Renter || Buyer

I saw this meme on Twitter and I just couldn't ignore it.

Some people would see this and immediately knee-jerk react to it as if it wasn't true. Perhaps @scaredycatguide could come in and give us his take on the matter. He is a real-estate guy after all.

My personal experience with this topic is likely similar to many others.

For my entire adult life (and some of my childhood as well) I was always told that buying property is better than renting it. After all, when you rent property: poof the money is gone and you have nothing to show for it. However, if you buy property you're creating equity in an asset that you actually own. Clearly buying is always better than renting, right? This is the narrative I've been hearing my entire life.

Very few people actually do the math on this.

I'm a bit of a scrapper myself and even though I've lived on the West Coast for most of my life (high cost of living) my rent has been between $400-$500 for the last twenty years. I've always had roommates or a girlfriend to split the costs.

I've never lived alone, and honestly I don't know if I'd ever want to considering certain agoraphobic and addictive traits that seem to set in when I'm left to my own devices. Have you ever smoked pot and played video games for 16 hours a day, months at a time? Yeah, me neither. Totally.

So assuming an average rent of $450 per month (which is probably high) over twenty years yesterday I calculated that to be $108k in rent I've paid over two decades. Wow! $108k down the toilet and nothing to show for it! What a fool I've been, I thought, as I calculated this number and came up with six figures gone that I can never get back.

Time to do the other side of the equation.

Okay so I've lived in California for most of my life. I did a few Google searches yesterday and found out that property tax in Pennsylvania is around 1.5% while California is closer to half that at 0.75%... OUCH! Does this mean that CA is a better deal than PA? Actually it's a bit of a wash because property is way more expensive in CA than PA. In PA I could easily buy a house for $250k, while that same type of house might cost $500k or more in CA.

In both of those cases property tax is $3750 a year.

- Are we seeing the problem here?

- $3750 a year is $312.50 a month.

- I was only paying $450 a month total rent in the other scenario.

- That $312.50 a month is only property tax.

- It does not include all the other things we need to worry about.

- Overhead opportunity cost of down payment.

- Loans & interest rates.

- Maintenance costs.

https://twitter.com/StealthQE4/status/1629590155043512322

OMFG THE MATHS!

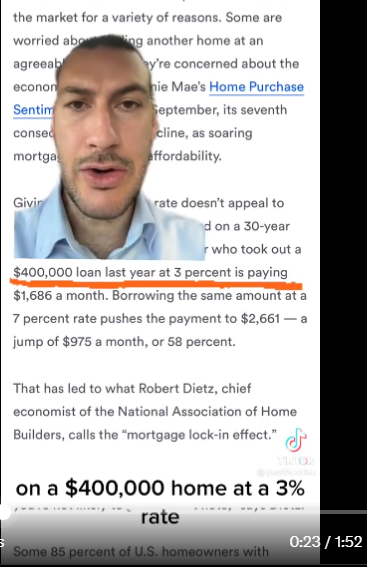

Remember in high school when you learned about the magic of compound interest rates? Well they are only magical if those ROIs are being paid out to you. When you take a loan from the bank and they are sucking you dry it's a bit of a different story, isn't it?

Seriously look at how insane that is:

- A $400k loan at 3% interest is $1686 a month.

- After 30 years this comes out to $607k total.

- A $400k loan at 7% interest is $2661 a month.

- After 30 years this comes out to $958k.

WOW WHAT AN AMAZING DEAL

So after 30 years you pay the bank $958k for a property that was worth $400k when you bought it. After 30 years we would obviously hope that the $400k house we bought was worth around a million dollars or more, but again there are no guarantees. It's a gamble, albeit real estate is considered to be one of the safest gambles and stores of value out there in the legacy economy.

If the property accrues a +10% value every year then after 30 years it would be worth $7M. Obviously in this case the investment becomes a bit more worth it... except then the process starts all over again when someone else has to buy the property from you for $7M using a loan from the the bank.

Getting back to the real point

The interest rate on the loan makes a HUGE difference in the long run. That TikTok video shows how just a 4% increase on interest rates jacks up the monthly cost by 58%. And that's just money going straight into the banker's pocket. Insanity!

One thing that this real estate TikTokker isn't taking into consideration is that he is assuming that everyone who sells their house needs to buy a new house (presumably at these higher rates). That is wholly inaccurate. I've already stated why I think hedge funds will start unloading their property.

Property is a cramped hedge and not a very good investment anymore, especially when compared to Bitcoin. Hedge funds will eventually unwind these ridiculous illiquid positions and find something better. At the same time homeowners may realize what I'm realizing as well: buying property is a pain in the ass. I expect a lot of these people are just going to sell and start renting again, or perhaps just sell vacation homes or other vacant assets without the repurchase. Of course this begs the question: "who's buying?"

