Digital Advertising Platforms Taking A Tumble

If you were a holder of Twitter shares, you're probably smiling from ear to ear bagging that premium from the Elon takeover, especially considering the battering social media and digital advertising platforms are taking in the market of late. As the world moves out of the stay-at-home trend and we get back to meat space, trading the metaverse for personal interaction, we're seeing capital follow too.

Digital stocks were the darlings of the pandemic years with many turning to them for goods, services, and entertainment, but now that this is over, we would see a correction. A lot of fo capital that was funneling into online stores is funneling back to the remaining local stores.

We're also seeing commodity and supply chain issues affecting big business meaning they only have so much capacity, and when you can't work at full tilt, you're going to be cutting your advertising.

Meta

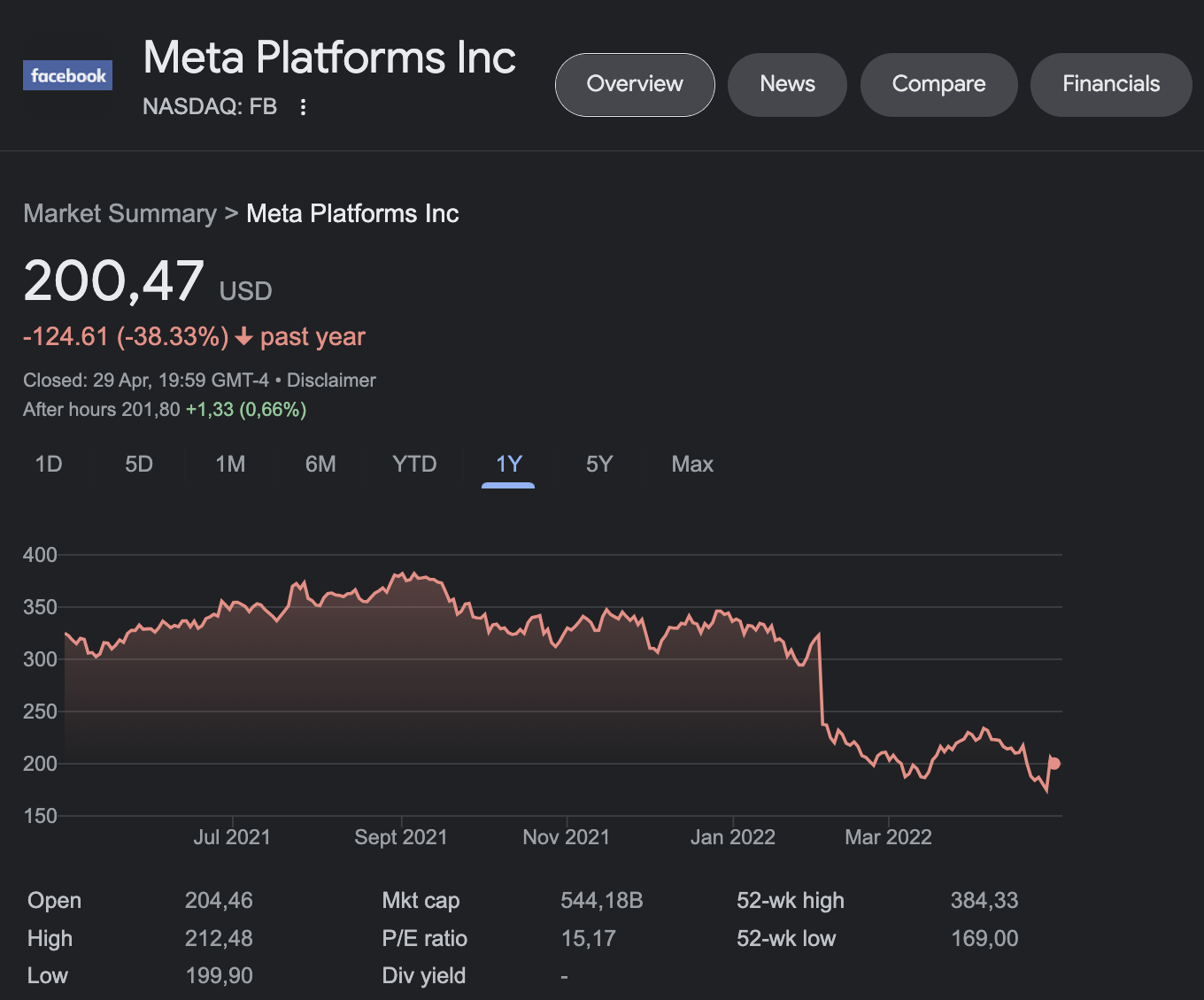

If we look at the granddaddy of social engineering online we can see that it's down 38% YTD, trading like a shitcoin if you ask me. At a PE of 15 for a tech stock, it's pretty reasonable and it could bounce back, but that doesn't mean there isn't more room for pain.

Facebook just seem out of ideas, After a failed attempt or 2 at issuing a stablecoin and now the play for metaverse, it just screams desperation for a company that hit its peak ages ago and relied on acquisitions to keep it going.

I am pretty sure if Instagram and WhatsApp didn't sell Facebook would have been way smaller than it is today and with Tiktok stealing users and time of users every day Facebook have some serious problems on its hands.

Every mom's favorite digital dream board, Pinterest, still has not found a way to properly monetise, it has traffic, and ads in certain parts of the world but has yet to roll out worldwide. Building an ad platform isn't as easy as it sounds and supporting global payments is a pain in the arse.

Yes they are still seeing growing numbers of users as they expand outside the US and ad revenue is increasing, it's still not enough to warrant a PE of 38.

If they offered a pre-paid voucher credit system and allowed you to pay with bitcoin, I think they could get a lot more paid traffic coming through their network.

Snapchat

The world's biggest dick pic app at one time has surprisingly stuck around despite competition from simping apps like onlyfans. there hasn't been much going on with Snapchat and im pretty sure Instagram and Tiktok migrating Snaps best features killed its USP ages ago.

I still think the only way out for Snap is to sell off to Facebook, and I still think it's on the cards. Facebook needs new user juice and Snap needs a better ad platform, so it makes sense to join Meta.

Alphabet

If you want to tell if advertising is drying up online look no further than Google, sure it's not as reliant on ads as Facebook's 97% reliance, but it's still a massive part of their business and it subsidizes a lot of what they do in other departments.

Ads are not only in Google search, but display networks, partner search engines, in-app ad networks, Gmail ads, and of course YouTube. Brands simply don't have the cash to fight it out for clicks online and we've seen a drop in revenue from ads with Google and YouTube, and when it's your bread and butter, shareholders tend to get worried.

Traffic needs to be repriced

Website traffic has been overvalued in the past 2 years as people were spending so much time on their hands, as the value of traffic gets repriced and eyeballs move offline, it's going to put pressure on these services.

How they innovate their way out of it is anyone's guess, but I think it's an important sector to watch in the future as a lot of people are still heavily invested in the outcome of these networks.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

Dear @chekohler , Do Hive and Steemit also depend on digital advertising revenue?

Do you think traffic 's price should be lowered?

No these sites don't effectively monetise the traffic they get, to do that because there are so many front ends and no unified method to adverise across their websites the way you can with websites attached to google display network.

Most people are here to earn, and don't want to spend money on more views, like you see on other social media. traffic gets priced dynamically based on the amount of interest and bidding for views

@chekohler , Are you a programmer who can create websites?

I have a hard time understanding your technical terminology.😅

I will try to understand your words.

Thank you!

I can build websites yes, but its' not my speciality, I used to do coding when I was younger, but at the moment I do digital marketing

@chekohler, I envy your ability to create websites. I am a beginner in learning to code now.

What is the digital marketing?😯

https://twitter.com/LeoAlpha2021/status/1522466607918116865

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

They also took some bad hit...

Posted Using LeoFinance Beta

um, okay

Sooner or later, it had to happen.

Posted Using LeoFinance Beta

Excellent round up. The pernicious increase in the belief that advertisers should care about what they advertise alongside is going to continue to destroy the business model of advertising supported content.

Local advertising will work but the big bucks of brand advertising is suffering an existential crisis caused by bowing to a woke mob.

And all along Facebook Google and others have been over counting reach.

Interesting to watch. I just hope Facebook and Google survive long enough for our court case in Australia to deliver the death blows. 😏

I think there's still enough inertia in the first world and onboarding in the 3rd world to keep revenues going, but their PEs will be compressed, why bid up a risk asset with expensive cash flows when you you can go get a value stock paying dividents or trade bonds?

I think the woke-ism has definitely started to eat into their ad model for sure, as a marketer myself, having had to use these platforms to earn a living, I can say I won't be sad to see them die, too many marketers are making a living off blasting shit in peoples eyeballs

Those Stocks have bubbled up a lot during the lockdown times, it was about time to come down, and now that markets overall have weakened, so yes, probably they will wait and bleed until you bring justice to them.

They are back to levels of 5 years ago except... Microsoft!

