USDC On Shakey Ground

In today's edition of YIYL (You Invest, You Lose), we take a look at what basically underpins the shitcoin market and what is the killer app that keeps all these networks afloat today. Despite all the so-called "financial innovation" the main use case of these networks is moving around digital dollars.

Turning fiat, the thing we wanted to get away from with bitcoin into a faux digital alternative and creating a backed digital bearer asset has some value. The first thing is stablecoins allow for faster clearing between exchanges and individuals in a currency that they understand.

Stablecoins allow for a dispersed Euro-dollar system and today more people in countries with failing currencies have access to stablecoins. You only have to look at the volume and transfers on TRON to realise how people are using these stablecoins in different countries.

Instead of having to deal with local money changers and black market dollars, you now simply exchange value in a stablecoin you prefer like USDT or USDC.

Now I concede that this is a use case that has value, then there's the other speculative side. Where stablecoins are used to create liquidity pools between nothing coins.

Where stablecoins are used to secure borrowing nothing coins to try and execute trades.

Where stablecoins are leveraged to high hell with the idea of making a quick buck. If it wasn't for the growth of stablecoins, altcoins and their respective chains would not have the liquidity they have today, and if stablecoin markets are regulated, or banned a lot of the altcoin market would vanish.

The stablecoin giants

There are several stablecoins in the market today but only two really matter USDC and USDT that take up the bulk of the transactions and holders. These two stablecoin issuers have been at loggerheads to rule this market and feel there can only be one winner.

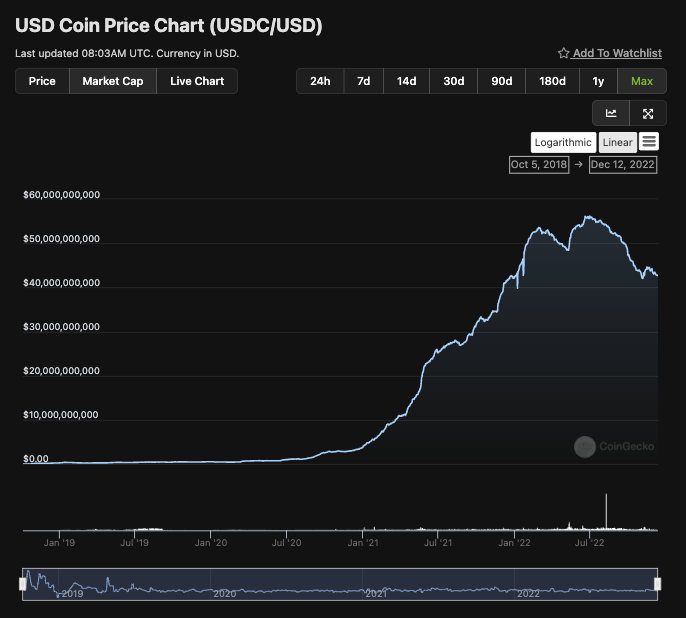

Tether has been running for longer so it naturally had the head start and continues to hold pole position, but USDC has made a good go of closing down the gap. The difference today is about 20 billion, between USDT and USDC but Circle feels there is still room to grow.

Redemptions of both USDT and USDC have been pumping of late as people just feel like it's better to get out, this is not the normie, this is institutional players, because Tether and Circle only deal with big boy deals.

USDC market cap has dropped considerably as we move into the bear market with it dropping from 55 billion to close to 40 billion.

Tether truthers and USDT users

As these blow-ups continue and redemptions on stablecoins pile up the Tether truthers begin to show up once again. They usually go quiet in bull markets and come out swinging in bear markets and its the same story, no attestations, no audits, Tether going to blow up.

Now i'm not here to defend Tether, I don't use it but it seems to be doing okay and processing redemptions, while also launching new products, so who really knows what will happen.

Tether does make money but yes the idea that we cannot look into their books lingers on

https://twitter.com/nic__carter/status/1594780412232011783

To this day Tether FUD continues

Coinbase shot at Tether

Circle is not going to lay down and let USDT have a free run at this profitable EURODOLLAR market and is actively looking to erode Tethers' growth. Coinbase is waiving the conversion fees for users who wish to switch to a "trusted stablecoin" in a new campaign that highlights the quality of reserves that back Circle-owned USD coin (USDC).

That is not to say Circle are squeaky clean, sure they've been more open with their audits but we do have rumors that Circle is constantly losing money since the company has been raising money twice per year for the last few years to pay for the ~5% incentives they offered.

https://twitter.com/CryptoInsider23/status/1542027718677504002

Another blow to Circle was Binance choosing to de-list it and offer a swap for its BUSD a move that skyrocketed the size of BUSD and took a bit of the wind out of USDC's sails.

Will it fail?

I am not saying that either Circle or Tether is going to implode tomorrow but to think that these are "safe" assets to park your money in is a massive stretch. You don't have a cooking clue what their burn rate is nor their assets to liabilities and you're only relying on the fact that the company is willing to buy back their tokens 1-1.

If the company can no longer do that, all bets are off and that doesn't just mean a stablecoin de-pegs. No it means all your liquidity pools, all your loans, all your treasuries, all your algo stablecoins are going to get taken down too.

So use that information as you see fit

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Earn Free bitcoin & shop | Earn Free Bitcoin & shop | Claim Free Bitcoin & Shop |

|---|---|---|

|  |  |

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Earn Free bitcoin & shop | Earn Free Bitcoin & shop | Claim Free Bitcoin & Shop |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta