Coinbase Profitability Under Pressure

Coinbase is one of the biggest names in the cryptocurrency space, Brian Armstrong had supported bitcoin in the past, but as his company got bigger and investors got hold of him, he pivoted the company into a shitcoin casino to try and increase fees and trading on the platform.

Eventually, this lead the company to IPO on 21 April 2021, to a huge fan fair. Coinbase holds a lot of people's digital assets, it makes a fair bit of money, compared to other tech companies, it's trading in a low multiple to earnings.

What could go wrong?

More tokens would arrive, more NFTs and they'd use that to advertise on the Superbowl, Coinbase was hitting the big league. The pitch to normies was trade crypto, cheaply with a trusted custodian and get your dollars into stablecoins with us, basically a Robinhood of shitcoins.

The pitch for investors was, get bitcoin and crypto exposure via our stock, its weather proof since we can earn fees regardless of the bull or bear market. Invest in the shovel not the gold, (The gold being bitcoin in this instance)

Coinbase stock perfomance

So did Coinbase fulfill that? I don't think so As of the date of this screenshot, Coinbase is down 57% and looks like it has a lot more room to trend downward.

The stock still trades at 10 times earnings, which is not crazy for a tech stock, if we compare it to the FAANGs, but for a financial institution, which is what it is, its rather high meaning there are more forces to push this down than their is to push it up

People are price-sensitive when it comes to buying shitcoins, they go where it's cheapest so exchanges have to compete on fees, which is a race to the bottom so we'll see more fee compression overtime impacting their revenues.

In addition, if we look at their fees versus assets under management I think it's revenue of around %4 compare to a traditional bank they get around 1 - 1.25% so even as they grow their AUM, you'll see fees compress offsetting that growth.

Finally, Coinbase, unlike banks, deals with assets that can be self custodied, with networks like Liquid and Lightning making it even cheaper, it pulls more capital out of the exchange, to be used as float.

For the moment coinbase is still a profitable company, but the way things are trending, seems like that won't last for another year and that's going to be an interesting turn on the narrative.

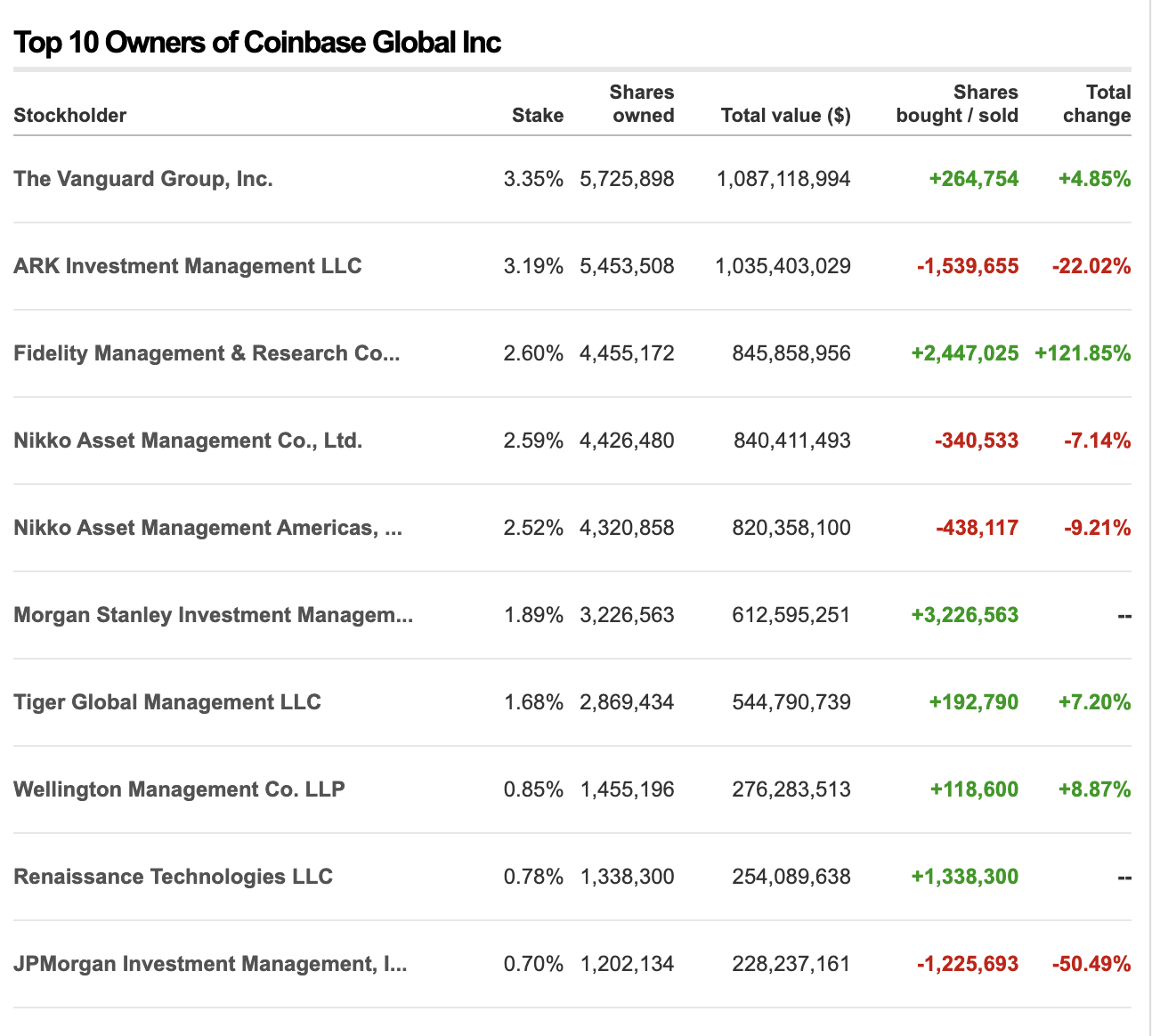

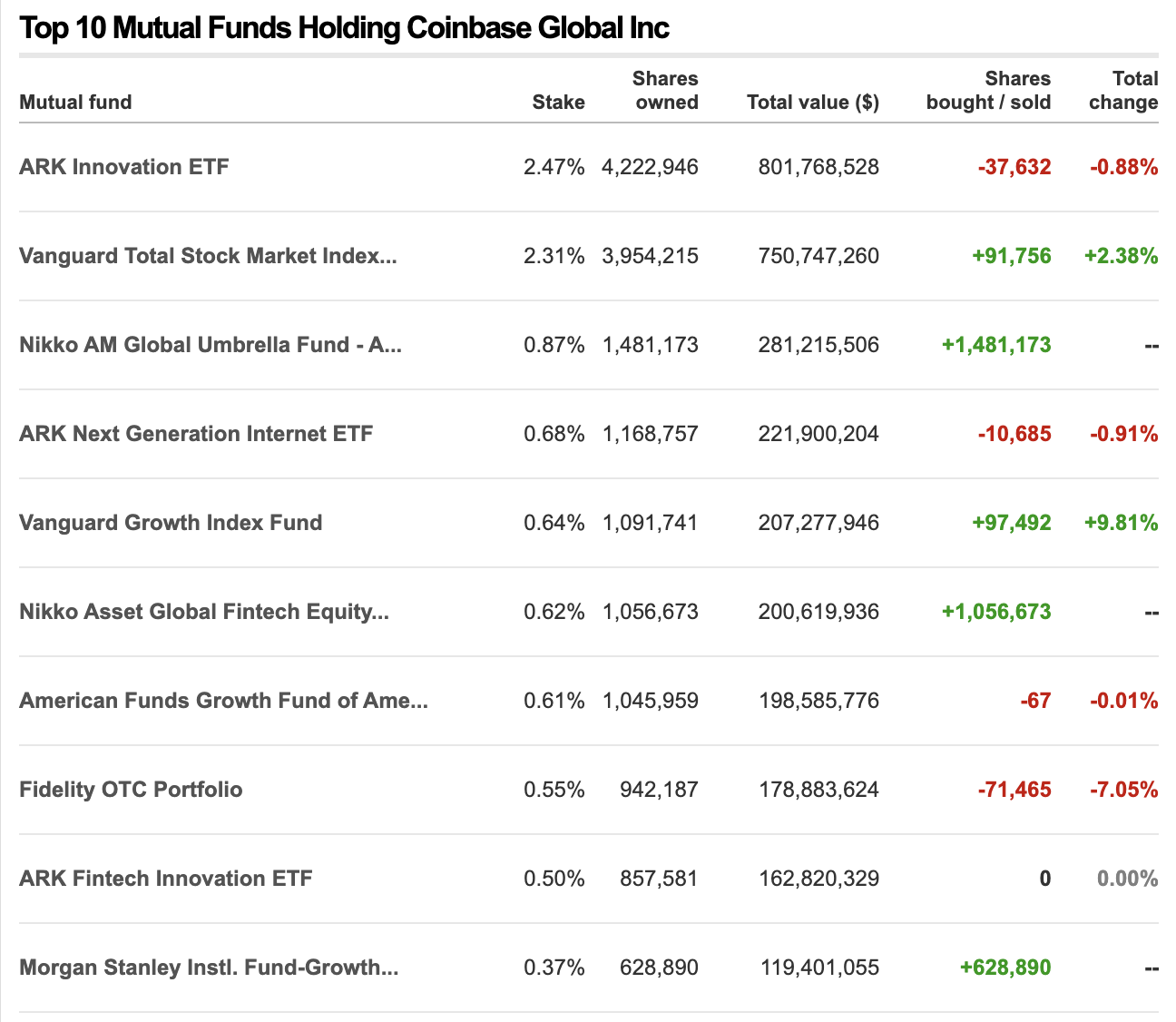

Who are the biggest holders of Coinbase?

As for those who are the bag holders, it's obviously the big boys, you can see the big holders like Vangaurd, Ark and Fidelity, they don't really care, this is just a hedge for them in the portfolio.

Short of Cathy Wood who seems to love anything tech regardless of the price, I don't see why these funds would see a reason to up their allocation in coinbase either.

The suckers in the space will be the passive funds going into the market, it's these ETFs that are just seeing monthly capital flows coming in and allocating a weighted percentage. These are the suckers, these are the patsies at the table, this is the dumb money.

Source: money.cnn.com

I think Coinbase proves that the idea of the shovel outcompeting the gold was not true, bitcoin has held its value far better and is on an upward trend. Since unlike coinbase, Bitcoin has a massive TAM and no competition, it is the apex preditor.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

Almost all exchanges followed this path... and now they're all a mess. A huge number of tokens that will be left with no liquidity as people panic and sold them on the way down. 😐

What will they do then...? Start delisting the tokens, that's what.

There are plenty of bitcoin only exchanges like River, Swan and Amber, but yeah if you want to make short term profits, you gotta adopt the casino model.

Not only that, I've spoken to bitcoin miners, who have told me that exchanges are asking them if they can buy or even lease their bitcoin to cover their positions, because the bitcoin on exchanges are not 100% backed

Uh, oh... 🤪

That's not going to end well.

Bugger! I just made my first crypto purchase through Coinbase!

Posted Using LeoFinance Beta

Pretty sure it won't disappear anytime soon, but I wouldn't feel comfortable leaving my money on any exchange, this doesn't just go for coinbase. I just think they overcapitalised for what they are able to offer

Thanks for the tip. I've just started so the risks are tiny at the moment and I'm always looking for alternatives.

There are several exchanges in Oz, here's a curated list of your options

That's an excellent list. Thank you!

Justified expectations, therefore, are considered very valuable, because they happen very rarely)

Posted Using LeoFinance Beta

I'd rather be hedged against risk, when we're in a fiat world like this you don't know how far contagion spreads

I doubt that you can insure against this, but if it is an infection, you need to use an antibiotic) ... try to go the other way.

Posted Using LeoFinance Beta

Pretty easy, remove your bitcoin from exchanges and hold your own keys

There is an even simpler option, do not register on the exchange where doubts can visit you. By the way, regarding our conversation about the human factor, the topic may be wider, there may not be a theft, it is enough for the developer to leave, as happened in BRO-ARCHON-DHEDGE and everything goes crashing, words, what if, the developer will return. ... are not very convincing. There is no theft, but in the end, people lost a lot of money.

Sure you could go P2P or use an exchange that has proven reserves, but I think most exchanges have enough liquidity to cover your withdrawl if you don't leave it on there, leaving it on there thats for the suckers.

Lol couldn't care less about those shitcoins, or people who hold them

Nowadays Coinbase is the only exchange I can use to withdraw my earnings to my Hungarian bank account. The transaction fees are very high on Coinbase, but I have to use it, because currently there is no alternative.

Have you tried P2P sites like hodlhodl, paxful or localbitcoins, you could find a direct trader in your country to swap with instead of going through all those hoops

I know that lots of coins keep getting listed on Coinbase but I and many others aren’t biting that shit. Bought my first little bit of ethereum in a long time there to even out my position on that but otherwise it’s all bitcoin for me bitches! Lol

Not shocking at all that vanguard is the biggest shareholder. Those vultures!

Posted Using LeoFinance Beta

They will just keep trying to add pairs like grocery stores keep adding new candies, so people can come back and try it lol, I aslo dabbled in the shitcoins like many did and got burned and learned from it, now its all bitcoin all day long no distraactions

Don't you have access to things like strike and cash app with low fee bitcoin buys?

Lol is there nothing blackrock and vanguard don't own at this point?

I guess I should look into cash app to see what I can do with that. I try to keep my financial things minimized to as few as possible. Less risk that way I think. I’ll have to see what cash app charges for fees to buy bitcoin, Coinbase is 4.99 or something. Another exchange I was exploring was going to charge me like 10$ or something fucked lol

Posted Using LeoFinance Beta

$5 is redonk, here I pay 0 fees on deposits of fiat into my local exchange and then my daily auto buys are 2% fee whereas my limit orders are 0.4% charge and no fees on withdrawing to your bitcoin wallet.

I hear kraken and bitcoin reserve have also removed their fees on bitcoin withdrawls but I can't be sure about that. I only use this one exchange because I want to keep my footprint small, but I am using services like hodlhodl and robosats to buy non-kyc when I can