Battle of the Crypto VISA Cards: Binance vs Crypto.com

One of the stated use cases for crypto is the idea that it could have value as a medium of exchange. The idea that it could be used as a commonly valued asset that could be exchanged for goods and services.

That holy grail is still quite a long way off, with the clear majority of companies and individuals not actively accepting cryptocurrencies as payment. In fact, most people on the Earth don't have any connection to cryptocurrencies at all... and if you think otherwise, then you are in a bubble!

The biggest difficulty at the moment for cryptocurrencies as payment is the problem of volatility. Namely, the comparatively large swings at short time scales compared to the long reporting periods that companies need to cover and publicly disclose.

However, there is some slow bridging taking place between the crypto and fiat worlds using debit cards on the VISA network. In some ways it is a bit of a clunky solution, as the cryptocurrency is sold for fiat and then the fiat is used to pay for services. Thus, the buyer (you) pays in crypto, but the seller receives fiat. Clunky... but works.

Two of the main offerings at the moment are VISA debit cards from Crypto.com and Binance. They function in a very similar way, but they do have different approaches to regulation and details that might make one a better fit for you. In fact, there are some things about them that are almost completely diametrically opposed in style and philosophy!

Keep in mind that I'm a user on mainland Europe (Euros, SEPA zone), as your experience with different banking systems and regulations might be quite different to what I have!

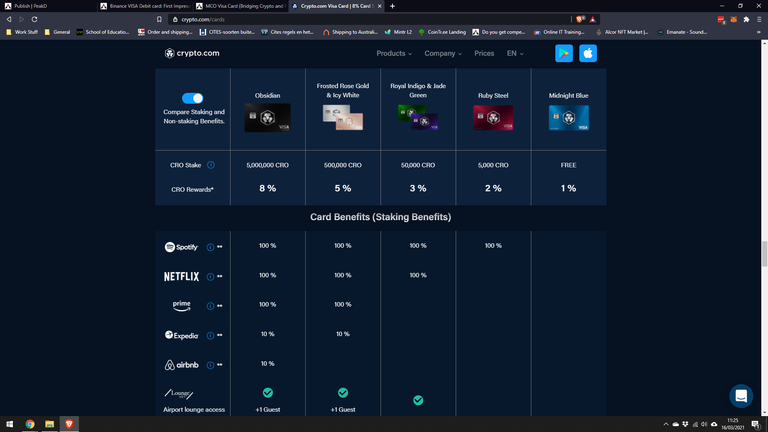

Crypto.com (CRO)

I will start with the Crypto.com (CRO) as it was the first card that I received. Straight off the bat, the card and packaging is beautiful as you can read about in my unboxing. So top marks for presentation!

Crypto.com (CRO) is an exchange that is hewing towards the regulation compliance model, and much of the way that they approach their products reflects this. So, you should have no problems using in the US! They are also pretty upfront about the fees (https://crypto.com/cards), including those for non-use or cancellation. However, it does mean that you need to read!

You can easily deposit Euros via a SEPA transfer or credit cards to the Crypto.com (CRO) and the processing time is generally pretty quick (1 day at most). You can also fund the card with crypto held in your Crypto.com (CRO) account.

They operate a tiered model for the cards, which will have various benefits depending on the amount of CRO you have staked. Now, I am a bit less keen about the way that they have handled the CRO staking across their various products in the past. They have different staking buckets for all the different products, so one bucket for the card, another for the exchange, and yet another for the wallet (and to make things worse, they are time locked). It means that you need to have the CRO for all the various tiers and products that you would like to get benefits from... it does smack of unnecessary differentiation to artificially maximise CRO utility. In addition, they have changed the tier levels significantly over the years in response to the CRO price decline. This was necessary to keep solvent, but it is something that goes down with users badly... at least they kept everyone on the same tiers that they had before the change.

Many of the benefits are quite interesting, especially if you are subscribed to the services already. There are many recognisible names there, and I am pretty happy if Crypto.com (CRO) pays for my Spotify, Netflix or Amazon Prime subscriptions!

There is a CRO crypto-back rewards system that is based upon your tier. At each tier, you will receive a portion of your purchase back in CRO. A nice handy way to slowly trickle back some of your fiat purchases into the crypto world, even more so if it is a side effect of normal spending!

Binance (BNB)

Binance is an exchange that has a reputation for "regulatory arbitrage". I love the exchange, but this view does sometimes reflect in the way that they present their products. Their card is one example of this.

The card is pretty damn cheap looking... it's flimsy plastic but is otherwise functional. You can read about the unboxing. Their terms and conditions are a little bit misleading. They state that they don't charge fees on purchases... which is technically true, but their VISA provider (Swipe) does. A small percentage for sure, but that would have been better to show up front!

The card is easily topped up with SEPA, iDEAL or credit card deposits of Euros. It can also be funded directly with euros, Bitcoin, BNB and a small selection of other crypto. It has a seperate "wallet" that is accessible from the main Binance app, so that is top marks for integration! Deposits from thh fiat system are near instantaneous.

Like the Crypto.com VISA card, it has reward tiers for crypto-back on purchases (paid out in BNB). These tiers are based upon your TOTAL BNB holdings on the entire Binance platform. This is a much better approach than the segregated time-locked buckets! The calculation is a rolling average, so you aren't going to be able to game the rewards system.

There are no partnerships like with the Crypto.com system... so, no exciting freebies! Again, a much more functional approach. Unlike the crypto.com card, the rewards are only paid out when the payment is processed by the seller. Depending on the seller, this can take up to 30 days... although in practice, it generally is only a few days.

Due to their regulatory approach, Binance can be a bit more difficult for US customers!

My Thoughts

Not all VISA cards are the same. Although both these cards have access to the VISA network, I've had more luck with the Binance card for seller acceptance. I'm not sure if that is a quirk that is peculiar to where I am, but the Crypto.com card gets rejected more often. That said, both of them will tend to fail at the NFC and will need to use the physical chip at stores.

Both cards have decent apps with easy and quick funding from SEPA transfers. The Binance card has the edge as it also offers a EURO savings product (~3 percent) where I can park my euros until I want to fund the card.

The tiered models of the two companies are quite different. The CRO time-locked and segregated staking model seems a bit predatory to me, I am much more fond of the BNB model of time averaged holdings across the whole platform. The tiers are also much more generous to smaller holders of BNB, on the other hand the CRO model REALLY rewards those with large stakes!

This leads me to the use case of the CRO vs BNB. Unless you are immediately cashing them out to Bitcoin or something else, then you have to look at the use cases of both cryptos. At this moment in time, CRO derives it's only utility from the staking tiers... which is probably why they have opted for such a restrictive model of staking. They will have a CRO mainnet launch at the end of March, which might provide a DeFi model of use case... but I think that they are really going to struggle against the existing platforms of Ethereum, BSC and the upcoming Polkadot and Cardano ecosystems.

Meanwhile, BNB has established use cases across their BSC blockchain and within their own exchange for Launchpads/pools and fee reduction. At this present time, BNB is the better option to hold (but CRO is relatively cheap!).

So, wrapping up... for me, despite the horrific but functional card, I prefer the Binance offering. I use the Crypto.com ecosystem much less than Binance, so CRO has much less utility than BNB for me. I don't like the model that CRO has adopted, but I'm still happy to stake and take some of the benefits of the beautiful metal card.

What it all comes down to... when I'm at a shop and going to pay for something. The Binance card is the one that I reach for first! I just wish it looked as beautiful as the other one!

Handy Crypto Tools

Ledger Nano S/X: Keep your crypto safe and offline with the leading hardware wallet provider. Not your keys, not your crypto!

Binance: My first choice of centralised exchange, featuring a wide variety of crypto and savings products.

Kucoin: My second choice in exchanges, many tokens listed here that you can't get on Binance!

Coinbase: If you need a regulated and safe environment to trade, this is the first exchange for most newcomers!

Crypto.com: Mixed feelings, but they have the BEST looking VISA debit card in existence! Seriously, it is beautiful!

CoinList: Access to early investor and crowdsale of vetted and reserached projects.

Cointracking: Automated or manual tracking of crypto for accounting and taxation reports.

Account banner by jimramones

Posted Using LeoFinance Beta

https://twitter.com/CryptoBengy/status/1371779811107045376

Congratulations @bengy! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 330000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPA few years back there was something being proposed called the crypto fairness act which made crypto purchases under $600 bot taxable events. Im not sure if a card purchase would count under that proposed rule I assume probably not since its more a sale and then using the cash but untip we have something like that using a crypto card seems like it woupd make doing my taxes a headache

Oh crypto taxes are a nightmare in some countries. Especially if they are classed as Capital Gains. Here in the Netherlands, they are classed as assets generally... and it means that it is just a single year percentage on the total worth... instead of each and every transaction!

An interesting and useful summary. Thanks!

The main reason I started using crypto.com was because I could go straight from British pounds to crypto. That stopped in January so I went back to using Coinbase Pro.

I have a small amount of CRO which I stake each month in the Supercharger. But recently I've realised that the fees to remove the earned crypto will probably be more than the amount earned, unless it goes up significantly. So not really sure it's worth bothering with this.

Posted Using LeoFinance Beta

Yeah, the CRO is still on the Ethereum network which makes small token transfers useless. Wait till the 25 of March, their CRO mainnet will launch and perhaps it will be easier after that.

I didn't realise this. Fingers crossed transfers will be cheaper after March 25th otherwise I will need to rethink my supercharger strategy. 😊

Posted Using LeoFinance Beta

I think the decisive factor in this battle will be the Fee, and this is what people are looking for

Posted Using LeoFinance Beta

Yes, the fee is important, especially if you just liquidate the rewards immediately. However, I do find that the minimal transaction fee on the Binance card to be worth the BNB over CRO rewards. Plus, it is better integrated into their wider ecosystem.

I have the Binance card for about two months and it works flawlessly. The only thing that stops me from ordering a crypto.com one is that fact that you can only use CRO with it. Maybe we'll have even more options in the future.

Posted Using LeoFinance Beta

You can fund the Crypto.Com card with other crypto (Bitcoin Eth....) or fiat. But the rewards (in CRO) are less useful for me, but perhaps that will change with the mainnet launch later this month.

Ok. What do you pay with, CRO, BTC, ETH or EUR? For example if I want to withdraw EUR from Binance on the crypto.com card and pay with it can I do that? On Binance you also have the BNB cashbacks which are nice.

Posted Using LeoFinance Beta

I always pay with EUR on both cards. Not sure I understood your question, but no you can't use one card to load up the other (yes, I tried...).

Nice comparison but you neglected to mention annual fees on the cards.

Crypto.com doesn't have fees (it has staking instead) while Binance has an annual fee.

My crypto.com card has good acceptance including with NFT. The only places it hasn't worked as places that don't accept any international credit cards.

Thanks! I didn't see any mention of annual fees for the Binance card. I will check it up...

Europe is a bit more hit and miss with the Visa network, credit cards aren't really used so commonly and it is up to the vendor if they want to accept it or not (and the technology of their point of sale machines).