When Common Sense Fails

There are many things in life that make perfect sense on paper and make zero sense in reality. On the other side of that coin, there are many things that don't make any sense in reality but are completely true. Many of the best inventions, much like evolution itself, were created by completely random-chance accidents. Examples of such products are the ever important Slinky, chocolate chip cookies, Velcro, super glue, and even Penicillin. And lets not forget the most important one: beer.

When I was a kid I remember this one time my teacher told the class that there's more bacteria in a kitchen sink than there is in a toilet. I parroted this information to my father and he immediately rejected it.

No, that's wrong.

Zero consideration about whether the statement could be true or not. It sounded wrong so he said it was wrong without a second thought. I found this alarming, and it became a core childhood memory and part of my current personality. I didn't even try to argue with him. What was the point? Such a stupid hill to fight on.

2022 Google seems to think I was correct and Dad was wrong.

People get trapped in this know-it-all way of thinking where they just assume things are true without maintaining healthy levels of skepticism about the perceived world around them. This is not only a bad idea on a scientific basis, it's also just flat out dangerous.

Look at the world around us. Every day more and more lies coming from the powers that shouldn't be. We live in a Clown World now where some conspiracy theorists are batting 1000 and end up being right about everything they say these days. And do they get any credit? Do the nay-sayers apologize or admit they were wrong in retrospect? Of course not. They just sweep it under the rug like it never happened and continue living out their life in Clown World. This is why we can't have nice things.

Applications to crypto

Pegging a crypto to gold sounds like a good idea. Right? Common sense dictates that crypto has no intrinsic value, and by pegging it to another asset that has had value for thousands of years we can give crypto more legitimacy.

That is just common sense.

And once again common sense fails us. Pegging a crypto to gold is terrible because pegging a crypto to a physical asset means a physical asset must be redeemable by the users. So tell me, how easy is it to secure a physical asset in the physical world compared to securing a digital asset with private key encryption? The difference is night and day. Crypto pegged to gold is inherently centralized on every level, and even if the security of the physical gold was somehow a decentralized solution it would still be a thousand times more complex and haphazard than just scrapping the entire project and allowing digital assets to do their thing.

This is precisely why NFTs are 'never' going to represent physical property. Imagine demanding the police to use the threat of lethal force to remove someone from a property because you owned an NFT. Eviction is a legal process that takes months. In California it takes like six months. Physical property can only be truly secured by the threat of lethal force. The NFT doesn't matter. The threat of law enforcement telling you to do something is what matters. To claim that these two things will become one and the same is a complete fantasy. Only within the borders of a crypto city-state could this ever become a reality, and even then it might be a completely failed experiment.

Market feed is better

It is also possible to create a derivative that is pegged to gold but can't be directly redeemed for actual gold. This is a better solution, but still not ideal. Imagine if HBD was pegged to gold instead of USD. We have all the tools to make this a reality today this instant. All that would be required is that the witnesses change the price feed from a USD metric to a new unit-of-account (in this case gold). Then HBD would be pegged to gold instead of USD.

What is the risk of that?

The benefit of pegging HBD to USD is that USD is the most stable asset in the world and the value of it is guaranteed to slowly go down over time. With gold we would be gambling with network debt and hoping that the value of gold stays low. If it didn't the network would lose money and have to pay back more debt than it issued.

Also it's important to note that in the worst case scenario, the debt we owe back becomes too high of a percentage and the haircut kicks in, which completely ruins the peg and creates an extreme loss of confidence of anyone who was holding the token for the sole purpose that it was artificially pegged to gold. This has a much higher chance of happening with a volatile asset than it does with FIAT, which is exactly why it is the way it is.

The economy is fishtailing

The entire world is fishtailing honestly. The incumbent president can no long win reelection even though that is the standard. The democrats have lost their fucking minds and have swung so far into authoritarian extremist territory that we live in a constant clown world. The Green clean-energy initiative is hypocritical and completely lacks any self-awareness. Ironically, it also lacks sustainability, which is exactly what the movement requires. Demanding everyone get an electric car and then tell people to stop using electricity a week later. Clown World.

Looking at the economy.

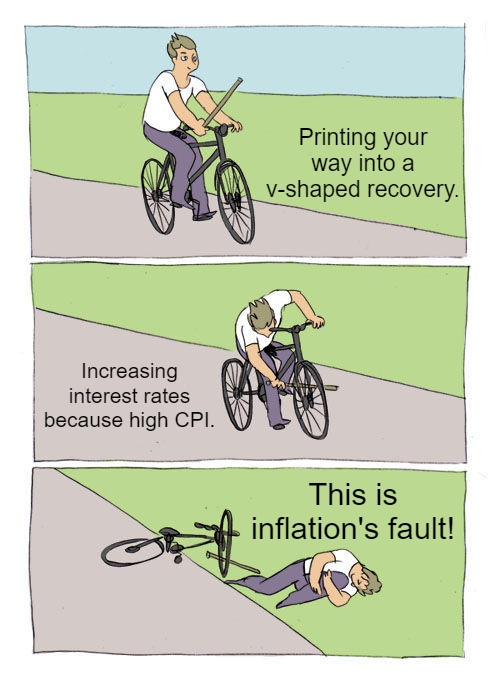

The world economy is a slow lumbering beast. Many are trying to say that "inflation" is making stocks and crypto go lower. That's just common sense, right? We can see it happening. CPI is high and stocks and crypto are going down. Obviously!

Yeah... not so obvious...

What people fail to consider is that all the actual inflation occurred in 2020 and 2021 when all that free money was being printed out. No one complained about everything pumping to the moon. That was inflation. Inflation pumps the market.

Now the chickens have come home to roost, and because the CPI is high due to supply shock, the FED is increasing rates and choking the debt market. The FED can do nothing about supply shocks of goods and services, and can only choke demand, which is exactly what they are doing. And then people wrongfully say inflation is to blame.

Correlation not causation.

It is the response to a high CPI that stomps the market.

Not the high CPI itself.

What is happening here is that the FED is peacocking for the world and pretending like they have power over this situation. They increase rates... and honestly I don't even think it's helping at all. Rather, the economy is just going about its business and the CPI is rising and falling based on completely different factors.

Once the CPI goes down by itself, the FED will come forward and announce that they are the ones who defeated inflation. It's comical. They aren't helping anything. The CPI will go down on its own because of factors that are completely out of the control of the FED (like people running out of money). All the FED can do is insider trade the recession they are creating... seemingly on purpose.

What many do not seem to realize is that if inflation hadn't of happened in 2020 and 2021, Bitcoin would have never gotten as high as it did. Nobody cares. The greed is infinite. Everyone just runs around thinking they deserve $69k BTC. You don't. It was overpriced because of the free money floating around. Now on the swing backwards we blame inflation, when it is really deflation and choking the debt market that is fucking everything up. This is what we get for not paying attention. In retrospect a lot of this was pretty obviously guaranteed to happen. We all knew the economy was in bad shape ever since the COVID crash in March 2020. Greed didn't care. Now here we stand.

Conclusion

Common sense isn't very common, but those who employ it too often without real-world experience are going to get it wrong a lot of the time. Even worse is when people get it wrong and then don't even check their own work and just keep running around thinking they were correct the whole time.

Just because something doesn't make sense on paper doesn't make it false. On an intrinsic level, common-sense involves a lot of speculation, guessing, and projection of knowledge from adjacent territory that may or may not apply. Anyone who knows about the Butterfly Effect knows just how wrong extrapolating a small subset of data can be.

We often criticize those who have no common sense. We even resort to insulting their intelligence and blaming them for the faults of this world (this is why we can't have nice things). However, there's a reason why people have such a diverse set of skills and reasoning ability. It's a feature, not a bug. Everything is working as intended. Intuition is a double-edged sword. It is a blessing if we guess right and a curse if we guess wrong. Some people are more risk-averse than others. Working as intended.

Posted Using LeoFinance Beta

What are you saying? We already have NFTs, they are just named differently and are not in a form of tokens on decentralized blockchain. All property rights are like that. Bonds, stocks, mortgages, future contracts or gold certificates represent claim to physical or financial property. But even if you have allocated gold account, it might happen that the custodian "lost" your ingots and you won't be able to reclaim them (and will have to settle for contracted compensation). Even if you own the house, it doesn't mean you can evict its residents without following proper procedure.

As long as the blockchain where such property rights are to be stored offers abilities envisioned by law (like the ability to override owner signature with some mix of official keys for the purpose of handling inheritance or confiscation for example), there is no downside to making now "paper" NFTs into tokens on such blockchain. The law has to recognize property rights in such form and it just makes it nearly impossible to forge, with perfect track record, easier to trade and tax.

I can't even send $1000 to the correct address without thinking I somehow messed it up and lost $1000. Will these NFTs be on Ethereum? There are airdrops on ETH that can trick people into giving an attacker control over the wallet. There are so many stumbling blocks in play. It's not going to be pretty. I highly doubt it's going to work within a legacy system. It's going to end up being a weird novelty that doesn't work very well and get's forced for a long time. Fake it till you make it.

Ok, I think we are talking about two different things here. Apparently you are talking about existing chains that support NFTs - of course legacy system can't use them. I'm talking about NFTs as a concept, that is already present in legacy system, just not in a blockchain-NFT form. There are a lot of benefits in migrating legacy property rights from paper and proprietary (bank/broker) electronic forms into NFTs on public open source blockchain. As long as you don't get too far with such transition. Your concerns about the transactions being "too easy", which might make phishing and theft safer for the perpetrators, therefore more profitable and frequent, are not without merit. That's why I don't think transition of property rights from paper to blockchain would change much in terms of what steps you need to take to make a transaction. I don't know how it looks in other countries, but when I was buying my flat, I met with the seller at the notary where we signed the contract, the official checked documents and relaid them to the court where new entry in real-estate register was added. In the process there were many opportunities for competing paper trails to emerge. If the same process was encoded on blockchain, everything could be done in couple of minutes, with less chance for fraud or mistakes. But you'd still need the notary to certify with his signature that the seller was the one that was on record as an owner and not just the person that has the valid key, that you are not "under influence" or threatened etc. The fraud would still be happening, but there would be a lot more steps to take to make it happen with "success".

For simpler property rights, like stocks, moving to blockchain would most likely be smooth, since trading already has no extra steps (unless you are buying amounts that require you to disclose your holdings - that could be automatic). There would still be accounts and brokers to co-sign your trades for the sake of KYC, differentiation of "licensed investors" from common folk, reporting and taxation, but some things like naked shorts would stop being just illegal and would become impossible, which is a plus. I'm not sure what kind of technical solutions would be applied to such blockchain, because it needs to be public to ensure immutability, with proper keys you need to be able to see your own trades, but it should not reveal all trades (BitShares model is too open).

One thing is for sure. In order for the law to recognize property rights encoded as NFTs on blockchain, the legislators need to have full control over its rules, since setting the rules is their job. That's why it would not be any of existing blockchains (but it might be a clone of one if its mechanisms fit the purpose). Only official entities would be block producers, but to ensure transparency and immutability (and therefore increase legitimacy in the eyes of the public) there should be no limit on validators of existing blocks.

In order for a technology to take over it has to be ten times better than the incumbent system.

It's very obvious that crypto will be that to money.

Not so obvious that NFTs will be that to contracts.

In the end it will probably just take a bit longer to catch on.

I imagine the world will look completely different by the time it does.

Shit is going to get super complex when you start mixing physical with digital.

Remember, NFTs (on immutable blockchains) simply 'track' authenticity and show a digital ownership trail.

Sure you can say that entry on the blockchain relates to a certain physical item, but there's no locked link.

An entry on a blockchain (the NFT) may say it's yours, but what if someone in the real world just says nup, steals the physical item and puts it in his house?

Then takes you to court in their local jurisdiction which is different to yours and they decide actually it's theirs now?

Shit can and will get messy quick.

Posted Using LeoFinance Beta

No no no. I'm talking about moving existing property rights from paper to blockchain. Since those "legacy rights" are a subject to specific jurisdiction, so will their representation on the blockchain. So if you own real estate in Puerto Rico, you go to the court in Puerto Rico if there is a problem, even if you live in Germany (or more likely you hire legal representative in Puerto Rico to fix the problem for you). For the sake of resolving conflicts it doesn't matter if you have paper deed or a key to NFT on legally recognized blockchain that represents ownership of the house in Puerto Rico (in fact NFT form is better because it is harder to forge).

Indeed sometimes the common sense mislead us. I agree on your assertion not to peg crypto to gold. That is one of the worst thought to consider taking the history of fiat currency into consideration. Fiat use to be backed by gold. Around 1930, this standard was abandoned during the Great Depression. In that there was more money than there is Gold making gold much more valuable.

If it didn’t work with fiat, I doubt it will work with crypto

People need to use their own judgement and common sense rather than deferring to the media or some clown level "expert".

With all the people dying from the vaccines those that promoted them should have zero credibility at this point. These are the same people promoting globalism, green, carbon tracking credits, vaccine tracking passports, inflation and spending without limits, bug eating, woke ideology, cannibalism among other crimes against humanity.

One other point is when interest rates go to extremely low or high levels it wipes out small investors in the process and those with the most resources scoop up distressed assets. The Fed's actions are entirely deliberate and it's not trying to help anyone but the globalist elite. Central banks are a cancer on society and only further to enrich the elite class. Interest rates and lending should be free of any central authority and set by the free market.

Here, here. It's surreal how the OWS movement shows the power of propaganda to corral chattel, and the real ruler we are not allowed to criticize. The desperation of the lies has increased to a fever pitch that shows no sign of cooling off, and this indicates that fever is approaching it's breaking point, at which time cool heads will prevail.

While we're being herded into CBDC UBI bugpods some of us dig our toes into the dirt, and keep in mind that cataclysm, rather than demographics, determines evolution. Cattle fattened in feedlots all perish when the corn runs out, and the bigger the herd the faster they fall to less disruption. Being reliant on centralization is catastrophic in a cataclysm, and corrals are designed to keep cattle from jumping the fence. It's only possible to survive such events if you never feast on the corn that fattens the herd in the corral, and manage on what resources aren't provided by centralized industry.

Decentralization of means of production creates independent means, which is the real definition of wealth. They will be the only means available when the cull begins. Freedom is real wealth, and all that will matter when the fever breaks.

Stay frosty.

Um, please remember that I am not an American citizen and obviously don't have the history of such things and have no dog in this race whatsoever... but it is not the American Republican party that is going hardcore authoritarian with the state policies it enacts the the federal policies it presents?

What policies are you referring to? Both parties are full of compromised politicians though as of late there are a few Republican party members standing up for freedom. Any politician that supported lockdowns and vaccine mandates is not your friend.

So, I guess I'll start with the Californian policy that I think Edicted is referring to:

https://ww2.arb.ca.gov/rulemaking/2022/advanced-clean-cars-ii?utm_medium=email&utm_source=govdelivery

I wouldn't say this is a authoritarian extremist policy. By 2035 car manufacturers can not sell new ICE cars in California. It doesn't force people to own an EV, people can still buy ICE cars from dealers, second-hand or interstate. I think we can also argue that the pollutants that come out of the tailpipe of ICE vehicles are not good for anyone, but regardless, its not forcing anyone to buy an electric vehicle, it only applies to auto manufacturers, not dealers.

Compared to say, the Georgia Republican policy:

https://www.legis.ga.gov/api/legislation/document/20212022/201121

This law makes it a misdemeanor to give anyone water or food within 150 feet of a voter polling establishment or 25 feet of any voter standing in line. Anyone breaking this law can get a year in jail or $1000 fine. I would argue this is an extremist authoritarian law. Someone shares their water with their spouse while waiting hours to vote, and spends a year in jail... bonkers.

Obviously there are thousands of laws/policies enacted by both US political parties, but it seems to me from the outside that the GOP has a more extremist authoritarian lens than the Democrats... but obviously I could be totally wrong on that and would be happy to discuss.

California is run by some of the worst democrats in the country. They don't have the infrastructure to power electric cars and even if they did it wouldn't be green. The Liberal government in Canada wants to enact the same insane regulations here; at least we have more hydro power but battery technology just isn't a replacement for ICE engines. Good luck when it's minus 25 and your battery doesn't work.

Both parties have changed over decades and the democrats are just full out globalist communists at this point. The republican party has a faction of corrupt globalists (republicans in name only) but also has a group of the only people fighting for personal freedom and any resemblance of what life used to be like with some level of prosperity. The democrats, the media and the rest of the big tech platforms are all on board for the great reset and the new world order agenda.

Okay, thanks for your reply.

Interesting info

but is it not the American Republican party that is going hardcore authoritarian…?

Fixed your typo. 😁

Hahaha, thank you. I seriously had to read this 4 or 5 times to work out what the typo even was. Thank you for this... clearly I need more practice at asking clear questions.

Both sides love rule by force/fear.

I mean lets be honest that's the only way anything can scale up within an empire.

The SDP and NSDAP were both statist parties, but one relied significantly more on force/fear than the other, not unlike current differences.

Proving once again that good cop bad cop works.

Both cops are still complete trash because it's an act and they operate within the overarching authoritarian system.

Yeah I mean normally I would say that's the case, or at least was my interpretation of decades past.

But now everything is so volatile and clown world it's hard to tell.

At this point both sides are sliding more and more authoritarian.

It's alarming.

No, it's not. Thousands of years ago you could trade an ounce of gold for a custom tailored toga and sandals in Rome, and today you can trade an ounce of gold for a custom tailored suit and a pair of shoes in NY City. Try to find anything that is the same price in dollars today it was just ten years ago.

What? I used to think you were so smart I couldn't understand you. Now I am beginning to suspect you're just wrong.

Inflation devalues debt, which is why it causes interest rates to rise, because that enables issuers to justify suffering inflationary loss. That's why the interest rate on HBD is 20%, because that pays investors to hold that debt that is constantly devaluing as USD loses value through erupting into the universe like particles at the Schwarzchild Radius of a black hole. Dollars just appear on the balance sheets of banks lending them out, and since January 2020 that rate has of issuance has increased at a far higher rate than 20%.

Gold does not have this problem, and were HBD pegged to gold Hive would have to pay a far lower interest rate to convince people to hold it.

At the outset of sanction Russia jacked it's interest rate up to 20%. Overnight the ruble gained value against the dollar. Investors were compensated for the parasitic losses to inflation and sanctions by that interest rate. The ruble has outperformed every fiat and cryptocurrency in the world to date.

Gold would be a vastly better peg than dollars, except for the ignorance of normies that are the market for HBD and dollars alike. Inflation robs them, and they don't buy gold. It's notable that PM markets are notoriously manipulated by JP Morgan, who serially is convicted of criminal fraud for it. They pay a fine, a couple desk jockies go to jail, and they continue to profit by issuing massive sell orders in the morning that they cancel without fulfilling because that sets the price on the market.

Eventually that will end, because JP Morgan will no longer exist. It's covertly government policy to conceal inflation and skin rubes. We live in a world governed by fraud and actual consequences can only be hand waved away for so long. Issuing more debt just increases inflation.

Hello Zimbabwe? Weimar Germany? Venezuela? Want sound money? Peg it to gold. That's what Zimbabwe is doing, finally, now that Mugabe is gone. https://www.reuters.com/business/zimbabwe-introduce-gold-coins-local-currency-tumbles-2022-07-05/

Gold is the stable currency, and dollars are trash.

I'm not even sure where to begin with this one...

First of all, it is a known fact that USD is more stable than gold.

The timeline you picked was Ancient Rome,

so right off the bat you pick some ridiculous edge case that doesn't apply to the situation.

How many people are alive today that bought a custom tailored toga and sandals in Rome?

Zero.

But again, this was probably not the correct way to begin this conversation, because now you're just sitting there thinking about all the ways I'm wrong about what I just said. I'm not wrong.

The goal of HBD is stability.

Plain and simple, that is the goal.

And what is more stable than a peg to gold?

A peg to USD with a high interest rate.

So whatever the devaluation of USD is, just match it with an equivalent interest rate.

Boom, HBD becomes more stable than both USD and gold combined.

Gold is not a unit-of-account

And it hasn't been for a long time.

USD is a superior unit-of-account.

This can't even be argued with as the facts speak for themselves.

Everything is priced in USD. Everyone knows what USD is.

Ask someone how much gold it costs for this or that. Crickets.

This is probably the main point I should have started with.

What good would HBD be if the peg breaks right when people want to cash out?

Make it make sense.

If HBD is pegged to gold and then Hive goes down and gold skyrockets and we have to haircut the peg...

what's the point?

Totally worthless peg that no one will trust.

Gresham's Law

Bad money drives out good money. We want HBD to be bad money on purpose by design. We want to issue debt and then have the debt holders slowly bleed their value into the main network. We want to constantly be devaluing and lowering our debt, because debt is bad and we want to get rid of it. The peg to USD is glorious, and allows us to incorporate all the soul sucking debt-based bullshit and reallocate it to our own network. Except we balance all of that out by offering a high yield so really it's just a solid hold at this point in time. If it gains adoption and the debt-ratio increases too high we'll need to lower the yield and start sucking value back into the main network. But having a higher yield than inflation at these low debt-ratios is a good way to kickstart adoption.

HM, yeah... 0%. Maybe even negative percent. Doesn't make it a better option.

USD is the best option by far. It's really really obvious.

Doesn't even matter if USD started hyperinflating.

We could just increase interest rates to match the hyperinflation rate to balance it out.

And that would still be better than pegging it to gold.

Again, bad money has a purpose; ironically a really important one.

People actually want to spend it.

Velocity of money is high and that's important.

Ah you tricked me into writing a comment post again.

Good job.

I have paid in gold for things. Unit of account doesn't matter. Value does. I use goodwill to pay for things more than I do gold, TBQH. Goodwill has never been a unit of account. Also, you didn't read the link, or aren't addressing it.

Pick any year you want, since gold began to be used as currency, up to the present day. It's not an edge case at all. It's always been the case that an ounce of gold has been worth a tailored suit of clothes and a pair of good shoes, and it is the case today. Gold is a stable source of value relative to human labor and goods. Gold is good money and good money eventually drives out bad money. You just have to HODL until the scam collapses. Scams always collapse.

Bad money eventually disappears, and that's when gold proves it's value. Good thing I do not rely on Hive as money. There is no good money today, because PMs are manipulated, which is why I endeavor to use goodwill instead.

No less than 25% of the dollars in existence were created since January 2020, and personally I think more than half of the dollars that exist have been. As long as the network continues to be available, this will drive up the price of Hive (unless inflation of Hive increases faster, which it doesn't), as long as Hive has a use case, which it does.

But the network is the critical resource upon which Hive depends utterly, on which all cryptocurrencies so depend.

