Infos dropout + TA + Books + Macro Overview

I just want share random stuffs, mostly about macro or investments that I have been gathering while studying/learning. As some might know, I love macro, wouldn't be doing anything if not read that, lol.

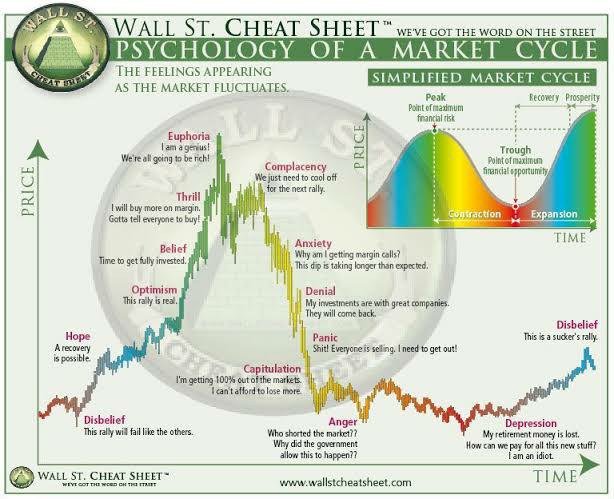

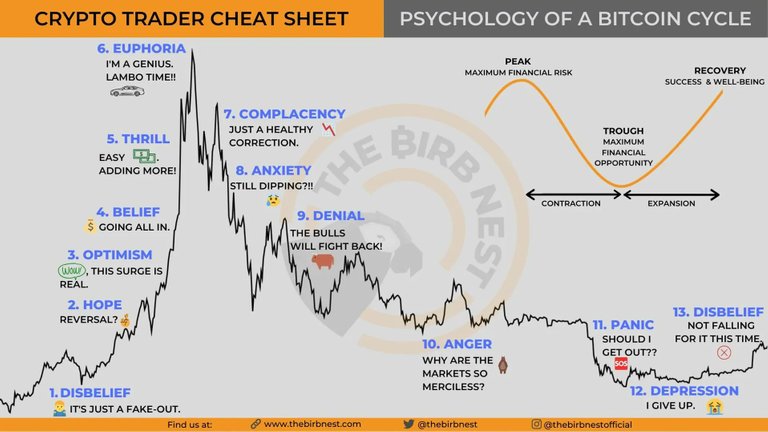

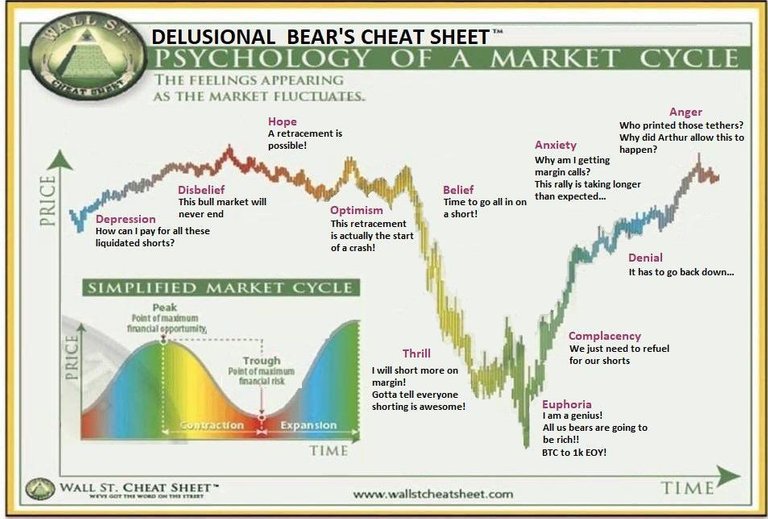

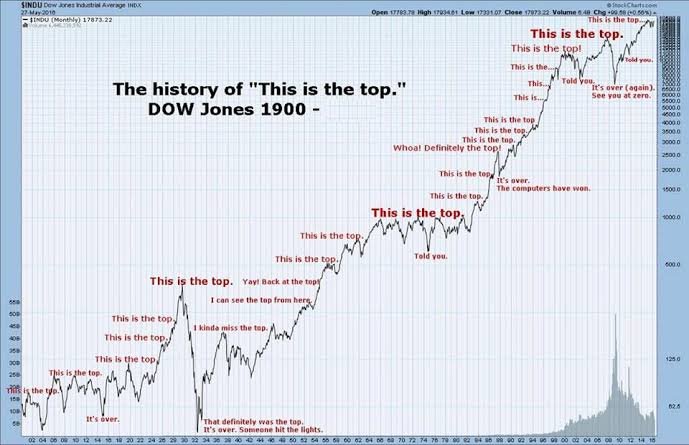

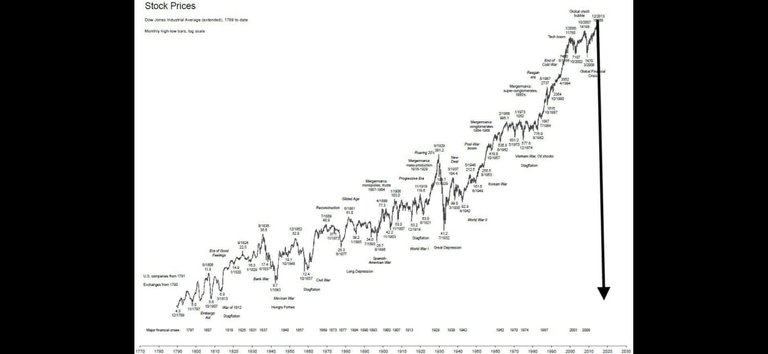

This tryies to take in consideration the dow theory and its interesting, normally used to lecture the S&P. People should check to have some notion about cycles, macro psychology, to deal with natural biological reactions, and yah know, stay cool.

Some of us will overtrade and learn, I would just recommend to lower the hand until you learn or prototype this before. Many things we ponderate a lot before saying to not influence bad decisions (even with the "nothing is advice" bs), I mean, we got talk about lower your risk, if you are not a "pro" trader that can scalp in 1 min with 20x to 100x on futures contracts / or options