Thought Experiment: Coinbase Goes Bankrupt

Recently the SEC forced Coinbase to make a statement.

What did Coinbase have to say?

Hilariously enough:

Not your keys, not your crypto.

Yes, the SEC basically demanded that Coinbase announce that if they go bankrupt, all the crypto that belongs to Coinbase users, well, it actually legally belongs to Coinbase and will be counted as part of their assets.

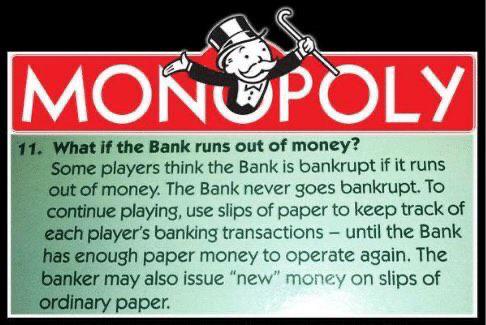

The thing about bankruptcy is...

You're not allowed to declare it if you have assets that could be used to pay back the debt. That's how it works. If you have money you can't just be like "I'm broke" then take the money and run. Well, actually, people can't... corporations can, because corporations have more rights than people do. I'll get to that later.

So Coinbase declares bankruptcy.

What's next?

All of Coinbase's assets are declared and added up, then compared to the debt that is owed. Then, all of Coinbase's assets are liquidated and divided out to the entities they owe the debt to. Whatever is leftover and can't be paid back is zeroed out.

However, the brand and the business itself are also assets, which are now owned by the people that Coinbase owed money to. Will they pick up the pieces and keep Coinbase operational? Probably not. Say they owed a bunch of money on a traditional bank loan. Are legacy bankers really savvy enough to turn around a failed business that they now own? Probably not, and they are smart enough to know it. Not worth it. So they let the thing die a swift death. Easy.

Overhead costs of running a business are massive and profit is a thin trickle .

How does this play into not your keys not your crypto?

It's just funny how even legally, this is true. Most people out there would assume that not your keys not your crypto means that someone is going to illegally steal your crypto. Rather, we see that no, the crypto is stolen perfectly legally during the process of bankruptcy.

You'd think that people would have rights and people would own the money that they deposit in a bank. This is simply not true. Centralized lawmaking is centralized. The institutions own everything. If they make a bad decision? Too bad, so sad. Poof, gone.

Thought experiment: Coinbase knows they will go bankrupt.

Here's the really messed up thing. Imagine you are an executive at Coinbase, and you know there is a 99% chance you're going to go bankrupt. But hey, fuck it! Let's go for that 1% Hail Mary play!

So you go to the bank and you get a loan.

It's a huge loan. The bank thinks Coinbase is doing great and the executives haven't been honest with the struggle. So what happens? Well, first of all, maybe the Coinbase executives just give up and give themselves huge bonuses with the bank loan. Pocket the money and declare bankruptcy. Then when the bank goes to collect their debt guess who pays for it? Yep... all the people who deposited money into Coinbase. Isn't that fun?

They could also dump their stock knowing the company will go under, but that actually is illegal and would be insider trading. Doesn't mean it doesn't happen, but there is a stark difference between legal and not so it's noteworthy.

It is in this way that we can see that it is not legal to steal customer funds directly, but stealing indirectly via bankruptcy is perfectly legal. People often talk shit about Donald Trump and how bad of a businessman he is for having so many failed businesses that went bankrupt. Yeah, those people don't know how it works. Try again, you're bad at this. Corporation/Debt harvesting is a profitable business. Doesn't work out so well for the corporation in the end. Just like a cow at your local farm.

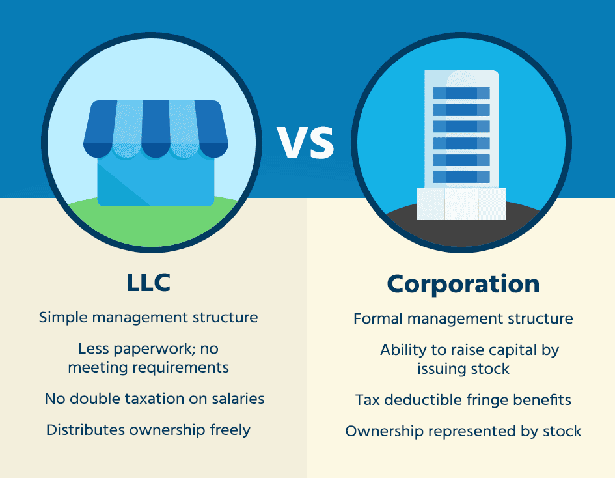

LLC: Limited Liability Corporation

This is where all the magic happens. Legally, this is how barriers are put into place that stop the court system from suing the owners of a company for debt personally. Anyone who sets up an LLC can't be sued for their house and other assets if their business goes under, because the business is a 'person' and this 'person' doesn't own the house in question.

