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Why don't we tweet spam Nayib Bukele about Hive?? :D

https://twitter.com/708333512571551745/status/1588601579925798912

https://twitter.com/1884771912/status/1588959029489205248

https://twitter.com/1369890829477814274/status/1588989780934950912

The rewards earned on this comment will go directly to the people( @shiftrox, @m0rt0nmattd ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Like a lot of your posts some things go over my head but give me good terms to search the meaning of and then I get it the next time I hear it 🙈

Can't argue on that one.

Now we know the truth.

@taskmaster4450 is actually a bot that someone trained by applying GPT-3 to Alhambra Investments’ market research pages.

Pretty good deep fakes on ‘his’ videos, though. Those sunglasses, however, give away the fact that it’s really just Agent Smith hiding behind GPT-3 and deep fake tech.

Yeah right, my theory is you and taskmaster are bots from the future. The call you made about the month that marked the end of the bear market is beginning to look like it. 🧐