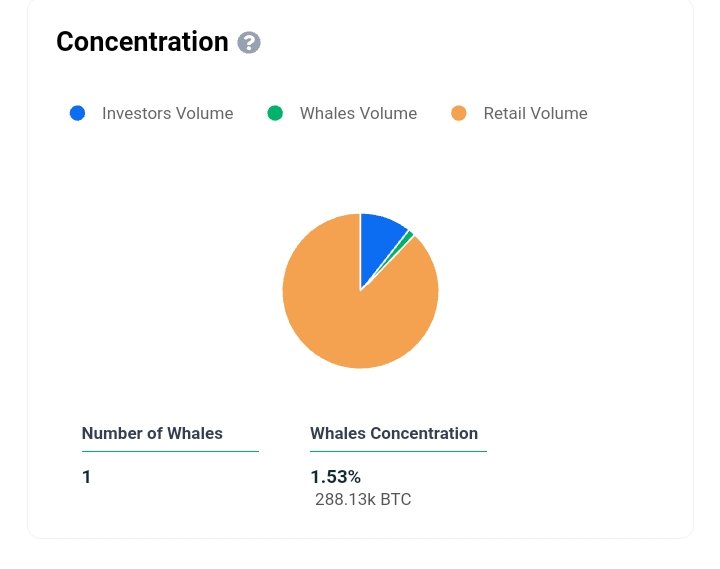

Distribution chart says it all...

More than 18 million BTC in circulation, where do the volumes lie and what indicators should be considered?

This won't be a deep dive, it would rather be precise. I've come across a lot of conversations on the topic "whether or not bitcoin is truly decentralized" This alone has got a lazy ass like myself, flipping through pages, numerous times, just to get the full picture of "Decentralization" because getting the meaning wrong, equals a flawed decision.

One of the most important parts of project building is coins/token distribution, you get that wrong, you get it all wrong. The chances of shifting to a better position is slim when most of the community power has been issued to the wrong hands, especially a small circle.

Decentralization doesn't necessarily mean "uncontrolled" it rather means "operated in a wider range" Most people picture the word to directly promote a situation unguarded, but truth be told, with such flow comes security risks and that's a bad indicator for any investment field. Yes bitcoin isn't centralized if you're looking for a quick assurance, however, investing in it is a personal choice.

Looking at the pie chart above, there's quite a number of good indicators there. The biggest threat any project would face is having a high supply to a small circle of people. Meaning that there are certain addresses in control of large token volumes, this is what we've seen with dogecoin, and with this indicator on ground, dogecoin chances of being a long-term asset of value is more than 6 feet beneath the surface of the earth. Bitcoin began with zero price value and made its way to a market capitalization over $800 billion.

With passing from a barter trade, through primitive based, across commodity based then fallen into government based monetary system, I'd say it was quite a journey to get to a currency based on a binary system, call it math or internet money. The beauty of a currency not centrally operated is a self marketing force.

When we take a second gaze at the bitcoin distribution ledger, you'd notice that a large portion of it is widely spreaded and this creates a blockage against instant devaluation. Out of over 18.5 bitcoin in circulation, about 20% were reported lost, meaning that roughly 3.7million BTC have been washed away, creating more scarcity for an already limited supply currency, what better hedge to inflation would you think of?

Though the pie chart indicators are roughly evaluated, there are other ways to determine the wide range spread of bitcoin, thus determining its nature, whether or not it is decentralized. See here for a list containing specific volumes of bitcoin held, ranging from top holders to the least. Nonetheless, having a large portion of bitcoin concentration found on retail traders indicates two things, one is its decentralized nature and two is its active market structure, placing it on a podium of long term survival.

In conclusion

Meeting an agreement on bitcoin decentralization is simple with this clear indicator, ignoring the FUDs could be anyone's greatest financial decision, wink ;)

Posted Using LeoFinance Beta

Electronic-terrorism, voice to skull and neuro monitoring on Hive and Steem. You can ignore this, but your going to wish you didnt soon. This is happening whether you believe it or not. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism

With Bitcoin, this only applies to distribution, it does not factor into decentralization.

Token holders have no say in the operation of the network. That is completely up to the miners. Someone could own all the Bitcoin and the transactions would still fully be in the hands of the miners to validate.

This is not the case with other forms such as PoS. There stakeholders have a say in the governance.

The recent shutdown of miners in China did provide a step for even greater decentralization for Bitcoin since the hashrate is now spread out even more.

That pie chart in a PoS system would be very impressive.

Posted Using LeoFinance Beta

I'd have to disagree and agree.

Agreeing in the sense that miners play an important role in the system, however, without token holders who further process transactions, miners become irrelevant.

The beauty of the network therein lies on both miners and holders, which generally are all holders, considering the fact that mining rewards are bitcoin, which means mining units receive and store bitcoin becoming holders as well.

Decentralization on the bitcoin network is more about how its operating on a wider range, than the current Fiat based system which is very small circled, making it centralized with less public users having an impact on the system.

Posted Using LeoFinance Beta

Congratulations @badbitch! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Check out the last post from @hivebuzz: