Alt Market Strong; Maximalism WRong

Whelp... $$$

Bitcoin is still at $55k but Ethereum is murdering it.

Continuing to push all time highs.

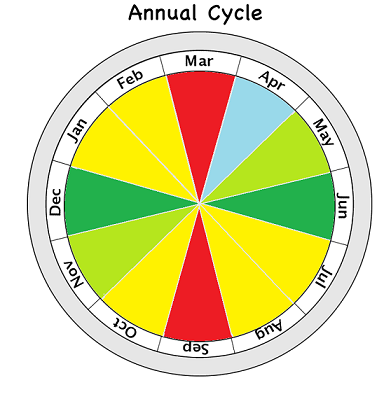

Again, if patterns from 2017 somehow repeat this time around ETH should flip BTC at the end of the year, signaling a full on bear-market meltdown and the peak of this mega-bubble run.

Another Flippening I'm looking out for is XRP.

Again, if XRP hits the #2 rank (maybe even #3 at this point) this could also signal the beginning of the end.

Even BNB could flip ETH at this point. There are no rules. However, ETH has a huge advantage over BNB in that it has been 100% officially deemed "not a security" by the SEC and already has institutional adoption trickling in.

The chance that BNB gets that kind of green light is extremely low. I think it's pretty obvious that BNB is more of a Stock 2.0 than an actual decentralized crypto, and that's fine. CZ knows what he's doing and BNB is one of (if not the best) consistently performing asset out there with actual fundamental development.

Great time to buy BTC

Even though alts are outperforming and BTC is losing dominance, it's still the smartest and safest thing to buy on multiple levels. No network has higher security or decentralization. The naysayers can grasp at straws all they want:

BTC is becoming more centralized: corporations own it all.

That's a laughable statement. First of all the centralized custodians of Bitcoin don't actually own the Bitcoin. They are just holding it for their clients. They are bound by the laws of the legacy economy. "Not your keys not your crypto," only applies to Bitcoin governance. According to the legacy economy ownership works much differently. Ignoring that fact would be a huge blindspot.

Secondly it is extremely ignorant to make the claim that BTC is becoming more centralized when new players are entering the space and buying a ton from whales. The whales are selling a tiny bit of their stacks into corporate sharks. That's literally the definition of decentralization. Bigger stack flowing into smaller stacks: duh.

Out of gas?

Within four hours, @deathwing was able to create a Hive >> BSC bridge for those who've run out of gas. There is currently no frontend for this service, so if you need gas on BSC all you have to do is send at least 20 Hive to @bscbridge with your MetaMask (or whatever) public-key as the memo.

This comes with a 2.5% fee (pretty steep on a relative scale) but it avoids the need to circumvent the IP block imposed by Binance against Americans and other countries, and you can do it directly from your Hive account.

This bridge isn't good for larger amounts, as the bot has significantly less than 1 BNB on it at the moment. If you send too much money or there are any errors it will simply send your Hive back to you.

CUB developments have been delayed and delayed again. ERC20 >> BEP20 Bridge coming sooner™. Kingdoms should also come around but the recent upgrade to pancake swap adds an extra complication.

On the frontend, many people use an interface called React in combination with JavaScript. I've been thinking about doing some React tutorials so I can create better frontends for my own projects. Maybe one of these days I'll take a job from Khal.

April is coming to a close, and it can't get here soon enough. I'm ready to say "I told you so" when May comes around and everything is once again breaching all time highs. Hopefully Litecoin gets there as well as I have many friends who are all in on it from back in the day (DCA down to $60 a coin).

There are so many developments going on it's impossible to keep up.

Hive Hard Fork 25

So I found out recently that RC pool technology will be coming out shortly (weeks) after HF25. Apparently this technology does not require a hardfork (softfork) and can be added retroactively after HF25 goes into effect.

This kinda blew my mind for two reasons. The first is that RC pools are a more important upgrade than any of the consensus rules are are changing in HF25, and all of the consensus rules that we are changing in HF25 are huge upgrades. RC pools will allow us to scale and fix the exploitation that occurs with account onboarding and delegations (especially during mega-bubble spikes). No one will be able to Sybil attack the network by farming accounts for 10HP delegations like they did in 2017. Huge huge upgrade: it increases scalability and onboarding exponentially.

The second reason why I'm baffled by this development is that I don't understand how implementing RC pools is a soft fork. I just assumed that organizing our resources like this would conflict with the previous system, but I guess not. Perhaps @blocktrades could jump in and explain it because I think that's pretty interesting. Ah well any Hive dev will do there are a lot of competent people around here.

HF25 Recap:

- HIVE >> HBD conversions (5% tax)

- Increasing HBD yield farming and limiting to savings accounts.

- Removing the convergent curve (x2 rewards for comments).

- Modifying competitive curation to flat-rate kickback.

- RC pools.

The list just keeps getting better.

RC pools will come weeks after the actual hardfork but we can still include it for all intents and purposes. In fact it's better that it will be added after the fact to reduce complications of HF25. We are changing quite a bit.

When it really comes down to it on paper this appears to be our best hardfork of all time by a huge margin. Definitely looking forward to it. RC pools are a huge deal and most people have no idea why.

Hive DEFI

By fully separating our bandwidth resource from our monetary resource, we fix a lot of problems. On top of that, we also create another way to yield farm on Hive. Everyone with a lot of HP will theoretically be able to sell their RCs to anyone that needs them, or simply donate them to a project they want to support. It's a "free" replenishing resource that has a lot of value. The more valuable RCs become, the higher Hive tokens will spike in price. People love DEFI farming and passive income.

This probably sounds stupid at the moment, but it will make way more sense when bandwidth on this network is actually a scarce resource. Our current max blocksize is 65KB, meaning we have a maximum bandwidth of 22KB/sec.

We run this entire network on 56k modem speeds and we make bold claims about how scalable we are. Pretty funny honestly. One popular dapp later the entire blockchain will be full and running a node will start getting expensive. Good thing our devs seem to be really good at optimizing costs.

It's easy for witnesses to just "raise the blocksize" but doing so makes nodes much more expensive to maintain. The higher our blocksize, the more nodes will drop out due to prohibitive overhead costs and the more centralized we become. We have to walk this tightrope very carefully or risk pushing devs out that would have otherwise brought a lot of value to the network.

Conclusion

This mega-bull run is far from over, no matter what the newbies who've never experienced a standard 30% retracement say. Developments are rolling in from every angle, and sooner or later price is going to reflect that. In fact, prices are going to get so high you had all better DCA the top so you can defend the bottom when it hits. It's our job to stabilize the network, not buy lambos. You aint rich till the bear market is over, and the bull market has only just begun.

Posted Using LeoFinance Beta

Great information posting about crypto

what is DCA?

and what is the problem with lambos i want one.

Posted Using LeoFinance Beta

It means Dollar Cost Average... and it basically means to continually purchase crypto at small amounts (ie, every pay cycle) so that price volatility doesn't affect you as much. You can DCA in and DCA out of a coin (buy regularly or sell regularly), and as long as it's trending consistently you'll be fine. It's definitely the least risky way to purchase or sell an asset.

Thanks a lot some term in english technical financial are new for me, but we are learning a lot in leo finance.

Posted Using LeoFinance Beta

Unfortunately there are lots of acronyms in both finance and blockchain... but luckily someone should always be around to help.

The problem is nobody wants to join Hive.

Posted Using LeoFinance Beta

And what will you say in 9 months when so many people want to use this network that we can't accommodate them?

Again, Hive is an operating system. You wouldn't say "nobody wants to join Windows". "Nobody wants to join Linux!" Ah well they would if the OS had a dapp that people were using. One dapp later and we completely run out bandwidth.

Do you really believe this or just want your bags to be worth something?

My bags are worth a small fortune already I don't care about the money.

lol

Posted Using LeoFinance Beta

Hive has the ability to award content creators ~just by creating content. Maybe you're used to it, but that is mind blowing for a lot of people. A killer app is begging to be created.

Or better said, not much faces lately. Hope dies the last.

Posted Using LeoFinance Beta

So why are u here? We just need a few million out of 7 billion, don't worry

True.

Posted Using LeoFinance Beta

Everyone wants their Cake and to eat it too.