It's a nice protection for entrepreneurs.

I'm sure many people would never start a company to begin with if these protections were not in place, so theoretically it's helpful to have these things around to expand the economy. However, just like any rules or regulations, those who know them the best know how to exploit the system for personal gain.

So yeah, it's possible to funnel debt through these systems and leave everyone else high and dry. A house bought with profit from an LLC can't be taken back by the bank after the fact (assuming the LLC isn't the owner of the house). Welcome to the wonderful world of corporations legally counting as their own person within the legal system. It would be like if the bank tried to sue you because your brother owed them money. Hm, yeah, nice try bank. Pass.

Bail-in

I've talked about bail ins like a dozen times over the years. During the next banking collapse, everyone is going to know what they are because they will be happening left and right. Essentially anyone who deposits money into a bank that fails will have the money haircut as described above. In exchange, they receive ownership over the business. However, what good is ownership over a business worth $0? Who will pick up the pieces when the debt is restructured? There are no guarantees.

Conclusion

Not your keys, not your crypto. Even the SEC knows it and forces crypto banks to declare it. Pretty wild honestly. It's safe to say that we should never hold more than 20% of our crypto assets on these centralized exchanges, and even then it should be spread out across multiple exchanges (the best ones) to ensure that if one goes under we don't lose it all.

What are the best crypto banks? Eh, Binance. And even then, they participated in the Steem hostile takeover in a big way and made no attempt to help us. We know where the loyalty lies when it comes to corporations. Can't trust them but also have to trust them. Perhaps one day the DAO will make them irrelevant, but that's at least a decade out.

I used to think Coinbase was a really solid place to hold money as well. However many issues have come to light that show otherwise. Regulations are choking American crypto exchanges (just the other day I was forced to answer a bunch of bullshit questions because my account was locked), and the bear market doesn't help either.

At the end of the day being our own bank and not relying on centralized custodians is the answer. We will see this theme play out over and over again. People trust the custodian because it's convenient, and then they get absolutely burned and are essentially forced to do it the right way. I expect a big hack or insolvency to roll around that really brings this issue to light (if the dozen random exchanges that have already gone bankrupt weren't enough).

Posted Using LeoFinance Beta

https://twitter.com/EstBridge/status/1564995519092592642

The rewards earned on this comment will go directly to the people( @solips ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I have some monthly buys that happen automatically on Coinbase. It is only a fraction of my holdings, but I have been slowing moving some of that out into custodial wallets as my quantities allow.

Posted Using LeoFinance Beta

This is a strategy I also use.

I want my coins in my wallets.

!LUV

@simplegame(1/5) gave you LUV. tools | wallet | discord | community | <>< daily

tools | wallet | discord | community | <>< daily

HiveBuzz.me NFT for Peace

Bail ins are why the Europeans banks are in shit shape. They did not use bailouts like the US. Yes it was painful and everyone bitched but the toxic debt got off the books of the US banks. European banks? Nope much of it still there.

I laughed when I read they were stressed tested and passed. The NY banks wont take EU debt as collateral. What does that tell you?

So where is all the debt ending up? On the books of EU banks.

It only keeps getting worse.

Posted Using LeoFinance Beta

Maybe that's why they've cooked up their new scheme of using development bank monies to guarantee investors if the invest in green technologies and it doesn't work out they are guaranteed their money back. It gets worse. They use those same funds to bribe countries that need money to invest in the technologies of the investors. Countries have to commit to something related to the energy transition to get any funds. This way it keeps it off the books, it's already pre-allocated tax payers monies backing guarantees, no bail outs needed if they fail.

Holding money in these places are risky but like you said we don't have any other choice most times so we have to trust them. I've heard a lot about binance and it seems like one could trust it a little but fingers are still crossed.

Posted Using LeoFinance Beta

Yep, nail on the head, I can see that playing out too and a whole lot of pissed off people who were too lazy to take their money off the exchanges, and hey I am one of them, I have coins on Coinbase and Binance, so I should really listen to my own advise and yours and the SECs..... or.....

It's gone.....

That sketch was pure genius from South Park, was laughing my ass off!!

The market keeps on fluctuating. Thanks for the detailed analysis

I've been expected Coinbase to go bankrupt for a year now.. but "not your keys,not your crypto" ... the actual truth.. no I never saw that coming

Because when a shareholder takes the funds from the LLC to purchase the house they are taxed at that point. So that's what separates liability. Of course if the funds are taken from any other values within the LLC that would be fraud and while bankruptcy would not come into play civil proceedings could be actioned against said shareholder.

I think.

Random brain fart here.

What you're talking about is the corporate veil. It's a legal concept that separates the shareholder from a corporation or the member from the LLC as far as liability goes.

