Blockfi Aftershock

Collateral Damage

It looks like even exchanges themselves don't understand the concept of 'not your key not your crypto'. Blockfi has been the next target of FTX rolling liquidations. Apparently multiple exchanges had exposure to FTX and are now realizing their money is frozen.

Hurp a Durp.

All for what? Why would you EVER deposit money from your exchange onto another exchange and assume that is okay? I hope the 3.6% yields were worth it, BlockFi. Spoiler alert: they were not.

I'd love to go get more information for this on crypto Twitter, but my account has been suspended for "12 minutes". Of course they won't show me the Tweet that got me suspended or start the countdown timer until I give them my phone number. lol, fuck off, Musk. You're trash. I tempted to see if a proxy phone number will work. Ah whatever I have nothing better to do lets find out.

X minutes later...

Still haven't gotten it done... downloaded an app that should of worked and then it blocked the 2FA and told me to pay a subscription fee to access it. Seriously WEB2 is so fucking lame. Now I'm hearing that FTX in America is also insolvent which is why price is currently crashing again today. Cool story. Too bad I refuse to give Musk my phone number. Very stubborn right now.

Y minutes later...

Alright well Google Voice works. Got my Twitter access back and got to see the Tweet that got me suspended... it was a joke where I said "burn the witch" because...

https://twitter.com/TRHLofficial/status/1590925809694306305

I replied "Burn the witch; you saw her halloween costume; what more evidence do you need?" Because she instantly predicted that Biden's student loan forgiveness was a lie and would be repealed right after the midterm elections. Which it was. I don't know, it seems pretty thin to suspend my account for that and then demand I provide a phone number, but that's just me. Would be interesting to know if anyone even reported it, or if it was just Twitter algo bots doing their thing (huge difference). Whatevers!

Oh wait now that I've been on Twitter for a second I've noticed that they changed my 12 minute suspension into 8 hours, then I tried to retweet something and it reminded me I still can't do that and will unlock in 12 hours. lol Twitter is so done. Very sad. I wonder how much that will affect crypto seeing Twitter is where a lot of the crypto people are at.

https://twitter.com/JG_Nuke/status/1591070331988774913

It's also being reported that SBF and Gary Gensler were working on a way to create a loop-holed legal system the would burn the bridge behind FTX and make it so other exchanges could not offer the same services... so that's cool (if true). We all know the SEC are a bunch of hypocrites so no surprises there. It definitely lines up with claims SBF has made about regulation being great in conjunction with basically lying to congress and doing the exact thing he said no exchange should ever do straight to their faces.

https://twitter.com/im_goomba/status/1591039677389475841

lol...

CZ really did catalyze this... I mean it was likely always going to happen considering how leveraged long FTX was, but CZ made it happen... seemingly on purpose with no mitigation strategy in mind. People say CZ and SBF don't like each other. The evidence is thin but this really was a gut punch. Then again, CZ didn't have to announce he was going to dump all his FTT tokens. He could have just said nothing, so I appreciate the transparency... unless Binance's stake really could have all been bought back at $22 a coin... lol. Seems unlikely considering what we see coming to the surface.

https://twitter.com/Blockworks_/status/1591086026327326720

134 firms... all belly up... wows.

It's very obvious that Sam Bankman-Fried is so grossly out of his depth it's not even funny. He's committed multiple felonies and seems to think he can get out of it by saying sorry a couple times. Kid doesn't strike me as a runner. Sorry Do Kwon: no fugitive playmate for you. To be fair white-collar prison in America, and South Korean prison are... shall we say, not the same.

And that's not to say that I WANT SBF to go to jail. I don't. The prison industrial complex is a complete and utter failure when it comes to making society a better place. What I'm saying here is that regulators have been looking for someone to make an example of in crypto for a long time. Look no further, FTX serves up SBF on a silver platter. This isn't one of those situations that you just get out of because you're rich. His name might be Bankman, but he doesn't have the connections to worm his way out of this one. Then again his mom does have WEF connections so... it's gonna be interesting.

Bitcoin price targets.

It's no surprise that there's been extra downward action today. Most did not realize there was so much collateral damage on the table. Hopefully Blockfi can pull it together but... doubtful considering the brutality of this market. Today FTX has filed for chapter 11 bankruptcy and Bankman resigned. The dust is still far from settled.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

As far as Bitcoin price is concerned..

Yesterday proved that the critical resistance to break is $18k. If we can do that soon it will prove that we've been trading on rock bottom this entire time. That would be the ultimate confirmation: a V-shaped recovery in a short period of time right after one of the biggest exchanges goes belly up and unable to pay anyone back. If we get back to $20k, it will almost certainly signal the beginning of a rampaging bull market... which is why I don't really expect that to happen. #dreambig

On the bearish side we are obviously hoping to not make any lower lows. Even with more bad news trickling in this is still quite possible. At these rock-bottom levels, all the diehards have woken up and begun buying. Maximalists are thrilled to buy "FTX" Bitcoin if only as a statement to reiterate that everything else is a shitcoin. As Bitcoin continues to dip from here, demand to buy will increase exponentially.

I still believe the targets calling for $10k and even $13k are not going to be filled. What about $14k? What about $11k and $12k? The bears are drawing support lines using linear data as if Bitcoin trades linearly. It does not. Every $1000 dip from this point on will trigger a huge wave of new buyers.

Currently we are oscillating around an average price of $17k.

Not a whole lot of data here considering it's only been three days. Luckily we seem to be winding down. When we settle on $17k and trade sideways a bit, we'll hopefully pump out of that position near the New Moon on the 23rd. 12 more days of ridiculousness to go.

The bears really want USDT to crash to zero... which I find quite comical. People are saying FTX is shorting USDT. How is that possible if they are insolvent, their accounts are frozen, and they just declared bankruptcy? We see over and over again that bears want to believe that can make one last huge score before buying back in... yeah... good luck with that. Bitcoin is down 75% from all time highs. A clean 80% would be $13.8k. If some other ridiculously devastating event comes our way maybe we'll get that low but... I wouldn't count on it unless we can see warning signs like we did with FTX.

A little reminder about USDT.

USDT is controlled by Bitfinex.

If we buy USDT, what happens?

Price of USDT goes up.

This is bad because anyone who wants to buy next will lose money.

The price must be brought down.

How?

USDT must be dumped on the market.

But think about how many USDT markets there are.

Dozens... possibly hundreds.

Across dozens of exchanges.

So if Bitfinex needs to arb USDT across hundreds of pairings and dozens of exchanges... how is that done exactly? Are they going to reactively wait for the price to change on some random exchange, send USDT to that exchange, then dump USDT on the market to balance the price out? Uh no... obviously that is a slow and shitty way to do it. It makes the stable coin worse.

So you know what's way smarter?

You print the money out of thin air. It doesn't need to be backed by dollars in a bank because, guess what? Bitfinex is the one who owns the USDT they just printed. They can't go insolvent because they are the owners of the token and the token isn't in circulation yet.

So then they transfer the USDT out to every single exchange they want to arbitrage. They can print billions of tokens; doesn't really matter. Those tokens aren't in circulation. What matters is that when Tether breaks to the upside the USDT is available immediately to be dumped on the market for whatever it's paired to.

On the other side of this equation, every time the USDT is dumped for the other asset, guess what? Bitfinex is essentially going long on that asset without the proper USD reserves. Thus, they need to find another market they can dump that asset on (not the one they just extracted it from) to get actual USD in a bank so that they have the reserves to match the USDT they just issued.

The point here is that people think it is such a simple thing. "Your stable-coin should be backed 1:1 with dollars in a bank." LoL, really? Have you tried to accomplish that? Have you even thought about what that entails? It's way harder than it sounds, especially when you have to trust some other fractional reserve bank to remain solvent so the peg can be maintained on demand.

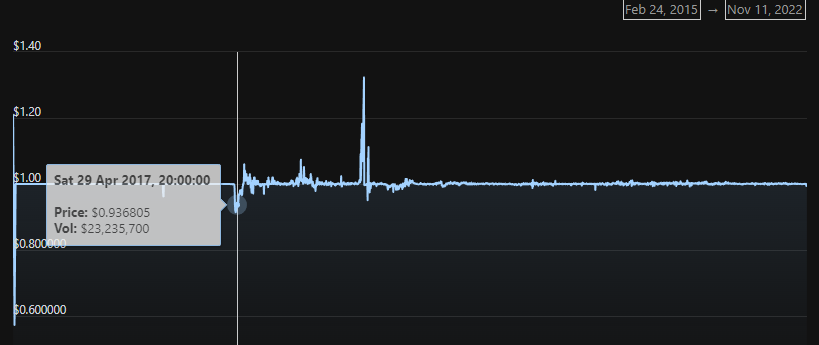

So when the FUDsters are running around telling you USDT is about to crash to zero... do you believe them? Look at the graph: the recent "dip" in price is barely visible. Even when they lost access to their funds in 2017 it only fell to 93 cents and swiftly recovered.

And if you ask people why these fluctuations happen, they will say it's because Bitfinex is running a fractional reserve and "printing money out of thin air". They aren't. This is basic logic. If they print money out of thin air and dump the market the peg breaks to the downward direction. This is the same as going long, if the market crashes they owe back more collateral the USDT they issued.

On the flip side of USDT breaking upward: is the bigger problem of breaking downward. Guess how Bitfinex stabilizes USDT to the downside? They have to have reserves on standby to buy up the USDT when sub $1. Either that or they have to take dollars out of the bank... buy Bitcoin (or another collateral) then dump the Bitcoin on the market to get the same effect. This is how everyone expects them to do it, but it's much slower and a worse user experience. A worse user experience means less trust and less adoption. Ironically: playing by the rules of 1:1 backing makes a stable-coin not that great.

Bitfinex can't go insolvent.

Even if Bitfinex only had 50% of their collateral stored in dollars, a bank run would not wipe them out (actual banks only have 20%). In reality it is likely much higher than that... more like 70%... 80%... 90% or even 95%. People don't care. They don't think about what it actually takes to make a stable coin work. They want a 1:1 peg and they want 1:1 stability and 1:1 collateral backing and instant gratification with none of the drawbacks of any of those strategies. It's delusional thinking peppered with entitlement and naivety.

I think I'm done ranting about stable-coins.

HBD forever.

Do you know why big players like Binance and Bitfinex are more inclined to play by the rules and not gamble with customer funds? Because that's a risky/illegal strategy and they are already at the top. They've cornered the market. Getting greedy at that point is just a liability that allows their competitors to overthrow them.

The 'magic' of crypto and DEFI was that it facilitated all these random exchanges to pop up offering yield that Bitfinex and Binance could not provide (because they are the risk-averse incumbents). So FTX and Luna and friends started offering these completely unsustainable "perks" to their userbase to try and lure them away from the big boys.

Now we see how the story has ended; in the complete obliteration of the riskier business models. This is what will ALWAYS happen within crypto because it is so exponentially volatile. Increasing risk is never a viable long-term strat. You're bound to get caught with your pants down sooner or later, and it only takes one fuckup to be wiped off the board forever.

Conclusion

Don't listen to anyone who says Bitfinex or Binance is next. They are doing just fine. That is completely irrational overemotional FUD that would never even be tolerated if FTX hadn't just imploded. Not your key, not your crypto. I can't believe this is a lesson that even centralized exchanges learned this time around. Don't store customer funds on another platform. Duh. Seriously though.

Still plenty of drama in the days to come. Again, we are hoping for the dust to somewhat settle a week from now. $17k is the average price. $18k is the critical resistance. $20k is the ultimate victory and confirmation of rock-bottom. $15500 is the new local low and $13800 is a full 80% retracement from peak. Here's to a V-shaped recovery.

Posted Using LeoFinance Beta

$15k, $13k, it doesn't even matter. It's gonna take some time to recover and that's it. Somehow the halving date is still relevant for the Bitcoin cycles even if the cut in mining rewards is no longer that impactful.

I'm glad Google Voice worked out for you even if they still aren't letting you interact with the platform. If you take the time to remember it, that Google Voice number will come in handy for a lot of different uses.

Posted Using LeoFinance Beta

PURGE!

I really enjoyed your stable-coin ranting, cheers! 😊

Posted Using LeoFinance Beta

A week ago, I was almost sure that the price of 13000 would not be. But perhaps I was wrong.

Binance? Next? Some people don't understand what it means to control the most volume in crypto space.

Posted Using LeoFinance Beta

Not only next but it's implied to be like this month... lol

such knee jerk cowardly reactions.

Hmmm. Twitter wants me to pay again...

Welp. Fuck em. I'll just use some tweet context as content, and get paid.

And if case nobody figured it out, that's how you 'full' twitter, for free.

https://twitter.com/1415155663131402240/status/1591322411013926913

https://twitter.com/494429019/status/1591403534423322627

The rewards earned on this comment will go directly to the people( @rzc24-nftbbg, @successforall ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

In short if Bitcoin goes down it will surely affect usdt because they won't some capital to buy back usdt when is more in circulation

Posted Using LeoFinance Beta