Posted Using LeoFinance Beta

Yes that's what it looks like, they're returning to prepandemic highs, but here's the kicker, how much monetary inflation has happened since then. So while your Facebook stock is now back in the 200 dollar range, is that the same $200 you had 5 years ago? No, you've lost out

yes exactly, I hope msft doesn't follow as it's one of my biggest positions.

I'm sure they will go even lower.

Posted Using LeoFinance Beta

i just continue DCA no matter what happens. lower prices is good as I'm still a buyer

It's your choice) ... respect!

Posted Using LeoFinance Beta

There's still way overvalued for their cash flow so yes theres room to go lower, but with no where to go for investors, I think it will get bid up again

I think that sociologists continue to work and much will depend on the mood of people in the world.

Posted Using LeoFinance Beta

In the early days of the pandemic, consumers spent more time on computer screens and did more shopping online, but their behaviors are returning to more normal patterns as Covid-19 fears wane.

Posted Using LeoFinance Beta

Lol whats the point of repeating what I say in my post?

These purchases differed from the usual reaction to advertising, it was a necessity, which gradually develops into a habit and you begin to react less to excesses.

Posted Using LeoFinance Beta

Ads play an importance roles in online business, the way I am seeing it is that, ads are the improvements that motivate an investor that, this particular firm or entity has a lot to offer and my worth given a try.

Posted Using LeoFinance Beta

Ads are their only method of monetisation, it's the reason investors buy the stock to get exposure to that cash flow, so whats your point?

Giving it out would be a good option, instead of continuing going backward

giving what out?

Wow. They are all dropping down since reliance on ads has reduced and people now getting busy in their physical business than being proactive online 😅😂.

Just thinking by the way, would the prices placed on making ads be reduced to get more people interested?

Even though they get reduced, still it doesn’t mean it would get those huge amount of views during pandemic times.

Posted using LeoFinance Mobile

Not exactly no, yes it's one of the trends, but also any interest rate increase would taper growth stocks as you discount those cash flows and people will sell off,

Yes, the bidding for ads would reduce in price somewhat depending on the demand for certain niches, it's a dynamic market but overall I think fees for clicks will decrease. That's correct you always chasing more views and not every view will convert into a click

Moldovan wineries hold their heads because of the rise in the cost of logistics, packaging and energy resources. Previously, they allowed themselves to spend a lot of money on advertising and the production of new labels, I think that the design companies that develop such products will close soon.

Posted Using LeoFinance Beta

The drying up of traffic will always see a price squeese in certain markets and leads costs will become unsustainable. I think Europe has bigger problems than online marketing right now if we look at the PPI across the region, the amount of inflation coming wont be pretty

Wait a couple more months...until August, when the grain crops are harvested...then, there will be a new countdown of a new era. India is on fire, and Ukraine is at war, I doubt that this will have a positive effect on the global economy ... famine is possible. And, hunger, this is the strongest driving force, revolutions and the like, there will be no time for marketing.

Posted Using LeoFinance Beta

This time can be called the beginning of the sieve, the cells of which will narrow.

Posted Using LeoFinance Beta

Wow. I learned a punch here. So you mean SnapChat was initially somewhat like Olyfans? Or their guidelines were just loose? Wow

Also, I don’t think Facebook is willing to buy it. I bet they’d prefer replicating those features. The fan base is something they can’t get. I know a lot of people who doesn’t use Facebook but uses Snapchat. Maybe they’d be willing to offer it a price tho.

Posted Using LeoFinance Beta

Snapchat pioneering the disappearing message so yes it was always going to be a dick pic app. Facebook offered to buy snapchat in 2013 for $3 billion, they only started to absorb the features when snapchat refused to sell.

Trying to reduce snapchat users so they can buy it at a discount

Oh yea! I got your pint now #disappearing features.

I’m sure this wouldn’t work. 😂

Nice info. I hadn’t looked at the prices for these stock’s. It makes sense that they have gone down post-covid.

I’m really curious what the next monetization strategy will be.

It probably won’t come from these big tech giants as changes usually come from the fringes or from outside.

Have you seen anything that looks like a new model?