With an LLC, you as a member (owner or part owner) can take a distribution. Pretty much anything goes as long as there's still enough left over for the company to operate and fulfill its obligations. Obviously this is ill defined, but it's really there just to stop you from doing something like taking out a loan on a new LLC, taking all of cash from the loan as a distribution, and then declaring the entity insolvent with no attempt to repay. If you pull some kind of fraud like that, this will pierce the corporate veil and creditors can then seek your personal assets as compensation (other procedural violations can cause this piercing as well). That said, if you dot your i's and cross your t's, there's nothing they can do in a bankruptcy but try to extract what the entity is liable for from the business' inventory and non-inventory assets.

Corporations work slightly differently. Unlike an LLC were the member can't take a salary, shareholders can be salaried employees of the entity and legally collect money from the company that way. They can also collect dividends. Other than those things and selling shares, I don't believe there's any other way to take money out of a corporation as a shareholder. Violate those rules, the veil is pierced, and they can legally go after your personal assets.

But it still leaves a trail for seizing assets acquired from the proceeds. I think it would not be covered by criminal law but certainly civil law would have that as a protection. Hence why regulations and laws exists.

This supports what I had stated above.

Oh yeah, for sure. I was more confirming and clarifying what you said than challenging it. I've gone through this process of starting an LLC myself within the last few years, so it's fresh in my mind. Even as I take advantage of it, I realize how F'd up it is that people can be completely insulated from legal and financial liability this way. It's really up to the individual as to whether they'll game the system to screw people over or act with integrity. Also yes, criminal law makes no distinction, but in practice it can insulate people from liability. We've seen situations in the last decade or so where entities have been held criminally liable and not a single officer, board member or shareholder was held directly accountable. They just levied a huge fine against the company and they just went on about their business. IIRC one of the big investment banks went through this. Nobody went to jail.

A helpful disclaimer. People will probably keep ignoring it. The SEC can be a force for good sometimes ;)

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @bluerobo, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!If you like BEER and want to support us please consider voting @louis.witness on HIVE and on HIVE Engine.

Hi @edicted can you buttress more on this;

Posted Using LeoFinance Beta

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 42000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz:

South Park is a great example, it looks scary but it's udt as its said.

Posted using LeoFinance Mobile

This is a scary thought. If Coinbase files for bankruptcy, that is going to be bad for the entire crypto market. To the average investor, Coinbase is the safest option to invest in crypto. If for no other reason than brand name alone. You think we are in a bear market now? This would set the crypto world back years. Plus all of the crypto nay sayers would say "Crypto is bad. Just look at Coinbase." for decades.

Well done, and worthy of part 2, a corporation as a super citizen.

Posted Using LeoFinance Beta

Personally, I don't see the point of using centralized wallets other than simply being a risk. I used to use Binance for everyday transactions and due to a country move and a couple of phone number changes (for 2FA) it was enough reason to lock my account and ask me for a video to confirm my identity, lol. The worst part of the case is that I can't do it because apparently their phone APP is buggy.

I know the security issue is also important, but there are times where the absurdity is pretty high. Since then I won't get tired of saying it: personal wallets are the best place to store your cryptos.

Coinbase has been absolute dogshit since they went public via Direct Listing. When I saw the listing price, I actually laughed out loud. I knew even then that it was all just speculation, nothing more. The insiders proceeded to dump the stock for the past 2 years.

If I had shorted the stock at open, I could have made BILLIONS of dollars, Like the CEO Brian Armstrong, the criminal that he is, has.

Anyone wanna ask WHAT he did to deserve making $10B? The answer: nothing. He's a criminal, Coinbase is a pile of shit, and I'm glad I never went near their operation.

When I read their last earnings report, I laughed out loud again. Their business model is almost completely dependent upon transaction fees. So, in bull markets, they made a TON of revenue, but in the bear, they can't even hold their heads above the water.

The dirty secret about Coinbase is their balance sheet, as you pointed out. ALL deposits to Coinbase is Coinbase's money, not the depositors. There is no such thing as FDIC insurance for crypto.

The mere fact that their profit margin is NEGATIVE (-4.79% for most recent quarter) should tell you all you need to know. Their entire business is as a centralized KYC-only cryptocurrency exchange, and they can't even make an economic profit from that. When BTC dumps back down to $3800, Coinbase will declare bankruptcy, steal all the money from their suckers (depositors) and then make off like the bandits they are.

From a balance sheet perspective, they have $5.69B in cash and $3.62B in debt. But, their debt-to-equity ratio is 62.26x. That's insane, that's an unhealthy financial services business. Their operating cashflow for the past 12 months is -$528M. They have almost been in the red by HALF A BILLION DOLLARS, in a year. Their business will crash, just wait

Posted Using LeoFinance Beta