Narrative Shift: Bitcoin No Longer Risk-On

There comes a certain time in the market where Bitcoin stops being a degen-gambling speculative asset and starts decoupling from the market and acting as a hedge. Most people like to say that Bitcoin is not a hedge. They like to say that it does not protect against inflation. They like to say that it is correlated to the stock market and thus no different than any other speculative asset.

Saying things doesn't make them true.

We've all hear these same tired stories. They are littered with half-truths and difficult to parse. However, I think about it this way: The stock market is up less than 50% over the last five years. Imagine if the stock market, instead of being up +50% in five years, was instead down 5% right now, trapped inside a terrible bear market.

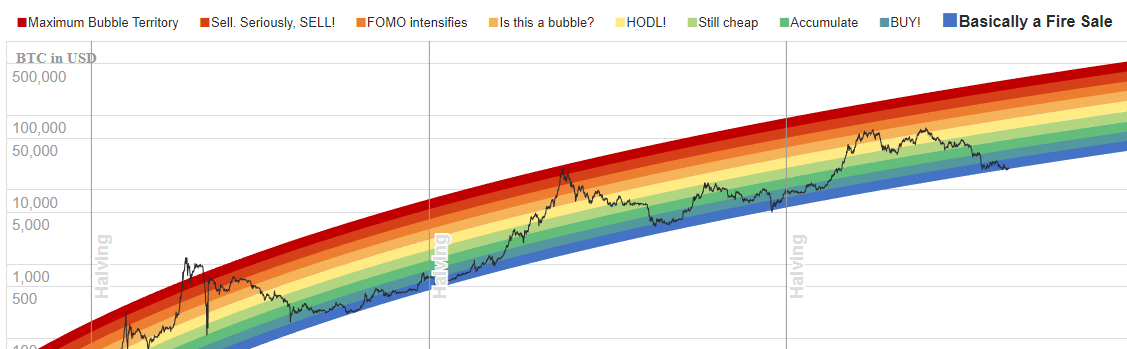

Given this scenario, would Bitcoin also be down some percentage over the last five years? This must be true, because Bitcoin is correlated to the stock market, is it not? Therefore, given a 5% decline over the last five years the current value of Bitcoin would be under $1000, yeah? This is the kind of logic being spewed out their on the internet, and it's obviously ridiculous nonsense. Even if Bitcoin was only $2000 right now that's still doubling in value while the rest of the market traded slightly down.

It's obvious as day that Bitcoin is gaining adoption and value at an exponential pace. The market whispers fears into our ears, and we have a tendency to listen. This is especially true while in the midst of a bull market where the price is still 75% less than the all time high and basically needs to go x4 before we can return to the glory days.

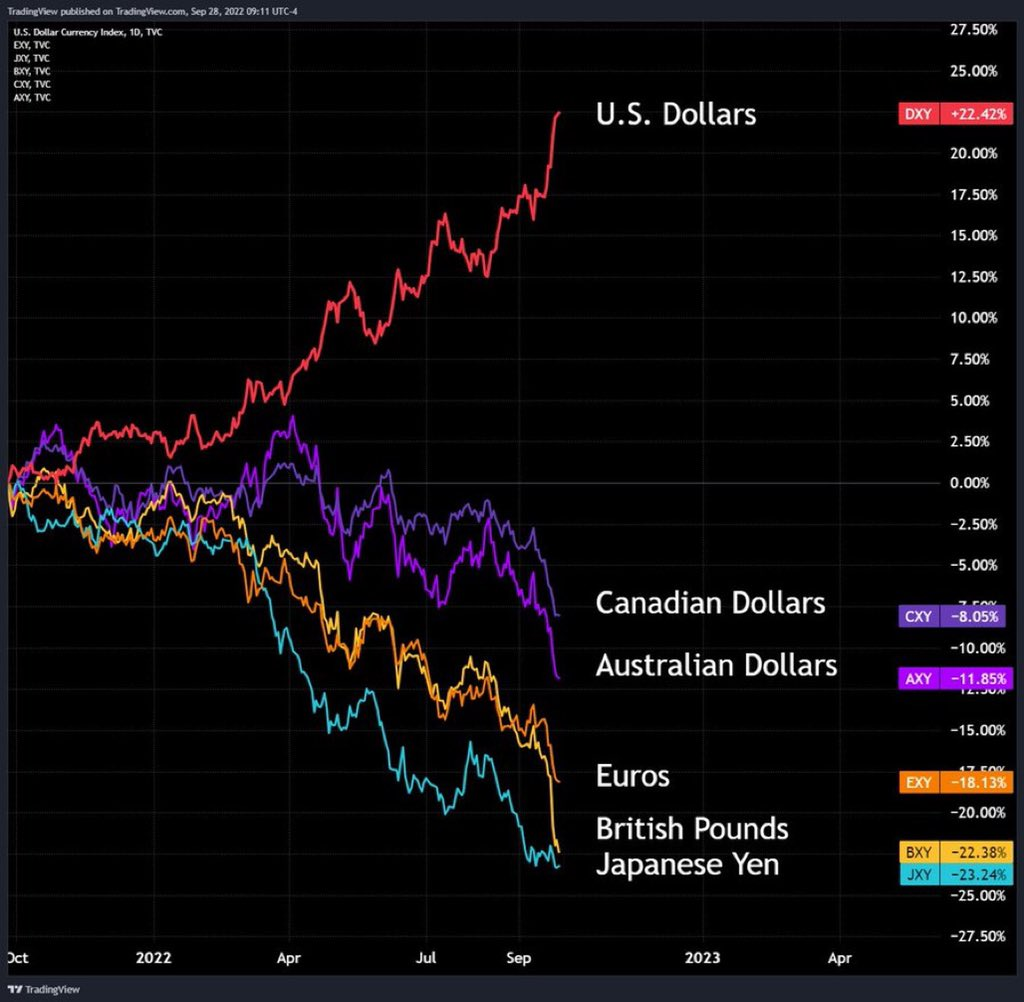

dollar milkshake theory

According to the dollar milkshake theory, the United States is stuck in a cycle in which it must protect the stock market from collapsing. As a result, excessive QT leads to bearish stock markets, raising the risk of a recession or even full-fledged stagflation.

The theory, coined by Brent Johnson, CEO of Santiago Capital, envisions a scenario where the US dollar sucks up liquidity from other currencies and countries worldwide.

Hmmm, call me crazy, but kinda seems like that's exactly what's happening. I even came up with a similar theory on my own years ago. USD can't hyperinflate or crash into the mountain until dozens of other countries have been absolutely decimated. Welcome to the empire.

This situation is worsened by investors “flying to safety” by selling both currencies in favor of the “safer” US dollar as well as US dollar-based assets. They also dump European and Japanese government bonds in favor of higher-yielding US bonds.

Because many countries in the world have weak and badly managed currencies, a lot of their public and private debt is denominated in dollars. To pay this debt, they need dollars.

But since the dollar is up, 10%, 20%, and over 50% in some parts of the world, It becomes more and more difficult to service this increasingly expensive debt, and defaults become a major risk.

As companies – and even governments – default, the remaining capital flees to safety as well. And as the most powerful economy, the US is seen as the safest place to park that money. Thus, the dollar becomes like a straw, sucking up liquidity from the entire world economy and drinking everyone’s milkshake.

Hm yeah so that's fun.

Good to be an American I guess... for now.

Can you imagine looking at these indicators, as a bear, and thinking Bitcoin still has another 50% dip left to go? I really gotta say, especially seeing how much BTC just got dumped onto the market and the price did nothing... the idea of Bitcoin dipping another 50% just like that is just flat on delusional at this point. Bears want a big win after price has already crashed 75%. Um, too bad? Not how this works.

And it's easy to look at the economy and think wow we are in for some shit. This house of cards is going to implode. But guess what? Bitcoin isn't a house of cards. Bitcoin has basically become the most solid asset in the entire world in this moment.

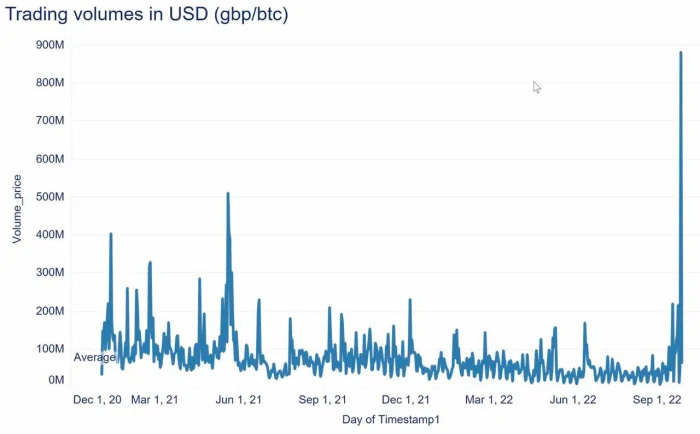

BITCOIN VOLUME SPIKES WITH MARKET UNCERTAINTY IN THE UK

The United Kingdom has already been forced to turn on the money printer up to astounding levels just to stop the engine of the economy from seizing up and defaults rampaging the system.

Here's a chart that has been lingering in my mind throughout the week. It was shared by the team from Coinshares and highlights bitcoin trading volume in the U.K. earlier this week while the British pound was in free fall. As you can see, volumes exploded to just under $900 million, reaching their highest level in more than two years. It's hard to discern the intent of those who were trading bitcoin in size over in the U.K. It could have been people looking to take advantage of quickly developing arbitrage opportunities, people looking to sell bitcoin to get liquidity to service failing trades or people looking to purchase bitcoin as a hedge against rapid currency debasement.

For every buyer, there must be a seller, amirite?

And vice versa. So what makes sense? Would people from the UK realize "holy shit my own fiat currency has become a risk-on asset" and buy Bitcoin? I mean obviously at least some people did that. It's unclear just how many. What is clear is that Bitcoin volume quadrupled and volatility was extremely low, which is quite odd and may be signaling some kind of reversal, or at least that the current support is rock-solid.

Liquidity is thin

On a global scale Bitcoin is still very very tiny. The market cap of gold is $11T (remember when BTC was $1T?) The market cap Apple is $2.2T. Google is $1.25T. Bitcoin is sitting at $0.37T. Let that sink in. This is an obvious buying opportunity even in the event of a complete financial meltdown. If unsustainable debt is the problem, Bitcoin is obviously the solution.

Speculators don't even follow their own rules.

In 2020, the narrative was "printer go brrr". I'm not even saying this is true, this is simply a lesson in hypocrisy. Okay, so the money printers were turned on. What happened? Bitcoin spiked very quickly x4 from $10k to $40k and then back to $30k then to $69k. The mainstream narrative aligns with the idea that Bitcoin worked. It acted as a hedge against inflation. It pumped just like we knew it would.

However, now everyone is backtracking and saying the exact opposite. They are saying that inflation is what is causing the markets to tumble, even though it is deflation and increasing rates that is causing the market to tumble. The response to inflation is causing the market to implode, not the inflation itself, but rather the deflation being employed to balance it out.

Nobody cares. Everyone feels entitled to the gains they made in 2020 and 2021. Rather than admit that it was inflation that pumped their bags in the first place, they turn around today and say it is inflation that is dumping their bags. They say that Bitcoin is not a hedge and that it's correlated to stocks. This is how people do mental gymnastics around the reality of the situation. Rather than admit Bitcoin was bloated and overbought by easy money last year, they blame inflation this year for their 'losses'. Truly it is a sight to behold.

Conclusion

When every asset becomes a risk-on asset, Bitcoin starts looking a hell of a lot more attractive than it did as an overleveraged bubble. Fiat is not a safe haven during this time. Neither are stocks or bonds. This unsustainable debt market could implode at any time. Even money in the bank is not safe from the threat of systemic collapse. FDIC insurance means nothing if everything fails at the same time.

This is exactly why Bitcoin exists in the first place, and nobody wants to buy it, thinking it will surely tumble with the rest of the markets. From what I'm seeing, a decoupling could strike at many moment as many begin to realize that Bitcoin may be the safest asset out there while still maintaining exponential rewards over time. That's a killer combination, and again liquidity in the BTC market is just a tiny little straw compared to everything else. It would take very little for a reversal to occur.

Even if Bitcoin does crash one more time, I can almost guarantee a V-shaped recovery after the smoke clears. I'll be looking to margin trade in that event for sure. There are a lot of scary looking resistance lines approaching as this entire shitstorm moves forward. No matter what happens, it will be interesting. The crab can only walk sideways for so long.

Posted Using LeoFinance Beta

Great perspective. Don't fight the current go with the downstream flow. 👍👍😁

https://twitter.com/Farmsteader/status/1576352066808975361

https://twitter.com/RuelChavez5/status/1576571663549755392

The rewards earned on this comment will go directly to the people( @wanderingmoon, @rzc24-nftbbg ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Bitcoin as a life hedge

Agree Bitcoin will decouple from the market and just become a hedge against life.

This:

Why do you think they call WeeWork the 27 Billion Dollar Unicorn?

Posted Using LeoFinance Beta

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share 100 % of the curation rewards with the delegators.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Read our latest announcement post to get more information.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

Congratulations @edicted! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 460000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Good post, it will truely be interesting to see what bitcoin does when the house of cards implodes. And as you said, bitcoin is not a house of cards...don't wait for the herd mentality to tell you that

@tipu curate

Upvoted 👌 (Mana: 38/48) Liquid rewards.

Bitcoin is definitely a good asset to keep as much of as we can. I’m trying to wait and see how low it goes, thankfully Coinbase now allows for limit orders about fucking time! I set a few and waiting to see what happens! Long term it’s going to be good for sure.

Posted Using LeoFinance Beta

Good article and thoughts as usual. My biggest concern around Bitcoin price, NOT Bitcoin the network, is the existence of Bitcoin futures.

The gold and silver markets have been manipulated, to the downside, for years if not decades using futures. There has been talk about the physical and paper prices of gold/silver decoupling but that hasn't happened YET.

As you said, the BTC market is tiny compared to gold. As long as there are futures contracts the price can be messed with by the same people who are messing with gold and silver prices. Same is true for ETH.

We all can decide, of course, the value of the BTC we hold and whether we want to sell at a given price. Gonna be interesting to see if there is a decoupling as things get crazier.

Gold and Silver can be manipulated much more easily because they are physical assets.

Even more importantly, they can be manipulated because they do not evolve.

Gold will always be gold. Silver will always be silver.

Crypto is evolving every day.

Not really comparable to physical assets that aren't tech.

The reason gold and silver can be so easily manipulated by their digital representation is because the digital derivative has a lot of value, because they are physical assets and can't exist in the digital world, except on paper/digitally. This is a problem that crypto doesn't have because it is natively digital. In fact crypto will likely help destroy the value of paper gold/silver and pump the price of the physical version as a robust hedge.