Getting Sued for Financial Advice

You know how everyone says "Not financial advice" to avoid getting sued for illegally giving financial advice? Have you ever wondered how many of the people who parrot this phrase blindly have actually looked into it? Probably not very many right?

So the other day I was sitting in the waiting room at the doctor's office and I was like: you know what, I live in the future. I have a super computer in my hand, and this super computer has direct access to the internet. What a crazy time to be alive, amirite?

So I looked it up.

And this is what I found.

https://purposefulsp.com/is-financial-coaching-breaking-the-law

As I was reading this document I was absolutely shocked on multiple occasions. It became so painfully obvious that the vast majority of people who are saying "not financial advice" have absolutely no idea why they are saying it and never even thought to look it up. They just say it instinctively because "What's the harm in saying it?" I must admit there is no harm (aside from unearned overconfidence assuming you won't get in trouble), but once you look at the actual law you may never say it again and be just fine with it.

So let's get into it, shall we?

This document is a primer on the potential liability associated with giving advice through financial coaching. Throughout this document terms like “potentially”, “can”, “may”, and other qualifiers will be used. Do not construe this use as a suggestion that it is safe to do something as you are only potentially in danger. These qualifiers are used solely to highlight that only a court can ultimately determine whether a specific action you take is illegal.

Are they fucking serious?

Even the Not-Financial-Advice article begins with a "Not Financial Advice" disclaimer. Unbelievable. So meta. No matter, as there is still good info here.

Investment Advisers Act

Violating the IAA carries with it some hefty penalties, including fines, civil liability, or jail time.

Violating the IAA (offering investment advice illegally) carries with it a fine up to $10,000 and up to 5 years in federal prison, as outlined in § 217. Notice this is ‘and’ not ‘or’, meaning you could face both the financial fine and the prison time.

Starting strong with punishments

It's always good to know what you're up against, and after reading this it's easy to see why so many would choose to deflect with a "not financial advice" statement. Those who are actually drawn and quartered by the SEC find themselves torn to pieces by the regulators. These are serious punishments that are not to be taken lightly.

However, we can see that the language of this law is "up to" meaning "cannot exceed". Within this legal context we can begin to understand what this actually means: It means that every case is basically up to the discretion of the judge or jury involved, and that most punishments should be less far less than the maximum sentence.

If this wasn’t bad enough, advice given to each of your clients could theoretically be seen as separate counts of violating the act, meaning the full prison sentence could be more than 5 years. So giving the same advice to 10 clients could, in theory, result in a 50 year prison sentence. While this is theoretically possible, only an attorney could tell you if it is likely or realistic.

AKA it is not realistic to expect that kind of punishment.

But legally they aren't allowed to tell you that explicitly.

I can because I'm not a person.

I'm @edicted.

Try to sue me.

See what happens.

As explained in § 209, the damages start relatively small at $5,000 for natural persons or $50,000 for other persons. The issue, of course, is that if you operate your business as an LLC, S-Corporation, or other legal entity; you would fall into the natural persons category and your business would fall into the other persons category.

I pasted this because corporate personhood is an interesting topic that I do not fully understand. To be fair only niche lawyers fully understand it, and I'm not a lawyer, so there is that. It looks like if you use both your personal and corporate brand to further the agenda of illegal financial advice then your LLC is far more liable than you are. Interesting. I actually would have assumed that only the LLC would be in trouble... as that's usually the entire point of creating the LLC (literally short for "limited liability").

A person could sue you for damages if you offered advice illegally and then:

- the portfolio halved in a market crash

- the portfolio was lost to a lawsuit because your advice left the investments more open to creditors

- the assets were transferred to someone other than who was in the will due to your advice

- or one of many other scenarios which are possible (and often given as advice on radio shows or podcasts)

Think about this:

So if you tell someone to move money out of their retirement account and into an investment that succeeds greatly and goes 10x... they can still sue you if they go bankrupt (through no fault of your own) because the value that was in the retirement account was immune to bankruptcy law, but the 10x investment was not and creditors garnished it all to pay back the bad debt. Aint that but about a bitch? No good deed goes unpunished, amirite?

This is what caught my eye.

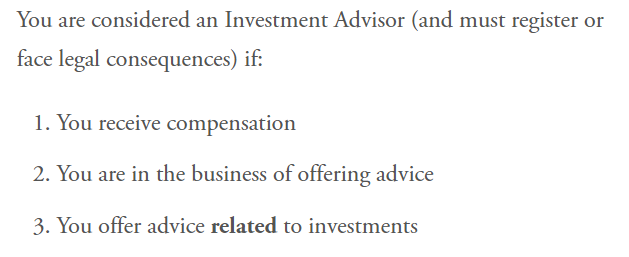

This is why I decided to write this post. Does this sound like you? Do you get paid for the advice you give? Are you in the business of offering advice? The answer for 99.9% of us that say "not financial advice" is unequivocally "no". Given this fact, the chance that we could actually be sued for giving financial advice is very small because one of the key elements to getting sued for financial advice is making money off said advice, which we are not.

Of course if the SEC really wanted to be a dick about it they could say the money I made on the blog post counts as being paid, which would be pretty ridiculous considering I'm not being paid because of the advice I gave.

I'm being payed because of the reputation I've farmed and the networking connections I've made over the last six years. Of course the situation gets more and more iffy if Hive moons and suddenly a post pays out thousands of dollars in my name. Good thing @edicted is anyone in the world with the posting key to @edicted, amirite? Could be anybody really. Who's to say?

The IAA defines an investment advisor as “a person who, for compensation, engages in the business of advising others, either directly or through publications, as to the value of securities or as to the advisability of investing in, purchasing, or selling securities or . . . who promulgates analysis or reports concerning securities . . . .” (1)

BUT THIS REALLY CAUGHT MY EYE

When we look at the actual legalese for truly defining these things, we see some VERY interesting statements.

- For compensation (you got paid)

- Engages in the

businessof advising others - as to the value of

securities - or as to the advisability of investing in, purchasing, or selling

securities - who promulgates analysis or reports concerning

securities

SECURITIES SECURITIES SECURITIES!

Notice how "securities" gets repeated over and over and over again. If the product you are shilling is not a security, the chance of you being sued over that advice drops dramatically. This means that anyone who shills gold or Bitcoin (or even Hive) will probably never get sued. Even if you did: your lawyer could make a very compelling argument that the prosecution has not even done their due diligence in proving that the underlying crypto asset is a security in the first place.

No wonder why the SEC wants to declare everything under the sun a security.

If it's not a security, they have absolutely no power over it. This is what I have learned every time I've delved into the law regarding these matters.

- If it's not a security: it doesn't pass the Howey Test.

- If it's not a security: the SEC has no power.

- If it's not a security: it's not insider trading.

- If it's not a security: it's not financial advice.

Seriously though...

How deep does securities law go?

No wonder why the SEC has denied every single Bitcoin ETF proposal.

It makes perfect sense now.

The crux of the SEC's position is that bitcoin's price is subject to manipulation on unregulated platforms, and approval of a bitcoin spot ETF would only invite further manipulation.

We've heard them make this claim 8 ways till Sunday, and we've called bullshit on them every time. How is a Futures EFT any less prone to manipulation? We know that it isn't so we assume the SEC are just dirty lying bastards. Typical government.

The real difference is that a BTC Futures EFT is obviously a security; issued by an incorporated entity with an address. If anyone fucks around they're going to find out. Because Bitcoin itself isn't a security at all: if they allowed a raw EFT to materialize it would be impossible for them to regulate it after they approve it. If people were insider trading that market they'd just get away with it... legally. Wow...

This really makes you wonder why the SEC even has the authority to deny a BTC EFT in the first place. Bitcoin isn't a security so why is it the SEC that gets to make this decision? Clearly this should obviously be the decision of the CFTC (Commodity Futures Trading Commission). I can only assume it's through delusion and red-tape power structures of government regulatory agencies. It gets especially weird when we consider that crypto is still legally "property" because the legal system has no way to classify it and they want to consolidate as much power as they absolutely can.

Conclusion

Getting sued for investment advice is actually much more involved than most people who blindly repeat the disclaimer assume. In fact many of you have probably heard that the "not financial advice" disclaimer doesn't mean anything and won't keep you out of trouble. I hope after reading this assessment everyone can see why this is true.

There is no way to loophole out of giving illegal investment advice with a disclaimer. Nowhere in the law is it stated that you can simply say some words and everything is all good. That's not how it works.

Hm, nice try.

If you got paid and you shilled a security, you're guilty of giving illegal financial advice unless you have a permit to do just that. This is the plain and simple truth of the matter. The disclaimer may score you some points in court (or even deter a lawyer from taking on the case in the first place), but it is by no means a get out of jail free card.

No immunity for you, sir.

The most important thing we learned out of all of this is that it's actually much easier to stay out of the "business of giving advice" than we originally thought. Anyone can shill a product to the moon as long as they aren't getting paid to shill. Look at all these famous people who shilled crypto projects that failed or were rugpulls. They didn't do it for free. They were paid huge sums of cash to shill a security and then didn't even bother to declare what they were paid to the public. That's a huge Gary Gensler no-no.

Regulation Daddy doesn't like that!

Long story short, if it's not a security, then it probably isn't illegal financial advice (or insider trading for that matter). This means we can shill Bitcoin and Hive to our hearts desire, and even get paid for it, and it would still be legal.

But think about it: how would you get paid to shill Bitcoin, Hive, or gold? The only possible way to go about it is on Hive with the proposal system. The magic Bitcoin fairy isn't going to shower you with gems for telling people to buy Bitcoin. Same story for gold, silver, or literally any other commodity.

These are the core differences between securities and commodities. Commodities don't have a centralized owner with intellectual property rights or investment contracts, and securities absolutely do. Not only that, securities have a financial incentive to pay you to shill their product. Don't do it... that's illegal... dummy.

Is Jim Cramer a licensed financial advisor?

He does seem to get paid huge amounts to push securities.

But, he is "their" boy, so he will probably never get sued... as long as he never crosses T.H.E.M. (this is not legal advice)

All of this not-financial not-legal thing is all about controlling an industry.

Imagine needing the crowns permission to speak your mind on something like finances?

And, oh no, i just shilled FOOD in my post today.

They are going to lock me up and throw away the key.

Three hots and a cot. Guaranteed retirement plan.

always a silver lining ^_^

This would be true only in places where the legal system is sound. Sadly, that's not the case these days in many jurisdictions in the United States and the rest of the Anglosphere.

Posted Using LeoFinance Beta

This is good.

I had plans involving the giving of financial advice, but I realize, I just wanted to give “tips” to feel correct about the assumptions I hold. Rather than get in trouble for sharing advice or not disclaiming I’m sharing it, I’ll just write other informational pieces.

Besides, advice isn’t anymore constant than the wind or the clouds. Why give it away for money- it doesn’t last. Even if you did give a guy the best advice in his life, he’s liable not to take it. Best I just report on the task I accomplish with my suggestions, once I’ve done it.

“Sit tight and be right.” A real good stock operator said that once.

I always like to add to the 'this isn't financial advice' line 'I am clearly an idiot, and only a fool would think I have any idea what I'm talking about.' Even if I get slaughtered by the SEC, I get to call my enemies fools, and at that point, what else can you do?

Thanks!

No one's paying you and you're the last person to shill a security.

You're safe.

But obviously the disclaimer is clutch so ya gotta keep using it.

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @steemflow by upvoting this comment and support the community by voting the posts made by @indiaunited.

Then I should say, "For entertainment purposes only, Lol! 😄"

Posted Using LeoFinance Beta

Hilariously enough that probably would be better.

https://twitter.com/1413161729106776065/status/1626832643416289280

The rewards earned on this comment will go directly to the people( @no-advice ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

A lot of projects offer people a little reward in crypto (usually worth under ten cents) to tweet or retweet or comment or all three. Is the SEC really going to go after all those people who say they like a project, because they might have received a few cents worth of crypto?

This post has been manually curated by the VYB curation project

We're dealing with the same sort of people who would endorse the decision to use an air-to-air missle which cost @ USD 472K to bring down a hobby ballon or craft which cost less than USD 50.00. It doesn't make sense to go after peopel earning cents off a tweet or thread, but these are the people we're dealing with.

Posted Using LeoFinance Beta

The SEC is ensuring the end of the American Empire by destroying the chance for the USA to be a leader in the next technology revolution.

Luckily I don't really believe the SEC has this power.

Regulating centralized agents doesn't seem to concern me.

The Ripple lawsuit shows that even if they lose, they still win.

The Ripple sale of XRP can violate an investment contract without XRP itself being a security.

The law and crypto simply do not mix, and overreaching regulators prove this every day.

_"I'm Rick James, bitch!"- -- Dave Chappelle

I had to get that out of the way. That's what it reminded me of as soon as I reached that point in the post.

Owning securities is like living under someone else's roof: Their house, their rules.

I'm not saying we shouldn't own securities, but we can't let ourselves be under any illusions that we are free to do with them whatever we want. If control over one's own money is a priority, then owning decentralized money is a must.

The best we can do is present information to the readers. Even if we give actual financial advice, it's up to the reader to act on the reading material. What happens after that is responsibility of the reader.

Posted Using LeoFinance Beta

https://leofinance.io/@magnacarta/re-leothreads-d6ez3

The rewards earned on this comment will go directly to the people ( @magnacarta ) sharing the post on LeoThreads.

I like when you say you aren't a person, you are @edicted

That is another powerful thing HIVE and the Hive Dollar have going for them. A lot of the witness nodes are anon. So it would be extremely hard at this point to point a finger at any one person or entity

I'm moving all my worldly goods into Hive on your say so @edicted 😎. And up voting you.

Not financial advice.

You tryin to ex post facto me?

I'll have you know that the magical Bitcoin fairy is actually a good friend who's really generous with her gems thank you!

Shoot well I guess I'm getting sued then.

🤑