What is The front Running in cryptocurrency.

Some examples, and possible solutions.

Hello leofinance friends, I hope you are all very well, since mankind began to understand the value of knowledge, this became power, whether political power, or economic power, having access to valuable information can turn the most mundane of men into someone powerful overnight, so today we will talk a little about Front Running, a new form of the old vice of using privileged information to get ahead of everyone else in lucrative business, but this time, with futuristic overtones.

Let's start with the Basque.

What is Front Running.

The term Front Running has long been used in the world of buying and selling stocks to refer to the practice of making a transaction based on information that no one else or very few have at their disposal, thus obtaining massive profits, since knowing with certainty whether the price of a stock will go up or down in the world of trading, is like having a winning lottery ticket in your hands to which you put the amount.

This practice is not unlike Inside Trading, and the terms can be used interchangeably, although Inside Trading is more often associated with government officials taking advantage of their access to classified information to invest in companies with which their government will eventually announce massive contracts. For example, in 2020 several members of the U.S. Senate were caught using inside information provided to them through official channels to trade on the stock market and profit in the midst of the financial crash brought on by the pandemic. https://en.wikipedia.org/wiki/2020_congressional_insider_trading_scandal

But in the world of cryptocurrencies

the Front Running mutates and updates with the new times.In this front running can occur in several ways, one, the simplest if you want to say so, is possible thanks to the privileged information received by the people in charge of the operation of the Exchanges, they receive information about the future launch of cryptocurrencies on the platform on which they work, along with all the technical information of the same, and on how they will drive them in the market, with this information you can buy quantities of the same at a much lower price than it will potentially reach, obtaining large profits. This information is for the most part legally accessible to the public, but it is not easy to access, and most investors do not get to know it until after the project enters the market.

An example of Front Running by a high-ranking member of an Exchange would be when Nate Chastain, product manager of OpenSeas, the famous NFT Exchange, was caught making purchases of NFTs with favorable prospects before they came to market on the platform. https://www.cnbc.com/2021/09/15/opensea-insider-trading-rumors-are-true.html

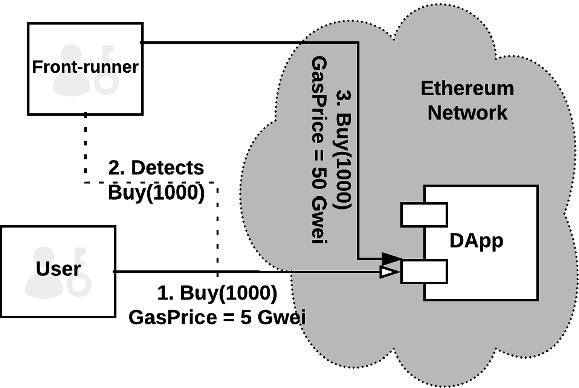

Another form of Front Running derives from the exploitation of a specific feature of certain networks, such as Ethereum for example, in which all pending transactions are placed in a publicly accessible Mempool, and if someone pays an additional cost for their transaction they can move it forward in the queue, these two facts make it possible for a person, with a computer program for the automation of operations commonly called Bots, and sufficient processing power, to get ahead of all purchase orders and profit at the expense of other users.

Basically, using robots to break the mechanics of the market.

In the last couple of years the world of cryptocurrencies has expanded qualitatively and quantitatively, and problems that were once isolated events now threaten to become threats to a future where cryptocurrencies are part of everyday life, so while front running has long been in a limbo of legality, today different platforms are rushing to implement countermeasures against it, For example, today CoinBase announced a zero tolerance policy to front running, and promise to implement measures to eliminate this practice both internally in the company, as well as to prevent external actors can access privileged information from the network and use it for their benefit and to the detriment of other users.

Among the internal measures are the prohibition for company employees to carry out commercial operations using as a basis the sensitive information accessible in their jobs, and to compartmentalize the review process and announcement of the launch of new projects so that the information is only accessible on the day of the launch of the same. https://markets.businessinsider.com/news/currencies/coinbase-acts-against-front-running-of-new-crypto-listings-assets2022-4#

In terms of broader measures, we are studying the possibility of using hidden Mempools, and keeping better control of purchases and sales, wallets and their addresses in order to identify Front Runners Bots.

Recommended Bibliographic Reference

[1] coinbase acts against front running of new crypto listings