Real Disruption/Displacement: Real Estate vs Crypto

Measuring Volume

How does one go about measuring the volume of an object that has curved or jagged edges? This task can be very difficult without the proper tools. We can always measure the total length, width, and depth of the object, but that only leaves us with a cube-like outline that will always have greater volume than the object placed within it. Using this tactic, we could probably make a decent guess as to how much dead space there was within this 'cube', but depending on how accurate the measurement needs to be this may or may not be an acceptable way of going about it.

Water Displacement

Whenever we want to know the true volume of an object (including a person) one way to get a near-perfect measurement is to fully submerge the object in water. If you drop a rock into a measuring cup filled with 500 milliliters of water and the water line goes up 100 milliliters to 600 milliliters total, we can be quite certain that the rock has a volume of 100 milliliters. The water flows around the object and becomes displaced, resulting in a higher line level. The difference between the line before and after displacement must be assumed to be the volume of the object.

Bruce Lee on Becoming the Cup

Fluidity is even more important within the context of the economy than it is within the context of hand-to-hand combat. Some assets are much more liquid than others. For example, currency is extremely liquid and billions of dollars could be dumped onto the markets with very little slippage in value. Property, on the other hand, is notoriously illiquid. Within the context of crypto, Bitcoin would be the best currency and NFTs would be the property that is much more difficult to sell at market price in a short amount of time.

What is the point?

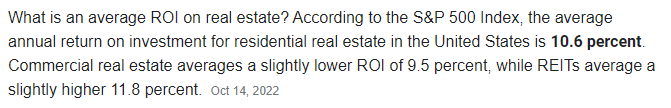

The point is that real-estate is considered by many to be a very solid investment. This sentiment has been constant for over a hundred years. Even as far back as the 50's we see this concept of having a wife, 2.5 kids, and a house with a white-picket-fence as the standard for stability and the ultimate life-journey with a happy-ending.

But something... changed... didn't it?

Something has happened after the last few decades that has stripped the middle class down to the bare bones, and with it all the opportunity that comes along with being middle class. Technology has ascended to godlike levels as the gap between the rich and the poor breaks record after record each and every year. Recessions make the gap even worse, with the elite clocking record gains even in the middle of a "deadly pandemic" amid forced economic shutdowns.

We can even see that this asset (real-estate) that was meant to be the crown-jewel of all investments is actually complete trash. In order for 99% of the population to get ahold of real-estate, they must qualify for a bank loan. That right there is enough to argue that debt-slavery is essentially a requirement to capitalize on one of the best investment classes the world has to offer. Is that acceptable? I must conclude that it is not!

What is the solution?

Well first of all let's fully flush out the problem:

- Interest rate on the bank mortgage cuts into 11% ROI.

- Inflation of USD cuts into 11% ROI.

- At best your house is only a store of value.

- We would prefer to generate value with our investments.

- Hedge funds have aggressively moved in and cramped the trade even further (and they don't need a regular bank loan which means that normal people can not compete with these Goliaths).

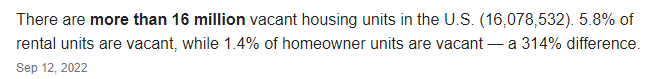

These hedge funds buy up property and are more than willing to let the property sit empty if that's what needs to happen. At the same time, if there were no vacant rental properties that means every time you tried to move: there would be nowhere to move to... so vacant properties create that much needed liquidity within the rent-seekers market.

Guess how many homeless people are in the USA?

GAH!

So let me get this straight... there are 16 million vacant properties... and half a million homeless folks? Aren't those numbers... kinda fucked up? Well of course they are... and we left-wingers are always quick to point out this blatant hypocrisy.

You know what we are not quick to point out? That if we owned property we absolutely would not allow a homeless person to stay there for free (because duh). Having tenants that actually pay you is already a huge pain in the ass as it is, just ask @scaredycatguide. So this entire argument is ironically just more hypocrisy. This onion has many layers, folks!

And as @builderofcastles was kind enough to point out to me years ago:

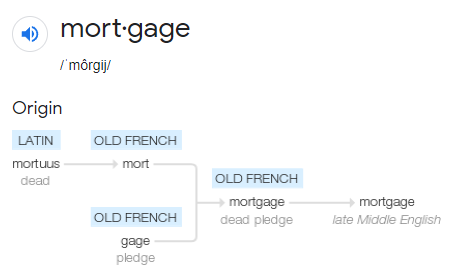

The origin of the word itself ['mortgage'] literally translates to...

YUP

Mortgage literally means "death pledge". As in you're going to be paying this loan until you die. As in, "Haha, we got you by the balls now!" As in literal debt slavery. Even the term "he bought the farm" DIRECTLY translates to "HE DIED". lol? da fuk? Not cool bro. wtf is happening here? It's engrained in the very language we've been using for generations.

So what is the solution?

I bet you already know what I'm gonna say! Obviously crypto is the solution. Look at HBD! My god! 20% yields on a FULLY LIQUID asset.

HBD:

- Does not require a bank loan.

- Is liquid on demand.

- Settles in 3 seconds.

- Is a substitute for USD itself.

- Pays 20% yields... twice as much as real-estate.

- Is sustainable even though people think it isn't.

- This is absurd across all metrics.

And if we are just looking at crypto in general (especially Bitcoin) all of them are basically superior to real-estate as a store of value.

- Bitcoin's yield is 100% on average every year since 2013.

- Yield was even better before 2013 (very volatile).

- Alts can give higher yields but at the cost of higher volatility/risk.

- Hive is oversold.

- Privacy coins are oversold.

- DEX tech is undervalued.

- AI coins will be the next degenerate scam.

- We've already suffered the standard 12 month bear market.

Of course this isn't to say that we wont suffer another non-standard bear market due to the flailing economy, but the result is the same: anyone who can HODL (and even buy more) during the bear market without becoming a distressed seller is going to see a guaranteed bigger return than anything the legacy economy has to offer. Including securities.

Hands down.

Bitcoin is pristine collateral and pristine property. Your Bitcoin is never going to have a leaky roof. Your Bitcoin is never going to have a cracked foundation. The same cannot be said (figuratively) about alts, which is why Bitcoin should always be a very significant part of every crypto portfolio no matter what. It took me years to learn this the hard way. Learn from the mistakes of the people that came before you and you'll do just fine.

Conclusion

It is guaranteed that crypto is going to displace real-estate as the world's top store of value (just like dropping a rock into a glass of water). On a percentage basis, the world is simply not ready for this to happen, but it is going to happen anyway. A vacuum is going to be created that sucks value away from home-owners and into the cryptosphere. There's really no doubt about it.

Be on the lookout for signs of this to come. This transference of wealth will no doubt be fueled by the greedy hedge funds that bought up all the property and drove prices up for everyone else. As they unwind those positions a lot of that value is going to find itself parked within Bitcoin. I specifically say Bitcoin here because it's pretty unlikely that any other asset will have the liquidity to accommodate such a transfer of wealth... as even Bitcoin doesn't have nearly enough volume to handle it either. No matter what happens: prepare for volatility. Always. This is crypto after all.

Posted Using LeoFinance Beta

This is what I want to read!

I wish they could all be this good! 😅

https://twitter.com/1405202280/status/1627430479044440064

The rewards earned on this comment will go directly to the people( @manniman ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

This is a problem that I very much like to blame on boomers.

I'm still not convinced that owning a house is the best bet financially... there are so, so, so many costs, interest eats up so much... but, at least you're not at the mercy of jerk landlords who'll find any reason to throw you out and keep your deposit just so they can charge the next people more.

The ultimate problem with real estate is that once someone finally buys a house, and so much of their net worth is tied up in that house, it then absolutely becomes their prerogative to restrict building as much as possible to keep their investment value high... so you have 60% of Americans actively trying to keep the other 40% out. It sucks.

Nice addition.

I did not think about how the financial incentives align to create diminishing returns.

Classic capitalism!

Truth! And not just that. Boomer voting power (among other reasons) kept the U.S. government engaging in policies that would raise the price of homes such as FHA loans, Fanny n Freddie, etc.

Posted Using LeoFinance Beta

There is literally a calculator (hell if I know where it is anymore) that tells us whether it makes more financial sense to rent than buy. In many areas now, it makes more sense to rent.

Posted Using LeoFinance Beta

There is another piece that makes real estate a very bad investment (now)

"Real Estate" the name, and all that is associated with that.

The King's Estate. (Real from Spanish. Like in El Camino Real)

It basically means, all the property is gone.

And the new generation have to outbid every previous generation to get a place to live.

Why do we have the mentality that those who are least capable, those who just left school, should be burdened with the biggest hurdle?

We, as a society, should have property for new adults.

I do not know how we do it, especially in the current paradigm. But we better figure it out quick.