We cannot depend on Hive unless we can depend on the network, and it's going to be increasingly censored going forward, catastrophically so when the global financial system collapses. Without our own infrastructure we cannot sustain cryptocurrency when the central banks want us to have no options to CBDCs. They're not going to provide the infrastructure we need to escape their clutches.

Would you? No, you wouldn't. They won't. Hive, BTC, ETH, won't survive that censorship, whether it's just demanding keys for communicating on the network or the network actually dies. I didn't come here for tokens, BTW. I am here for something far more valuable than money: free speech. I am still waiting for common sense to kick in and folks that value money to realize the money will disappear when the network is yanked out from under us, because creating such a network will preserve our ability to speak. I'm not seeing that happen, sadly.

Losing all I owned more than once has taught me that cataclysm happens. Being dependent on centralization is a cataclysm waiting to happen.

Hedge.

The only point of a CBDC is to barnacle onto the crypto train.

There's no point in making one unless crypto exists and they can tap into the value of the open network.

You don't seem to understand that if they have complete totalitarian control... the CBDC is completely and utterly pointless (their systems work just fine without it). But you do know that they need complete totalitarian control for the vision of CBDC to become a reality. Can't you see that the entire thing is a paradox? It can't happen the way you say it will happen.

What kind of magical infrastructure are they going to build where CBDC works but the Internet has been turned off?

I will not hedge against impossible outcomes.

That's just a waste of resources, leaving other legitimate positions much weaker than they should be.

These networks are reactive, and you vastly underestimate the ability to build the infrastructure if we need it. We don't need it right now. We are piggybacking off of the old system. We are using it as a dependency. For good reason. We stand on the backs of our ancestors. It's a feature, not a bug. Reinventing the wheel is not a productive use of time until the wheel fails.

Would it be nice if things were a little more proactive and more hedging was being done? Sure. But also if we're just running around securing walls that don't need securing, then we're just waiting our time.

Again, the only point of CBDC is to create interoperability between state-controlled system and the one we are creating. That is the only possible value of it. And even then it's probably going to be a complete fail. Look at enterprise blockchain. Billions spent developing it: completely worthless. Don't be surprised when CBDC ends up going down exactly the same path.

People are greedy. They want more money. You know how I know Bitcoin isn't going to get shut down? Because leaving it running is a thousand times more profitable than not. FOR EVERYBODY. There's no one left to fight against it. Anyone that does is going to be completely and utterly trampled by the stampede. It's a system fueled by greed. Of course they aren't going to shut it down. And if 'they' do there are a thousand work-arounds and a billion people ready to support it. The worst case scenario in every country is that maybe that country tries to ban it (which we already see doesn't work). But that is a small-minded egotistical view. On the average it thrives no matter what across the world. Billionaires aren't looking to lord over an empire of dirt that resembles a feudalist dark age. That's a loss for everyone. Crypto is the obvious win/win.

Nothing more magical than the SWIFT network.

I am old. I've been betrayed by everyone that mattered to me. You're young yet.

You'll learn from it, if you won't learn from my example.

Have you considered that you're coming from an position that is an extreme outlier and not relevant to most people's experience? Have you considered that your experience could have thrown you into a fishtail that's pushing you too far to the other side? Do you think you've found balance in all of this? I'm skeptical if you say 'yes'.

I do appreciate the wisdom though which is why I dedicate so much time into these discussions.

Even if it may appear that I am completely discounting them.

I am not.

The point is that extreme conditions are when the value of an investment - or a person - are revealed. Zero Hedge points out that over a long enough horizon, life expectancy becomes zero. These things inevitably happen in due time.

Yes well I'm almost 40 and I've never had anything to lose.

Still don't, at least that's what I tell myself.

https://twitter.com/AdrianPapava/status/1573033692020219905

https://twitter.com/RuelChavez5/status/1573131359392243712

The rewards earned on this comment will go directly to the people( @acesontop, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Uncommon sense

Posted Using LeoFinance Beta