Final Thoughts: Perspective

I'm getting pretty bored of continually talking about the fine details of HIVE >> HBD conversions, and I'm sure my readers are much more bored than I am. I'll try to keep this brief.

But I do have some more corrections and revelations to make on this topic.

This may be presumptuous of me to say, but I believe the way that I thought it worked in my previous post is superior in every way to how it actually works as described above...

Indeed it was VERY PRESUMPTUOUS. Durp!

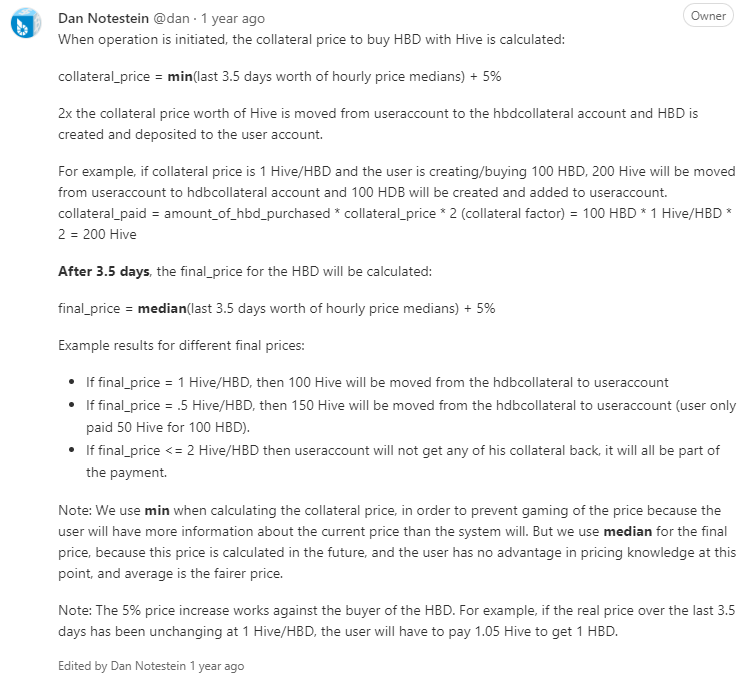

The way it works is fine, which was confirmed when I actually figured out how min(price_median) is calculated. The Hive blockchain aggregates median price once every hour (presumably for efficiency). Given the 3.5 day window it looks at for conversions, that's 84 data points, all median averages from the top 20 consensus witnesses.

min(price_median) is simply the lowest number out of all those 84 averages. To be fair I was told this before, perhaps multiple times over the time I've spent trying to figure this thing out. It just wasn't clicking, but it makes perfect sense to me now.

So the death-spiral scenario I talked about has a way smaller chance of happening than I originally thought. If the price of Hive is crashing, then the blockchain is going to record a new min(price_median) every hour rather than having to wait days for it to move.

While I guess it's possible that some crazy shit happens in between the hourly ticks... it's pretty unlikely that something like that could ever happen non-organically (like a liquidity hack from a centralized agent). In the event that it happened just because a bubble popped (which is most likely)... HBD would break its peg to the downside a little temporarily, which is something this network is more than used to. Buy the dip, as they say.

But what of perspectives?

When I was reading @blocktrades' description about how these conversions work... everything seemed backwards. The logic was backwards. The terms were backwards. The equations presented were backwards. Last night I was thinking about why this would be, and then it hit me.

@blocktrades was not thinking about this topic from a user's perspective. He was thinking about it as though he was the Hive blockchain himself; Putting himself in the blockchain's shoes and working from that vantage point. As a Hive Core dev, that perspective makes a lot of sense. After all, if one is programming the network and tinkering with things, we'd want them to be coming at it this way. Protect the network first and think about the users second. That's the safe way to approach these things, and I think it really shows within the given text.

I find it interesting that there are such massive differences between how I interpret HIVE >> HBD conversions vs the devs who actually built the thing approach it... even though all these interpretations inevitably lead to the same final result.

All roads lead to Rome

In any collateralized loan based system, we tend to think about the collateral first. Not only is this not the case in the above description, but the conversion itself is not even thought of at a loan at all, but rather as a point of sale. The language of the code itself describes it as a trade rather than a loan. While I lean toward this perspective being semantically inaccurate, again it all makes sense why it would happen this way.

Who is @blocktrades? Both a person and a company really. And that company has humble beginnings as a lesser known exchange. All exchanges are basically arbitrage factories, and they allow one asset to be traded for another on the books. It's not a surprise why HIVE >> HBD conversions would be framed in that same narrative.

So while I'm looking for logic that starts with the collateral and moves from there, what I'm given is logic that starts with the loan and works backwards, which I found jarring at first. Honestly looking at it right now it still does not logically flow in muh brain. Thinking about it in way is totally foreign to me considering how much research I've done on collateralized loans, in addition to actually using them.

For me the most logical flow starts with the collateral. We find the value of that collateral, and then draw() a loan from it based on that estimated value. The official description starts with the HBD "purchase" and then calculates a "collateral price" for that HBD, with a "final price" to be calculated 3.5 days later. I find this odd because the user never chooses how much HBD they want to borrow and the network calculates that for them after the fact. It all has a definitively reverse-engineered feeling to it.

From my point of view this "final price" is actually a forced liquidation of collateral, which is very common in both centralized and decentralized margin trading and loan architecture. Again I find it weirdly interesting that my perspective on this topic is basically the polar opposite of the explanation given. No wonder why I had such a hard time understanding it.

Conclusion

Polarized perspectives can surprisingly lead to the same final result.

I'm done talking about conversions for at least 12 months.

No more.

Posted Using LeoFinance Beta

We'll see...

lol what are we seeing?

the last bit of not talking about it?

Yeah, 12 whole months of not talking about HBD conversions over 5 or 6 blog posts a week plus comments... I'm, ah, not confident.

It's a nice problem to have because I would only break this 'promise' if HBD is spiking out of control while making money hand over foot.

Median out of 84 numbers is the 42nd and 43rd after you sort it from largest to smallest and then minimum of the 2?

No sorry the minimum of all 84 hourly averages.

So basically the lowest price recorded over the last 84 hours.

That’s very nice. So minimum of the (median hourly price)

Yeah I think the most confusing part of understanding this is that the number used to calculate the

final_priceHive cost of the HBD isn't just a median average... it's a median average of list of median averages. It's a weird two dimensional nested average which isn't explicitly stated. It's also a bit weird to think that the hourly averages get aggregated over 1200 blocks of data and then those 1200 blocks of data basically get trashed to save disk-space and RAM.What’s the source of the price data? Is that vulnerable for hacking attack? (Corrupt the price data)

Ah the source is the witness feed.

https://peakd.com/me/witnesses

So yeah the people who run Hive could hack the data quite easily, but it would be painfully obvious and they'd lose their position as a consensus witness, basically losing all reputation and all the block rewards. Of all possible attack vectors this is the one I'm worried the least about.

Whale votes are several thousand times more powerful than plebeian votes. The witnesses could manipulate the price for the benefit of whales without repercussion.

Posted Using LeoFinance Beta

That is... wildly incorrect for a lot of scattered reasons.

Do the game theory on it and show me how it would actually happen.

The generic possibility of such a thing happening is pointless compared to materializing in reality.

First of all: who benefits from the scam? It's it's like 10 or 20 accounts it won't work. Too many stakeholders would oppose it. Then we have to consider that the value of Hive will collapse to zero which is a bigger loss than any possible gain from the scam. Then we have to factor in the idea that systemic failure will just lead to another hardfork were all the attackers lose their money permanently.

I'm fairly confident that the way you think this could happen absolutely 100% can not happen the way you're assuming.

