Crab Walk Consolidation

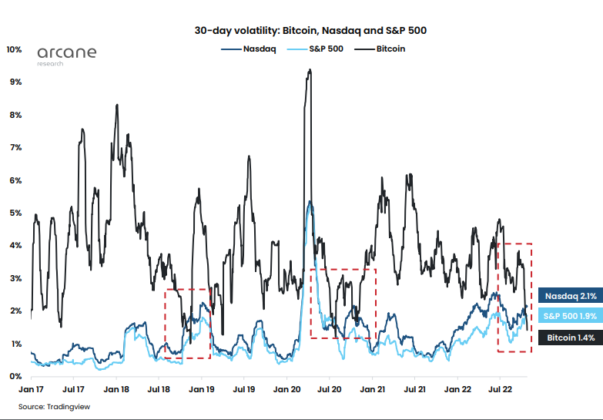

The Bitcoin market has been one of the most boring sideways crabwalks we've ever experienced. I bet if FTX never collapsed it would have been even worse, and we'd still be moving sideways around $20k instead of $18k. Sometimes people make jokes about wanting a dump just so the market is less boring, but I find Bitcoin's stability to be quite reassuring. This is the first time ever that Bitcoin has had significantly less volatility than the stock market, which is truly insane when we consider the market cap of stock indexes compared to BTC and crypto at large. For example, the market cap of the S&P 500 is over $30T. BTC is comparatively chump change and should always be more volatile as the biggest risk on asset. The fact that it is not in this moment is quite significant.

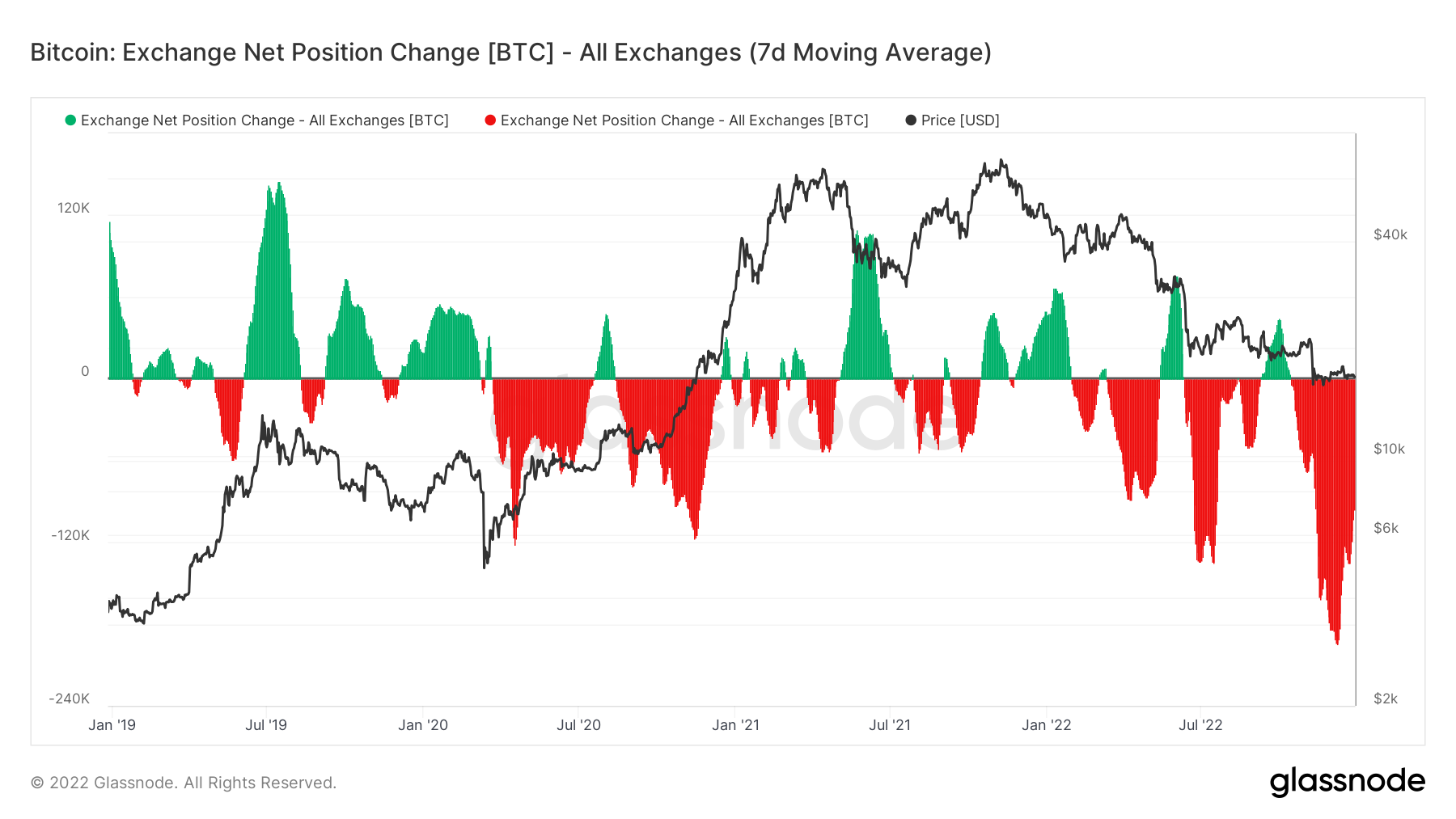

Exchange outflows at record highs.

This is to be expected because of the FTX collapse and subsequent Binance FUD. Many users have had enough of trusting centralized services and have moved to protect their assets from incompetence, hacks, insider corruption, and the like. However it is worth noting that there are still billions upon billions of dollars being stored on the exchanges. After all, without Bitcoin on the exchanges, there would be no volume, depth, or liquidity in the market. Ironically, pulling all BTC from centralized exchanges would greatly lower the value of BTC overall because of how convenient it is to have direct fiat onramps into the cryptosphere. That being said, we aren't the ones who should be taking that risk. Let the institutions and the billionaires and the bots deal with counterparties.

Shouldn't we be expecting the price to move up if BTC is being pulled off the exchanges? Not really, as the reason for pulling Bitcoin off the exchanges is purely motivated by fear and a complete lack of trust of institutions. The Bitcoin being pulled from exchanges right now wasn't going to be sold anyway. Most of it was not on the books to begin with, so pulling it off doesn't help the price go up. We can see that while there is a clear correlation between price action and inflow/outflow from exchanges, we'll never be able to guess whether that will cause the price to go up or down.

The best example of this was when BTC tapped $30k after spiking to all time highs in early 2021. Inflow to exchanges was massive and the price did go down a bit, but then six months later we were back at all time highs once again.

We can also see a massive amount of BTC exiting exchanges right before the TERRA LUNA blowup but the price just continued to crash regardless. There is really very little rhyme or reason as to what will happen next, but it does feel nice that we are at record-breaking outflows regardless of what that means for the price moving forward.

Personally I think we will crabwalk for a few more months.

This bear market has left a very bad taste in everyone's mouth and crypto users are salty as hell. Until the Binance and Tether FUD fade into vapor retail is not going to change sentiment. We need multiple months of boring before retail concludes that nothing else is going to happen and this is a good point to leg back in.

Unfortunately we can see that smart money has been capitalizing on this fear the entire time. Steady hands have been DCA buying this entire time, which is why the market is so stable. Responsible buyers are out here propping the price up at the current level and allowing anyone and everyone to sell the bottom if they so desire. Volume levels show that once again, a record breaking amount of wealth has traded hands during this bear market. Those who sold the bottom will FOMO back in when they realize what a mistake they made. My guess is when BTC holds above $20k for a few weeks is when everyone begins to panic that they went bearish at the exactly wrong time.

Identifying bear vs bull market.

It's actually pretty easy to know when it's a bear market or a bull market. Technically we should be DCA selling during the bull market and buying during the bear market, but it hardly ever works out that way (quite the opposite). In fact, if more people could actually handle this kind of fiscal responsibility, these markets would be x100 more stable in the first place. Buying the dip and selling the spike creates stability. It's when people panic while having completely unbalanced positions that price goes completely haywire, which we see is the standard rather than the statistical outlier.

We are obviously still in a bear market.

But when will it be apparent beyond any doubt that we are back in a bull market and should start DCA selling again? Clearly all time highs are a good point to look at. If BTC was trading above $70k, that's obviously a bull market. Considering the doubling curve will be at that level in six months it's not an absurd target to wait for. Getting greedy and waiting for $100k could end up being a big mistake. We've got to ask ourselves how many other laser eyes will be making that exact same move. Trading with the herd never ends up in our favor.

The next bull run probably isn't going to be a bull run at all. More like a big bounce that once again gets crippled by a complete failure of the legacy economy. History shows that the bottom isn't in until the FED's fund rate is back at 0%, and even then we have to wait 6 months for that to cycle through the economy. The herd impatiently waits for the very beginning of the pivot, so we should expect a bull trap during that time. If history rhymes, this should happen sometime around the summer. It will be even more pronounced if Ripple magically wins their lawsuit with the SEC by that time (many are hoping for summary judgement in March/April). It's quite possible that BTC could get back into the $50k-$70k range only to retest $20k-$30k while the legacy economy is experiencing a deflationary super cycle caused by a seemingly purposeful war being waged against "inflation".

What about Hive?

Hive is clearly in that phase of low volume in which each 1% move on BTC can create x5 that gain or loss on Hive. I'm willing to defend 25 cents but can't really justify entering here because my portfolio is so wildly overextended already. What I really need to be doing right now is get as much BTC as I can and prepare for 2023 being the year of the maximalist. BTC holders suffered a lot of imagined losses during the last bull run when all the DEFI projects were making x100 gains. Now that most of those tokens have crashed to zero it's about time for BTC to shine. Let's be honest, it's been years since BTC was the best place to put our money. I'm expecting 2023 to be a period of gloating from this toxic group of hypocrites. That's fine, let them have their fun. Remember that the only purpose of BTC is a small niche: the highest security chain of crypto. Looking at the current environment, security is in short supply at the moment. This will only last so long before the alt market boots back up again.

It's very hard to juggle an asset like Hive because I don't necessarily buy it because it's a good financial decision. I buy it and hold it because I want more voting power and reputation within the only community that I actually care about what happens to it. That makes it difficult to create an even spread that actually making financial sense. However, I think political purchases (rather than financial ones) will start to make more and more sense as time goes on.

However, HBD provides the perfect deal at a time like this. 20% yield on a stable coin used to be the standard, then UST imploded into an epic ball of flames. Now HBD and Hive stand alone, and I can certainly justify hedging my bets by stacking more HBD. Remember: a 20% year over year gain is just as good as Warren Buffet does at professional investing. All we have to do is stack HBD. It's too easy. It might be boring, but it's also the best deal available on the market for those who prefer stability over degen gambling.

What will the next bull run be fueled by?

- In 2017 the bull run was fueled by ICOs

- In 2021 the bull run was fueled by DEFI.

- In 2025 the bull run will be fueled by _____.

It looks like NOSTR is getting quite a lot of attention as a social media platform. Even Jack is coming forward to support it even though he's working on his own separate platform. I don't need to remind everyone that if the next bull run is fueled by decentralized social media, Hive will automatically go at least x100 during the next run. Perhaps even x1000 depending on how 'lucky' we get. Although I don't consider a pump and dump of epic proportions to be lucky, and would prefer a stable rise in price of x10 instead over time. Unfortunately beggars can't be choosers.

Even if something like NOSTR took the vast majority of market share of the decentralized social media bull market, Hive would still do quite well. In fact, Hive only needs to get like 1% of the attention for it to experience screaming success. I've been ignoring protocols like NOSTR until now, but I suppose I'll have to write a post on it soon enough after some cursory research. I hate to 'waste time' on the 'competition' when I know for a fact I'm going to participate in the shiny new thing, but I suppose I'm forced into it at this point.

Other possible catalysts for next bull market?

- DEFI 2.0

- Gaming

- Governance

- Security

- DEX tech

Let's be honest, DEFI 1.0 was a disaster that employed some of the worst and unsustainable practices that led to most tokens crashing to zero or near zero. DEFI 2.0 will be much more sustainable, and if they do it right, much more stable as well. Yield will still be available, and users will be able to borrow against collateral, but at the same time elasticity will exist that will increase or decrease supply based on variable demand (just like FIAT currency does to maintain stability). The value of removing fiat's monopoly on stability can not be overstated.

Gaming is going to be huge, it's just not clear when this will actually occur. It takes a massive amount of overhead to create a good game, and to date no one has created a successful template that meshes well with crypto and decentralization. A random breakthrough will occur at some point that allows players and community members to develop these games and claim ownership over their own work (likely in the form of NFTs). I look forward to it.

Governance would be a pretty interesting catalyst for a bull run, but I just feel like we are very far away from that moment in time. Hive would do quite well in this scenario as well as our distribution is simply better than most other networks, and our infrastructure of coin voting is superior to bigger networks like Bitcoin and Ethereum. We've been at this a while and would be on the front line. However, I think governance will not have its time to shine until crypto communities begin to break through to the real world and project that governance within landmasses that they actually own and control. It could be a decade before something like this comes to fruition. Be on the lookout for islands being bought by crypto communities or any other landmass. We see this happening even today, but the success of such communities is yet to be proven.

If security ends up being the catalyst for the next bull run, that puts Bitcoin squarely within an epic super cycle of worldwide adoption. And by worldwide adoption I mean banks, corporations, and governments around the world all competing for more. This would be good for everyone, as gains in BTC help all other valid networks (and non-valid ones too), however the alt market would be very stunted in this scenario and it would just be better to own Bitcoin and use those gains as leverage to get more alts after the fact. Stack them sats.

Considering 2023 will likely be the year of complete regulatory overreach, the chance that the next bull market is sparked by decentralized exchanges is quite high. 99% of all regulations will be targeting centralized exchanges, as centralized exchanges are, for all intents and purposes, banks. Regulators are perfectly adept at regulating banks, which will increase the value of decentralized exchanges by orders of magnitude. Networks like ThorChain and possibly even ragtag new networks like MorphSwap could make massive x1000 gains.

Conclusion

We are in the boring sideways phase of the bear market. Calls for $10k were obviously overstated. We are trading at rock bottom and even a 1% dip triggers the diamond hands to buy more. Binance and Tether FUD are complete vapor that will turn out to be nothing during the current bear market. No promises during the next one though. However, as stated, that's a problem for next time, not this time.

If we pull a repeat of 2019, 2023 is going to be the year of the maximalist, with a nice run up during the summertime. That run won't reach all time highs, but could easily go x3 from where we are now ($50k). Unfortunately this run may be doomed to be crippled by systemic failure of current debt-based infrastructure and deflationary pressure caused by the FED's crusade on 'inflation'. Try to maintain balanced positions and DCA accordingly. Easier said than done, I know.

Posted Using LeoFinance Beta

Thanks for the insightful analysis! 😊

I think there's a good chance that decentralized social media will be on the rise in the coming few years due to many of the events that we've witnessed over the past few years. It seems that censorship-resistant social media interest had reached a spike towards the beginning of 2021, but we're yet to see whether that was just a hyped-up prospect or the way of the future. I hope that it will, indeed, be our future.

I'll have my breakfast on live television if we 100x. You might be right, 2025 might be the year of decentralized social media. After all, Twitter disclosing so much shit on censorship and propaganda might push the adoption of projects such as Hive.

I don't have enough money to even care about all this but I really enjoy the way you write about it. Crabwalk seems way better than total colapse I'll give you that though

My guess now is that 2025 will be about privacy blockchain tokens. But in crypto terms 2025 is light years away 😂😂😂

100% and Hive could have privacy if witnesses would care more about :(

Let’s hope the bear market will make us rethink and evolve.

yeah!

DCA? What's that?!? lol

Posted Using LeoFinance Beta

Crabcore!

I'm keen to hear more of your thoughts on NOSTR from a Hive perspective.

The last CTT Twitter Space also had some good chat around it which is worth checking out if you missed it and can invest the time.

Posted Using LeoFinance Beta

I like crabs. And carbs

I have been trying to figure out what the next mouse trap is going to be as well to get in front of that.

I started digging into this Nostr. I'm going to have to look further into it. I saw Minds had partially integrated it but I'm not really on there anymore. They really seemed like they had flip flopped all over the place when it comes to implementing various things and how the accounts were managed.

I think there is certainly a place for DeFi with better tokenomics on chains that are fast and efficient that don't go down once a week. I was recently revisiting Telos which has their EVM implemented but it gets confusing interacting with that vs the native Telos tokens. Plus it has fallen so far in marketcap it becomes hard to recover without paying devs a lot to build stuff which can erode at the price when projects have to hire more people. Seems like all the projects somewhat suffer from that which is another reason why Proof of Work projects that are basically completed seem to remain strong despite not being capable of nearly as much. BTC, DOGE, LTC, XMR

I'm sure there will be thousands of new tokens to capture people's economic energy this next cycle.