Posted Using LeoFinance Beta

In 300 years...maybe their stock will go up)

Posted Using LeoFinance Beta

I don’t think any of them will be able to survive that long

This thought can be traced behind the scenes of my answer to you)

Posted Using LeoFinance Beta

lol

Yes, when I wrote this, a smile visited me)

Posted Using LeoFinance Beta

Well Facebook is banking on metaverse which I think is a mistake after failing with their stablecoin, as for Pinterest, they are still growing they've only recently started picking up outside the US so plenty of room to grow

Snapchat I honestly see this one being acquired

As for Google, they're banking on auto driving as their next big wave, if they can pull that off, every driverless car will have to pay google for API calls or license the software

I think those that adopt bitcoin and lightning will have a future, of which I don't see any making moves apart from Twitter

yeah, Google seems to want to integrate into everything we do. like smart homes and our cars indeed.

Google wants to become part of everything we do, just like Microsoft before it and alongside it today.

One side effect of this will be an increase in the sales of dumb devices (think Nokia before iPod came along). Dumb vehicles should hold out for a bit longer, but in their case they are being regulated to oblivion. Eventually EVs will rule the roads, but what happens when their electrical systems catch fire or their computers get bricked?

Posted Using LeoFinance Beta

well at least electric vehicles catch fire a lot less than gasoline powered ones. good battery management systems help with this along with better battery chemistry

Just a hunch on my part, but it looks as if digital ID and databases will grow in importance over the next few years. They were going to get bigger, anyway, but COVID-19 was a catalyst for much activity in these areas. Biometrics for sure will become bigger business.

If advertising monetization drop, other kinds of monetization should increase. All that's left is data and DNA.

Posted Using LeoFinance Beta

I think how often over the past six months I have relied on advertising, advertising on the Internet ... not once, the realities of our days change the picture of the world and sources that should catch our attention.

Posted Using LeoFinance Beta

Lol you're not the consensus mate, I work in marketing people have NO choice but to use these platforms to gain traffic and paying them isn't going away anytime soon

Yes, look at my comments under your post and you will stop doubting it. I feel sorry for the people who will be left without work, but, most likely, the business will cease to be interested in new marketing moves, and will develop old, spent resources, for example, they will not experiment with a new form of a ballpoint pen, but will order its old variations for their advertising.

Posted Using LeoFinance Beta

Advertising a product by yourself is not easy unless you will make use of people that's their before to help you on your Ad if you want it fast.

Posted Using LeoFinance Beta

I don't get what you're trying to say

K

Posted Using LeoFinance Beta

Wow, they all went down down down. I don't know what Alphabet is, never heard of it. But I know more and more people are leaving Facebook. Tiktok sure looks like it has taken on a lot of people... who owns that?

I personally have had problems with Facebook for a long time. It takes way too much time from people who would be better off doing things they love doing. Though it's not my place to tell someone if they should spend their free time on Social Media or not, we're all free somewhat after all

Posted Using LeoFinance Beta

LOL WTF? Alphabet is the parent company that owns Google and YouTube, how do you not know that? Yes people are leaving facebook, but where do they go? To other Facebook products, instagram and whatsapp

Bytedance owns tiktok its a chinese company and it's not public so we don't get much oversight on the data like we do these other public companies

Yeah, never bothered to check who owns youtube or google.

One, I have no stake in google.

Two, if you're about to get run over by a bus, does it matter who's driving the bus really?

Thanks for the info though.

Posted Using LeoFinance Beta

That is such a stupid analogy what’s the point you’re trying to make? Also why would you bother reading finance articles if you have no idea what it’s about

On terms of markets, when you can see or make an intelligent prediction as to which way they will go, are you worried about the parent company or moving your funds in a position of growth?

The bus analogy is perhaps too simple for you?

Let's take a car for example. Do you need to know the inner mechanics of that the engine that drives the wheels forward to learn how to drive it?

I am in no way ashamed that I did not know what Alphabet was, and by the way people can move on you know, living without a centralized social media is more than possible... people are doing it!

Posted Using LeoFinance Beta

''Snapchat

The world's biggest dick pic app" ... You are for sure one of the most fun profile. I love your sharp humor!

I can't stand Piterest, -70% well deserved.

What's your beef with pinterest? id say its one of the more solid social media sites, no drama and keeps it focused on content creation and consumption

It's one gigantic promotion and advertising page, never liked it. Do you think it's cool? Maybe I'll give it another chance.

lol and how is that different from any other social media? Maybe I’m biased but it’s been my best performing social media channel in terms of reach and traffic

That's very interesting to know! I had the opinion that there are basically only ads, Cross Promotion, and sales pitches while 0 user-generated content for consumption only.

I've never sent even a single message via snapchat. I have it for the filters though. It's literally my camera App!🥰

Posted Using LeoFinance Beta

hahaha that got me! Great to see them slowly burning.

Posted Using LeoFinance Beta