I doubt that the witnesses would vote for a blatant scam.

However, if you look at the witness list, you will see that most of the witnesses are voting for the exact same HBD reward percent.

20% is a rather arbitrary number. Clearly there is a powerful force pushing this figure.

I opposed the 20% interest. I noticed that witnesses who opposed the 20% interest rate dropped in rank. Those who supported it rose. This probably happened because a few whales supported the move.

I think that 20% is unsustainable. The Ausbit HBD page says says: "HBD Marketcap is currently 5.429 % of HIVE Marketcap". If the percent jumped dramatically, I suspect that we will see the witnesses reacting in concert to the change.

If we saw a bunch of witnesses change their upvotes at a given moment; this would be indication that witnesses and whales communicate with each other.

I have heard rumors that some people on HIVE communicate with Discord Servers.

It is common for legislators to communicate before a vote. Congressional leaders usually know the vote total before a vote is taken on the house.

There are 435 members of the US House of Representatives. If you followed proceedings, you would notice that the powers-that-be pretty much always know the vote count for a piece of legislation before the vote takes place.

It is common for representatives to put off voting for a bill simply because the leaders of the house know that the legislation won't pass.

I guess that game theory suggests that it is impossible for a group of 435 representatives to communicate about a vote before a vote. But it seems to happen anyway.

There are scenarios where witnesses might manipulate the price of HIVE.

Imagine that Justin Sun bought a million HBD. Justin Sun tried to convert his million HBD in one lump transaction.

I would not be surprised to see 20 accounts reporting inaccurate figures just to cause Justin Sun grief.

I think that there is a strong argument for witnesses to counter a blatant move to manipulate either the price of HIVE or of HBD.

Again I realize that I am off base. There is no direct evidence of anyone on HIVE communicating and coordinating activity with DISCORD.

!PIZZA

I hear top witnesses and devs have a dialog on Slack.

That's where all the super secret meetings take place.

20% is not an "arbitrary" number.

In fact it might be the least arbitrary number out of all the numbers.

This is the exact same APR (or higher) as the other stable coin yields we compete with.

Yes, of course people talked about 20% off-chain.

Politics is politics.

People talk.

I mean you can think it all you want but that's not going to make it true. The only reason you believe that 20% is sustainable is that UST death-spiraled to zero. So many people blindly jumped on the "unsustainable" bandwagon after this event. Show me the math. Actually don't... because you'd just be wasting your time.

I've already done the math.

5% * 20% is a 1% drain from the Hive market cap. Obviously 1% is sustainable, and that assumes that 100% of all inflation has zero demand and is all being converted back into Hive.

As opposed to not reacting?

We WANT them to react to systemic changes within the ecosystem.

The debt cap for HBD is 30%.

Even if we were sitting at the literal haircut line that's 20% * 30% = 6%.

Again, perfectly and obviously sustainable.

Hive will obviously grow over time more than 6% year over year, and that is the literal worst-case scenario that will never happen. And again this 6% assumes that 100% of all HBD inflation lacks market demand and is all being converted.

@taskmaster4450 points out quite aptly that not only is 20% totally sustainable, but also that 20% isn't high enough to meet expected demand. We expect the demand to exceed 20% per year. Hell, if we got a single exchange listing, it would require millions of HBD just for that. Have you factored this math in? No, you are just looking at the 20% and being like, "That doesn't sound right UST collapsed must be a bad idea". "If a bank account gives you less than 1% then surely there is no way Hive could give 20%." Again, crypto defies the senses. You haven't done the math.

wHaT?

It doesn't matter if they collude and come up with a plan.

They can not execute that plan.

I have already explained why in the previous comment and refuse to talk in circles.

Conclusion

You are suffering from some kind of Murphy's Law affect.

"Whatever can go wrong will go wrong."

That's simply not how it works.

I'd give you a free pass if you hadn't been here since 2018, but you should know better.

On a technically level, Justin Sun owns us.

He bought the network, so he owns us, right?

That didn't happen.

You are applying Layer One technicalities and trying to say things are possible in theory when they are in fact impossible in the real world. You are completely discounting the idea of a Layer 0 and that the community will simply not allow these things to happen. The community will not simply roll over and die within the examples you give. You are implicitly assuming they absolutely will.

It was never possible for Justin Sun to own us, just like it is not possible that the top 20 witnesses could get away with the black-hat collusion that's being implied. It will NEVER happen. No one will EVER be able to pull off something like that and actually turn a profit. Ever.

100% of all of Hive's liquidity exists on centralized exchanges.

Trying to attack those liquidity pools is just going to get accounts frozen.

Even on the centralized side of things the plan still fails.

Just look how much money Justin Sun lost trying to pull that bullshit.

I basically doubled my stack off of his own foolhardy attack.

And now he's still engaged in a lawsuit over all the stake he stole.

It costs money to attack a chain like Hive; not the other way around.

TLDR

You haven't done the math and you haven't come up with a step by step example.

If the math is done and a step by step example is attempted, your theory falls apart.

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @yintercept, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.The biggest thing I learned from the 8000 words you've written on this over the last few days is that I no longer feel bad for not understanding it myself. This did help though. I think I now have a basic understanding of how it works and, more importantly, know where to find it if I ever want to really delve into it.

I'm with the first poster...we'll see if you can go 12 months. I'll take the under... :-)

Posted Using LeoFinance Beta

Ha only way I'm talking about it again is if Hive and HBD are spiking up so fast that the min(collateral) isn't enough. See you at 20x

Yeah seriously though this is such a seemingly simple topic that is wildly complicated in comparison to the expectation.

I agree. I tried arbitraging it once from BSC to H-E and best I can tell, I lost like 4 Hive. lol I never did figure it out exactly. Since then I've stuck with the simple stuff. If HBD breaks peg upwards, I sell any liquid I have into Hive and hope it holds serve until HBD comes back down. I don't mind getting Hive though so if it doesn't work, I don't feel bad.

10 HBD says you don't make it 12 months :P

That does seem to be the consensus.

I'm not complaining - I kind of like the deep dives. I have a different perspective as a dev, so seeing folks discuss their understanding is enlightening. Plus, since I don't have a ton of hive-dev experience, getting that extra context is always super interesting.

Hm yeah I'm like a wannabee dev.

I dabble in the stuff and have a computer science education, but have never worked as a professional.

Hopefully one of these days I'll pull my head out of my ass and build something cool.

You mentioned blokctrades... I was planning on using it for exchanging Hive and other tokens but it seems you gotta create an account to be able to use it. I don't really like that... I wish the exchange was something like a DEX...

Sure but he's running a limited liability corporation so it is what it is.

It will be interesting to see what happens when Hive does get listed on a good DEX.

I wish we had our own. Blocktardes could probably make one...

I gifted $PIZZA slices here:

@yintercept(2/5) tipped @edicted (x1)

Learn more at https://hive.pizza!

I am so glad there's seemingly such smart and wonderful individuals involved with all the complicated particulars of Hive!

Personally, i have had a really good feeling about this cryptosphere thingy and am doing my best to understand it and be involved!

Go Hive!

GO @edicted!! love your little cartoon!! ;)

Posted Using LeoFinance Beta

Thanks I appreciate that.

Although I wish I was doing so much more for this community.

Maybe one day.

I have been ignoring this for a while. Five? Years!

I guess I must turn my attention to it this weekend and see if it is profitable.

Posted Using LeoFinance Beta

At the point of no more is the beginning of another interesting episode 😉 I read from the post of @andablackwidow who cited your post on conversion which triggered him to reading and writing on same . This is to say your readers might not be totally bored on this topic , yet diversification is welcome. Hoping and waiting for your new series of articles. Keep educating us here. Thanks.

#LeoFinance