Let me tell you a little story about the early 90s

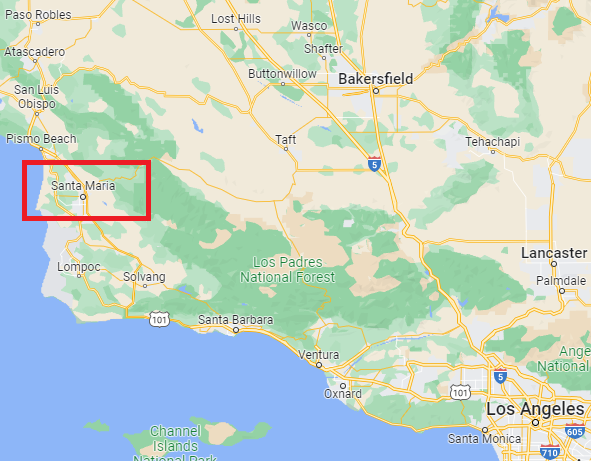

When I was just a wee lad my parents bought a nice place in a small town on the coastline called Santa Maria. Everything was going good. The backyard was mostly sand but my dad didn't mind much. He even did a ton of landscaping by himself on his own dime. Handy guy, my dad.

Of course I'm just now realizing that my dad doing landscaping on top of our sandy backyard was probably illegal... because we had an endangered species back there called "glass snakes"... which as it turns out are actually technically "legless lizards". Pretty weird, huh? Look it up.

Actually my dad is an insufferable rule follower... which is probably why I'm the opposite way... so what he did probably wasn't illegal and I do remember we left a big chunk of the backyard as sand for our legless friends (although I honestly can't remember ever seeing one when left to my own devices). I did catch like 1000 regular lizards though. Trap and release. Tried to make them my pets a couple times but turns out wild lizards don't take to captivity well. They wouldn't eat so I had to release them every time. Ah memories!

Yup it's a flippin lizard bro; I don't make the rules.

The point of this dumb story...

There was a gigantic tech facility that got built in Santa Maria. I don't even remember what kind of tech lab it was. Probably something to do with computing and the Internet. I tried to look it up yesterday but I couldn't find it.

In any case what happened is that this tech facility went out of business and shut down. Because it was providing a massive number of jobs for the small town of Santa Maria (like 30%-50%) property values in the entire area took a huge shit when that happened, and my parents were totally fucked financially. Talk about centralization, amirite?

Again, this was another situation that could have easily been avoided by simply renting property. Most people don't think about this stuff because like me they were told to buy property and build equity ASAP no matter what. It's seriously not a good idea in a lot of situations. Now that Bitcoin exists... I get the feeling it's a TERRIBLE idea. Bitcoin is so much better for all the reasons I went over in my post earlier this week.

LOL and we haven't even talked about the other 3 factors.

Maintenance costs

What happens if your backyard floods?

What happens if your roof starts leaking?

What happens if there's an electrical problem?

What happens when you need new paint?

What about the foundation?

What are you gonna do? Call the landlord?

When you own the house you are the landlord so you have to pay for every single problem that goes wrong, so that's fun. Speaking of landlords: when your tenants don't pay you rent and squat on your property and won't leave... it can take up to six months to legally kick them out... all the while they're not paying rent. And you can be damn sure when you do get the property back it's going to be trashed and you'll have to pay even more to get it cleaned up and ready for the next customer that may or may not pay you. Fun times.

We already talked about interest rates...

So what about the last variable? It costs a lot of money to afford a down-payment on a house loan. How long does that take? It can be anywhere from 5%-20% of the total price. If you're buying a $500k property in California a down payment might cost $100k upfront. OUCH! What? The silver lining is the more you pay upfront the lower your total interest payment is going to be.

Conclusion

At first when I calculated that I had spent $100k over the last 20 years on rent I felt like I had somehow swindled myself. However, after doing the math it becomes quite clear that it's very possible I dodged quite a few bullets in avoiding home ownership. There are a vast number of advantages to renting even though if we rent we are building up zero equity for ourselves and 100% of what we pay is a completely sunk cost.

I keep telling my girlfriend that when crypto goes x100 I'll basically be forced to take long-term capital gains and buy us a house straight up. This avoids the need for a bank loan and interest altogether, which eliminates a lot of the problems with homeownership. I asked her if I could take out a loan against the house during a bear market to buy back into the market and she said... "no". LOL, that's fair I guess. Safe play is safe.

I would never recommend buying property as an investment anymore. The only reason to buy property this day in age is if you're actually going to use it. For the most part I believe hedge funds and these chronically low interest rates have ruined the market. However, there very well may come a time in the near future where crypto pumps and real estate dumps, creating the perfect opportunity to trade crypto back into real estate. If this occurs it would be foolish not to jump on such a happenstance.

Posted Using LeoFinance Beta

You well point out that real property encumbered with a note is a liability, as well as an asset. However, people that make money on real property often have a variety of ways to limit the costs you have dealt with. One example would be distressed properties. I remember looking at properties in PDX for as little as $9k cash, but they were gutted by bad tenants. Another, preferable gambit in my mind, is distressed sellers. The problem your dad faced when the local employer folded is a good example, because there were probably folks around that suddenly couldn't pay their mortgages because the worked there. Either they sold quick, or they lost everything. Prices go down fast in that scenario.

Private financing, and paying principal faster than it's due, sweat equity, these are all means of dropping costs to get into properties that I have used, and were very effective. The main trick I used was to avoid banks as if they were infected with the plague. Despite that I did exactly that didn't prevent Citi from getting it's hooks into me, because they just bought my lender.

Ugh. Nothing is safe in this world, but there's life before we die, at least. Anyway, my point is that just lining up for your beating is rarely a reasonable course of action, and clever people can find ways to improve their potential by looking outside boxes.

Thanks!

First, i when crypto moons (and house prices continue to fall) i suggest you TRADE your crypto for a house.

Crypto is currently classified as a commodity, and a commodity can be traded for equal value... just have to find a lawyer who will write the agreement correctly.

Buying a house is for the most part shtupid. A money sink.

It is your biggest liability.

BUT! If you do buy in the down market, and are pretty sure there is going to be an up market. It can be a good investment.

You could also buy the largest bedroomed house you can, and rent all the rooms.

If you can manage this, it will usually get you free rent, and a house in the future.

Similar, you can buy a duplex and rent out half of it.

And lastly, it really depends on your temperament.

If you are a house fixing, DIY kind of guy, buying can work well.

If you like staying it one place and putting down roots, buying can work well.

If you don't want to touch the house, plumbing... anything, then renting makes that easy.

If you plan to move to wherever is most suitable for your job, then renting is far superior.

There have really only been a few times in the last few decades where buying was actually cheaper than renting.

One of those times may be coming up, as house prices fall faster than rents.

But many places buying is 2x rent, soooooo, it may be a while.

https://smartasset.com/taxes/avoid-capital-gains-tax-on-gold

I don't think commodity trade is going to fly in USA

There are some lawyers who believe that trading crypto for a house, directly, should be a non-taxable event. (not selling to cash)

But, who will be the first one.

The Infernal Revolting Syndicate will try every scheme to get taxes out of both sides, but as soon as they make a ruling, their hands will be tied.

Also, have to find a title company that will take such a trade.

You pointed out the advantages and disadvantages very well and it was expected anyway because in life, nothing comes without consequences.

I really hope crypto appreciates 100% so you would buy your own home too.... Great post friend because just like you said, if I calculate how much I've been paying also for rent, I would feel the same way😂

I dont know why but I just imagine someone writing this extensive post with such passion.... I have been renting too for the past 15 years and I have also spend around 100k doing it but buying a house on most places I have live in would be very expensive, I value a lot my logistics, I currently live 2 blocks from work and my kids school is less than 5 min away I spend zero cents in transportation, gas, food, I come home everyday during lunch to eat and see my family, also taking in consideration that for the first 10 years everything goes into interest of the loan, Im in the same position trying to build a capital to either put a 60% down payment for the property, I have seen ppl discuss this online lately and maybe 85% of the answers you get is buy a house renting is stupid until the day they know all the interest and taxes it takes to own a house and maintain the house

This is a typical and very real experience of a landlord that almost feels like many tenants who choose to be unruly know about this and milk it dry after convincing the landlords that they are well-behaved and responsible. Thanks for your great insights🙏

Yeah, as a homeowner myself... investment properties feel like a fuckin sham. Seriously. My wife is in insurance and there's basically nowhere on earth that will give you insurance for if a tenant decides to just trash your home - so every single 'investment property' is a time-bomb. One bad tenant and, well, hope you were in the game long enough to completely buy a new house because nobody's paying insurance for tenant vandalism.

But, as a homeowner that lives in the home I bought - fuck renting. It's such a pain in the dick to have to cater to some other jerk's whims about when I put up a shelf or what colour a room is... or worse, what asshole is sharing a wall with me (in the case of townhomes/apartments).

We had one neighbour downstairs when I was a renter that set their apartment on fire and that's the last goddamn time I'm living next to someone else.

The only idiot burning my house down will be me (or one of my family members) thank you very much, LOL.

There's a lot of freedom to living in a house you own, it has a ton of advantages and generally when you want to move on it's going to be a net profit when you sell. But it is a lot of work, and the banks do take a fuckin' chunk out of ya. I'm glad we got our 5 year fixed locked in at 2.9%, because a year later 5% was "good" and 5% of 380k is... well, you already did that math basically. It's not fun.

Thank you for this post.

You are right in your analysis, you may actually have dodged many bullets when you consider the taxes, the interests and inconveniences.

Here in Nigeria, it is totally the opposite in terms of Taxes (perhaps as a result of the poor legal system).

A colleague wanted to rent a shop recently and he was asked to pay about N2,700,000 ($3,600) for three years and this was shocking to us because I told him he could actually get half a plot and build his store with an amount a bit above N5,000,000 ($6,700).

He would pay some tax and do some land documents but on a greener side, the land and property would be his.

That's for a shop.

Residential lands are about N750,000 to N1,000,000 ($1000 to $1300) per plot and due to inflation, building may be expensive but, compared to renting also, it may be cheaper to build your house once and for all. Africans also have the culture and mentality of ownership. We really prefer to own our properties.

And some tenants would rather mismanage a rented apartment than see it as thiers in the time of the rent.

Your write up has given me insight to a land far away.

Thank you

The rate of return certainly isn't good, property as an investment in the UK makes no sense for the average person, it's one for the super rich who prefer tangible and non elastic assets.

As I've said before I'm glad I've got one house, but renting it out, yeah wave goodbye to 30% of your profit straight away in fees and taxes, it's just not feasible. I'm looking forward to getting back in it next month TBH!

A lot would depend on the numbers as well.

I bought a house at 30 at a decent price in a good location for 173K and put some hours and a little money into renovating it myself.

Before that I was paying $500 a month in rent and that wasn't a bad price in the city for a single room in a two bed apartment.

Suddenly i had a full house and garden for a mortgage of $750 which i could easily pay off in a shorter period than the full loan to reduce the interest rates. Property taxes are about $250 a year over here and mortgage rates under 2% so the maths are different.

Moved house three years later and sold it for $250K and a nice profit tax free. The market is booming right now and when it crashes again i'm hoping to buy a couple of cheap partments in the city and let them out. The rent will more thsn cover the mortgage so you have an income and free assets in time.

Different countries, different perspectives. There is also a huge accomodation shortage here as well so rental prices keep rising, you have no long term security and it's not a good place to be right now as opposed to buying and building a life in one place.

Posted Using LeoFinance Beta

silly Americans have property taxes, like you have to pay for something you own :(

It's how schools, police, fire etc are funded

Also common in Europe though

The post was too long to go into the fact that you can't own anything if you have to pay a tax on it yearly.

The way I look at it, I don't view it as an investment. Renting or buying, you're still going to have to pay for a place to live, unless you want to live on the street. I bought my house two years ago and the mortgage is the same as rent was for a similar sized apartment, but I don't have to worry about rent going up year over year. Also the apartments we lived in before were getting dangerous so safety is another factor in my decision to buy. So to me, the pros outweigh the cons when it came to buying a house. Can't beat stability in monthly housing cost and added security of controlling your own property.

Someone who is great with numbers shared this same thing with me some years ago.

"Renting is more sensible than buying," They said. With inflation etc as it was.

And the same thing with a car, I hear?

I'm still trying to run numbers on Astra and the Stellerium exchange over a year. My brain just can't do numbers well. I'm seeing a 10% odd return which would mean a R30k investment for me to have actual passive income that's viable. But that would mean a $120k return which just can't be right.

I never did get the info needed to make a proper decision so just played a little.

But I don't think I'm going to mess around with this stuff much more. I just don't get it!

My dad said pay cash. The end.

At least I'm at the point where this is a non-negotiable thing :)

No more credit! And this should (theoretically) lead me to no more debt if I'm responsible.

Of course a no-brainer that buying is not worthwhile, if you can´t create an income on it because you have to live there. Only buying to rent out the house/flats - and having done the maths before - makes sense. And even this is often a loss, depending how much rent you can get, interest rates, etc.

And very risky, too, depending on the location.

Buying houses is for people with deep pockets.

The naive idea of "instead of paying a rent I just buy a house" is similar to "instead of jobbing I just buy a company" in a certain way.

I'm going with the same strategy. Living in Poland, renting a room in shared flat costs me not more than $150 monthly, it's ok for now, however living in a van would be probably even cheaper than that :D

However there are many restrictions to how I can modify the place and how much space I have to use. So very often I think about something I'd like to do, but then I can't because of these factors, and growing up in apartment tower, I don't actually know, maybe homesteading would be my thing. I'd like to garden in some small plot ot just fucking compost my trash. Yeah, these might be fancy needs that cost more, but very hard with renting.

So yeah, waiting for crypto to boom

Ah I've lived in portland and even worked at PDX airport for a year.

Sounds like you are going pretty hard lol.

'' asked her if I could take out a loan against the house during a bear market to buy back into the market and she said... "no". LOL, that's fair I guess. ''

And even with this hypothetical 'safe play' you compare it with 'conservative' crypto ROI's and you feel dumb because the opportunity cost is costing literally you thousands.

I've been tempted for a while to take a personal loan for 5-10K$ at a 6-8% interest rate (which is huge) only because I have the collateral to pay back whenever I want. Savings at 20% APR is a game changer, but we don't know for how long.

Hive is crazily undervalued only for this when we factor in everything else.. woof. crazy times.

Pretty agreeable

The problem that I encounter is that buying a place costs significantly less than renting each month. The place I live has a mortgage of $800 / month and if I were renting, it would cost $1500 / month. So strictly from a cost of living perspective, buying made the most sense. I put 5% down (which isn't a lot on a cheap place) and am saving hundreds of dollars a month not renting. Granted, ownership has its problems... but I'll take them.

Yes,renting and owning property (houses in particular) comes with its own merits and demerits. But I got to admit,when something's under your name there's no taking that away. There's this satisfactory feeling from knowing you have something,"Yes that building's mine,I own it. I own the property", than the vice versa. Yeah being an owner isn't always easy but I think it's better.(My own opinion)

Buying a property is really for stability if that’s your thing. That peace of mind to never be asked to leave the property is worth it for some people.

Now the mortgage, when I took out mine, I budgeted 10 years, lucky I did and unlucky I did.

Lucky that I have no more mortgage as rates are going up like now.

If I went all in BTC or DOGE I would have 1000x more assets at least.

Anyone could say this on hindsight but it would be a gamble and who would have held all this time and not get a property along the way “prematurely” right? If you have held all this time would you ever pull the trigger and sell? Maybe at some point.

If I could cash out 1/100 and get a dream home, why not.

!PIZZA

I gifted $PIZZA slices here:

@themyscira(3/5) tipped @edicted (x1)

Send $PIZZA tips in Discord via tip.cc!

That meme is so true. While renters continue to bash and abuse landlords.

What a fantastic breakdown of the true cost of homeownership! As someone who has rented for years, I've always been skeptical of the "buying is always better than renting" mantra that seems to be so pervasive in our society. Your calculations really highlight the hidden expenses that come with homeownership, from property taxes to maintenance costs to the potential for unforeseen disasters. And let's not forget the fact that when you rent, you have the flexibility to move whenever you want, without being tied down to a particular location or property.

While there may be some situations where buying a home makes sense, such as when you're ready to settle down and put down roots, it's important to approach the decision with a critical eye and do the math to see if it truly makes financial sense in the long run. Kudos to you for taking a nuanced and thoughtful approach to this often-overlooked issue! Thank u

Posted Using LeoFinance Beta

I used to have a similar mindset as well when I was younger that renting was better then buying. But mindsets change as circumstances change. As some comments have noted, owning your house is mainly for stability as landlords can't keep upping the rent every 6 months, especially in the tight housing market in Australia with rental vacancies at under 1%.

It also depends on the tax regime in your country as in Australia, if you "lose" money on your rental, you actually get a tax reduction as this goes into the calculation of your assessable income. With a good tax accountant, you could be cashflow positive and get a tax reduction at the same time.

you are actually the real estate guy. I worked in real estate for 18 years. Made me never want to own. The whole thing sickens me. But I have had a few bouts with commecial rent that made me wish i own the building but I think I'll die renter. But hopefully will beat my "self swindle" with a ton of hive.

Posted Using LeoFinance Beta

It's interesting debate. But I don't think you will get universal straight answer. Too much depends on too many different variables - different locations, different lifestyles, whether you have family or not, different countries with different property laws and different tax rates and tax regimes.

Here in Croatia, for example, almost anyone takes the view that buying property is always preferable to renting. Partly it is due to traditionalist mindset that having something that you own and that you could pass on to your posterity is preferable than living at the mercy of a stranger. Partly it is due to view that real estate is most preferable long term investment and, in some circles, the most convenient and simplest way to park large amounts of money.

Posted Using LeoFinance Beta