If Pancake could do such numbers, Rune hasn’t even started yet

Probably yes.

But it's only because of 2 points.

If you have an app, you pay twice at the moment. For the onboarding and for an advertisement to get the user.

For example, you pay for a customer 2$ on average to create an account (it's good and cheap), but on hive you pay again Rcs or Hive for the onboarding process.

I have the opinion a hive wallet should cost 0,1 Hive or less ( 10 cents should be in general a good deal, maybe with a daily limit to see how it works). 3 Hive is pretty random and expensive (Rcs in general expensive too).

An innovative app needs to focus on the app first and should use hive because of its benefits. I think a longer way needs to go before it happens, but I expect it will happen, otherwise, I don't would be here :)

RC pools are a cool step to fund apps first place with "solar energy". So they can run their app with no upfront cost, maybe with a token as an exchange or something like that. Like defi. A cool marketplace would be needed, but lets see what happens :)

Posted Using LeoFinance Beta

ETH getting the no.1 spot will be epic... if it occurs of course. I have many times said that I don't believe we're near the top and it's just because we haven't had FOMO yet. We need at least a month of that and then I'll start DCA my way out. The epic phase is not yet. Some have used the odds better than others so far, but the big stake hasn't been served yet.

Posted Using LeoFinance Beta

That bridge is such a huge deal for everyone in the US who hasn't managed to get around the BNB purchase issue. Well done @deathwing (excellent handle by the way). I'm holding some liquid BNB purely for speculation purposes... but I'm now considering sending it all to CubDeFi just for forever funzies.

I'm not good at React but I kind of love it... but you should definitely get great at Javascript beforehand (which I did not do and am filled with mega regret).

Bring on May!

I still can’t understand why XRP holds the number 2 spot. They sold out long ago and frankly never developed the system for it’s true purpose; fungible p2p user generated crypto credit lines.

Posted Using LeoFinance Beta

It's the perfect metric for irrational speculation and greed.

I don't think resource credits are actually part of consensus at all, so any changes to it are a soft fork. It's just that all of the witness nodes enforce them and won't let transactions into a block unless the account has enough RC. If you run a witness node and disable resource credits then you should be able to include transactions into a block from accounts that don't have enough RC for those transactions and it will still be considered a valid block and valid transactions. The idea is that if you are doing this then you would presumably lose witness votes and not be able to make many more blocks.

The other witnesses would flag this block as a bad-block and reverse it I assume,

which again leads to a scenario of losing witness votes.

But again if this was the case that means the witness is breaking consensus.

So I'm still curious as to how this actually works.

Considering what happened when we booted up RCs I have to assume you're correct.

We all had negative RCs which would have been impossible with hard-enforced consensus.

No, since RCs are not part of consensus, this would be a perfectly valid block and would be included on the blockchain just like any other block. It really wouldn't create much of a problem either, the block size is limited anyway so at worst some accounts would be able to get in some more transactions than they normally would have been able to in any blocks created by that witness - which is a function of the amount of witness votes they have.

interesting and good to know.

Posted Using LeoFinance Beta

Witnesses can reject a consensus-valid block if they want, and it's still a soft fork. From a consensus perspective it looks the same as the situation where a block is received too late due to network delays and gets ignored.

The only thing witnesses can't do with a soft fork is accept a consensus-invalid block.

what's with the 5%tax for hive to hbd conversion?

is that to stop manipulation of the price or something?

Posted Using LeoFinance Beta

Yeah the idea behind the tax is that we want to add friction to this process so that it can't be exploited.

Ideally, we want users to be trading HBD and Hive on the open market, not using these failsafes whenever it suits them.

By creating a 5 cent buffer ($1.00 - $1.05) there's a lot of wiggle room to continue trading and providing liquidity to the free-market.

Well the RC pools are news to me. I do think it might help with the RC issue incase we have a large influx of users. So if we participate in the RC pools, does this mean our voting value will not be affected?

I don't think XRP will ever reach rank 2 but who knows since the market is so unpredictable.

Posted Using LeoFinance Beta

XRP already reached rank 2 in 2017 and it can easily do it again:

signaling the market has gone full greed full bubble.

I remember when people on hive were so desperate of the lack of movement they were saying that this cycle institutions won't fomo into alts, just buy bitcoin.

Alright

yeah that was hilarious

funny thing is this alt-market just getting started

I liked this article, since I am entering the world of cryptocurrencies, and also trading, good information as placed

IF ethereum takes #2

the whole system will shift.

Maybe Ethereum should catch

BTC at $100k now we are entering

the moon market.

XRP still not convince

I think #doge has more chance to reach $1 before

all this happen. I am saying.

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.Any word on when the next hardfork is planned?

Posted Using LeoFinance Beta

— blocktrades.

...

That's great! Thanks for letting me know.

Posted Using LeoFinance Beta

Upvoted and reblogged! Thanks for all the great info.

I can't use and don't need that "bridge" service mentioned, but I think it's a good thing the free market is providing these workarounds and pathways that are in demand. I hope to see a LOT more of that. We need to stop waiting for corporate solutions and just build things from scratch. "Crypto is going to be so cool when it's ready, just wait".... yeah I've heard that for literally 10+ years now. Let's get things WORKING. People willing to do a particular service/conversion should be commended. And if the fee is a bit high, well, somebody else will come along and do it for a little cheaper.

very informative article! being a newbie in the crypto world, I learned a ton of useful information! can you be more specific about 2017 and what happened there? Also, do you have any forecast or predictions about ADA? Do you think it is more stable than the XRP and BNB? HIVE is the way to go IMO!!!

In 2017 and 2013 we had mega-bubbles.

Seems to happen every four years from the bitcoin halving event.

Steem/Hive was valued so high that a 'hacker' started farming thousands of new accounts and upvoting himself with the 15 coin delegations. It made onboarding new users near impossible. We should solve that problem next time around.

One feature of the coming hardfork you forgot to list is recurrent payments. Also, if things go well, we will additionally have a stablecoin that really acts as a stablecoin, with all the possibilities this opens up.

And Pancake is up 20,000 % now ....

christ

Give me until next Friday.

many sexy things shortterm. More sexy things longterm.

And RC pools will be version one IMO. Version 2 will be smart Rcs for better distribution for power users that pays for the transactions for their app users.

Will be a big thing.

Posted Using LeoFinance Beta

Smart RCs? Better distribution for power users?

I think "version 1" actually is version 2.

Perhaps you could explain more.

The entity in charge of the pool gets to decide how much access each user has.

Therefore, theoretically anyone could pay the pool owner for increased access.

hmmm wait, I remember something only one account (creator) has access to the pool? The parameters I remember were not for power user RC spreading.

If more you can spread it out with easy control against abuse. Maybe I remember something wrong.

Do you have any source on how they should work? I remember something, but not sure it's the up-to-date plan.

Here's how I think it's supposed to work:

At the beginning, everyone will have their own RC pool based on how much HP they have powered up. This is the system we have already. The extra functionality comes because we'll be able to delegate our RCs to other pools, so technically dapps could pay users to delegate RCs to their pool should they need them.

The owner of every pool has 100% access to that pool. However, they can give other accounts access after the upgrade. This access can be limited in any way the owner sees fit.

For example.

I have a lot of RCs in my pool, so I start letting other people use it. I can choose who and who is allowed to use my pool, and I can choose how much of the pool they are allowed to spend. The super cool thing here is that I could give 1000 people 1% access to the pool. So on average each user will use far less than 1% of the pool, but those who need more can use more. This allows me to allocate x10 more resources to ten times the number of users. If my RCs run out everyone using the pool will be shit out of luck and need to wait for recharge or find another pool to draw from.

If you run out of RCs you could just change the rules so that users only have access to 0.5% of the pool or even less... or you could target users that habitually drain everything and cut their bandwidth individually.

OK that would be really cool.

I remember something like in maximum 3 pools per wallet and other things ( because doesn't require Hardfork to do).

If the version would be like this with a good UI, it would be nice.

Can be a yield farm thing at the end. Delegate and earn XYZ token for it. Really cool thing and unique :D

BTC will reopen the bullish recently.

Posted Using LeoFinance Beta

Here we go again

Posted Using LeoFinance Beta