and their Black-Scholes / Greeks friends (thats crazy to me). So, as all this turn much into a gamble, I prefer consistent long term strats where I don't need to check stuff all the time, and can keep compounding on time/ sleeping well. So, pool revenues comes exactly from lending to this market where many ngmi, using lots of levarege. We need the Consistency... Talking on general market, since hive is a friendlier environiment, liquidity is directed mostly to swap finality.

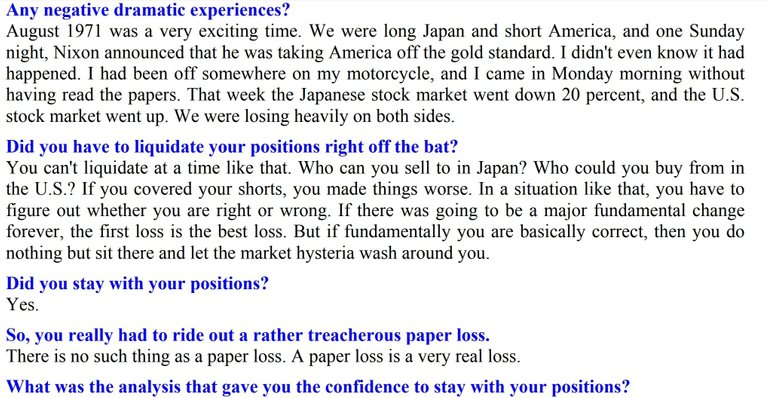

But would also recommend people to learn the Wyckoff Method, based on Jesse Livermore trader and J.P. Morgan banker. There is also the book from Livermore, "Reminiscences of a Stock Operator", its really interesting. And there is some difference from Investors and Traders, I would also recommend "Market Wizards" books, they gather interviews from big players, is very informative knowledge. Or if you are more conservative and interested in value / accountings (thats the language), there is "The Intelligent Investor" and "Security Analysis" both from Granham,

