WHAT ARE SIDECHAINS

As they are widely known, Bitcoin network enhancement implementations are not quick and simple. Since their introduction in 2009, they usually take a long time, as they depend on consensus, due to their high degree of decentralization and security. Even if possible, some changes may not be desired because of the risk of compromising Bitcoin's strengths, especially those that impact in some way its immutability and resistance to censorship.

As a result, Bitcoin has preserved these characteristics, but at times it accommodates some innovations, even if way a little slower.

For this, off-chain solutions were developed, which allow, for example, that users have access to a different way of carrying out transactions using the cryptoactives they have. These solutions are activities done in a second layer, on top of the main one, or in a parallel blockchain.

They work as payment channels and sidechains, being able to extend the functionality and security of the main network, increasing performance and reducing costs, without innovation technical and economic is hampered.

In this article, we'll better understand how these mechanisms work, which enable more scalability for the cryptoactives.

WHAT ARE SIDECHAINS AND WHAT THEY SOLVE

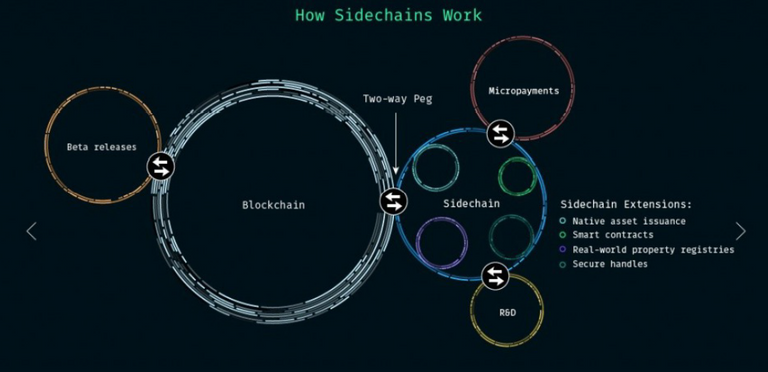

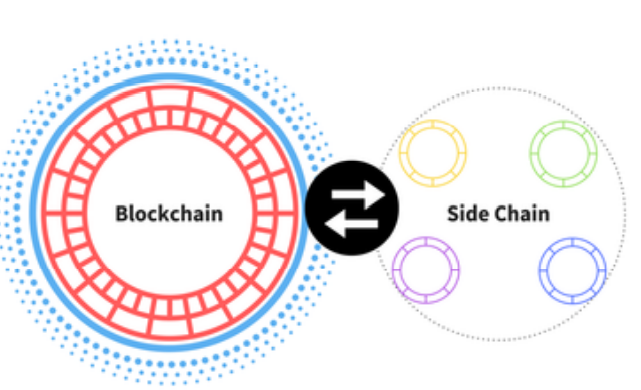

Sidechain is one of the off-chain solutions. They are a mechanism that allows tokens from a blockchain to be used securely within a separate blockchain, working in parallel with the main network (main chain) and allowing tokens to be moved between the two.

They were the first proposal to allow a blockchain to achieve almost unlimited scalability and better privacy while preserving base layer protocol security.

Furthermore, they are used by developers as platforms for experimenting with features that would otherwise require network consensus.

Despite the bidirectional transfer capability between Bitcoin and indexed sidechains, errors that occur in one sidechain do not affect the primary chain. Among the main problems it seeks to solve is that of scalability, which is the ability of a system to adapt to a growing demand.

Sidechains are interoperable, that is, tokens can transition from it to the main chain. For this, in some cases, when funds are moved, they are stored in a special address, not actually being sent, but a corresponding value.

For example, users lock some coins in the main chain and in exchange get coins in the parallel chain with their own rules, consensus and much more flexibility about how the protocol is governed.

They were the first proposal to allow a blockchain to achieve almost unlimited scalability and better privacy while preserving base layer protocol security.

Furthermore, they are used by developers as platforms for experimenting with features that would otherwise require network consensus.

Despite the bidirectional transfer capability between Bitcoin and indexed sidechains, errors that occur in one sidechain do not affect the primary chain. Among the main problems she It seeks to solve scalability, which is the ability of a system to adapt to a growing demand.

Sidechains are responsible for their own security. If there isn't enough mining power to protect a sidechain, it can be hacked. Since each sidechain is independent, if it is hacked or compromised, the damage will be contained within that chain and will not affect the main chain.

On the other hand, if the mainchain is compromised, the sidechain can still operate, but it will lose most of its value.

Sidechains need their own miners and they can be encouraged through merged mining, in which two separate cryptocurrencies, based on the same algorithm, are extracted simultaneously.

In computing, it is possible to increase the performance of a machine by improving the hardware. When it comes to a blockchain, the increase in scalability refers to your ability to process a greater amount of transactions.

If Bitcoin, for example, worked on a centralized database, it would be relatively easy for an administrator to increase speed and transfer rate, which is not the strong point of Bitcoin, precisely because it is decentralized, which makes many network participants (nodes) have to synchronize and update the blockchain copy.

If the network gets too big quickly and the blocks too big, the nodes cannot keep up with the expansion and retransmit them quickly. Thus, sidechains seek to solve this and other problems such as:

- Improve Bitcoin scalability without changing the base protocol.

- Preserve code stability.

- Maintain network consensus.

Also, it is important to note that sidechain issues do not seriously affect the mainchain. That is, side chains depend on Bitcoin, but Bitcoin does not depend on side chains.

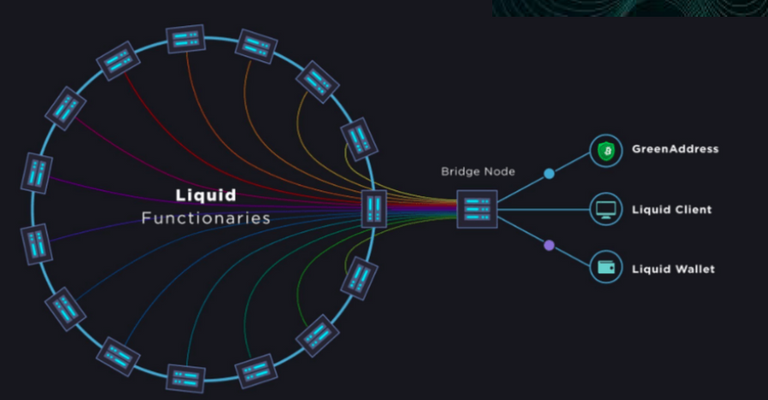

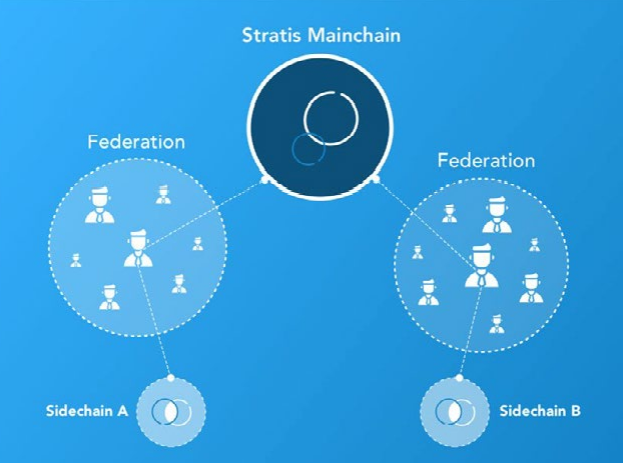

FEDERATIONS

A federation is a group that acts as an intermediary point between a mainchain and a sidechain. This group determines when the coins a user has used are locked and released.

A federated paired sidechain issues native tokens that are secured by mainchain tokens locked in an address multiple subscriptions (multi-sig). The private keys of this multi-sig are created and managed by a set. The mechanism used to lock and unlock mainchain and sidechain tokens is often called a two-way connection.

Sidechain creators can choose federation members.

Off-chain scalability refers to the ability to allow transactions to run without overloading the main blockchain. The protocols connect to the chain enabling users to send and receive funds without transactions appearing in the main chain.

They provide an environment where new features can be tested and implemented without affecting the mainchain.

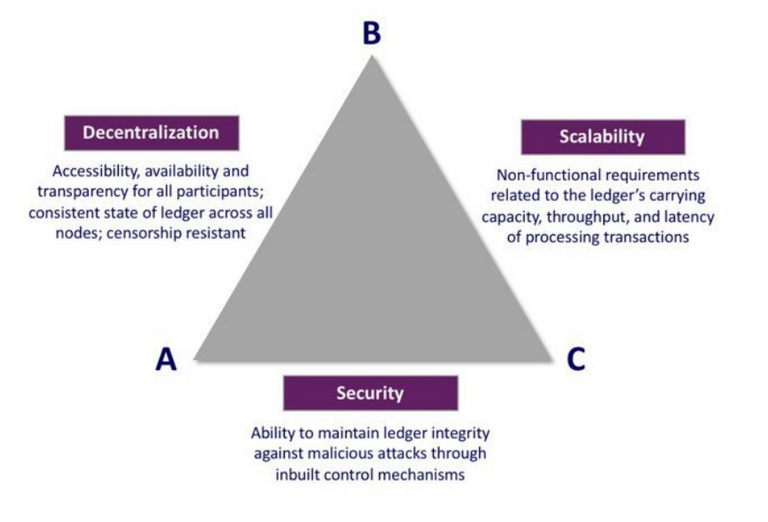

To understand why the Bitcoin blockchain is not scalable, we must understand that its security and decentralization make it unscalable. This concept is known as the scalability trilemma.

SCALABILITY TRILEMA

Ethereum creator Vitalik Buterin created the Scalability Trilemma to describe the challenge facing blockchains. In it, he says that protocols need to strike a balance between scalability, security and decentralization, but that this is currently not possible, as the third will always have poor performance.

For example, in a distributed system like the blockchain, it is possible to have decentralization and security, but the cost will always be the scalability and speed of transactions.

Therefore, off-chain solutions are seen as a way to achieve better performance, without sacrificing security and decentralization, which are maximized and prioritized in the main blockchain itself. Below we will look at some examples of off-chain solutions.

PAYMENT CHANNELS

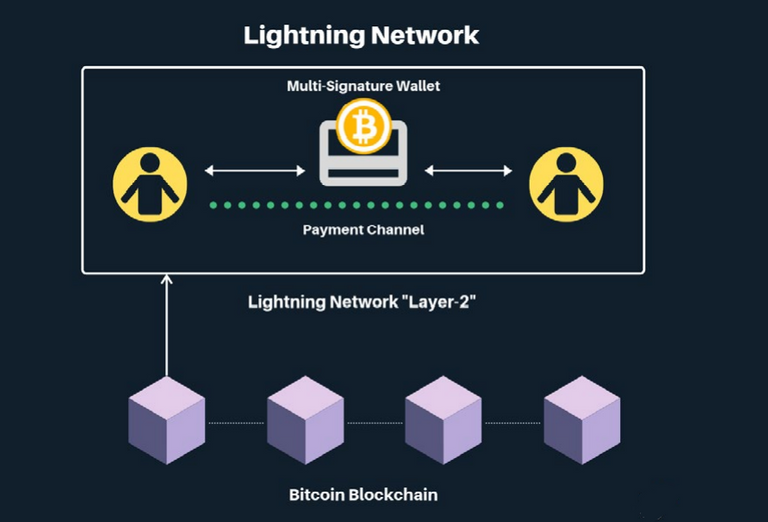

Like sidechains, they shift transactions out of the main chain to keep the blockchain from becoming congested, but unlike sidechains, they don't need a separate blockchain to function.

The best-known example is the Lightning Network, which is a second-tier micropayment network built for Bitcoin that provides two-way money transfers with near-instant speed, low rates, and protected by multi-signature locks.

This technology opens up private payment channels between a pair of nodes and all the other pairs it trades with, allowing only initial and final transactions to be transmitted over the main blockchain, meaning that far fewer transactions need to be mined, unburdening the network.

RSK - ROOTSTOCK

Launched in January 2018, the RSK sidechain allows not only transactions with faster confirmations, but also the creation of smart contracts. These smart contracts are compatible with Ethereum, that is, migration between networks is possible.

It has a bidirectional link to the Bitcoin blockchain and rewards Bitcoin miners through merged mining, which refers to the process of mining two or more cryptocurrencies at the same time, without sacrificing overall mining performance.

Basically, a miner can use its computational power to extract blocks in multiple chains simultaneously through what is known as Auxiliary Proof of Work (AuxPoW), where work done on one blockchain can be leveraged as valid work on another chain.

The blockchain that provides proof of work is called the parent blockchain, while the one that accepts it as valid is the auxiliary blockchain.

RSK's goal is to enable the Bitcoin blockchain to have smart contract capabilities and make payments much faster, thereby expanding the value and use of Bitcoin.

network. Through the RIF (RSK Infrastructure Framework) economic model, DeFi operations are protected with the unique Bitcoin hashrate.

This is currently the most secure proof-of-work based smart contract network.

The native token on the RSK sidechain is RBTC, which is pegged and represents 1:1 with the BTC. The total amount blocked in RSK's smart contracts is targeted at 1,500 Bitcoin. According to explorer RSK Mainnet, the number of accounts on the network has exceeded 50,000.

Meanwhile, RSK's net hashrate increased 78% in April, reflecting the increased involvement of Bitcoin miners. RSK-based applications processed 260,000 transactions, while the number of solutions working on the protocol has increased significantly in recent months.

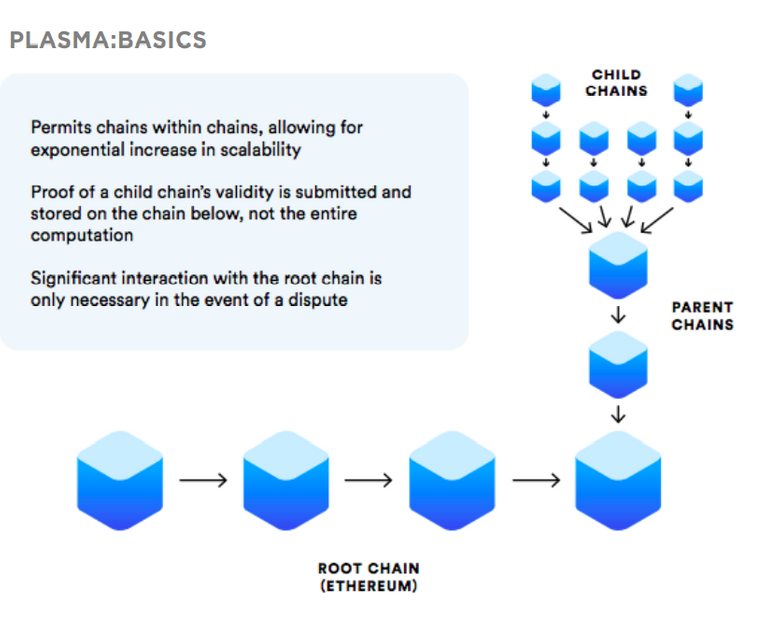

PLASMA

Plasma is the sidechain implementation for Ethereum.

It works as a framework that communicates and interacts with the main blockchain, operating as a tree that is hierarchically organized so that numerous smaller chains can be created based on the mainchain. These small chains are also known as Plasma Chains or Child Chains.

Block validation in the sidechain is done by a single operator or by consensus of a set of validators. This in itself allows for acceleration of block frequency and the maximum number of possible transactions in each, decreasing latency.

LIQUID NETWORK

Liquid is a sidechain network that can transform transactions related to exchanges and institutions much faster and more private with other members of the network.

It allows Bitcoin to be moved between the mainchain and the sidechain in a process known as peg-in, when moving BTC into the network, and peg-out when moved out. Liquid's connection and consensus are controlled by a federation.

Liquid's native token is LBTC and its supply is tied 1:1 with Bitcoin held on the mainchain.

The LBTC is created when the BTC is moved into Liquid's network and is destroyed when the BTC is moved out of the network.

There are a number of sidechains being created. It's worth researching and trying to understand the ones that are related to the main projects. Proponents of off-chain solutions believe that, over time, the main chain will only be used to settle high-value transactions or to dock/uncouple sidechains and open/close payment channels.

In addition to scaling and privacy, second-tier networks will extend the power of blockchain technology and open up new use cases that, in turn, will bring Ethereum, Bitcoin and other technologies into the hands of billions of people.