I feel like the only way to do that is to make it so property is returned to the community rather than allowed to be transferred as inheritance. This is a topic I've thought a lot about and considered quite a bit... and there are a lot of problems and loopholes that pop up. Still if we live in a society in which people do not need legacy-money to thrive then returning that legacy to the community at large is not that big of a stretch. I feel that communities will pop up in which members feel obligated to donate everything back when they die rather than trying to create a family dynasty. Maybe that wishful thinking.

My best idea goes like this:

Property is set aside from the community.

They are small parcels.

In highschool, all the boys build a house (like a garage downstairs and an apartment above that)

so, that when the boy graduates, they have a house, and a skill to know how to fix it.

Sounds like ya got it all figured out!

Not bad.

Moammar Gaddafi was the dictator of Libya for a while. He used to give newlyweds a new house as a wedding gift.

Given how that ended up, it may not be the enlightened policy it seems on the surface. At least, not while banksters run everything, as they do.

Thanks!

There is a real problem with "Giving" things to people.

It seems really important to make a person earn it.

And things have to really be made as fair as possible.

It is why my idea has every young man BUILD their own house.

Women are a different problem. Haven't figured out that half of the equation.

The community needs to make sure that house ownership is not out of reach ever.

The system we have has houses prices go up forever, and incomes to reach a plateau.

In this system, the slowest people get bankruptcy-ed. Its part of the system.

Anyway, in the future, i see ownership kinda as reversed, inside out.

The human belongs to the land.

Ownership is the person protecting and caring for the land.

If the person is not doing that, then they are not the owner.

But, in this system, there will only be little areas that are "owned", so if you want a place of your own, go find one.

Makes a lot of sense, economically as well as socially, and ecologically. Probably why there were serfs.

Ok. You talked me into it. Mortgaging my home now and putting all the cash into HBD.

Posted Using LeoFinance Beta

Lol no bro. You read into it

Too late. I'm all in. My kid's college fund is now denominated in HBD.

Posted Using LeoFinance Beta

Smart dad

That hadn’t occurred to me but you’re likely right.

And the scammers might even use AI to generate their pitches.

I appreciate you discussing value instead of TA. There's hope for you yet.

Thanks!

Soon I will reframe the TA in a way that reflects fundamental value.

It's actually quite easy to see when the market needs liquidity and when it does not.

Liquidity is a very important fundamental aspect of crypto... blah blah blah

I should do less TA for sure... I mean it's all trash but mine is REALLY trash... lol.

Especially when there's no pics of the Krystal Grrrls

The most succinct, eloquent statement I've read today

I'm with you crypto over real estate as Investment, but for me I'm still glad I own my own home, basically because I can develop it as I see fit, same with the land I'm going to buy at some point - I can use it in tangible ways that I can't with crypto!

But as a Vest for a return, BTC I basically agree. I actually have more now than a couple of years ago and I'm glad!

Stop paying your property taxes and then you'll find out who actually owns your house! Crypto is the only truly non-confiscatable form of wealth, and as you pointed out, much easier to maintain than physical property.

https://leofinance.io/threads/@andyblack/re-leothreads-6j4fb

The rewards earned on this comment will go directly to the people ( @andyblack ) sharing the post on LeoThreads.

Not this decade,I believe majority of people will choose safe and small percentage roi to risk and some higher returns,even Bitcoin is volatile not to talk of altcoin ,100 years from now the value of real estate will keep increasing

Posted Using LeoFinance Beta

Real estate used to be a solid investment, but something has changed over the last few decades that has stripped the middle class down to the bare bones, and with it all the opportunity that comes along with being middle class. Technology has ascended to godlike levels as the gap between the rich and the poor breaks record after record each and every year. It's tough to get a hold of real estate without qualifying for a bank loan, and that's just not acceptable.

So, what's the solution? Crypto, of course! It doesn't require a bank loan, and it's liquid on demand. Just look at HBD with its 20% yields on a fully liquid asset! It's a much better solution than debt slavery, which is essentially what a mortgage is. Did you know that the word "mortgage" literally means "death pledge"? Crazy, right? It's time to break the cycle and invest in something that works for us.

Well its a good thing I own some HBD too (staked on cub tho lol).

Posted Using LeoFinance Beta

In case of HBD pamps?

A little birdy told me liquidity will return soon™

Thanks very much for this informative #threads @edicted, here in France and in Europe they are even talking about a plan on creating salaries, pensions and #incomes universal or not, with dates of peremption, money that gets out of date stopping any will to have a #credit to buy a property or even a car or else topped with a penalty system. #Decentralised banking with #crypto #hive and #leo definitely is the future