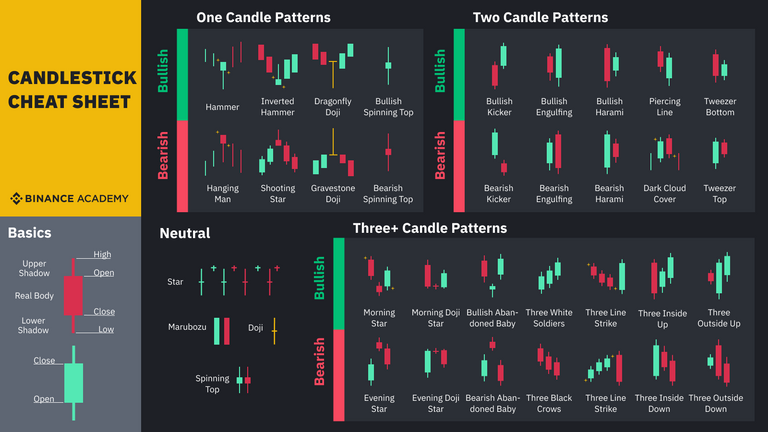

This is like the invertional of that for trick/cheat your own brain, like changing bar candles colors from green to red, Idk if this makes sense at all.

People also use the fear / greedy index to watch temperament, but I have no idea from where they get info, and each time I don't trust up moon only sources like yahoo finance or mootley fool that doesn't talk much about macro context. I ignore lots of things and try to take a confluence of factors to interpret...

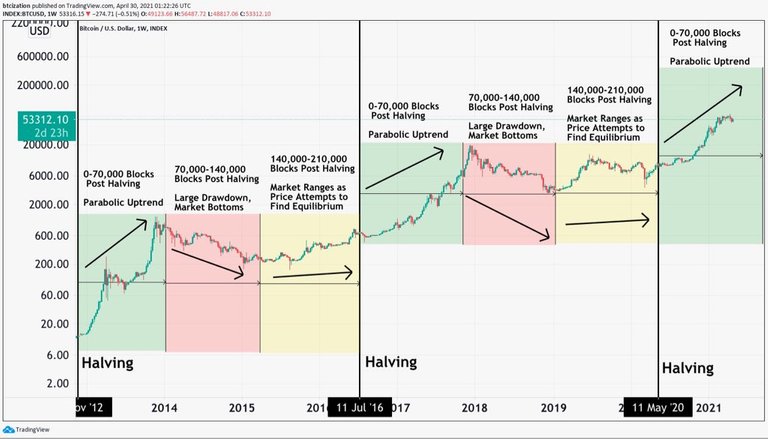

This halving scale makes sense, supply and demand, I mean the price scale is also weird at the same time, but I don't think others charts similar like stock to flow was invalidated, its still on range, but I think he missed the target or whatever, Idk if its astrology.

Setup

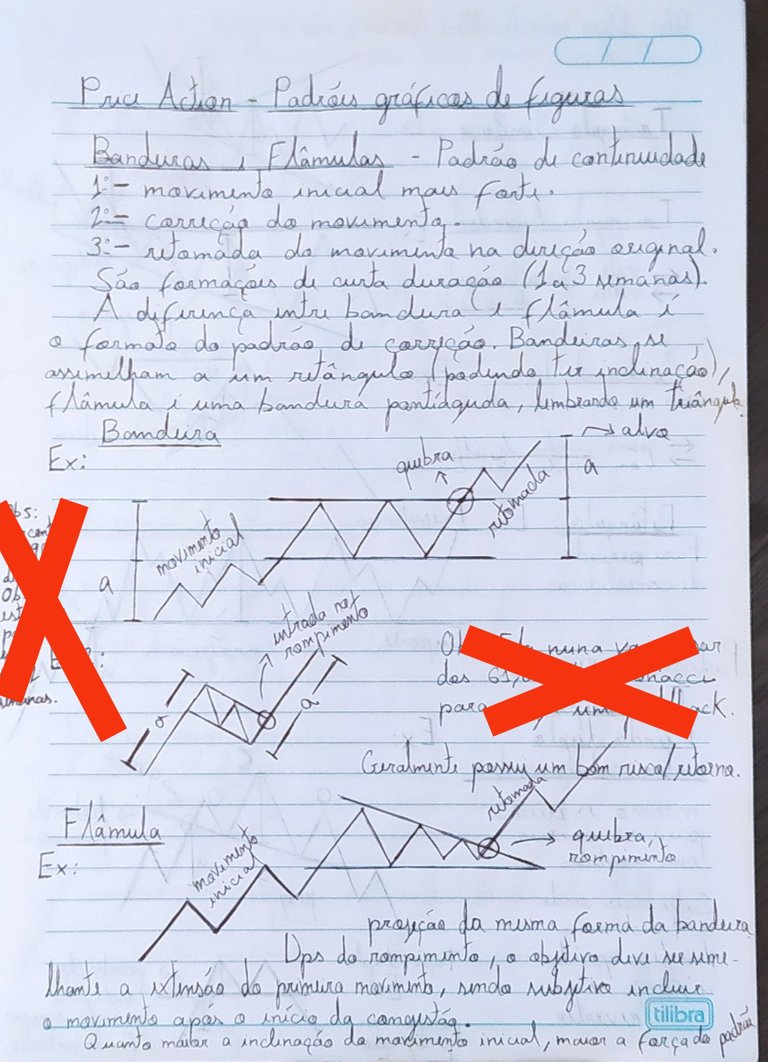

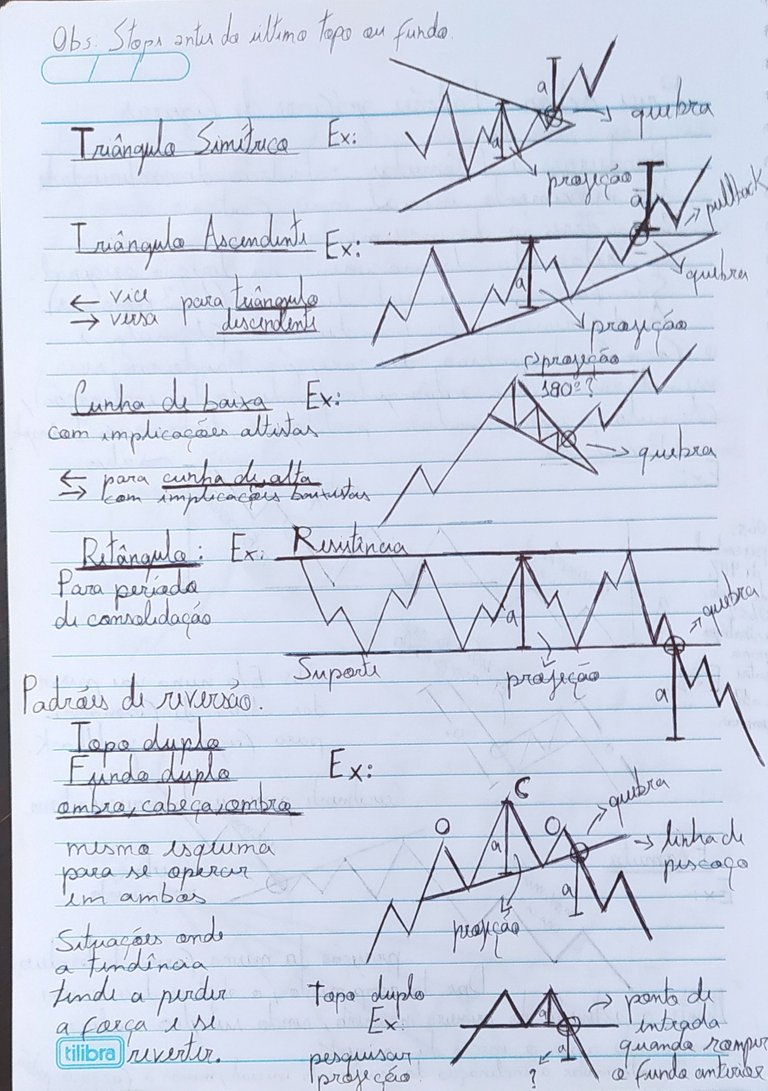

Why I like using RSI + Fibonacci. I like others stuffs, like long term time frame price action, tape reading and figure patterns. I do use MA200. I would regulate RSI overtrended zones to bellow 20 and above 80.

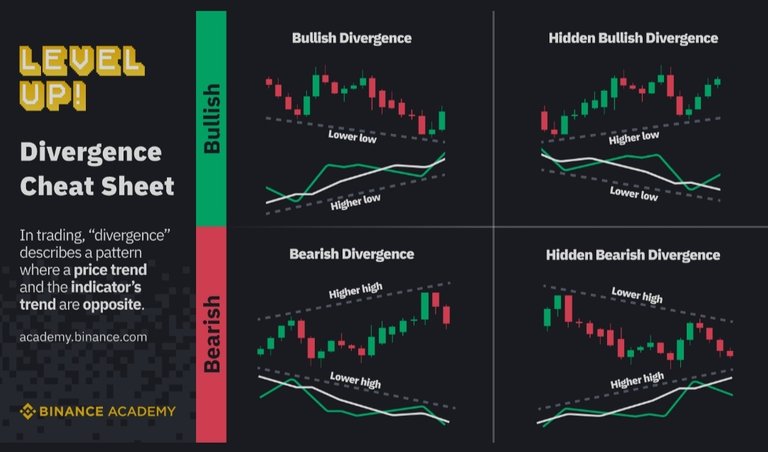

Regular and hidden divergences

Candle Reading

X = not sure infos. Be glad to use my own TA material, couldn't find much globed images on figure patterns lol.

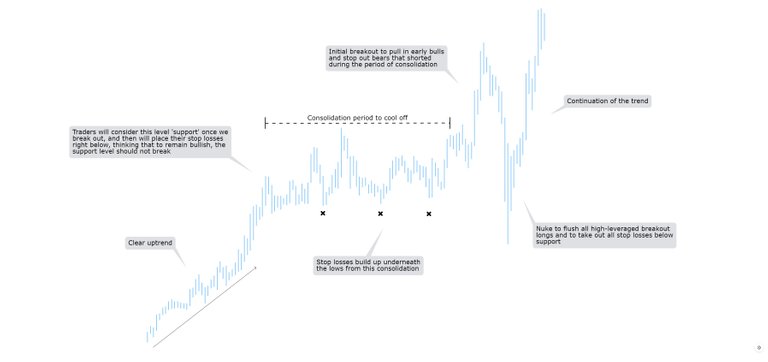

This is about false break outs, lots of mommentum divergence indicators deal with it, but you can scoope out your time frame to long term like 1W or 1M to take the noise out.

I don't even operate short term like that anymore, Im more like a holder fuck everything else mentality, just go farm and let the divs do the reinvestment work. Im trying to create others sources of incomes in/outside market... But I would watch macro interests rates cycles and then wait recession to buy cheap value or growth stocks.

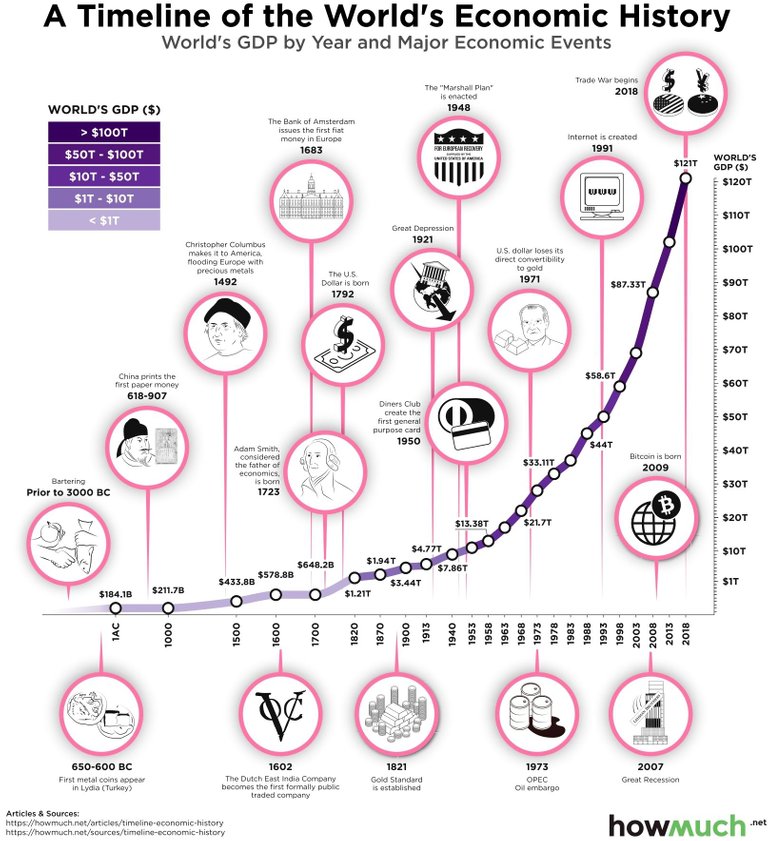

Plus Random Historical Macro Stuff

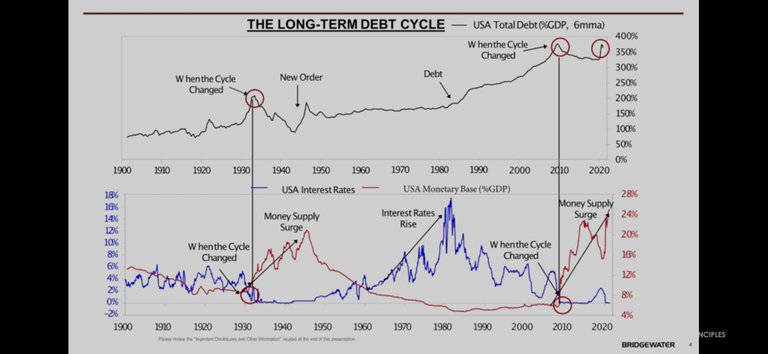

This looks more like some Ray Dalio's view on credit and debt cycles, his youtube channel and podcasts are really good.

That must be some fun joke somewhere.

???

Books stuffs... Dropouts

(Besides thoses mentioned above)

Wow, I would recommend people a lot to read "The Richest Man in Babylon", it uses some coloquial language, but is very nice once you get used and for personal mentality on income generation sources, habits, views.

Ed. Seykota's book "Trading Tribe" is also good for market mentality... Its more like a therapy session, lol. He was the dude that did the first large escale trading system with algorithms, based on trend following, his interview on Market Wizards is really interesting.

Books like "The Art of War" and "The Book of Five Rings" (from Mushashi), I thought the philosofical part to be nice, but its totally bullshit used on market, where it looks like its some carnivore behavior kind, because the books its also a real manual for war, while I don't think its like that, market for me is a reflection of civilization, so real gdp per capta is growing through history, level of life, techs, all cause we tend to evolute and can also be trying to help each others, cooperating. We can have differents people that don't have the abundance mentality where a lot is created all the time and turn more into an individual assumption of disputes. I think its clear that you are competing only with yourself...

