Market Watch: Eat My Shorts!

BRUTAL!

So this morning some dipshit CUB whale dumped the token like 40%. I call them a dipshit, not because they sold CUB, but because they sold it like a complete idiot; selling it all at once into a single LP pool, and gifting arbitrage bots thousands of dollars for free out of their own pocket. Use paraswap.io to avoid this, as their "MEGASWAPS" will buy/sell from all pools at once.

I've said it before and I'll say it again:

CUB has been range bound between $2M market cap and $5M market cap since inception. This sideways trading has been happening for an entire year now. If you saw the market cap at $5M like it was, you should be expecting a dump.

Of course no one was actually expecting a dump because who dumps that much CUB 5 days into a 60 day airdrop? What the hell? So crazy. Add to that the YouTube ban of LEOfinance and the fact that polycub is in hardcore bleed mode and we really have seen a perfect storm for our bags. Not fun!

I'm sure most of us I have been expecting some kind of bounce on the polycub market by now. It was at $5, then at $3.50, then at $2, then $1.50, then $1.00, and not sitting at something like 89 cents. Where does this dump end? It's kind of crazy honestly... not even CUB dumped this hard without at least getting a little upward momentum in between. No such luck apparently.

At this 90 cent level, polycub seems like a really good buy... assuming one actually has any liquidity to buy in with. That's the problem with hyperdeflationary tokens with zero elasticity. I've already told Khal this in DMs, but xpolycub should of had ZERO yield during launch. Zero. Or maybe just the 50% penalty from the other farms.

What is the benefit of single staking?

The benefit of single staking pools is that they can be used to provide elasticity. They can provide demand when the market needs demand, and they can provide supply when the market needs supply. Clearly, the incentive pendulum needs a little work to reflect this actuality.

When we need the price to go up, we increase yield to the single-staking pool. This incentivizes users to buy pcub, or better yet cannibalize their LP to shove it all into the single staking pool. This makes the token less liquid and easier to pump. If we want to bring the price back down we take away yield from the single staking-pool.

Why would we want to make the price go down.

This is a concept that crypto degens just don't seem to understand. STABILITY. Say it with me now: STABILITY; ELASTICITY; UNIT-OF-ACCOUNT. It should always be the goal of a currency to remain stable. Always. Always always always. Again, crypto bros do not understand this concept.

Only up. Diamond hands. HODL.

I'm finding the infinite greed quite tedious. And I'm not immune to the infinite greed either, which is even more frustrating! I had the chance to take $140k gains after two days of gambling, and instead I decided to let it ride instead of cashing out and having money to support these lower levels? Wow, that is so bad! What was I thinking?!! I'll tell you what I was thinking: what if pCUB spikes to $13 like CUB and I'm a millionaire. That's what I was thinking: MORE MORE MORE MORE MOAR. Look where that mindset gets you.

If you want to make money in crypto, you have to stop trying to make money. Build value from the networks you're trying to be a part of. Had I taken my own advice on this I'd have over $100k to defend the $1 support on pCUB. Instead I just have a bunch of pCUB and find myself locked in the system hoping for a pump up. Oops!

Market cap is the only metric.

We can't look at token price. We MUST look at market cap. It's the only number that means anything in DEFI with yields this high. When we look at market cap we see that POLYCUB only has like a $1M cap at the moment. That is actually absurdly low, and thus it is probably a good time to buy in considering that the token price has plummeted over 80%. It's all speculation, but a micro-cap under $1M? Wow, seems like a good deal honestly. That's less than half of CUB's lowest market cap to date, and yields on PCUB are obviously still sky high.

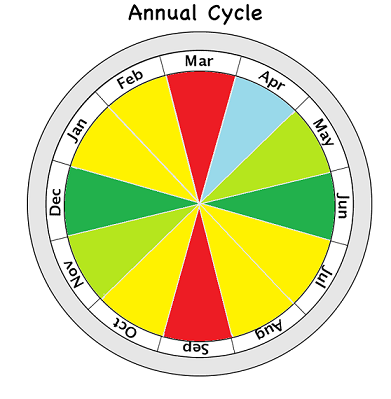

Looking at the market at large, Bitcoin and friends are on the Struggle Bus something fierce. This makes sense because, like I said, March is a trash month. Tax season is garbage. Russia just started a war and the sanctions on them clearly hurt everyone (even if they hurt Russia more).

That's because the economy and life itself is not a zero-sum game. When we sanction Russia, everyone that was doing business with them suffers. A 6% loss in crude oil creates a supply shock because corporations use a Just-In-Time business model.

Think about it: if there is a shortage of oil, who's going to stop using oil? Most people who use oil have to use oil no matter what the price is. Only a small fraction of the population can stop using oil if the price goes up, and even then that small fraction of people choose to pay the higher price because they want to drive to that dance club in the city or whatever the fuck they are doing.

