Which companies have the most Bitcoin on their balance sheets?

The list of companies that have adopted bitcoin as a reserve asset has grown in the last year.

We've seen several companies start to consider the idea of keeping bitcoin on their balance sheets, with this happening for a

series of reasons.

Some companies cited inflation, negative interest rates and the resulting loss in value of the fiat currency as the reason, while others found Bitcoin to be a liquid and profitable asset. Some, in addition to all this, want to support the idea of empowerment and economic autonomy of individuals.

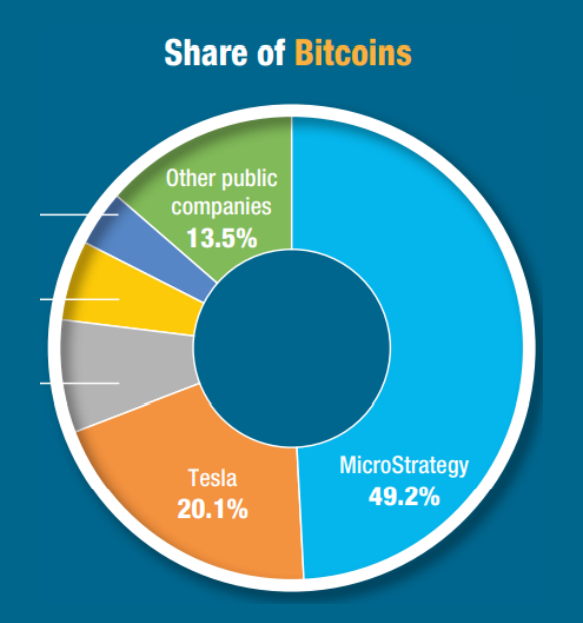

Currently, 27 publicly traded companies hold more than 208,000 bitcoins, which equates to nearly $9 billion at today's prices, according to data from CryptoTreasuries. Together, they represent 1.11% of the total bitcoin offer in circulation.

In addition to mining and blockchain companies, we have a few companies that do not conduct business related to digital assets, such as business intelligence software company MicroStrategy and electric car manufacturer Tesla.

Let's get to know the top seven publicly traded companies and how many bitcoins they hold individually.

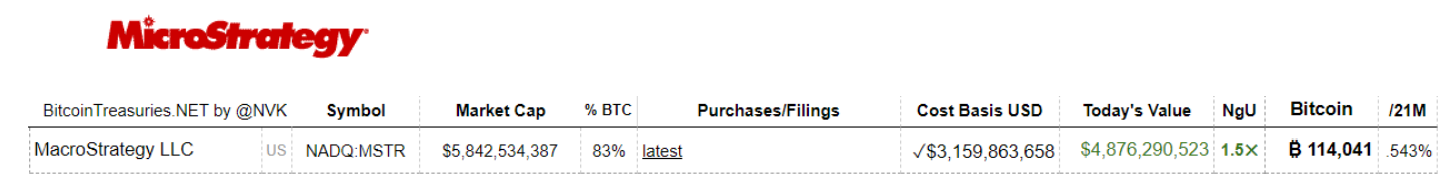

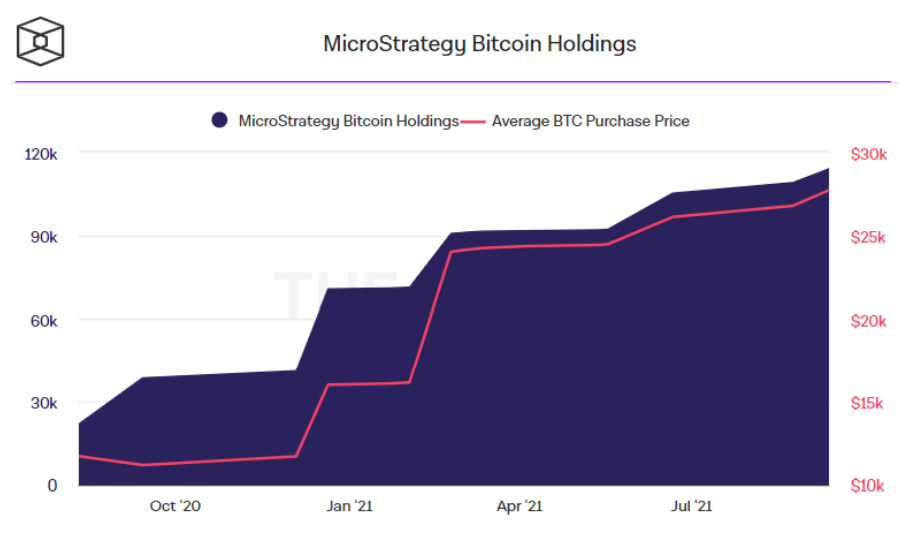

The champion company on the list is MicroStrategy (MSTR), whose CEO (Michael Saylor) has become one of the biggest Bitcoin advocates in recent years. MicroStrategy is a business intelligence platform and produces both mobile software and cloud-based services.

In early August 2020, MicroStrategy made its first investment in Bitcoin, purchasing $250 million in this asset. Since then, it has continued to acquire more and more (especially in

periods of fall in price) of cryptocurrency, making Bitcoin its main asset.

"Our investment in Bitcoin is part of our new capital allocation strategy, which aims to maximize long-term value for our shareholders." Michael J. Saylor

“This investment reflects our belief that Bitcoin, as the most widely adopted cryptocurrency in the world, is a reliable store of value and an attractive investment asset with greater long-term appreciation potential than holding cash ’’ Michael J. Saylor

On June 8, 2021, the company announced the sale of $500 million in seven-year guaranteed notes at an annual interest rate of 6.125% to finance the purchase of more bitcoins and then increased the size of the offering, as it received a larger volume of interested parties than initially offered.

MicroStrategy purchased another 5,050 bitcoins on September 13th and brought the total to 114,041 BTC.

The company has already invested $3.16 billion in bitcoin out of its total amount, which is currently valued at nearly $5 billion, at an average purchase price of $27,713.

The company has an entire section of its website dedicated to Bitcoin, and in February 2021, it hosted a Bitcoin conference (for corporations) with the goal of getting companies to stay familiar with the digital asset.

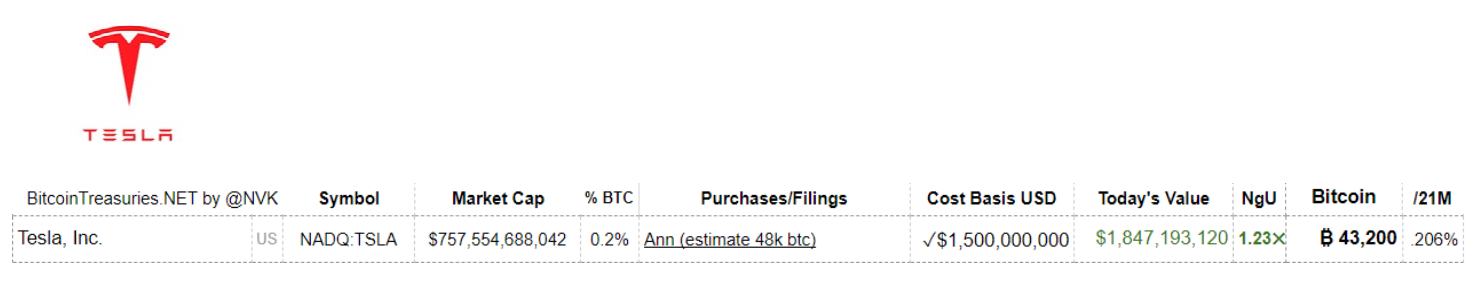

Despite the controversy surrounding its CEO, Elon Musk, another company that does not work directly with Bitcoin - but which has acquired a lot in recent months - is Tesla.

In late December 2020, Tesla (TSLA) announced that it had updated its investment policy to provide the company with more flexibility and diversity, allowing them to invest in digital assets like Bitcoin. The company then invested $1.5 billion in Bitcoin in January 2021 and said it could still acquire more, in addition to holding the asset for the long term.

Although Tesla sold part of its Bitcoin reserve (about 10%), which earned them $272 million in revenue, the company still owns more than 43,200 Bitcoins. Elon Musk recently confirmed that SpaceX also owns Bitcoin and that, as Bitcoin mining becomes greener, Tesla will likely start accepting Bitcoin as a form of payment again.

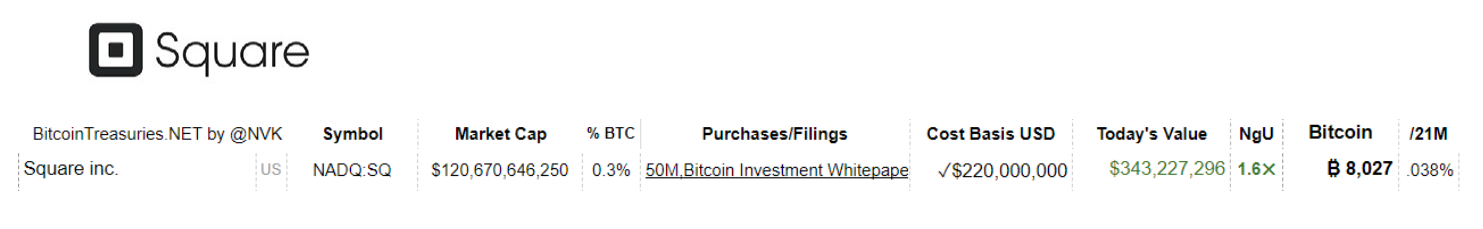

The payment companies of Twitter CEO Jack Dorsey announced in October 2020 that it would buy $50 million in bitcoin, representing an amount of 4,709 at the time of purchase.

