A Hypothetical Look At Russia's Energy Gold Move

I am not here to debate sides of the war, this is not my realm of expertise, and of course, I feel for citizens on both sides losing family members, but I can't comment on things I know nothing about, I can however walk through some possible situations for the world.

The west has pulled out some of the biggest economic sanctions on a single country, and the Russian economy has taken a hit and the ruble has hit all-time lows, while their stock market has been crushed.

On top of that more than half a trillion dollars worth of foreign reserves has been seized from the Russian central banks. Then they've been removed off SWIFT, a move that crippled both Venezuela and Iran in the past, so Western leaders are not playing around.

If you want to get a good summary of what the sanctions are all about, I recommend checking out this video.

Reliance on Russian energy

In the response to this news, I see so many people saying the West has Russia beat, and they'll feel the pain and eventually capitulate. I am not so sure, the Russians have always been a resilient bunch and they still have one key asset, energy production.

A large part of Western Europe and to an extent rest of the world get their energy from Russia, decoupling from that won't be easy and won't be cheap. Countries will need to pivot to homegrown electricity and purchase other energy sources from different countries to make up the shortfall, even then it will take at least 2 years to start to reduce dependence on Russia for energy.

Who knows what world we would be in, in 2 years.

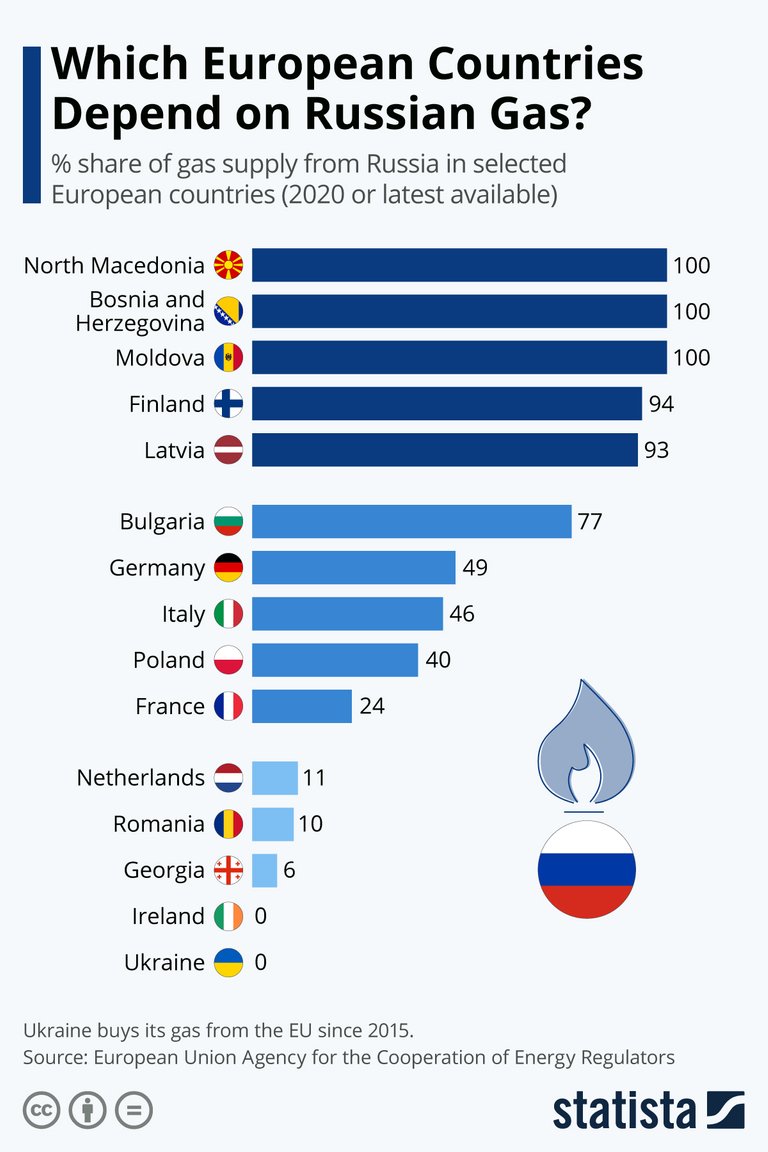

Below is a graph of countries depending on the energy in Russia.

image source: - statista.com

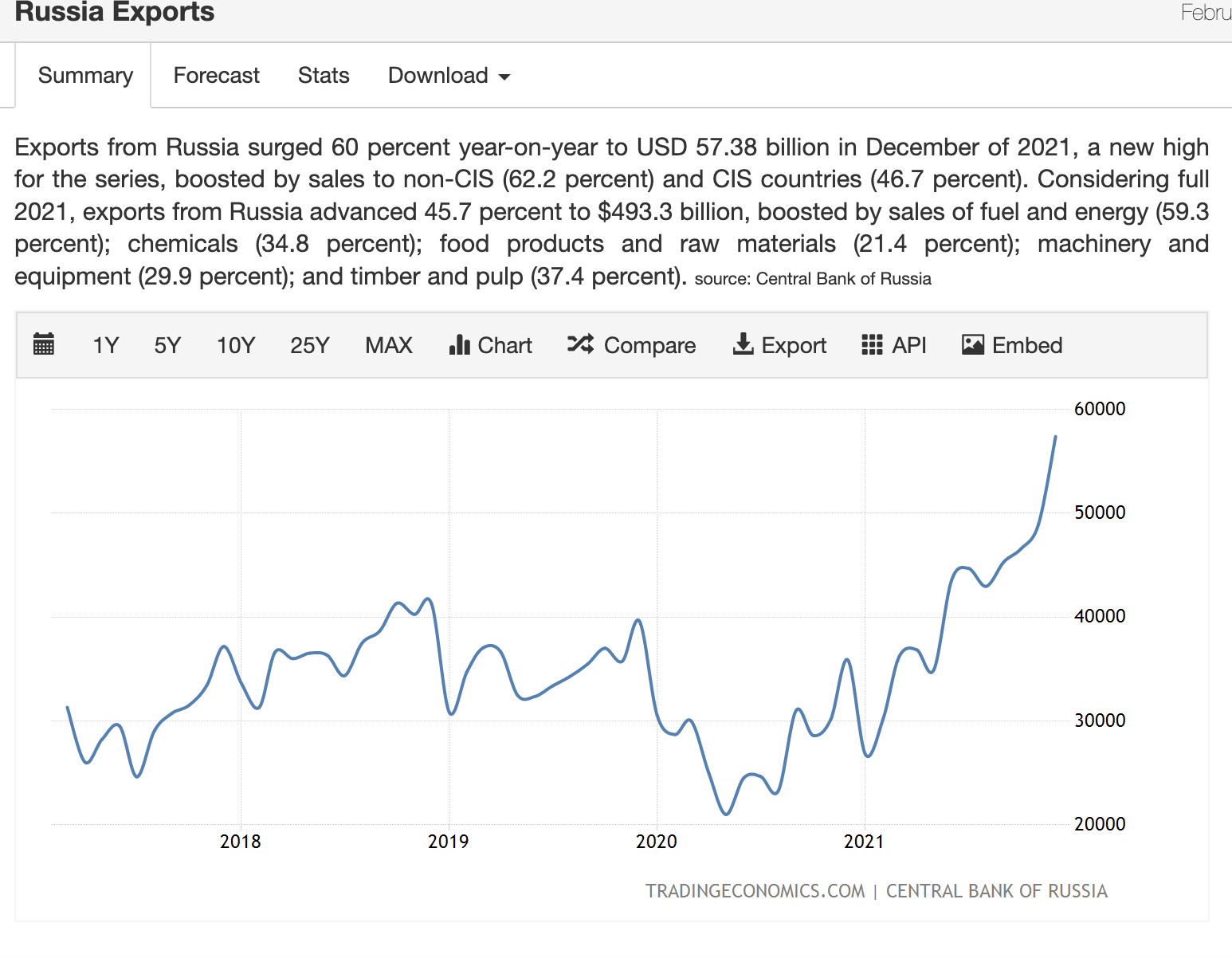

If we look at how much that translates into income it's peaking at the 600 billion dollar range according to tradingeconomics.com, that's a sizable chunk of change, and with it comes some interesting developments.

At the moment, Russia accepts dollars and to an extent Euros for their energy, of the profit they make, those are stored to be used by the treasury and central bank were some of those foreign reserves that were seized, as I mentioned earlier.

Now if I were a country selling energy that has my capital seized, wouldn't it make sense not to accept dollars and euros for your energy instead. Forcing countries to purchase the Rouble will drive up demand for the falling currency, which could help stabilize the economy.

This option is the better one of the two, the other could be far more devastating.

But what if, Russia pulls the trap door and says, I want gold for my energy. They have some of the largest reserves in the world so they know supply outside their country isn't exactly flowing apart from, perhaps China and India.

They could use an open blockchain to manage either a gold-backed rouble or gold-backed token itself and leave it open the world to see so there's no hiding.

So through this mechanism, we will accept gold for our oil and natural gas. If you think China, Iran, and Venezuela aren't going to join him on this after being hammered by the West you must be nuts, he will have support for it for sure.

If he ties old to gold and breaks the petrodollar system, this would throw the Americans and western Europe into a tizzy. If gold is allowed to reprice based on energy demands, it will expose how short countries are to support themselves and drive down fiat currencies as countries fight over the remaining gold float supply.

Now there could be 2 markets the gold and petro-dollar market for energy but this would only cause leakages and even more misallocation, and trying to compete with the Russians would see the US and the West's debts spiral out of control to keep up or they have to give into the gold exchange.

If Putin were to set a price let's say 1000 barrels an ounce, it could easily push gold above $100 000.

A forced return to the gold standard

Now we're back on the gold standard, treasuries are no longer the reserve asset, and boy you don't want to see how that is going to unfold considering the leverage in the system.

Now I am not saying this is going to happen, it's only a thought experiment, but if you think sanctions are the end you're correct in a way, it was the end of the petro dollar system, that's for sure.

We're moving into a new system, personally, I'd prefer it to be bitcoin at the base, I think it makes a lot more sense to trade energy money for energy at the base layer, but that's also simply my personal bias.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

Hmmm. Definitely food for thought.

The whole 100 years New World Order thing seems to be gathering momentum that's for sure.

I was surprised not to see the UK on the energy from Russia list.

Posted Using LeoFinance Beta

I am sure they are on the list, just not on the heaviest users but still enough for it to hurt citizens who have to cough up more for their energy

Dear @chekohler , Do you mean that the economic pressures the US and Western Europe are putting on Russia will eventually fail?

I think it would be a terrible disaster for Europe if the energy resources it imports from Russia were cut off!

Do you think Russia will disrupt the US dollar-centered international trade order?

No I am not stating that this is the case, I think I made it clear that this is a hypothetical thought exercise

With ol Putty being a WEF graduate, there’s certainly a lot that’s sketchy about this whole situation. He’s a smart guy and knows he’s got Europe by the balls with the Russian energy exports. All he has to do is turn off the gas valves and Europe is in the dark and crying rivers of elephant tears. I wonder if he will do something like that.

It would be wild if he opted for gold, would certainly be a power move!

Posted Using LeoFinance Beta

Yeah I don't think his this stark raving lunatic with a little dick complex the media make him out to be, I see even Russia Today has been cut off from our local TV provider, its like full on great wall and that;s only pushing them further into the hands of china.

It was just an interesting thought I came across from Luke Gromen On Twitter, I dont think he;d opt for the gold move or the turning that off, the pain that would cause would be crazy, especially if these northern countries can't get energy online when winter is in full swing.

I don't know how true it is but I saw something in Discord earlier that said Russia is going with the gold standard? I will see what I can find out in the morning!

Posted Using LeoFinance Beta

That's a really interesting graphic that you've shown there. there's also a lot of discussion here in germany that germany is very dependent on russian gas... it looks even worse in other countries. if i have a look at Finland...

It's a helpful graph, but it's obviously not perfect, many countries also have energy futures contracts, so while they may have not taken delivery they've already paid for the allocation. It looks like the need to go "green" in Europe and also to not consider nuclear as part of the mix has put them in this situation