Prices going up doesn't necessarily stop people from consumption, so the price goes up again, and again, and again. Before you know it, a 6% drop in crude oil creates a 30% spike in prices. This is the exact same concept that I have tried to portray in terms of market cap liquidity. Price of Bitcoin can go up without anyone buying it. The market cap of Bitcoin going up $100B doesn't mean $100B actually got pumped into it. These are facts. If you don't understand them you should figure it out because it's pretty damn important.

Full Moon March 18th.

Honestly the TA for BTC looks pretty good. We keep making higher and higher lows, and we are about to finally get past March Madness and into April which is a much safer month. Normally we would expect a local bottom in mid-late March... so hopefully it will be only up from there if it happens... At least until May/June. Again, hopefully the 18 month bull cycle is still in play.

Looking at the market... it's actually surprising that Bitcoin is holding the line at this level. Risk-on assets would have usually been abandoned at this point. We are in the middle of tax season. The economy and the stock market are suffering. The FED keeps talking about raising rates. Honestly I'm surprised that we aren't trading slightly below the doubling curve right now (something like $28k).

2022 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $27733 | $29867 | $32,000 | $34133 | $36267 | $38400 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $40533 | $42667 | $44800 | $46933 | $49067 | $51200 |

Believe it or not, we are actually in a damn good spot right now overall. If the stock market starts tanking and Bitcoin holds the line at the doubling curve, nothing could be better from an institutional adoption standpoint. That could easily create a chain-reaction domino effect that leeches more and more value from stocks and commodities into crypto. This is something that can only happen when Bitcoin is trading at or slightly below the doubling curve. When bitcoin is higher than the curve it becomes extremely correlated to legacy markets... because it is bubbled with legacy money. Traveling on the curve while stocks bleed would be a thing of legend. The bigger the bleed the more impressive Bitcoin becomes to the world. #dreambig

Conclusion

There are a lot of problems with polycub, but we are learning quickly what those problems are. We always knew it was going to be volatile... but seriously this is insane. Looking at the market cap we see that it is less than $1M (we must ignore the airdrop tokens that haven't unlocked yet but are being included in the total). The marketing campaign could kick this thing into hyperdrive... or it could be a big nothing burger... who knows. What we do know is that this has been a fantastic gambling experience, and will likely continue being so for quite some time. Don't gamble money you can't afford to lose... easier said than done I suppose when you see people around you becoming millionaires arbitrarily. Why not you?

Get rich slowly. Stop trying to extract value from networks and instead try to provide value to them. You can thank me later. Networks have a way of rewarding this kind of behavior over time.

Posted Using LeoFinance Beta

The people doing V2K with remote neural monitoring want me to believe this lady @battleaxe is an operator. She is involved deeply with her group and @fyrstikken . Her discord is Battleaxe#1003. I cant prove she is the one directly doing the V2K and RNM. Doing it requires more than one person at the least. It cant be done alone. She cant prove she is not one of the ones doing it. I was drugged in my home covertly, it ended badly. They have tried to kill me and are still trying to kill me. I bet nobody does anything at all. Ask @battleaxe to prove it. I bet she wont. They want me to believe the V2K and RNM in me is being broadcast from her location. And what the fuck is "HOMELAND SECURITY" doing about this shit? I think stumbling over their own dicks maybe? Just like they did and are doing with the Havana Syndrome https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Very important principle. I learnt that some years ago. Now, I just calculate every move.

Diamonds Hands only RN!!

Eat my !PIZZA . Numbers can only go up from here. Xpolycub would do well! or might do well. You're right, it's difficult not to gamble it. I think its more difficult to exit actually.

PIZZA Holders sent $PIZZA tips in this post's comments:

@curation-cartel(10/20) tipped @edicted (x1)

samostically tipped edicted (x1)

Learn more at https://hive.pizza.

excellent points here. Kind of makes me happy I'm learning with little bits. I like what you're saying about the market cap though. I rarely look that way but it seems like a good time to buy If I'm a believer

Posted Using LeoFinance Beta

Well, sometimes someone would make an unexpected move,. Just to cash in on the market, because they've probably been waiting for that move, irrespective of whether there's an airdrop or not. I think, it's probably their loss. We need more believers.

When I saw cub at $0.25 today that blew me away. It legit makes zero sense why you would dump right at the start of a 60 day airdrop lol oh well now I can buy more for less!

The biggest problem right now is not having enough liquid funds to ape even harder into cub.

This is the best time I've seen to really stack up on the token. I just wish I had the money to do it.

I bought some polycub for $0.90 yesterday. I'm not sure the price now. Maybe get some more if the price is right. I staked it into xpolycub !

Not worried about the short time volatility. Let's keep staking on Kingdoms and build the POL, in the long run it will gobble up so much polycub from the market that the price will shoot up! Patiently building my future here

The "problem" with this entire industry is that is seems to have been 100% usurped by the "Wen Moon?" who just nomadically travel around from one project to another, trying to be "first to market" in collecting ridiculous early APRs from Defi projects and then dumping and running for the hills.

It's 100% exploitation and has zero do do with either providing value nor with investing.

It's likely also the primary reason why any sort of broadbased adoption of cryptos will take much longer than most pundits believe.

=^..^=

Posted Using LeoFinance Beta

It would be great to create a fair start by a presale to real community members, filling their orders first with one dollar Cub. Instead of the bots getting most of the 1$ Polycub and then real people driving the price up. Perhaps next time…

Posted Using LeoFinance Beta

so the question we must ask ourselves is why are the opening yields so high?

shouldn't we be doing the exact opposite?

Bad yields in the beginning and ramping up inflation later when we need to stimulate growth?

I've talked about these issues many times.

It happens bitcoin will rise as always

18th March, 7 days more. I will mark that day on my calendar.

Posted Using LeoFinance Beta

The guys in the LeoFinance chat recently have been cracking me up. The get rich quick vibes, and then immediate frustration. You'd think no one has ever seen how an airdrop tends to go before. You give out coins and some dump them, that's how it works. Trying to out game a system or even trying to out game the natural progress of an airdrop is kind of funny.

In anycase the xpolygon is super interesting, and I'm kind of bummed on not being able to reinvest tokens earned from the farms.

It's new, still learning. Airdrops do what airdrops do. I'm stacking and stacking for when bitcoin goes up and takes the market with it. Those who sell out are not in my pools!

Posted Using LeoFinance Beta

😜

Posted Using LeoFinance Beta

The huge drop in CUB price was unexpected. I didn't know that the LeoFinance Youtube channel was taken down but I guess it's part of the norm when it comes to crypto channels.

Posted Using LeoFinance Beta

It will come back.

Posted Using LeoFinance Beta

Man I love your style.

Posted Using LeoFinance Beta

Posted using LeoFinance Mobile

It's funny because degens are made out to be this niche Defi investor type. It's actually the majority, and it is annoying. Thank you for hammering the fact that the network has a use, liquidity has value and by simply acting in a sensible way, we actually can win big over time! The bigger the whale, it seems like the more thoughtless, greedy and immature they are.

Posted Using LeoFinance Beta

Exactly what happened to me and probably tons of other people as well, according from what I read on Discord and HIVE. Which is ironic because most of us should know by now that investing into the farm token is usually a bad idea in the beginning of a DeFi platform with high initial inflation. But PolyCub sounded so amazing, especially after seeing the result of the first 24h in xPolycub, that we all aped into it. I paid $4.5 per Polycub and rest assured, I bought a lot. I wonder how long it will take now to recover just the loss.

What is even twice as annoying, is that 100% of all our gains we get on Polycub now from external liquidity are just meant to break even again. That potentially creates a huge selling pressure because to cover our losses, many will cash out for weeks to come. I certainly have enough Polycub for now and I will be extremely careful before buying more. Since you wrote this, we dropped from $0.89 to $0.72 and I don't see much reason why this downwards spiral should end during the first month of high inflation. Sure, it might pump if we get some awareness but what will happen then? Everyone and their mother will sell who bought like me at ridiculous prices, to at least cover some of their losses.

Interesting point. Didn't really support the platform to have a double incentivized single stake without any delay, penalty or bonding on it. It just kept liquidity out of the Polycub pools to increase volatility, as you wrote. This should be reconsidered for the next offspring.

Long-term sustainability is awesome but if it comes at the cost of the early believers/investors in the platform, then there is room for improvement.

!1UP

You have received a 1UP from @flauwy!

@leo-curator, @vyb-curator, @pob-curator, @pal-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

Polycub don't surprise me because it happens often in defi world. Price don't normally count with defi. You just have to wait till the price remains stable and go in harder.

Posted Using LeoFinance Beta

Not amused about that dump either! I just bought a good batch more CUB the day before this happened. Damn, i should‘ve waited just one day, but who could‘ve known that this would happen. With PolyCUB i had hoped it would stabilize around 1$, but nope, still diving deeper … where does it may bounce or is this gonna be a free fall? Who knows? PolyCUB $0.679 at the time i‘m writing this. 🖖🏼😎🤙🏼

Posted Using LeoFinance Beta

Damn, i wrote about a bounce in the above comment and today i woke up to see that the price i wrote it at was more or less the or a bounce. Gotta work on that and maybe call me predicted then 😜🤙🏽

Posted Using LeoFinance Beta

to be honest I expected exactly this after having seen cub go from $13 to 25 cents. but who knows, maybe it won't end like that as well

I had the same feeling with Splinterlands when I could have sold my collections for hundreds of thousands, but hold to those for the SPS airdrop and to be competitive in the game. Now that doesn't look like a great move from my side, but building upon my SPS for the future is what keeps me motivated as I consider that the most valuable asset in the game. And when lands will be released probably the ecosystem will reanimate once more. So, keep CALM and HODL!

Posted Using LeoFinance Beta

Instead of people to stake their polycub,some are selling it. But they don't know is not yet time to sell it.

Posted Using LeoFinance Beta