.

Square later purchased another 3,318 bitcoin in February 2021, totaling 8,027 bitcoin, at an average price of $27,407. The total value is now $343 million.

Square has been involved in this market since 2018, when it began allowing CashApp users to buy, sell and store Bitcoin and other cryptocurrencies. Jack Dorsey is a well-known Bitcoiner and has contributed to several initiatives to expand the crypto market. He created Square Crypto, an independent team that contributes open source Bitcoin to promote the protocol.

In addition, the Cryptocurrency Open Patent Alliance was created, a non-profit organization that seeks to drive innovation and help maintain open access to cryptography-related software and inventions. More recently, Twitter has started accepting bitcoin tips between users using Lightning network technology.

"We see bitcoin as an instrument of global economic empowerment; it is a way for individuals around the world to participate in a global monetary system and secure their own financial future. This investment is an important step in fulfilling our mission."

Jack Dorsey

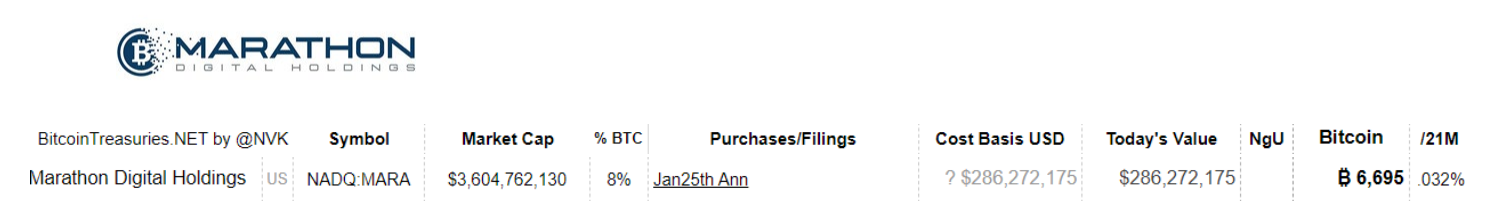

Marathon Digital Holdings (MARA) is a Bitcoin mining company that has, over time, amassed a portfolio of over 6,000 bitcoin.

The company aims to build the largest mining operation in North America, with one of the lowest energy costs. It produces just over 55 bitcoins a day with its more than 103,000

machines and represents 6.2% of the global Bitcoin hash rate.

Last year, its share price rose more than 3,000%, driven by the exodus of miners from China.

“We believe that holding some of our reserves in bitcoin will be a better long-term strategy than holding US dollars, similar to other forward-thinking companies like Microstrategy. ” Merrick Okamoto, CEO of Marathon

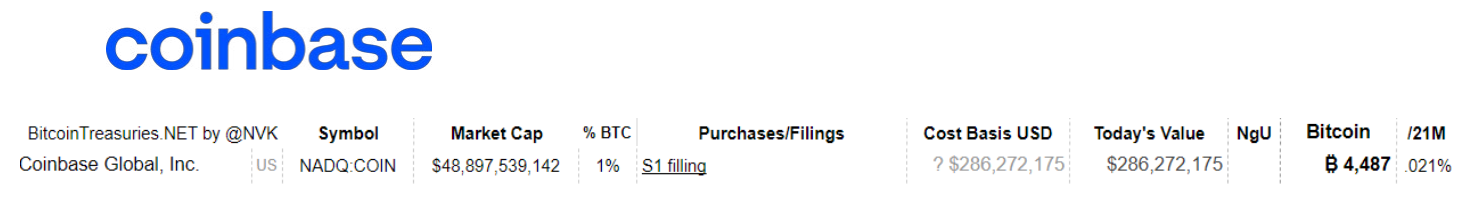

Coinbase (COIN) is one of the largest cryptocurrency exchanges in the world and the first to go public in the United States.

Coinbase's website has 56 million verified users, $335 million in quarterly trading volume and $223 billion in assets on the platform. The company has made no public statements about whether it will continue to have Bitcoin or buy more in the future.

The public listing on Nasdaq took place on April 14 of this year and, in the process, the shares in the company's cryptocurrencies were disclosed. It currently holds 4,487 bitcoin, at an updated value of about US$193,654,433.

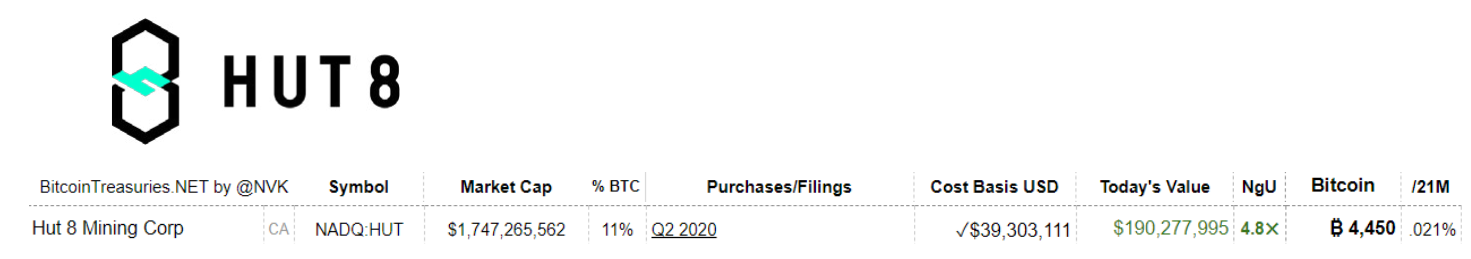

Canadian mining company Hut 8 (HUT) holds 4,450 BTC, worth $190 million, according to bitcointreasuries.org.

In June 2021, the company listed on the Nasdaq Global Select Market under the ticker HUT and intends to reach the goal of mining 5,000 BTC by the end of the year through the acquisition of new machines.

In addition, the company expects to be favored by China's crackdown, which has reduced the difficulty of mining, and by optimism that the geopolitical environment favorable to cryptocurrencies will improve.

In the next months.

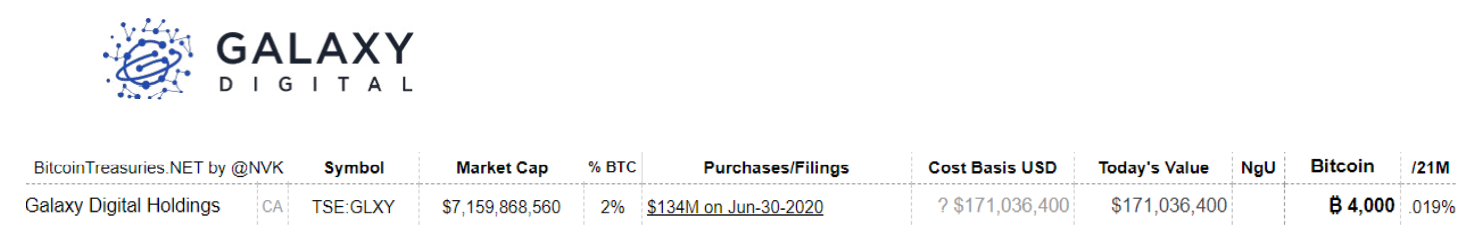

Founded in January 2018 by Michael Novogratz, a strong Bitcoin advocate, Galaxy Digital Holdings is directly active in the cryptoactives market and holds 4,000 BTC, valued at just over $171 million at current prices.

In April 2020, its controllers noted that stimulus measures announced in response to the coronavirus pandemic were generating interest in cryptocurrencies, due to aggressive economic stimuli, which flooded the economy with liquidity, causing inflation and loss of value of fiat currencies.

In total, 27 publicly traded companies have bitcoin on their balance sheets, which together amount to 208,364,6658 BTC, with a value of US$8,886,269.552.

OTHER HOLDERS OF LARGE QUANTITIES OF BITCOIN

In addition to the companies mentioned, there are still others that have bitcoin in their boxes, large investors, such as Roger Ver, Gavin Andresen, the brothers Winklevoss and Barry Silbert. Countries like Bulgaria, which reported having 213,519 BTC, Ukraine, with 46,351 and more recently El Salvador, which acquired 700 bitcoin, are other examples.

In addition, a large amount of bitcoin is held by ETFs, which acquire bitcoin to operate their funds. This is the case with Purpose, which currently has 20,221 bitcoin, Coinshares, with 69,730, and Grayscale Bitcoin Trust, which has 654,885 bitcoin.

The complete list is available on the Bitcoin Treasuries website Bitcoin Treasuries.

If a few years ago Bitcoin could be seen as too volatile or unreliable for a serious investor or a large company to acquire as a store of value, today this reality is quite different and institutional interest may increase a lot in the coming years.

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism