The Neutral Interest Rate. The unicorn that hunts the FED.

Lately we may have seen a lot of news announcing the Fed's failure to control inflation [and, consequently, jeopardize the dollar's supremacy]. But how exactly did it fail? What was the long-term plan?

Hello leofinance friends, I hope you are doing very well. if you have been reading my articles on the the economy.

For more detailed information on the subject, I leave here the document with the mathematical formulas used by the FED to make the calculation, https://www.federalreserve.gov/pubs/feds/2001/200156/200156pap.pdf.

Technically in an ideal world, in the last few months, you will have seen a small chronicle of how inflation is increasingly affecting the US economy, how it is affecting the rest of the world, the root of the problem, and the futile attempts of the FED to control it. On this last point, the mainstream media is already starting to publish stories about the Fed's failure.

https://www.economist.com/leaders/2022/04/23/why-the-federal-reserve-has-made-a-historic-mistake-on-inflation

https://www.marketwatch.com/story/the-fed-cant-prevent-a-recession-larry-summers-and-his-co-author-say-11651503567

it was hoped that by raising interest rates the FED could defuse the inflationary bomb it had on its hands without unleashing an explosion of recession, but more and more people believe that this will not be possible, https://www.bloomberg.com/news/articles/2022-05-06/el-erian-says-fed-lost-credibility-with-markets-american-public

but to understand why the Fed has failed, it is necessary to know what its plan with interest rates was, what its long-term game was.

This theory formulated by Swiss economist Knut Wicksell in 1898 proposes that a market interest rate can be achieved that can sustain efficient economic growth without affecting commodity prices, thus maintaining steady growth with stable target inflation.

Wicksell's work was not associated at the time with central bank monetary policy because at the time, the idea of central banks intervening in interest rates was unthinkable. It was not until the 1990s, with the Federal Reserve's decision to use interest rates to control inflation, that Wicksell's theory was accepted de facto.

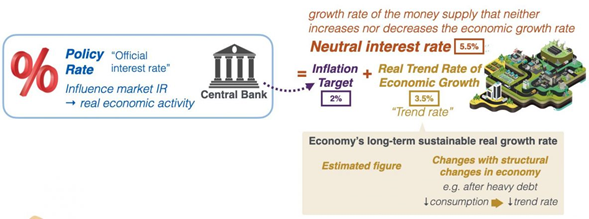

This panacea interest rate cannot be calculated exactly, to estimate it [this explanation is very superficial and crude] you must first calculate the inflation target, and the real trend of projected economic growth add them together and with that you should get an interest rate adequate to stabilize would be certain, and could bring economic stability and sustained growth. The problem.

The neutral interest rate theory has several flaws, to begin with, it is based on calculating something that cannot be calculated accurately, that magic number, is unattainable with accuracy since its calculation is an Assumption, based on the interaction of Other assumptions [project growth for example]. So trying to calculate that magic number is partly advanced mathematics, and partly a matter of luck, and luck should not be a factor in monetary policy that affects the lives of millions.

And even if the Fed did manage to calculate the ideal interest rate, the application of it and its success presupposes the existence of an ideal world, where factors such as behavioral economics do not affect markets, or where there is no unwarranted

speculation or economic bubbles. All these factors affect the economy on tremendous scales, accelerating or decelerating growth, increasing commodity prices [such as the war in Ukraine].

All of these testable events affect the factors in the calculation of that ideal interest rate, and therefore affect the final product. What's more, they occur unpredictably at times, while the Fed's machinery moves slowly.

Recommended Bibliographic Reference

[1]contrary what some economists clain fed cant give economy neutral rate interest"

The FED announced how they are going to handle this: crash the economy.

They admit that didnt cause a supply side issue so the only way to get it is to have the demand match supply. That means a reduction in demand.

Not exactly the formula for success but that is what they are doing. Raising rates in the economic circumstances we are confronting shows how political it is.

Posted Using LeoFinance Beta