However I really liked some others books like "Think and Grow Rich" from Napoleon Hill about law of attraction, or talkers like Bob Proctor, trying to gather some common mentality.

Einstein said:

"Everything is energy and that’s all there is to it. Match the frequency of the reality you want and you cannot help but get that reality. It can be no other way. This is not philosophy. This is physics".

Anyone can have any impression of anything to be good or not that they gonna be right, cause there will always be both sides in anything. So depends more on your own what impressions = results you want. By instinct this looks right to me.

(Im a fucking "skeptical deist" lol, bored to read Nietzsche or Dawkins delusions again, I don't think Darwin was that boring, but didn't read his stuffs yet. Im most into sci / rpg / romance fictions to pass time, whatever [go read "The Silmarillion"]. Would like to read some others 10 books on the line or so yet, but am kinda lazy now. Some about options, stocks, some more technical stuff... We get a lot of digested infos on youtube or articles).

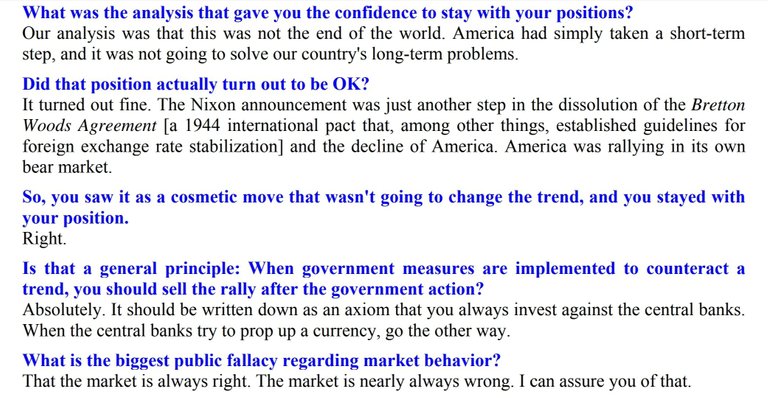

Some part from Market Wizards that took my atention. (For anyone interested, or just skip it...)

Macro Overview on S&P

Ok, lets talk the obvious here, this was already looking like an exaustion movement after all that inflated from 2020 to 2022, and there is a lot of confluence with the quantitative easing used. So, this last correction is also correlated to macro fiscal policies for deflation, the tappering and rise of interests rates. And a lot of net unrealized profits, too much money on the table. Macro tape reading for me is tough to compare with historical data, but mommentum indicators were showing divergences and now into the bearish trend zone. So, Im not even 2 years on the market, still a newbie, never saw a recession, Am trying to observe a lot and getting practice xp, I think it can still get more volatil due to derivatives, the lockdown crash was very fast for ex, some says it already precified the recession, but I don't know if deflation is over. Even though its due to opec supply shocks. So, its a time to reavaliate my understandment. And yah know, trying to relax, I expect hive/splinterlands to behave independently... Time to farm. People can make money during thoses cycles too, with hedging assets or just been pacient... As said many times, its totally subjective.

Congratulations @dstampede! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next target is to reach 30 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Upvoted thanks for using the bot

Yeah, bot is nice. You must have 200IQ

!MEME

!PIZZA

!LOLZ

lolztoken.com

The Boo Boo Dolls.

Credit: reddit

@memess.curator, I sent you an $LOLZ on behalf of @dstampede

Use the !LOL or !LOLZ command to share a joke and an $LOLZ.

Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

(1/1)

Credit: cmmemes

Earn Crypto for your Memes @ hiveme.me!

!MEME

Credit: cmmemes

Earn Crypto for your Memes @ hiveme.me!

PIZZA Holders sent $PIZZA tips in this post's comments:

@dstampede(1/5) tipped @memess.curator (x1)

Please vote for pizza.witness!